Table of Contents

Toggle** TL;DR ** This comprehensive guide establishes price intelligence as a critical business discipline for achieving market-driven pricing. It defines the concept as the systematic collection and analysis of competitive market data, moving beyond guesswork to inform strategic decisions. The article details the significant financial risks of operating without this intelligence, including revenue loss and margin erosion, and outlines the core components of an effective system: data collection, analysis, competitive benchmarking, and automated repricing. It further explains how these insights enable powerful pricing strategies such as competitive, value-based, and dynamic pricing and provides practical use cases across various business functions. The guide concludes by positioning price intelligence as an essential capability for maximising profitability and securing a sustainable competitive advantage in the modern digital marketplace.

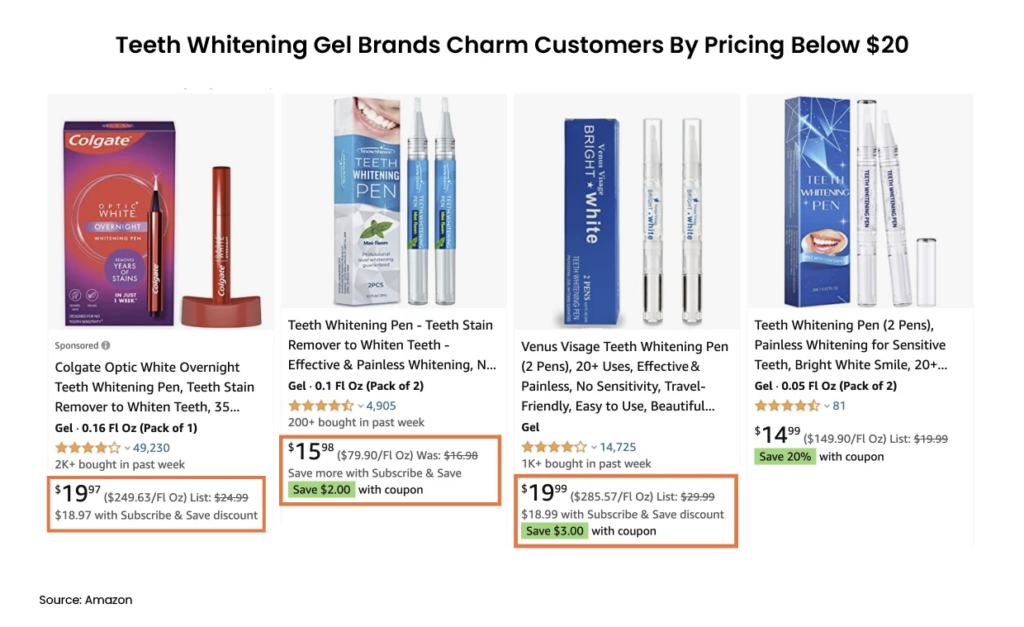

Establishing optimal product pricing is a critical business function with direct consequences for profitability and market positioning. Setting prices too high risks losing sales to competitors, while excessively low prices erode margins and can undermine brand value. Historically, these decisions relied on incomplete data and intuition. The contemporary solution to this challenge is price intelligence.

This disciplined approach eliminates guesswork by grounding pricing strategy in comprehensive market data. This guide provides a detailed examination of price intelligence, illustrating how the systematic collection of retail price data informs strategic decisions, enhances competitive positioning, and drives financial performance.

We will also explore how integrated solutions, such as those provided by 42Signals, automate this process to ensure pricing remains both dynamic and strategically sound.

Image Source: Competera

Price Intelligence and Its Strategic Value

Price intelligence is the systematic process of gathering, analysing, and applying market pricing information to guide an organisation’s pricing decisions. It transcends occasional competitor price checks by implementing a continuous, automated methodology for tracking pricing, promotions, and assortment data across relevant marketplaces and retail channels.

The foundation of this process is data acquisition. Effective systems capture vast datasets, including competitor pricing, shipping costs, promotional discounts, and inventory status. However, raw data alone is insufficient.

The transformation of this data into market price intelligence occurs through rigorous analysis, which identifies patterns, benchmarks performance, and reveals competitor strategies. This analytical depth answers essential commercial questions regarding brand positioning, promotional effectiveness, and demand elasticity.

The strategic objective is to transition from a reactive to a proactive pricing posture. Instead of responding to market changes after they occur, organisations can anticipate movements and adjust strategies to maximise revenue and share. This level of detailed competitive analysis provides a clear perspective on competitor behaviour, revealing strategic opportunities and vulnerabilities.

The Operational and Financial Risks of Neglecting Price Intelligence

Operating without a structured price benchmarking intelligence data program introduces significant and measurable risks to business performance. The absence of market visibility leads to several critical pitfalls.

The most immediate impact is on revenue generation. Prices consistently set above the documented market average without a commensurate value proposition will typically result in declining conversion rates. Research from McKinsey & Company underscores that a 1% price increase can yield an 8.7% increase in operating profits, assuming stable sales volume. This demonstrates the profound sensitivity of profitability to pricing; however, capturing this upside requires that price adjustments are strategically aligned with market conditions.

Conversely, persistent underpricing may increase short-term volume but ultimately devalues the brand and constrains investment capacity for growth and innovation. This model is unsustainable. Furthermore, a deficiency in ecommerce analytics specific to pricing creates operational latency.

When competitors execute flash sales or strategic price reductions, organisations without monitoring capabilities may remain unaware for critical periods, resulting in irrevocable loss of market share. Without price intelligence, organisations cede strategic initiative to more agile competitors.

The Architectural Components of an Effective Price Intelligence System

A sophisticated price intelligence capability is not a single tool but an interconnected framework that converts data into actionable strategy. Its core components function as an integrated system.

1. Data Collection:

This initial phase involves the automated aggregation of retail price data from a defined universe of online sources, including major marketplaces, competitor websites, and niche retailers. Comprehensive systems track beyond list price to include final cost variables such as shipping, available coupons, and stock-out information, providing a complete view of the customer’s actual price experience.

2. Data Analysis and Enrichment:

In this phase, raw data is processed, categorised, and normalised. Products are accurately matched across retailers, and advanced ecommerce analytics are applied. These calculations determine key performance indicators, such as pricing rank position, market average price, and the identification of emerging market trends. This process moves the function from simple data reporting to strategic insight generation.

3. Competitive Analysis and Benchmarking:

This component focuses on the systematic tracking of key competitors. A thorough competitive analysis reveals the pricing strategies of primary rivals, including their response patterns to your price changes, promotional calendars, and category-level pricing tactics. This intelligence is fundamental for defining and maintaining a distinct competitive position.

4. Actionable Insights and Repricing:

The final component is the translation of insight into commercial action. The system should provide clear, prioritised recommendations. For instance, it may flag products where your price exceeds the next competitor by a defined margin, indicating a high risk of basket abandonment.

For organisations with extensive catalogues, automated repricing is essential. This involves configuring rule-based logic to adjust prices automatically in response to specific market triggers, ensuring perpetual competitiveness without manual oversight.

Formulating Data-Driven Pricing Strategies

Price intelligence serves as the empirical foundation for several advanced pricing methodologies. It enables a shift from static to dynamic pricing strategy.

Image Source: Metrics Cart

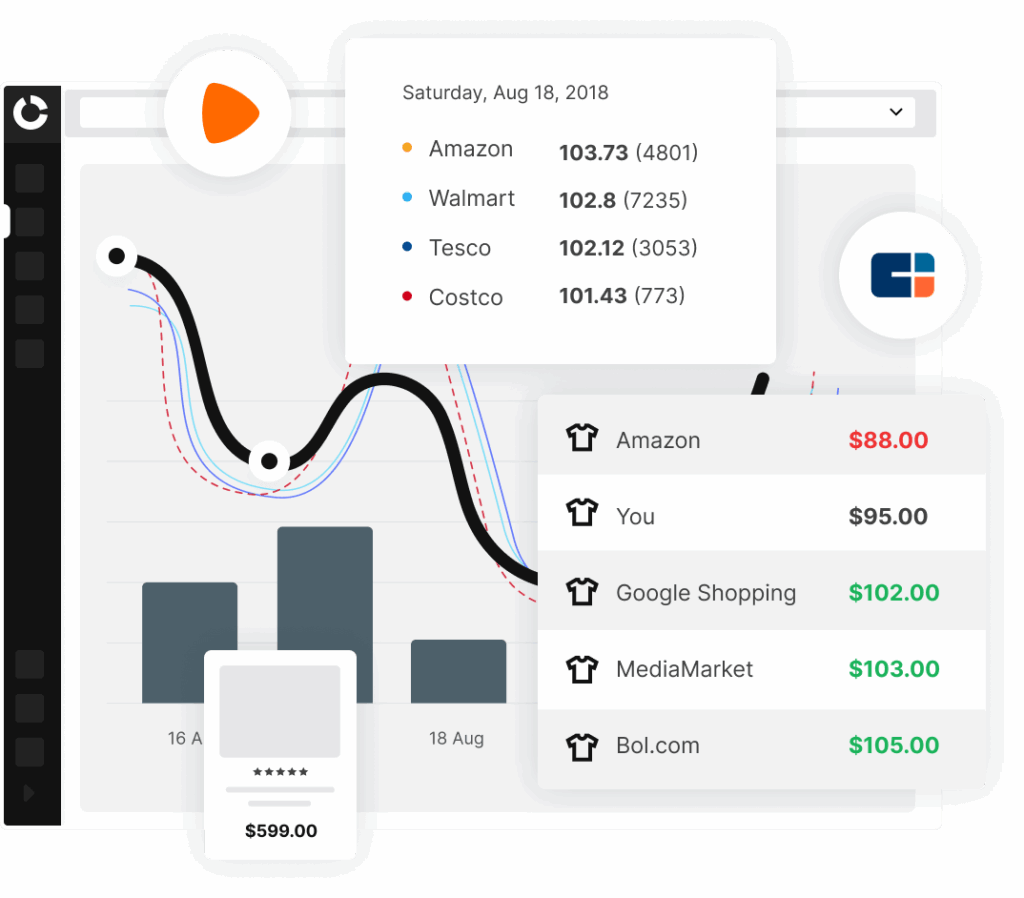

A. Competitive Pricing Strategy:

This is a fundamental application of market price intelligence. The objective is to align your prices within a competitive range relative to defined competitors. With precise data, you can consciously choose to price at, above, or below the market average to communicate a specific brand position. The critical differentiator is that this positioning is informed by continuous data rather than periodic assumptions.

B. Value-Based Pricing Strategy:

This advanced approach sets prices according to the perceived value delivered to the customer, rather than being solely tied to competitor prices. Even here, price intelligence remains vital. It establishes the market context and price benchmarks, ensuring that a value-based price is not perceived as an outlier, thereby helping to justify a premium and frame the value narrative effectively.

C. Dynamic Pricing Strategy:

Prevalent in sectors like travel and hospitality, dynamic pricing involves frequent adjustments based on real-time supply, demand, and competitor activity. In ecommerce, this is operationalised through automated repricing. A Forrester report indicated that effective dynamic pricing can increase revenues by 5 to 10 per cent and boost profits by 20 to 30 per cent for retailers. Executing this strategy manually at scale is not feasible; it requires a sophisticated price intelligence system to automate price adjustments according to pre-defined business rules.

Practical Applications and Cross-Functional Use Cases

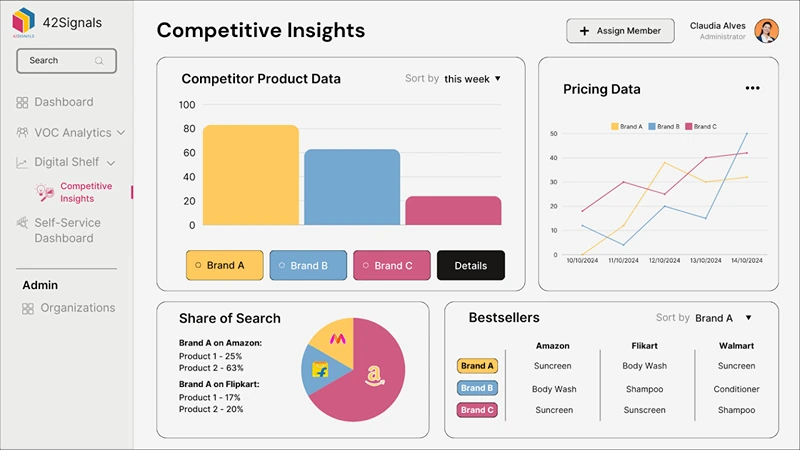

Image Source: 42Signals ECommerce Use Cases

The theoretical benefits of price intelligence are realised through its practical implementation across various business functions.

For Ecommerce Management: An ecommerce manager can utilise price intelligence to monitor pricing for key products on platforms like Amazon. Automated alerts for competitor price changes enable rapid response to protect Buy Box status and maintain sales velocity. This direct application of ecommerce analytics serves as a direct defence of revenue.

For Marketing Teams: Marketing departments can leverage competitive analysis to optimise campaign planning. By understanding competitor promotional cycles, marketing can strategically time its own campaigns to either capitalise on market attention or avoid periods of intense discounting. They can also target advertisements for in-stock products to customers viewing out-of-stock competitor items, actively capturing market share.

For Category Management: A category manager can employ market price intelligence to identify and track broader market trends. Observing a competitor testing a new product bundle, for example, provides actionable data. The manager can analyse the pricing and market reception of this bundle to make an evidence-based decision on launching a similar or improved offering, using market data to guide assortment strategy.

Selecting a Price Intelligence Platform: Key Evaluation Criteria

Selecting a price intelligence solution requires careful assessment of its capabilities against organisational needs. When evaluating a platform, consider the following criteria.

Data Quality and Coverage:

The solution must track all relevant competitors and sales channels for your business. Verify its ability to handle data from the required geographic regions and currencies. The accuracy, refresh rate, and comprehensiveness of the data are foundational to the system’s value.

Analytical and Reporting Capabilities:

Beyond raw data feeds, the platform must offer intuitive dashboards and clear reporting. It should present data in formats accessible to various stakeholders, from analysts to executives. The ability to easily monitor performance against key competitors is a critical feature.

Integration and Automation:

The platform should integrate seamlessly with existing ecommerce platforms, ERP, and pricing systems. This connectivity is a prerequisite for automating repricing workflows and ensuring insights flow directly into operational tools, eliminating manual processes and associated delays.

Provider Expertise and Support:

The chosen provider should act as a strategic partner, offering not only technology but also expertise in pricing strategy and ecommerce dynamics. A provider with robust support and strategic services can significantly accelerate time-to-value and enhance program effectiveness.

Integrating Market Intelligence into Pricing Strategy

In the current competitive landscape, pricing must be recognised as a dynamic and continuous strategic lever. Dependence on infrequent manual reviews or intuition inevitably leads to suboptimal commercial outcomes.

Price intelligence provides the empirical basis for confident, strategic decision-making. It enables the development of a pricing strategy that is both responsive to market conditions and aligned with long-term business objectives. By leveraging comprehensive retail price data and sophisticated ecommerce analytics, an organisation can solidify its market position and drive sustained profitability.

The transition to a data-driven pricing model begins with the commitment to replace assumptions with insight. Adopting a rigorous approach to market price intelligence establishes a significant and sustainable competitive advantage.

Try 42Signals’ pricing intelligence solutions that can be customised to your brand’s needs for reliable data at your fingertips.

Download The Diwali 2025 Sale: Pricing Strategy Infographic

Frequently Asked Questions

A Price Intelligence tool is software designed to automatically track, analyse, and compare competitor prices across online stores, marketplaces, and retail channels. It helps businesses make smarter pricing decisions by providing real-time insights into how their products are positioned in the market.

For example, 42Signals is a leading price intelligence platform that monitors competitors’ prices, detects MAP (Minimum Advertised Price) violations, and provides dynamic pricing recommendations. It allows brands to respond quickly to market changes, maintain profitability, and stay competitive.

These tools are particularly valuable in fast-moving sectors like eCommerce, consumer goods, and electronics, where pricing decisions directly affect conversion rates and margins.

The four primary pricing strategies that businesses use are:

Cost-Based Pricing: Prices are set by calculating production costs and adding a fixed profit margin.

Example: A manufacturer adds 30% over production costs as profit.

Value-Based Pricing: Pricing depends on how much customers perceive the product to be worth.

Example: Luxury brands like Rolex or Apple use perceived value rather than cost.

Competition-Based Pricing: Businesses adjust prices according to what competitors charge for similar products.

Example: Retailers matching Amazon’s prices to stay competitive.

Dynamic Pricing: Prices fluctuate in real time based on demand, stock levels, and competitor activity.

Example: Airlines or ride-sharing platforms adjusting fares dynamically.

The best software for price comparison depends on your business needs and scale:

For enterprise and brand intelligence, 42Signals stands out. It provides advanced data collection, competitor benchmarking, and automated alerts for price fluctuations or policy violations.

For SMBs, tools like 42Signals offer reliable competitor monitoring and reporting.

For individual shoppers, consumer-friendly apps like Honey, CamelCamelCamel, or Google Shopping help find the lowest prices for everyday products.

For large-scale use, 42Signals is ideal because it offers market-wide visibility, API integrations, and AI-driven insights that go far beyond simple comparisons.

Intelligent pricing is a data-driven strategy that uses AI, predictive analytics, and real-time market data to automatically determine the most profitable and competitive price for a product.

Instead of setting static prices, intelligent pricing systems analyse variables such as:

Competitor pricing

Demand trends

Customer purchase behaviour

Seasonality

Inventory levels

For instance, an online store could use intelligent pricing to automatically lower prices when competitors discount similar products—or raise them when demand surges and stock is limited.

This approach ensures optimised profitability, faster market response, and greater pricing accuracy, giving brands a competitive edge in fast-moving digital markets.