The pandemic has accelerated a lot of changes that’s already in place. The e-commerce adoption has grown rapidly in the last few years giving boon to a lot of digital-first companies. A recent report from BCG, highlights the bullishness that the share of Indian B2C e-commerce funding has gone up by nearly 20x in 2021. Partly, one could argue that the rush of funding is due to global excess liquidity and near zero interest rates and India being considered as the fastest growing markets , everyone wants a share of the Indian consumer. While the situation may be different in 2022 after the west is going through a lot of macroeconomic turmoil that it has not been witness to since 1970’s. The e-commerce landscape in India, on the other hand offers a pretty stable macro with inflation still being under control. Probably, for the first time in our generation – we are witnessing the Inflation in the west is higher than India. This, largely is reflected in the capital markets with India being one of the outperformers in 2022 compared to US/Europe/China markets.

What Makes India Attractive

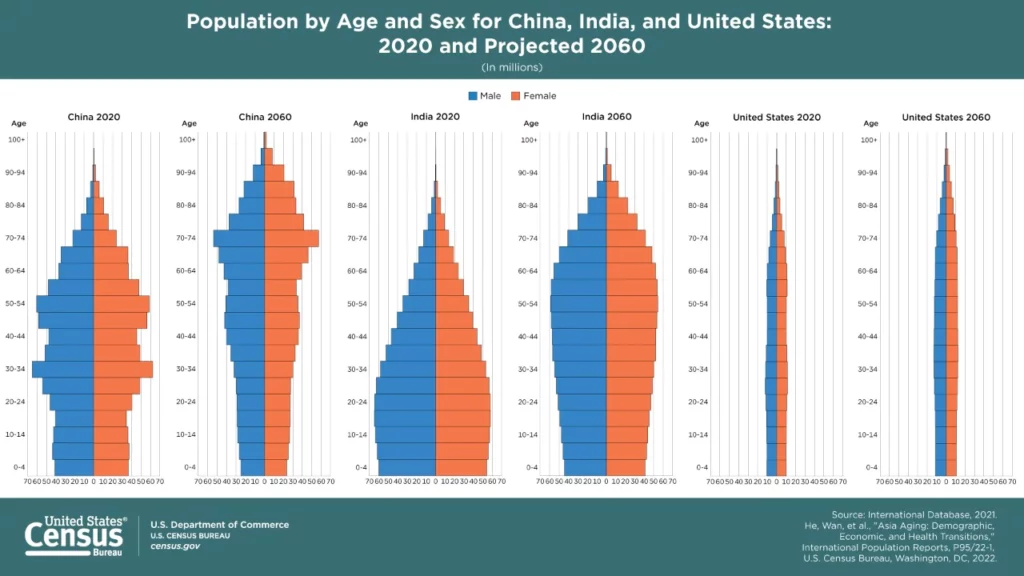

The demographics

With almost 50% of the population under the age of 30 and one of the few countries which promised to show y-o-y growth in the next few decades, India is the consumer capital of the world. For any B2C company, this is probably the gold mine they want to latch onto with a reasonable outlook projection of new consumers in the next few decades. It’s an anecdote that’s articulated well in the article above.

The Indian Tech Stack

It is a set of national APIs for payments, identity, KYC, e-signature, and document verification that scales to a billion people. With Aadhar at the core of identity tech stack, the UPI built the foundation layer and unlocked the potential for the digital economy the country is witnessing.

To extend the analogy, if identity is the mainstay, payments are the foundation. Without online payments, there are no online transactions – there is no digital economy to speak of. But, somehow most global payments infrastructure still runs on the technology from the 1960’s. Think of this – Why should it be expensive for people to send or receive their own money? Why do we need to wait days to move funds from one account to another? Why can’t you pay a friend, stranger, or merchant using something as simple as a username?

As per Indiastack.org, in 2021 the monthly transaction volumes crossed over 4 billion mark and overtaken credit and debit card transaction volumes. Fair to say, that the pace of UPI adoption is staggering and gave a boon to so many fintech, e-commerce, D2C in India companies in the country. With Aadhar and UPI as foundation layers, the tech stack in the country is growing stronger. The onset of OCEN (open credit enablement network) and ONDC (open network for digital commerce) ; the credit and digital commerce open layers have the potential promised to democratize e commerce and credit for MSME’s. There is always a saying in the last few decades India continuously disappoints the optimists and pessimists. One of the reasons this has happened is because of the constant leakages in the welfare supply chain between the government and the poor people and the hurdles the MSMEs face to get easy lines of credit at market rates. The banks can’t go to each nook and corner of the country to extend a small credit and the amount of paperwork involved in this process made it not feasible for the banks business wise. OCEN promises to change this. The MSME’s contribute to ~25-30% of India’s GDP and with ready credit available to them at reasonable rates, imagine the growth many of them can witness. On the other hand, ONDC promises to democratize digital commerce across the country and reduce the dependence of marketplaces.

India can’t be a capitalist country, because they have a lot of poor people to take care of and can’t afford to be socialist as well because the country needs economic growth to prosper. The India tech stack seems to achieve a fine balance between capitalism and socialism which should break the shackles and unleash the growth potential for the next few decades.

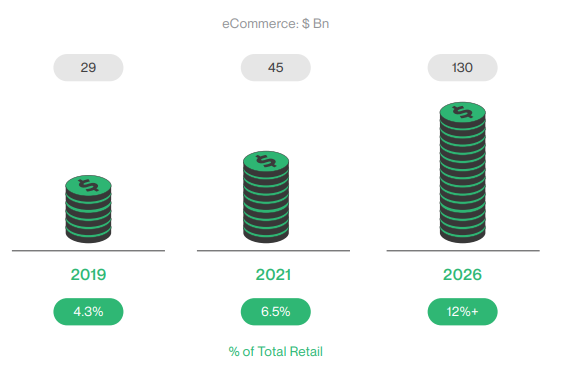

Online Commerce Still at Nascent Stage

The online share of retail is still languishing around 6-7% in India after the covid boon. In the US and other parts of Europe, the number is moderated around 15-18% , while China in 2021 clocked more than 40% of revenue coming from e-commerce. Considering the pace at which e-commerce is growing in the country at around 25%, there are many projections by researchers that India should be around 12-14% by 2026 with e-commerce market size to around US $130 billion. in

The Challenges

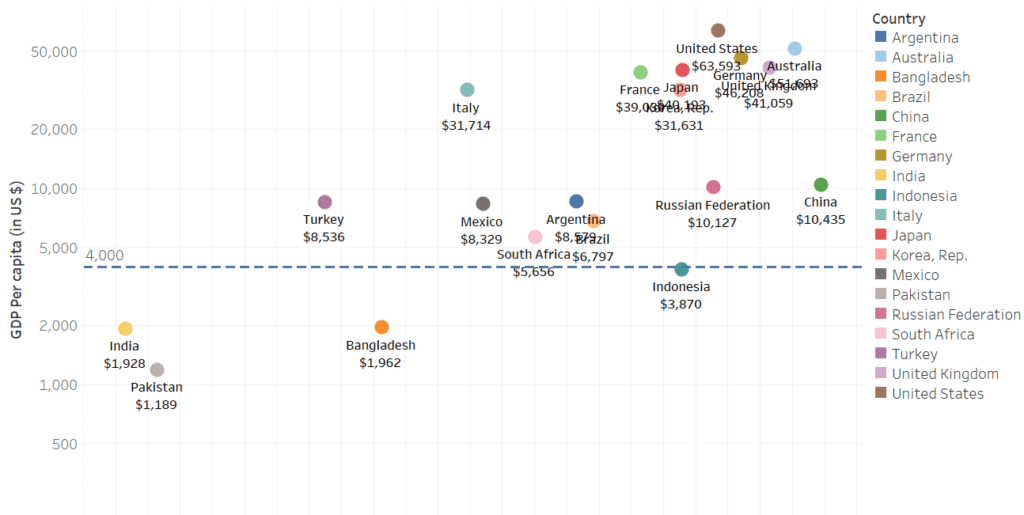

Low GDP Per-Capita

While the future may look bright, at present, the data doesn’t justify the valuations and funding many B2C companies got in the last few years. India’s per-capita is languishing around $2000 per capita GDP, which is amongst the lowest in G20 nations. Albeit, the hope is that being the fastest growing country and probably the only place for the world to look for stable growth. The per-capita income should move higher, so that the Indian consumer will be able to spend more. The sweet spot being around $4000 per-capita where many other consumer economies boomed.

The Omnichannel challenge

Gone are all those days where B2C companies could thrive with one channel to reach their customer. Most often, it’s the offline retail with a distribution network developed for many decades. If there is one lesson the pandemic taught the industry is that omnichannel is the way to go for any B2C company. Those companies majorly focused on offline retail saw their revenue plunged for a couple of years, forcing them to look at omnichannel seriously. On the other hand, the D2C in India, brands who had a free hit and grew multi-fold found it very difficult to scale it beyond a threshold because of their near-zero offline presence.

The marketplaces dominance in India can’t be ignored still considering they are the most preferred online shopping destinations for consumers. For many B2C & D2C companies more than 70% of their online retail revenue still come from marketplaces. This may change as the market matures and with the onset of ONDC, but one needs to wait and watch whether it will become the UPI moment for marketplaces!

What Companies Need to do to Stay Ahead?

The data-backed decisions are key for the brands to stay ahead in the digital world. Whether it is to track competitor moves, price intelligence, comprehend consumer preferences and brand affinity or many other use-cases that the business needs. The brands need a reliable data & technology partner to cater to the ever-changing online landscape. A data partner who mastered the art of data extraction at speed, scale and accuracy. A technology partner who can seamlessly integrate the data into an analytics engine that answers business questions. At 42Signals, we bring the data extraction mastery from PromptCloud and combine with new-age MI/AL technologies for brands to track, optimize and grow their online presence.