Over the past few years, the e-commerce sphere has seen phenomenal expansion, dramatically modifying the manner in which people carry out commercial engagements and obtain commodities. Leading this shift is the transformation of payment in e-commerce. Experts forecast that global retail e-commerce sales in 2024 will exceed a staggering 6.3 trillion USD, expecting further increases beyond that period.

As online shopping gains traction, payment platforms confront escalating expectations from customers seeking adaptable solutions aligned with their changing preferences and stringent security stipulations, thus necessitating continuous improvement in response to these burgeoning demands.

In this article, we explore contemporary breakthroughs of payment in e-commerce that augment user experiences, reinforce security provisions, counteract fraud dangers, and herald the next chapter of electronic trade transactions.

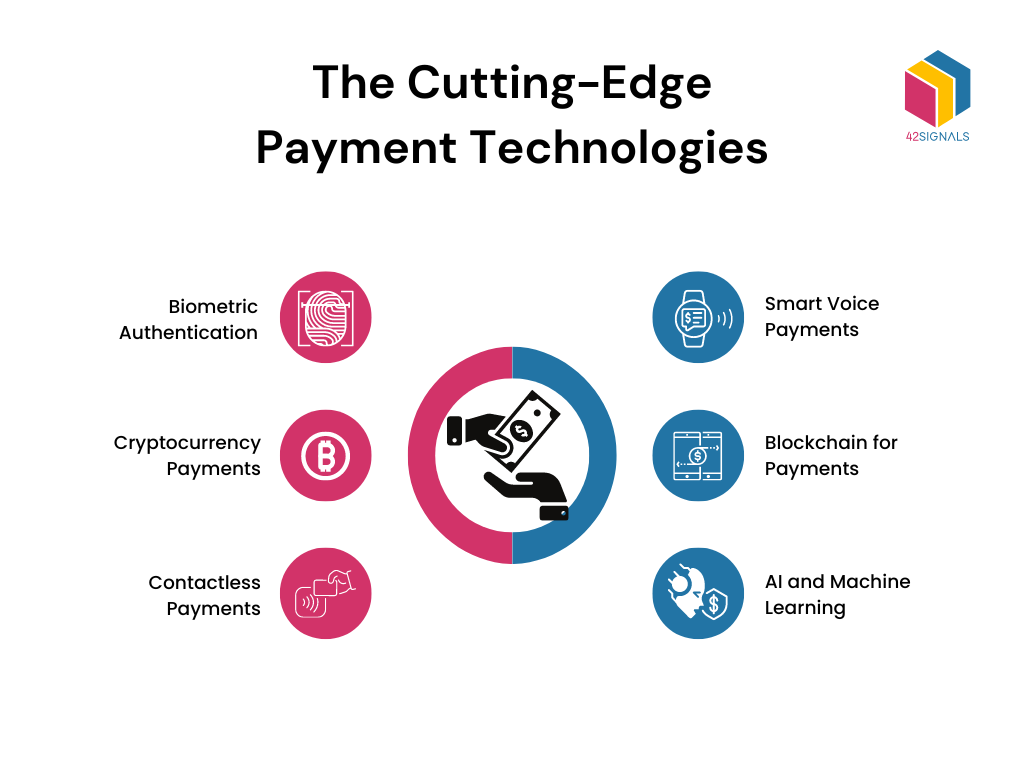

The Cutting-Edge Payment Technologies

Nowadays, the digital landscape teems with inventive payment solutions seamlessly integrated into e-commerce websites. Among them are mobile wallet services like Apple Pay, GooglePay, and Samsung Pay; speedy payment choices presented by Amazon Pay and PayPal; along with digital coins such as Bitcoin and Ethereum. By presenting flexible and easily accessible payment options, retailers address different client tastes, lower abandoned cart incidents, and raise conversion percentages. Consider these aspects when evaluating modern payment technology:

- Biometric Authentication: Leveraging fingerprint and facial recognition to secure transactions.

- Cryptocurrency Payments: Integrating Bitcoin and altcoins as payment methods for tech-savvy shoppers.

- Contactless Payments: Near Field Communication (NFC) enables customers to pay with a simple tap using their smartphones.

- Smart Voice Payments: Voice-activated devices now process purchases via verbal commands.

- Blockchain for Payments: Immutability and transparency in payment processing enhance trust in transactions.

- AI and Machine Learning: For predicting fraud and personalizing payment experiences.

Enhancing User Experience with Innovative Payment Solutions

Improved user experience (UX) is essential for encouraging repeat business and cultivating strong brand loyalty. Advanced payment solutions now emphasize UX enhancement by introducing features that accelerate the checkout process, securely preserve information, and smooth out international transactions – all significant components contributing to successful e-commerce interactions. Tokenization, biometrics, and localized payment methods exemplify recent advances aimed at elevating the overall user journey. Keep these ideas in mind when considering updated payment solutions:

- Streamlined checkouts – Evaluate ways to optimize the checkout process, focusing on minimizing friction and maximizing efficiency.

- Global expansion preparedness – Are you ready to tap into international markets? Ensure your chosen payment solution supports effortless cross-border transactions.

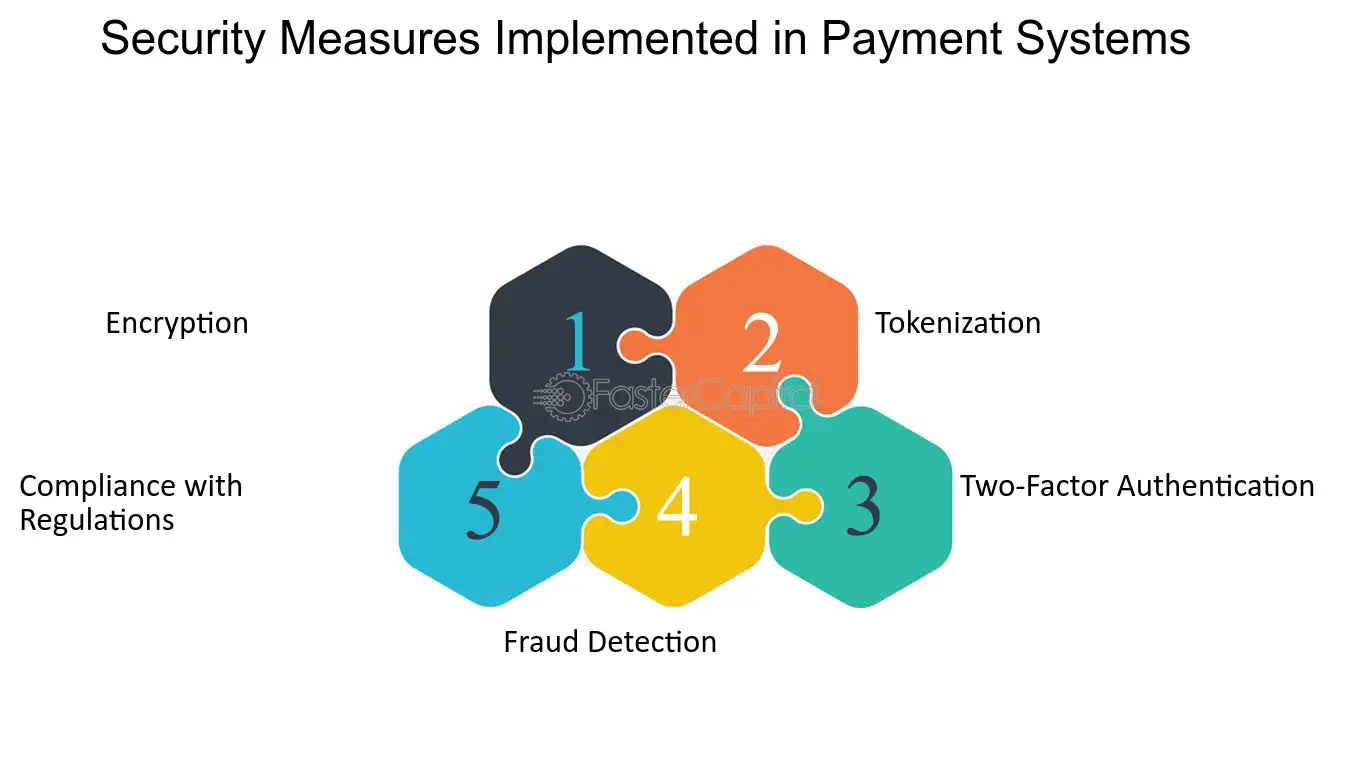

Security Measures in Modern Payment In E-Commerce Systems

Modern e-payment systems employ robust security measures to protect transactions and maintain user trust:

Image Source: https://fastercapital.com/topics/security-measures-implemented-in-payment-systems.html

- Encryption: Critical data is encrypted, ensuring that sensitive information is unreadable to unauthorized parties.

- Authentication: Multi-factor authentication, including biometrics, adds layers of verification, checking that users are who they claim to be.

- Tokenization: Replaces sensitive data with unique identification symbols, making breach recovery quicker and limiting data exposure.

- Fraud detection: Advanced algorithms and machine learning predict and prevent fraudulent activity by analyzing transaction patterns.

- Secure socket layer (SSL): Provides a secure channel between two machines operating over the internet, vastly reducing data interception risks.

These measures collectively create a fortified e-payment environment, essential for e-commerce success.

The Role of AI and Machine Learning in Payment Security

Artificial Intelligence (AI) and machine learning help improve security for payment in e-commerce by analyzing large datasets to pinpoint abnormalities indicative of possible fraudulent activity. Employing these tools enables real-time risk assessment and responsive threat management. When exploring AI applications within your payment ecosystem, ask yourself:

- Data analytics implementation – Have you incorporated advanced analytics to identify unusual behavior patterns among users?

- False positive reduction – What steps can be taken to decrease instances where legitimate transactions are incorrectly flagged as potentially fraudulent?

Mitigating Fraud Risks in E-commerce Transactions

Although novel payment technologies present many benefits, they also introduce fresh challenges regarding fraud prevention. Adopt robust anti-fraud tactics comprising thorough KYC checks, two-factor authentication, and vigilant transaction tracking. Utilizing big data analytics assists businesses in swiftly identifying warning signs, decreasing false positives, and maintaining regulatory compliance. Deliberate upon these key elements as part of your fraud prevention strategy:

- Compliance requirements – Familiarize yourself with relevant regulations governing e-commerce transactions and ensure ongoing conformity across all channels.

- Collaboration opportunities – Could partnerships with fellow industry members aid in combatting fraud? Investigate possibilities for sharing resources and insights.

The Future of Payments in E-Commerce: Predictions and Trends

Predicting precisely what lies ahead in the realm of payment in e-commerce can be challenging. However, several trends point toward increased prominence for contactless payments, voice-enabled purchasing, and decentralized finance powered by blockchain technology. Anticipate these developments and stay agile to capitalize on upcoming changes:

- Contactless adaptation – Prepare for widespread acceptance of contactless payment methods, driven by demand for cleanliness and ease-of-use.

- Voice commerce readiness – Will voice-activated purchasing disrupt traditional e-commerce models? Assess whether integrating voice commerce aligns with your strategic vision.

- Blockchain exploration – Could distributed ledger technology revolutionize your e-payment operations? Research the feasibility of incorporating blockchain into your existing framework.

Ultimately, payment technologies serve as a cornerstone for e-commerce development, propelling it towards remarkable growth and achievement in the expanding digital economy. Consequently, businesses should diligently track emerging tendencies and finest practices to effectively leverage innovation, thereby securing their position in this dynamically changing commercial landscape.