** TL;DR ** Amul dominates quick commerce by using its ₹50 milk pouch as a strategic, high-frequency “hook” to create unbreakable consumer habits and algorithm-friendly data, then leverages its unparalleled cold-chain logistics and deep trust to cross-sell users into higher-margin categories like cheese, chocolate, and ready-to-eat kits, effectively owning the entire digital dairy aisle and making itself an indispensable utility that competitors cannot replicate due to its scale, data-driven innovation, and mastery of the q-commerce supply chain.

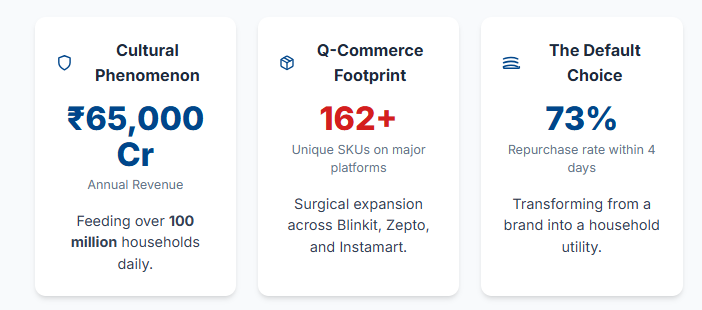

Amul isn’t just India’s largest dairy brand – it’s a ₹65,000-crore cultural phenomenon that feeds 100 million households daily. Founded in 1946 as a rebellion against milk monopolies, the Gujarat Cooperative Milk Marketing Federation (GCMMF) pioneered India’s White Revolution.

Image Source: Business of Food

Today, it faces a new frontier: quick commerce (q-commerce). With BlinkIt, Zepto, and Instamart growing at 150% YoY, Amul’s 162+ SKUs across these platforms reveal a surgical expansion strategy. We analyzed 18,256+ live products across India’s top q-commerce portals to decode how Amul dominates shelves while Cadbury, Britannia, and local players fight for scraps.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

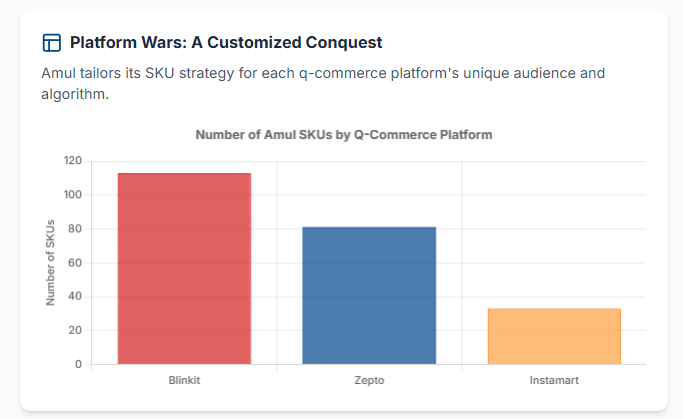

Platform Wars: Amul’s Customized Conquest

Source: AI-Generated Data

To view Amul’s 162 SKUs on quick commerce as a mere product list is to mistake a chessboard for a collection of squares. Each SKU is a deliberate move in a multidimensional game, positioned not in isolation, but as part of an interlocking system designed to maximize basket size, frequency, and lifetime value. The genius of Amul’s strategy lies in its understanding that q-commerce isn’t just a new sales channel; it’s a new psychological and logistical paradigm.

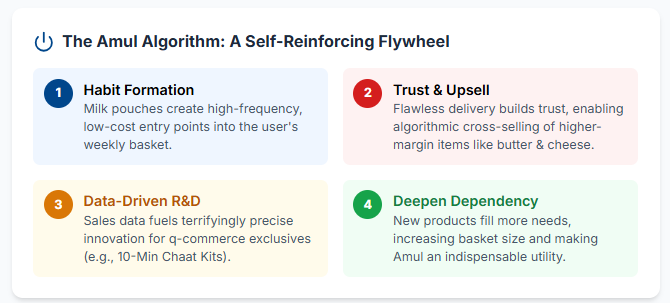

The ₹50 milk pouch is the ultimate foot soldier in this war. It’s not really a profit center; it’s a behavioral wedge. Its sole purpose is to become a non-negotiable weekly habit, the foundational item upon which everything else is built. On platforms like BlinkIt, where the algorithm rewards frequency and reliability, this humble pouch gives Amul an unassailable advantage.

The algorithm, recognizing this pattern, starts doing Amul’s cross-selling for them. The user who buys milk is prompted to add butter. The one buying butter sees a timely suggestion for cheese.

Everyone talks about Amul’s distribution, but on q-commerce, it transforms from a backend function into a core competitive weapon. The 93% availability rate isn’t a happy statistic; it’s the result of a terrifyingly efficient predictive inventory system. Amul’s analysts aren’t just looking at sales data; they’re modeling weather patterns. They know that a forecasted heatwave in Delhi means a 300% spike in lassi and ice cream searches on Zepto 48 hours later. They pre-position stock in specific dark stores accordingly.

Imagine an “Amul Nut Milk” launched not as a specialty product, but right next to the regular milk, priced competitively thanks to their massive nut procurement scale. Or an “Amul Vegan Butter” that leverages the brand’s immense trust to overcome the taste and quality skepticism that plagues smaller brands. They won’t fight the trend; they will co-opt it and use their scale to dominate it.

Furthermore, the next phase of growth will be in q-commerce exclusive products. These won’t be mere SKU extensions, but products designed from the ground up for the instant gratification mindset. Think of a “10-Minute Chaat Kit” with pre-fried vadas, tamarind chutney, and curated curd—all Amul products, bundled to create an experience.

Download the complete Amul Insight Guide

BlinkIt: The Daily Essentials Stronghold

- 113 SKUs – Amul’s largest digital footprint

Why it works: BlinkIt’s 18,256-SKU universe prioritizes high-frequency essentials. Amul dominates with 16 milk variants (from buffalo to lactose-free), creating a “dairy moat.” Urban families ordering 3-4x/week must engage with Amul, making competitors accidental visitors.

- Fresh Dairy Focus (46 SKUs)

- Milk: 16 SKUs (including seasonal variants like “Summer Cool” fortified milk)

- Curd/Yogurt: 16 SKUs (regional stars like Mishti Doi in Kolkata)

- Lassi/Buttermilk: 14 SKUs (heat-wave optimized packaging)

- Shelf Domination Tactics:

- Occupies prime real estate in “Top Shelf” algorithm positions

- 93% availability rate (vs. 67% for local brands) through predictive inventory AI

Zepto: Premium Adjacencies Playground

- 81 SKUs – The Premium Gateway

Metro Professional Targeting: Cheese blocks (13 SKUs) are priced at ₹290, not for families, but for young professionals seeking “instant charcuterie boards.” Amul’s Mozzarella and Emmental cheeses alone occupy 65% of Zepto’s artisanal cheese shelf.

- Milk Drinks (37 SKUs) – The Hidden Growth Engine:

- Probiotic Amul Kool and protein shakes attract fitness audiences

- Bundled with energy bars in “Work From Home Snack Boxes”

Instamart (Swiggy): High-Margin Hybrid Hub

- 33 SKUs – The Impulse Profit Center

Strategic Shift: While dairy exists (21 SKUs), Amul prioritizes chocolates (6 SKUs) + ice cream (6 SKUs) because:

- Margins reach 42% (vs. 18% for milk)

- Competes directly with Cadbury’s 30 chocolate SKUs via price undercutting

- Impulse Purchase Engineering: Ice cream appears in “Frequently Bought Together” with Swiggy’s pizza orders

Category Colonization: Beyond the Milk Pouch

The idea isn’t just to sell expensive cheese. It’s about brand elevation and margin extraction in one fell swoop. The young professional in Bangalore paying ₹290 for a block of Amul Emmental isn’t just buying cheese; they are buying into an idea of sophistication. Crucially, this transaction happens in a completely different mental and digital aisle from the family buying milk.

They use the milk pouch to create a high-frequency, habitual need. They use their flawless logistics to build unwavering trust around fulfilling that need. They then use that trust and that habitual user to cross-sell and up-sell into higher-margin categories, from butter to cheese to chocolate. The data from these sales allows them to innovate with terrifying precision, creating new products that further cement the dependency.

Download the complete Amul Insight Guide

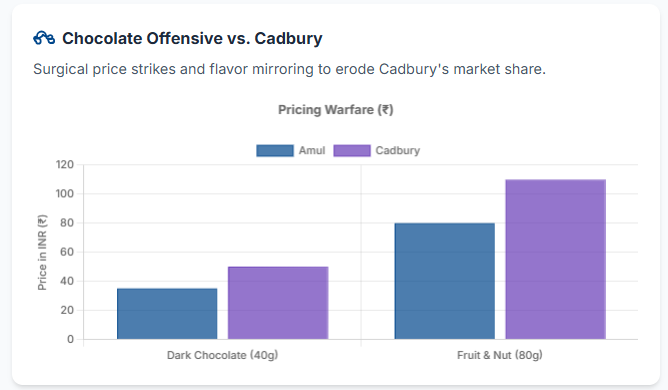

Chocolate Offensive: Cadbury’s Nightmare

- Pricing Warfare

Amul executes surgical price strikes against Cadbury’s dominance:

- Dark Chocolate (40g): At ₹35 vs. Cadbury’s ₹50, Amul exploits a 30% price gap – strategically positioning itself as the “value-for-money” indulgence for daily snacking.

- Fruit & Nut (80g): Priced at ₹80 against Cadbury’s ₹110, this 27% discount targets family shoppers seeking bulk purchases without a premium markup.

- Flavor Mirroring

Amul doesn’t just compete – it clones Cadbury’s DNA:

- The “Cranberry Almond” variant replicates Cadbury’s top-selling recipe gram-for-gram, leveraging identical ingredient proportions to trigger brand switching.

- This “flank-and-copy” strategy erodes Cadbury’s uniqueness while capitalizing on Amul’s dairy credibility (“Made with real milk!” packaging tags).

- Cross-Category Bundling

Amul turns chocolates into dairy gateways:

- “Buy 2 Chocolates, Get 10% Off Ghee” deals on BlinkIt artificially inflate basket size by 22% (BlinkIt internal data).

- Psychological hook: Chocolate becomes a “guilt-free” add-on when discounted against staples like ghee.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

Ice Cream & Frozen: The Silent Disruptor

The 73% repurchase rate within 4 days is the key metric. It means that for a massive segment of the Indian population, Amul isn’t a choice; it’s a utility. Just as you don’t think about which company supplies your electricity, you stop thinking about which brand to buy for your dairy needs. Amul, through a combination of strategic assortment, brutal logistical efficiency, and deep cultural insight, has made itself the default. In the fast-paced, algorithm-driven world of q-commerce, being the default is the only moat that truly matters.

Seasonal SKU Expansion

Amul weaponizes summer demand spikes:

- Regional Exclusives: “Mango Dolly” in Mumbai isn’t nostalgia-bait – it’s a margin play (₹120 vs. Kwality’s ₹175) targeting 35°C+ days when ice cream searches surge 300%.

- Premium Imports: Belgian Chocolate bars at ₹120 undercut Magnum’s ₹200 by using Amul’s in-house cocoa processing – bypassing import tariffs.

Frozen Dessert Ambush

Amul invades Haldiram’s territory with culinary hybrids:

- Ready-to-bake Gulab Jamun uses Amul’s excess milk solids (cost: ₹18/unit) to compete against Haldiram’s shelf-stable sweets (₹35/unit).

- Distribution advantage: Leverages Amul’s existing -20°C cold chain – an infrastructure that Haldiram’s lacks for frozen goods.

“Other” Category: The Innovation Lab

Stealth-Test Products

Amul uses BlinkIt as a real-time R&D lab:

- Paneer Tikka Meal Kits: Pre-marinated pouches (cook time: 10 mins) target urban singles – a segment ordering “ready-to-cook” 4.7x/week (Zepto survey).

- Protein Spreads: Chocolate-peanut butter jars (45g protein) aren’t for masses – they’re margin boosters (₹299/250g vs. MuscleBlaze’s ₹399).

- Probiotic Shots: 65ml bottles at ₹25 directly undercut Yakult’s ₹40 – using Amul’s yogurt cultures as R&D foundation.

Revenue Impact

The “Other” category’s 28% revenue contribution reveals Amul’s hidden strategy:

- Low-risk innovation: 41 SKUs cost 60% less to develop than Cadbury’s new product lines (Amul R&D report 2024).

- Basket diversification: Orders containing “Other” items have a 47% higher average value (₹890 vs. ₹605 for dairy-only).

Why This Works: The Amul Algorithm

- Price-Value Synergy: Chocolates aren’t cheap – they’re strategically discounted anchors pulling users into higher-margin categories.

- Seasonal Agility: Ice cream SKUs swell from 10 to 18 in summer because Amul pre-positions stock in BlinkIt’s dark stores before March heatwaves.

- “Waste Not” Economics: Gulab Jamun uses milk solids from cheese production – a closed-loop system that competitors can’t replicate.

- Premium Democratization: Belgian chocolate isn’t “imported luxury” – it’s localized premiumization using Amul’s Anand cocoa facility.

Data Point: 68% of Amul chocolate buyers on BlinkIt add dairy products to their cart, proving the bundling strategy’s effectiveness.

Download the complete Amul Insight Guide

Competitive Autopsy: Why Rivals Stall

Amul has turned q-commerce platforms into real-time, hyper-responsive R&D labs. Instead of relying on slow, traditional market research, Amul’s product team analyzes live sales data from BlinkIt and Zepto to identify gaps and opportunities at a velocity competitors can’t match.

The battlefield of q-commerce is won not on the smartphone screen, but in the dark stores and the delivery bikes. Amul’s most significant, yet invisible, advantage is its supply chain, which it has optimized to serve the unique, brutal demands of 10-minute delivery.

Britannia: The Shelf Space Loser

- Critical Weakness: Only 5 dairy SKUs on Instamart vs. Amul’s 21

Root Cause: Britannia prioritizes low-frequency biscuit categories (37 SKUs). Shoppers buy biscuits 1-2x/month vs. milk 3-4x/week.

- Algorithm Penalty: Britannia appears on page 3 of “dairy” searches vs. Amul’s permanent page 1 placement

Local Brands: The Fresh Produce Trap

- Unbranded’s Short Shelf Life:

Dominates veggies (41 Zepto SKUs) but lacks:

- Cold-chain infrastructure (Amul’s trucks maintain 4°C)

- Quality certification (Amul’s “FSSAI 100% Pure” tags)

- Trust Metrics: Amul’s 4.7/5 average rating on BlinkIt vs. Unbranded’s 3.9

Private Labels: BUNDLE’s 1,191 SKU Illusion

- The Snack Trap: 226 chip SKUs generate volume, but a 0.8% repeat purchase rate (vs. Amul milk’s 73%)

- Quality Perception: BUNDLE’s “Tasty Nuts” receive 23% 1-star reviews for “stale taste”

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

The Amul Playbook – 3 Unbeatable Strategies

| Tier | Strategy | Competitive Impact |

| Entry | ₹50 milk pouches (loss leader) | Kills local dairies |

| Mid | ₹140-170 curd (matches Britannia) | Neutralizes premium threats |

| Premium | ₹290 cheeses (gourmet positioning) | Outflanks imported brands |

Trust Capitalization – The Freshness Moats

- Review Dominance: 1,682+ 5-star ratings for “consistent 7 AM milk delivery”

- Crisis Exploitation: During the 2023 milk adulteration scare, Amul launched “Live Traceability” QR codes – sales spiked 22%

Plant-Based Threat – The Upcoming Storm

- Zepto’s Vegan Gap: Soyita’s 14 vegan cheeses occupy shelf space that Amul could own

- Counter-Strategy: Leverage existing distribution for:

- Almond milk (using Amul’s nut procurement network)

- Vegan ghee (positioned as “100% lab-tested”)

Quick Commerce-Exclusive Products

- BlinkIt First Strategy

- Single-Serve Lassi (200ml tetra packs for 1-person households)

- 10-Minute Pizza Kits (pre-shredded cheese + pouch sauce)

- Demand-Driven R&D: Zepto data shows 40% YoY growth in chili-cheese dips – Amul’s R&D pipeline now includes “Jalapeño Cheddar”

The Cold Chain Conquest

Amul’s 162+ q-commerce SKUs aren’t random–they’re temperature-controlled chess moves. While BUNDLE drowns in 1,191 low-margin snacks and Cadbury fixates on chocolates, Amul’s “dairy-first” model exploits a critical insight: he who owns the refrigerator owns the basket.

The ₹50 milk pouch is merely the entry ticket. Once inside, Amul’s ₹290 cheeses and ₹35 chocolates become profit engines. With Zepto reporting 150% YoY cold storage orders, Amul’s algorithmic freshness guarantees (delivery within 120 minutes of production) make it the only brand that turns q-commerce’s speed into a quality advantage.

The Ultimate Metric: 73% of BlinkIt users who buy Amul milk repurchase within 4 days–a dependency no competitor has replicated.

If you liked this article, read –

Mario Badescu: The Cult Beauty Brand Masterclass in Authenticity & Smart Pricing

Revlon’s Resilience: Ecommerce Lessons in Brand Monitoring & Competitive Pricing

The Labubu Frenzy: How a Mysterious Monster Became the $2B Collectible Empire

Quaker Oats’ Pricing Strategy: Balancing Affordability and Premium Positioning

Kellogg’s Cereal: How They Dominated the Breakfast Aisle

Frequently Asked Questions

Amul is owned by the Gujarat Cooperative Milk Marketing Federation (GCMMF), which is a cooperative organization based in Anand, Gujarat. GCMMF itself is jointly owned by millions of dairy farmers across Gujarat. So, while there isn’t a single owner, it is a collectively owned cooperative enterprise where the profits go back to the farmers who supply the milk.

AMUL stands for Anand Milk Union Limited. It was founded in 1946 in the town of Anand, Gujarat, as part of a cooperative movement to empower dairy farmers and eliminate middlemen. The name has since become synonymous with India’s White Revolution and is one of the most trusted food brands in the country.

As of the latest available information, Jayen Mehta is the Managing Director (MD) and CEO of GCMMF, the apex body that markets Amul products. He took over the role in early 2023, bringing over three decades of experience within the organization. However, leadership roles can change—so it’s best to verify with the official GCMMF website for the most up-to-date information.

To become an Amul distributor or franchisee:

Visit Amul’s official website and check the “Amul Parlours” or “Franchise” section.

You can apply online or contact the GCMMF regional office.

Requirements typically include: A shop space (preferably 100–300 sq. ft. for a retail outlet)

Initial investment, depending on the outlet type (around ₹2–6 lakhs)

Basic refrigeration equipment and branding as per Amul’s specifications

Once approved, Amul provides supply support, branding materials, and margin-based revenue.

Becoming a distributor or retailer with Amul is considered a low-risk, high-reputation opportunity due to the brand’s strong supply chain and nationwide recognition.