Table of Contents

ToggleBuilding a comprehensive competitor analysis framework is crucial for businesses seeking to maintain a strong position in a competitive marketplace. Such a framework allows brands to assess rivals at both the product-to-product and brand-to-brand levels, enabling a deeper understanding of how their offerings stack up and identifying strategic areas for improvement.

This article will guide you through constructing a competitor analysis framework that incorporates in-depth competitor research, market analysis, insights gathering, SWOT analysis, and benchmarking, with an emphasis on digital shelf insights to track online performance.

Why Do You Need a Competitor Analysis Framework?

A well-structured competitor analysis framework provides businesses with ongoing insights into how they compare to others in the industry.

Image Source: Board Mix

Rather than a one-time task, competitor analysis is a continuous process that helps brands anticipate market shifts, identify growth opportunities, and enhance their own strategies. The right framework enables companies to systematically gather data on competitors’ brands and products, informing strategic decisions that ensure relevance and longevity.

In the digital era, the competitor framework should include tools like digital shelf insights, which allow brands to gauge their visibility and performance in e-commerce channels relative to competitors.

This approach covers not only brand-level positioning but also specific product metrics, helping businesses fine-tune their strategies for the best results.

What Makes Up a Strong Competitor Analysis Framework?”

When creating a competitor analysis framework, it’s helpful to break it down into several core elements. So, let’s explore each element of this framework to understand how it contributes to a stronger strategic outlook.

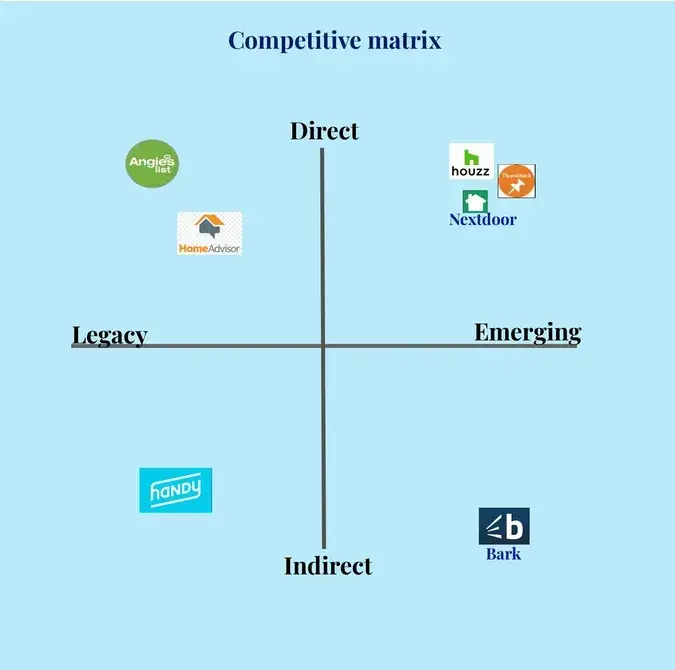

1. Competitor Research: Identifying Core and Peripheral Competitors

Competitor research is the foundation of any competitor analysis framework. This process involves identifying direct competitors who provide similar products and services, as well as indirect competitors who may address similar customer needs in different ways.

Image Source: Hubspot

Competitor research helps brands understand their positioning in the market, product range, pricing strategies, and customer engagement efforts.

To conduct effective competitor research as part of a competitor analysis framework:

- Identify Key Players: List both direct and indirect competitors to get a complete picture of the competitive landscape.

- Examine Product Offerings: Document each competitor’s product selection, key features, and unique selling points to see how they differentiate themselves.

- Assess Market Presence: Evaluate each competitor’s market share, geographic reach, and brand perception to understand where they stand in the industry.

- Analyze Customer Feedback: Use customer reviews and ratings to understand how customers view each competitor’s products and services.

This step in the framework allows businesses to determine which competitors pose the greatest threat and which areas demand closer monitoring.

2. Market Analysis: Placing Competitors Within the Industry Context

Market analysis provides a broader understanding of where competitors operate. By integrating market analysis into a competitor analysis framework, brands can identify industry trends, demand factors, potential obstacles, and opportunities for growth.

This step is crucial for understanding how competitors are influenced by and respond to broader industry conditions.

Effective market analysis as part of a framework includes:

- Identifying Industry Trends: Track shifts in technology, consumer behavior, and regulations to see how they affect competitors.

- Understanding Demand Drivers and Constraints: Examine factors that boost demand in the industry and any possible constraints, such as supply chain issues or economic fluctuations.

- Assessing Competitive Saturation: Gauge how many competitors are in the market and how aggressively they compete.

- Defining Customer Segments: Determine the specific customer demographics and preferences that each competitor targets to find any gaps in the market.

This aspect of the competitor analysis framework helps brands understand the broader environment in which their competitors operate, providing valuable context for strategic decision-making.

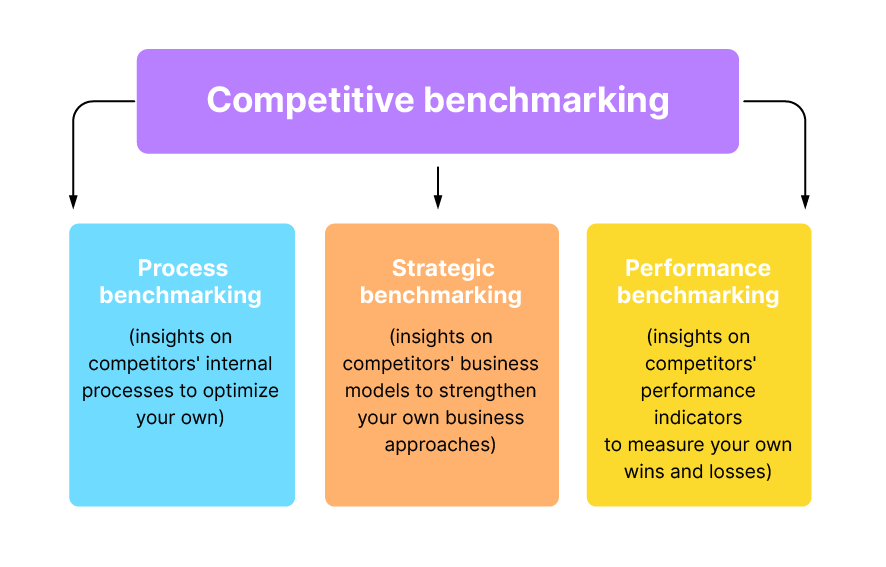

3. Competitor Insights and Benchmarking: Setting Standards for Performance

Competitive benchmarking is a critical part of any framework. By comparing their own performance against key competitors, businesses can set realistic goals and standards for improvement.

Image Source: Company Sights

This part of the framework involves examining aspects like product quality, pricing, customer engagement, and overall brand positioning.

For a well-rounded benchmarking approach within a competitor analysis framework:

- Evaluate Product Quality and Features: Examine competitors’ products to understand what customers value and where competitors may have an edge.

- Review Pricing Strategies and Value Propositions: Analyze how competitors price their offerings and what value they promise to customers.

- Monitor Customer Experience Efforts: Look at customer satisfaction, social media engagement, and support quality to see how competitors build relationships with their customers.

- Analyze Marketing and Brand Positioning: Review competitor campaigns, brand messages, and promotions to determine which tactics resonate with their audiences.

Including benchmarking in the framework helps businesses set clear, data-backed goals and gives them a realistic view of where they can enhance their competitiveness.

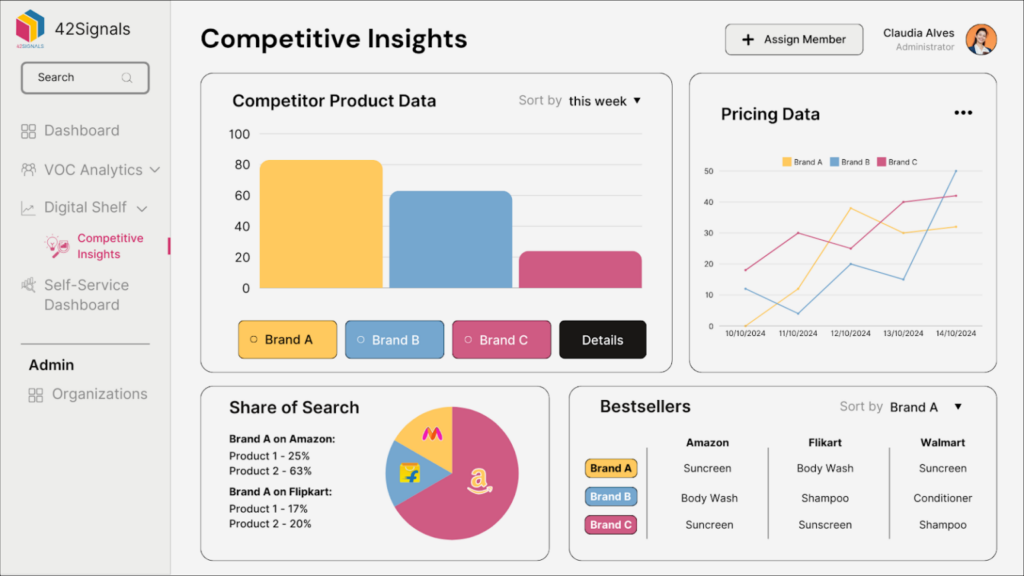

4. Digital Shelf Insights: Tracking Competitor Performance in the Online Space

The shift to online shopping makes it crucial to monitor digital shelf insights. Digital shelf analytics allow companies to track how visible their products are on digital platforms and how they perform compared to competitors.

Key areas for digital shelf insights within a competitor analysis framework include:

- Product Visibility and Search Rankings: Track how often products appear in search results and how they rank compared to competing items.

- Customer Feedback and Ratings: Monitor online reviews and ratings for customer insights on product performance and satisfaction.

- Pricing and Promotional Tactics: Observe pricing changes, discounts, and other pricing strategies competitors use to attract buyers.

- Inventory and Availability: Keep tabs on product availability to ensure that products maintain a competitive presence online.

Integrating digital shelf insights provides an accurate view of your product’s online performance, helping to adjust strategies for better visibility and customer engagement.

5. SWOT Analysis: Identifying Strengths, Weaknesses, Opportunities, and Threats

A SWOT analysis is an essential component of a competitor framework. By assessing each competitor’s strengths, weaknesses, opportunities, and threats, businesses gain a clearer understanding of their competitive position and can develop strategies to address potential challenges.

For a successful SWOT analysis within a competitor analysis framework:

- Identify Competitor Strengths: Look at each competitor’s major strengths, like a loyal customer base or standout products.

- Pinpoint Weaknesses: Recognize where competitors might fall short, whether it’s limited product selection or high prices.

- Spot Opportunities for Growth: Consider emerging trends or customer needs that competitors haven’t yet addressed.

- Evaluate Potential Threats: Identify risks posed by competitors, like aggressive pricing or changes in customer behavior.

A SWOT analysis allows businesses to prepare for potential threats, recognize growth opportunities, and understand how they can differentiate themselves in a competitive market.

Dual Strategy: Product-to-Product and Brand-to-Brand Level in Competitor Analysis

Image Source: The Good

A robust competitor analysis framework is essential for strategic decision-making. While examining the overall market landscape is crucial, true competitive advantage often emerges from dissecting the competition at two distinct, yet interconnected, levels: Product-to-Product and Brand-to-Brand. Each level provides unique insights and serves different strategic purposes.

1. Product-to-Product Comparison: The Tactical Microscope

This level zooms in on the specific offerings within a defined product category or against a direct rival product. It’s a granular, feature-by-feature assessment focused on understanding how your specific product stacks up in the eyes of the target customer making a purchase decision.

- Core Focus: Individual product attributes, performance, user experience, and value proposition at the point of sale or use.

- Key Components:

- Feature Parity & Differentiation: Meticulously map core features, unique selling propositions (USPs), technical specifications, and performance benchmarks (e.g., speed, capacity, accuracy). Identify where you match, lag, or lead. Example: Comparing camera specs (megapixels, aperture, zoom) and image processing software between smartphone models.

- Pricing & Value Perception: Analyze not just the sticker price, but the pricing structure (subscription, one-time, freemium), discounts, bundles, and perceived value-for-money. How does your price point compare for the features offered? Example: Comparing cost-per-unit or cost-per-feature of project management software tiers.

- Customer Experience & Feedback: Dive deep into user reviews (on platforms like G2, Capterra, Amazon, Trustpilot), app store ratings, social media sentiment, and support forum discussions specifically about the product. Identify recurring pain points, praises, and unmet needs. Example: Analyzing reviews for a specific blender model regarding noise, durability, and ease of cleaning.

- Availability & Channels: Where and how is the competitor’s product sold? (Direct, retail partners, online marketplaces, geographic regions). How does this impact accessibility and customer convenience? Example: Comparing the shelf placement and in-store promotion of competing cereal brands.

- Design & Usability: Evaluate the physical design, user interface (UI), user experience (UX), packaging, and aesthetics. How intuitive and appealing is it? Example: Comparing the checkout flow and mobile app design of competing e-commerce platforms.

- Strategic Purpose: This analysis is vital for:

- Product Development & Refinement: Identifying features to add, improve, or remove. Informing roadmaps based on competitor strengths/weaknesses and customer feedback.

- Pricing Strategy: Setting competitive prices, developing discount tactics, or justifying premium pricing based on superior features.

- Sales Enablement: Equipping sales teams with concrete talking points to highlight advantages or counter competitor claims during pitches.

- Marketing Messaging: Crafting specific, feature-focused campaigns that directly address competitive gaps or superiorities.

2. Brand-to-Brand Comparison: The Strategic Wide-Angle Lens

This competitor analysis framework pulls back to examine competitors as holistic entities. It focuses on the overarching perception, reputation, and relationship the competitor’s brand has built in the marketplace over time. It’s about understanding their position in the customer’s mind and heart.

- Core Focus: Overall brand identity, market positioning, reputation, equity, and the emotional/intangible connection with the audience.

- Key Components:

- Brand Positioning & Messaging: How does the competitor define themselves? What is their core promise, mission, vision, and values? How do they communicate this consistently across channels (advertising, content, PR, social media)? Example: Comparing Volvo’s “safety” positioning vs. BMW’s “ultimate driving machine”.

- Brand Perception & Reputation: What do customers, industry analysts, and the general public really think about the brand? This encompasses trust, reliability, innovation, prestige, ethics, and social responsibility. Tools include brand tracking surveys, media sentiment analysis, and social listening beyond product reviews. Example: Analyzing perceptions of a bank’s trustworthiness vs. its fintech competitor’s innovation.

- Market Share & Growth Trajectory: Understanding the competitor’s relative size, historical growth patterns, and future ambitions within the broader market and specific segments.

- Customer Loyalty & Advocacy: How strong is their customer retention? Do they have loyal advocates? What are their Net Promoter Scores (NPS) or customer satisfaction (CSAT) scores like overall? How effective are their loyalty programs? Example: Comparing the passionate fanbases of Apple vs. Samsung.

- Marketing & Communication Strategy: Analyzing their overall marketing mix (channels used, campaign themes, content strategy, PR efforts, influencer partnerships). What tone of voice and imagery do they consistently use? Example: Comparing Red Bull’s extreme sports event sponsorship vs. Coca-Cola’s mass-market feel-good campaigns.

- Company Culture & Leadership Perception: How is the company itself perceived as an employer or industry leader? Does leadership have a strong public profile? Example: Comparing the public personas and perceived visions of Elon Musk (Tesla/SpaceX) vs. Tim Cook (Apple).

- Strategic Purpose: This analysis is crucial for:

- Defining/Refining Brand Strategy: Identifying your unique brand position, core values, and personality relative to competitors. Crafting a compelling overarching brand narrative.

- Building Brand Equity: Developing strategies to enhance brand awareness, loyalty, perceived quality, and associations.

- Reputation Management: Proactively addressing potential reputational risks and opportunities based on competitor standing.

- Long-Term Market Positioning: Making strategic decisions about market entry, expansion, partnerships, or pivoting based on the broader competitive brand landscape.

- Crisis Preparedness: Understanding competitor reputations helps anticipate how industry scandals might impact your own brand by association or contrast.

Product-to-Product and Brand-to-Brand analyses are not mutually exclusive; they are deeply complementary. A strong brand can elevate the perception of individual products (making customers more forgiving of minor flaws or willing to pay a premium). Conversely, consistently excellent products build a strong brand over time. A product might win on features (Product-level), but lose the customer due to a lack of trust in the brand (Brand-level). Conversely, a beloved brand might retain customers even if a specific product iteration is slightly behind.

Conclusion:

A well-crafted competitor analysis framework is a vital tool for any business looking to stand out in a competitive field. With elements like competitor research, market analysis, benchmarking, digital shelf insights, and SWOT analysis, companies can gain a clear and actionable understanding of their position relative to competitors.

Tools like 42Signals can help businesses with this intel and provide the right actionable insights in an easy-to-understand, intuitive competitive analysis dashboard.

Curious to know more? Schedule a free demo.

Frequently Asked Questions

What is the framework of competitor analysis?

The framework of competitor analysis refers to a structured approach used to evaluate competitors’ strengths, weaknesses, strategies, and market positions. It typically involves identifying competitors, analyzing their offerings, assessing their market strategies, and understanding their impact on your business.

The framework often incorporates tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) and Porter’s Five Forces to provide actionable insights that inform strategic planning and decision-making.

What are the 4 competitor analysis?

The “4 competitor analysis” typically refers to four critical aspects or areas of focus in understanding competitors:

- Market Dynamics: Broader market trends, customer behaviors, and technological advancements influencing the competitive environment.

- Direct Competitors: Companies offering similar products or services targeting the same audience.

- Indirect Competitors: Businesses providing alternative solutions or substitutes that address the same customer needs.

- Potential Competitors: Emerging or new players in the market who may enter and disrupt the competitive landscape.

What are the 5 steps parts of a competitive analysis?

The five key steps or parts of a competitive analysis are:

- Benchmark and Formulate Strategies: Compare your business to competitors and develop actionable strategies to improve your competitive position.

- Identify Your Competitors: Determine who your direct, indirect, and potential competitors are within your market.

- Gather Information: Collect data on competitors’ products, pricing, market share, strengths, weaknesses, and customer feedback.

- Analyze Competitor Strategies: Assess their marketing, sales, and operational strategies to understand how they position themselves.

- Evaluate Strengths and Weaknesses: Use frameworks like SWOT analysis to identify areas where competitors excel and where they are vulnerable.

What is Porter’s framework for competitor analysis?

Porter’s framework for competitor analysis, also known as Porter’s Four Corners Model, is a strategic tool designed to predict competitors’ behavior and reactions. The framework focuses on understanding four key areas:

- Motivations – Drivers: Examines what drives a competitor, including their goals, corporate culture, and leadership motivations.

- Motivations – Assumptions: Evaluates how competitors perceive themselves, their capabilities, and the market environment.

- Actions – Current Strategy: Analyzes competitors’ existing strategies, including marketing, pricing, and product offerings.

- Actions – Capabilities: Assesses their resources, strengths, and weaknesses to understand what they can realistically achieve.