The grocery retail landscape has changed quite a bit in the last few years. Recently, heightened customer expectations in the value of products and convenience have resulted in brands sensibly pricing products or offering them good discounts. That’s why a grocery price tracker is crucial for businesses in the space.

Retailers need real-time competitive insights to protect margins, optimize promotions, and win the battle for the digital shelf. Implementing a sophisticated grocery price tracker helps grocery retailers with the right insights to make complex decisions easily.

The Need for a Grocery Price Tracker

With several platforms readily selling all types of groceries from vegetables, fruits, to longer non-perishable items, prices can fluctuate daily depending on demand and seasonal produce. Let’s understand some core concepts first.

1. The Q-Commerce Tsunami and the Dark Store Revolution

The rise of quick commerce – promising delivery in under 30 minutes – has fundamentally reshaped grocery expectations. Giants like Gorillas, Blinkit, and Zepto, alongside established players like Instacart and Uber Eats, are expanding into ultra-fast delivery and have conditioned consumers to expect immediacy.

This model relies heavily on dark stores: small, strategically located, tech-driven micro-fulfillment centers dedicated solely to online order picking and packing, bypassing traditional storefronts.

The Data Speaks: According to a McKinsey report, the global q-commerce market for grocery and convenience goods could reach a staggering $300 billion to $400 billion by 2025, representing a significant portion of the overall online grocery market.

Impact on Pricing: Q-commerce players, often operating on thin margins initially to capture market share, employ highly dynamic pricing strategies. Prices can fluctuate multiple times a day based on demand, inventory levels, competitor actions, and delivery slot availability.

This creates immense pressure on traditional supermarkets and even established online grocers to respond swiftly. Dark stores enable this agility but also fragment the competitive landscape, making manual tracking impossible.

Image Source: CNN

2. Hyperlocal Fulfillment: The Engine of Speed and Price Complexity

Hyperlocal fulfillment – sourcing and delivering goods from locations extremely close to the end consumer – is the backbone of q-commerce speed. This involves dense networks of dark stores, micro-fulfillment centers within existing stores, or even leveraging local convenience stores.

Image Source: LinkedIn

The Pricing Challenge: Hyperlocality means competition isn’t national or even city-wide; it’s intensely neighborhood-specific. A dark store operated by Competitor A in Neighborhood X might have drastically different pricing and promotions than Competitor B’s store just a mile away in Neighborhood Y, targeting distinct demographics or inventory positions.

Traditional broad-stroke pricing strategies fail here. Retailers need granular, hyperlocal fulfillment zone-level price intelligence.

3. Why Real-Time Competitive Price Insights Are Non-Negotiable

The velocity of q-commerce and the granularity of hyperlocal competition demand continuous price monitoring. Here’s why real-time insights are crucial:

Margin Protection & Optimization: Identify underpriced items eroding your margins or opportunities where your prices are uncompetitively high. React instantly to competitor price drops before losing significant volume.

Promotional Effectiveness: Measure the true impact of your promotions by instantly seeing if competitors are matching or undercutting you. Optimize promotional spend and timing.

Assortment Rationalization: Identify gaps where competitors consistently undercut you on key items, signaling potential delisting or substitution opportunities.

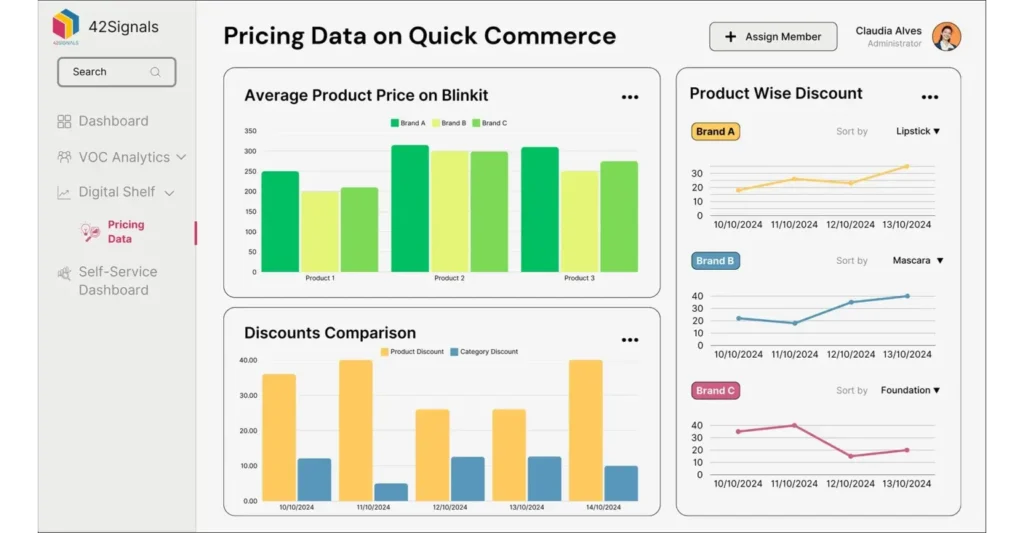

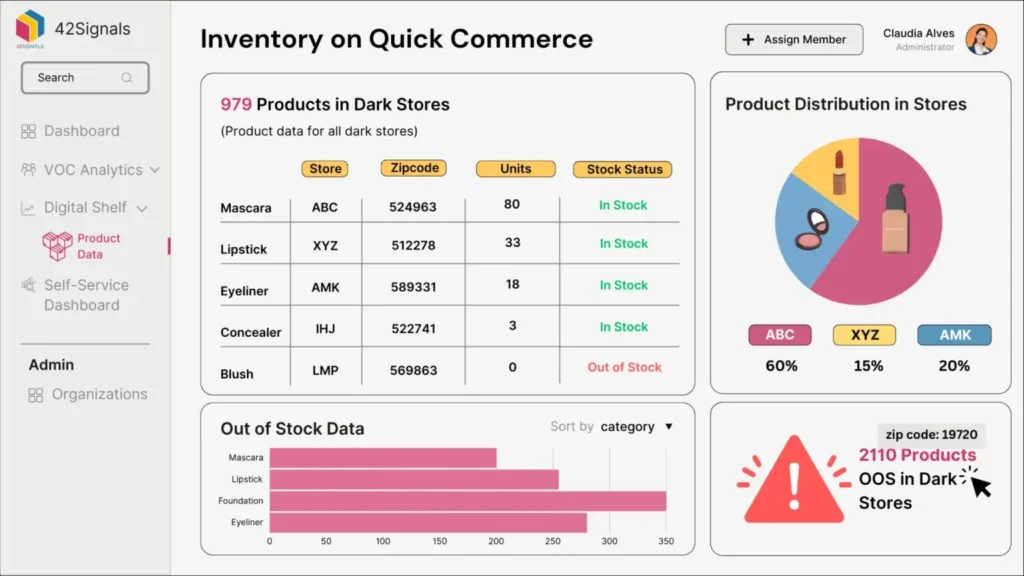

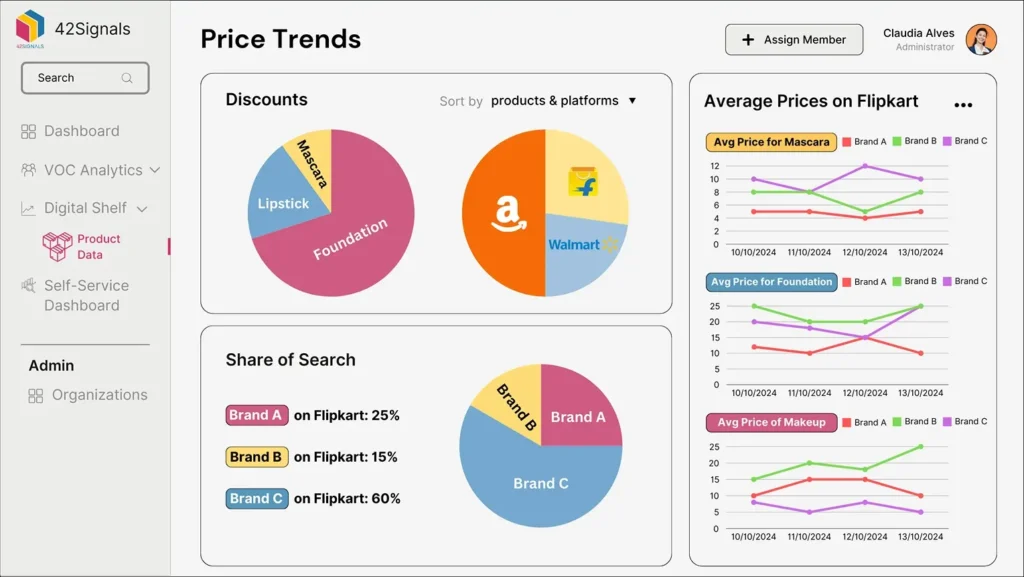

Image Source: 42Signals Product Data

Price Perception Management: Ensure your overall basket pricing remains competitive within your target hyperlocal fulfillment zones to maintain customer loyalty.

Supplier Negotiations: Armed with real-time competitor data, negotiate better terms with suppliers based on actual market pricing, not outdated reports.

Mitigating Channel Conflict: Ensure consistent and competitive pricing across your own e-commerce, third-party marketplaces (like Instacart), and physical stores to avoid customer dissatisfaction.

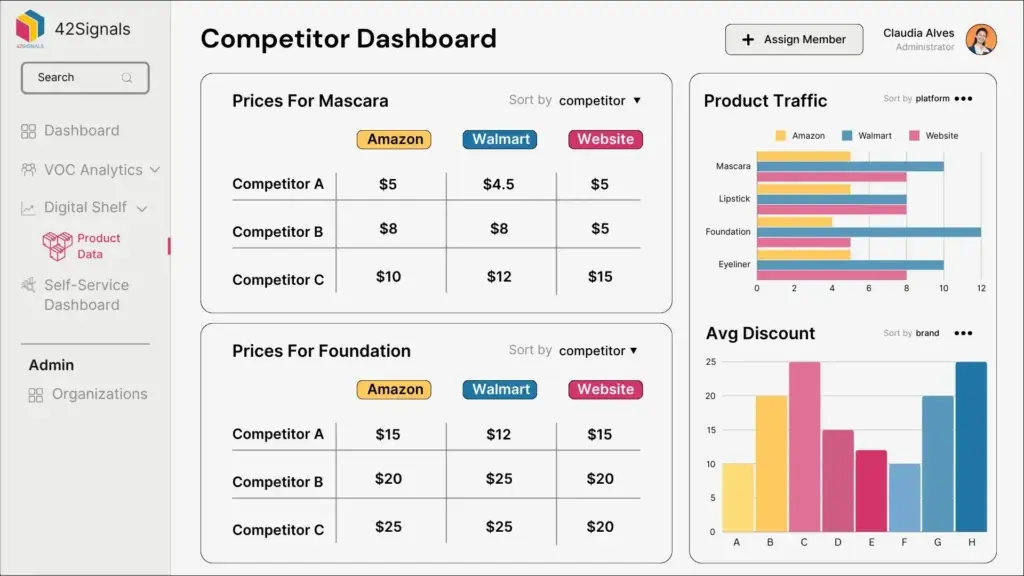

Introducing 42Signals: Your Command Center for Digital Shelf Analytics

Navigating this complex, fast-moving landscape requires a purpose-built solution. 42Signals is a leading provider of digital shelf analytics and ecommerce insights, offering a powerful platform specifically designed for the challenges of modern grocery retail, including the intricacies of q-commerce, and perfect for a grocery price tracker solution.

Beyond Simple Scraping: 42Signals goes beyond basic price scraping. It provides comprehensive digital shelf analytics, monitoring not just price but also product availability, assortment changes, promotion execution, search ranking within grocery apps and websites, and even imagery and content accuracy across hundreds of competitors and thousands of SKUs.

Q-Commerce Focused: The platform is adept at tracking the unique storefronts and SKU structures of leading Q-commerce players and aggregators operating within hyperlocal fulfillment models.

Hyperlocal Granularity: Track competitor pricing and promotions down to the specific dark store or fulfillment zone level, providing truly relevant competitive context.

Actionable Ecommerce Insights: Transform raw data into actionable intelligence with intuitive dashboards, customizable reports, and deep analytics revealing trends, share of shelf, and competitive positioning.

Step-by-Step: Implementing Your Grocery Price Tracker with 42Signals

Implementing a robust price tracking system with 42Signals involves strategic planning and execution:

Define Objectives & Scope:

- What are your primary goals? (e.g., protect margin on key SKUs, optimize promotions, monitor q-commerce threats).

- Which competitors are most critical? (Include major chains, regional players, and key q-commerce apps like DoorDash, Swiggy Instamart, GoPuff, and pure-play dark store operators relevant to your markets.)

- Which geographic markets or hyperlocal fulfillment zones are priorities?

- Which product categories and specific SKUs (National Brands, Private Label) require monitoring?

Start strategically – perhaps high-volume staples, key promotional items, or categories under intense Q-commerce pressure.

Configure the 42Signals Platform:

Onboarding & Integration: Work with the 42Signals team to set up your account, define user roles, and integrate data feeds with your internal systems (PIM, ERP, BI tools) if needed.

Competitor & Source Mapping: Precisely define the online sources to monitor (competitor websites, app-based storefronts for specific dark store locations, major marketplace grocery sections).

SKU Matching: Establish accurate matching between your internal SKUs and how they appear (including variations) across competitor digital shelves. 42Signals uses advanced matching algorithms, but the initial setup is crucial.

Zone Definition: Configure the specific hyperlocal fulfillment zones or geographic areas for which you require granular pricing data.

Implement Price Alerts & Thresholds:

This is where the power of automation shines. Configure price alerts within the 42Signals platform:

- Absolute Price Changes: Alert me if Competitor X drops the price of SKU Y below $Z.

- Relative Price Changes: Alert me if my price for SKU A exceeds Competitor B’s price by more than 5%.

- Promotion Detection: Alert me when Competitor C runs a BOGO or significant discount on a key competing product.

- Stockout Alerts: Notify me when a critical competitor SKU goes out of stock in a key zone.

- New Competitor Entry: Alert me if a new q-commerce player or dark store becomes active in one of my priority zones.

- Define Alert Cadence & Channels: Receive alerts instantly via email, SMS, Slack, or integrated within the platform dashboard based on severity.

Data Collection & Validation:

42Signals’ platform automatically and continuously crawls the defined sources, collecting pricing, availability, promotion, and other digital shelf analytics data.

Implement initial data validation checks to ensure matching accuracy and data quality. Refine configurations as needed.

Analysis, Reporting & Action:

Dashboards: Utilize real-time dashboards for an at-a-glance view of key metrics: price position (high/low/average), promotion intensity, availability rates, share of shelf by category/zone.

Custom Reports: Generate scheduled or ad-hoc reports on competitive price movements, promotional effectiveness, gap analysis, and q-commerce activity in specific hyperlocal fulfillment areas.

Drill-Down Capability: Investigate anomalies or alerts by drilling down to specific competitor storefronts, SKUs, and historical price trends.

Integrate Insights: Feed these ecommerce insights into your pricing, merchandising, and marketing systems and workflows. Empower category managers and pricing analysts with direct access to relevant data.

Continuous Optimization:

- Regularly review the scope: Add new competitors, SKUs, or zones as your strategy evolves.

- Refine price alerts based on what’s proving most actionable.

- Leverage 42Signals’ analytics to identify new trends and adjust monitoring priorities (e.g., sudden price volatility in a category due to a new q-commerce entrant).

Leveraging Price Alerts for Strategic Agility

Price alerts are the tactical heartbeat of your price tracker. When configured effectively within 42Signals, they transform data into immediate action:

Defensive Actions: Receive an alert that a supplier has significantly undercut your milk price, causing a MAP violation. Immediately reach out to any such violators and take action so your brand’s value isn’t undercut.

Offensive Opportunities: An alert indicates a competitor is out of stock on a high-demand item in Zone 2. Temporarily increase your price slightly or launch a targeted “in-stock” promotion to capture margin and volume.

Promotional Calibration: Alerts notify you within minutes that competitors have matched your BOGO offer. Quickly assess if deeper discounting is needed or if you can hold position based on other value props (speed, loyalty points).

Supplier Engagement: Use alerts demonstrating consistent underpricing by a competitor on a national brand as leverage in your next supplier negotiation.

New Threat Detection: An alert flags a new q-commerce player offering aggressive introductory pricing in a core market. Mobilize your strategy team for rapid competitive response planning.

Hypothetical Study: Regional Grocer Thwarts Q-Commerce Threat with 42Signals

Challenge: “FreshMart,” a successful regional supermarket chain with a growing e-commerce presence, faced aggressive entry from a well-funded q-commerce player (“QuickBasket”) leveraging dark stores in its primary urban markets. QuickBasket launched with deep discounts on the top 100 SKUs, threatening FreshMart’s online sales and customer loyalty.

Solution: FreshMart implemented 42Signals, focusing intensely on QuickBasket’s hyperlocal fulfillment zones and specific discounted SKUs. They set aggressive price alerts for any QuickBasket price below FreshMart’s cost on core items and tracked promotional cadence.

Action & Results: Real-time alerts allowed FreshMart’s pricing team to implement zone-specific, surgical responses:

- Matched prices only on the specific SKUs being targeted within the affected zones, minimizing margin erosion.

- Leveraged ecommerce insights from 42Signals to identify high-margin private label alternatives to promote aggressively, where QuickBasket only carried national brands.

- Monitored QuickBasket’s stockouts (frequent during initial surge) and capitalized with guaranteed availability messaging.

Within 3 months, FreshMart stabilized its online market share in the contested zones. 42Signals data revealed QuickBasket gradually increased prices on initial loss-leaders, allowing FreshMart to strategically ease its matching.

FreshMart also used competitive intelligence to optimize its own hyperlocal fulfillment delivery fees and slots for better competitiveness.

Future Trends: Ecommerce Insights as the Core of Grocery Strategy

The integration of real-time price tracking and broader digital shelf analytics will only deepen:

- AI-Powered Predictive Pricing: Platforms like 42Signals will evolve beyond monitoring to predict competitor reactions to your price changes or promotions and suggest optimal pricing strategies using AI.

- Personalized Price Optimization: Leveraging individual customer data alongside real-time competitor insights to offer dynamic personalized pricing (where feasible and ethical).

- Integration with Supply Chain: Real-time price and demand signals feed directly into hyperlocal fulfillment center replenishment systems for greater efficiency.

- Marketplace & Aggregator Dominance: Monitoring pricing parity and promotional execution across third-party marketplaces (Instacart, DoorDash) will become as crucial as monitoring direct competitors. Q-commerce will increasingly flow through these aggregators.

- Holistic Digital Shelf Health: Price will remain paramount, but analytics will expand to comprehensively measure overall digital shelf health – content accuracy, image quality, review sentiment, search visibility, all impacting conversion alongside price.

Gaining Control with a Grocery Price Tracker

The grocery battlefield is now digital, hyperlocal, and measured in minutes, not days. Quick commerce and dark stores have intensified competition, making real-time competitive insights derived from a robust grocery price tracker essential for survival and growth. Hyperlocal fulfillment demands equally granular competitive intelligence. Manual methods are utterly inadequate.

Implementing 42Signals provides a powerful solution. Its focus on digital shelf analytics, including real-time price tracking with configurable price alerts and granular visibility into q-commerce and hyperlocal fulfillment dynamics, delivers the actionable ecommerce insights needed. By following the strategic implementation steps – defining scope, configuring the platform, setting intelligent alerts, analyzing data, and taking swift action – grocery retailers can transform from being reactive to proactive.

They can protect margins, optimize promotions with precision, counter competitive threats surgically, and ultimately win the loyalty of value-conscious, convenience-driven consumers. In the age of instant gratification, real-time price intelligence isn’t just an advantage; it’s the foundation of competitive grocery retailing.

Partnering with 42Signals equips you to master this new reality. Sign up for a free trial today.