What is Competitive Benchmarking?

Competitive benchmarking is a process of comparing your business’s performance, products, or services with those of your competitors to identify areas where you can improve and gain a competitive advantage.

It involves gathering information and data about your competitors’ strategies, practices, and outcomes, and then analyzing and comparing them to your own.

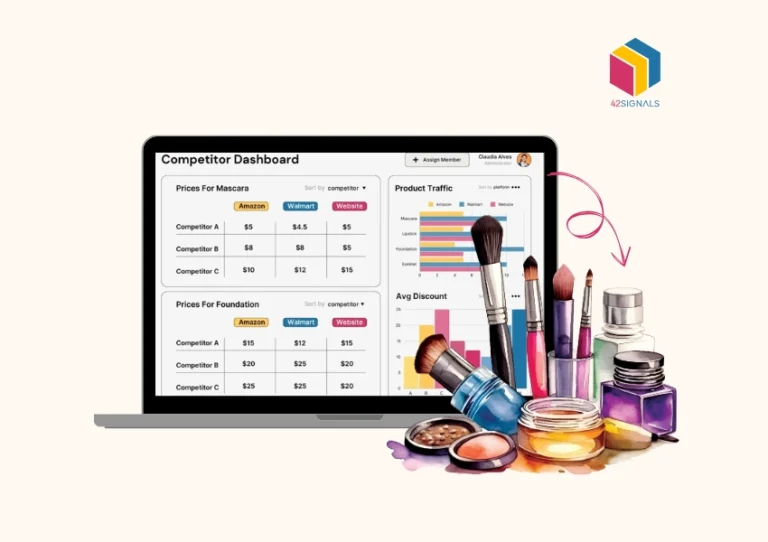

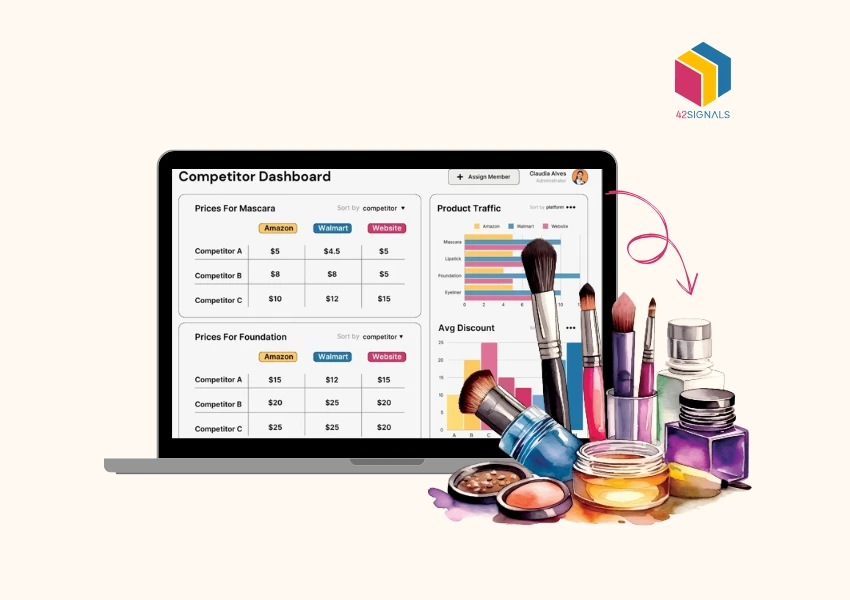

Image Source: Dash Hudson

Here’s an example to help illustrate competitive benchmarking: Imagine you own an online clothing store and want to evaluate your performance compared to other similar retailers. You visit their websites to analyze their product range, pricing, website user experience, customer reviews, and shipping options.

Additionally, you gather data on their sales growth, customer retention rates, and social media engagement. By comparing this information with your own company’s metrics, you can identify areas of strength and areas that need improvement.

For instance, you might discover that your pricing is competitive, but your website navigation could be improved, or that your customer reviews are positive, but your shipping options are limited.

Armed with these insights, you can make informed decisions to optimize your online store, enhance the customer experience, and gain a competitive edge in the market.

Why Use It?

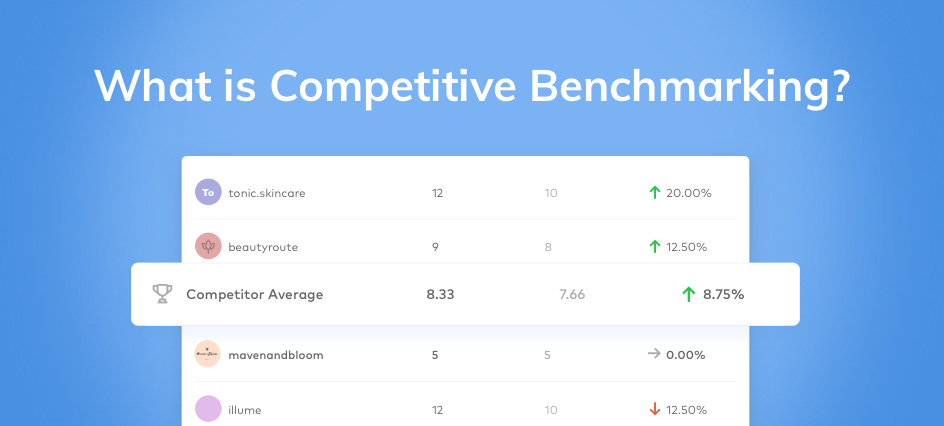

Image Source: Voxco

Competition benchmarking is crucial for businesses as it provides valuable insights into their performance compared to competitors.

Analyzing key metrics like sales, market share, and customer satisfaction, can help companies gain a clear understanding of their position in the market. This knowledge helps identify areas of strength to leverage and weaknesses that require improvement.

Studying best practices, processes, and customer engagement methods empowers organizations to enhance their operations and overall performance.

Additionally, competitive benchmarking aids in setting realistic goals by understanding competitors’ performance levels. It serves as a benchmark for success, guiding businesses to outperform their rivals.

It fosters a culture of continuous improvement. Constant evaluation and enhancement of processes, products, and services drive innovation, efficiency, and customer satisfaction.

Effectively leveraging benchmarking allows businesses to gain a competitive edge, optimize operations, and achieve long-term success in their industries.

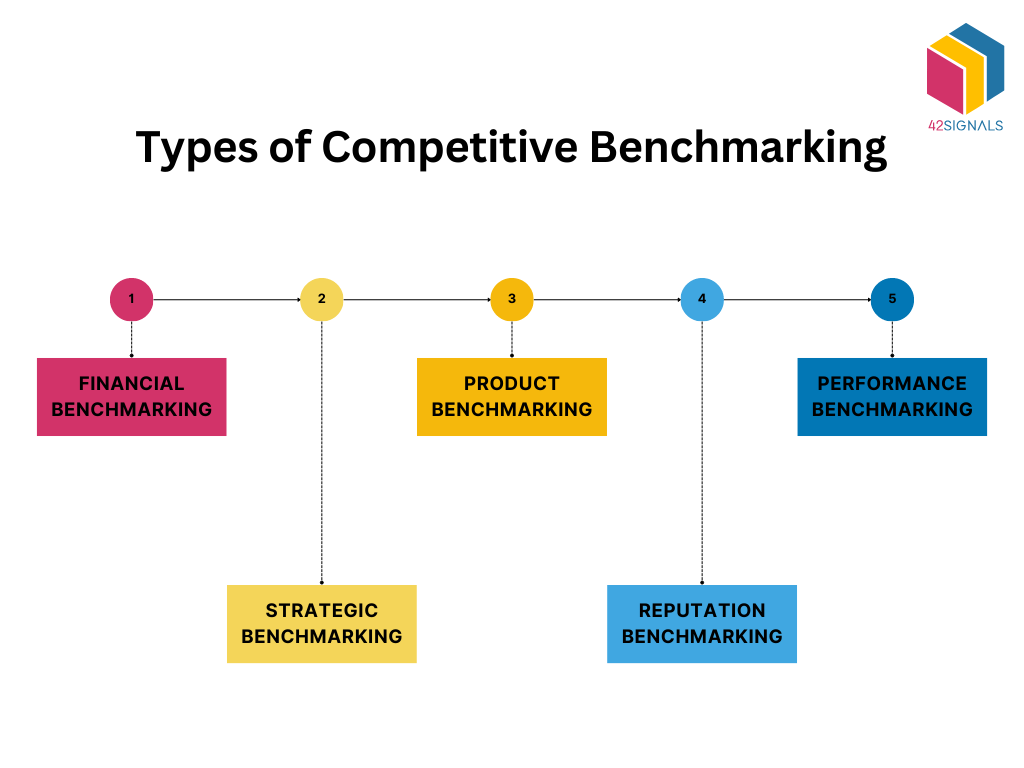

Types of Competitive Benchmarking

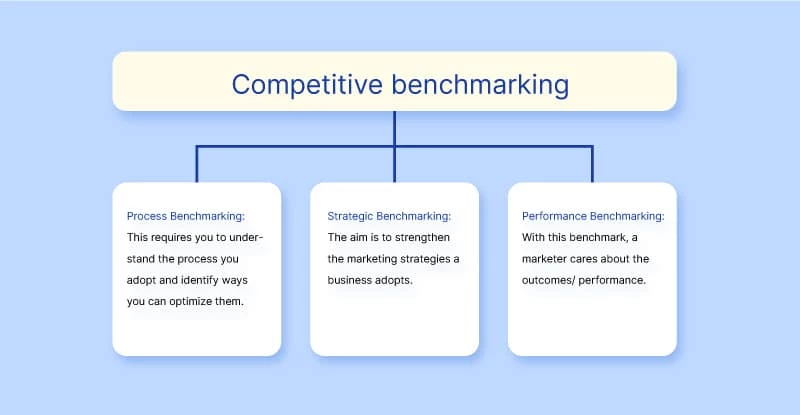

Competitive benchmarking is an indispensable strategic tool, enabling businesses to move beyond internal introspection and understand their true standing within the dynamic marketplace. By systematically comparing specific aspects of their operations, products, or performance against direct competitors and industry leaders, organizations gain critical insights needed to identify strengths, weaknesses, opportunities, and threats.

However, benchmarking is not a monolithic activity; it can be categorized into distinct types based on the specific focus area being evaluated. Understanding and strategically deploying these different types allows for a more nuanced and actionable analysis. Here’s a detailed exploration of the most common and impactful types:

Financial Benchmarking: The Bottom-Line Reality Check

- Core Focus: This type centers on rigorously comparing financial performance metrics and health indicators.

- Key Metrics: Revenue growth rates, profitability (gross profit margin, net profit margin, operating profit margin), liquidity ratios (current ratio, quick ratio), solvency ratios (debt-to-equity ratio), efficiency ratios (inventory turnover, accounts receivable days), return on investment (ROI), return on assets (ROA), return on equity (ROE), cost structures (Cost of Goods Sold, SG&A expenses), and market capitalization.

- Sources: Public financial statements (10-K, 10-Q), investor relations presentations, industry reports (IBISWorld, Statista), financial databases (Bloomberg, S&P Capital IQ), and analyst reports.

- Strategic Value: Financial benchmarking provides an objective reality check. It answers critical questions: Are we as profitable as our peers? Are our costs under control relative to the industry? Is our growth rate sustainable? It helps identify financial inefficiencies, opportunities for cost reduction, areas for improving profitability (e.g., pricing strategies), and potential risks related to leverage or liquidity. For example, a retailer comparing its inventory turnover to a leading competitor might discover opportunities to optimize stock levels and free up working capital.

- Implementation Challenges: Requires access to reliable competitor financial data, which can be difficult for private companies. Accurate comparison also necessitates accounting for differences in business models, size, and geographic focus.

Strategic Benchmarking: Decoding the Long Game with Competitive Benchmarking

- Core Focus: This high-level type involves analyzing and comparing the overall strategies, business models, and long-term direction of competitors.

- Key Aspects: Market positioning (premium vs. budget, niche vs. mass market), core value propositions, target customer segments, geographic expansion plans, diversification strategies, merger and acquisition (M&A) activity, key strategic partnerships and alliances, innovation focus areas, corporate culture implications, and long-term vision/goals.

- Sources: Company websites, annual reports, CEO letters, press releases, analyst commentary, industry conferences, news articles, patent filings (indicating R&D direction), and investor day presentations.

- Strategic Value: Strategic benchmarking helps answer the “why” behind competitor actions. It reveals how competitors are attempting to differentiate themselves and achieve sustainable competitive advantage. By understanding their strategic moves (e.g., entering a new market, acquiring a tech startup, forming a key partnership), a company can anticipate market shifts, identify potential threats to its own strategy, uncover new strategic opportunities, and refine its own long-term plans. For instance, a telecom company analyzing a rival’s aggressive investment in 5G infrastructure gains insights into future market dynamics and potential competitive gaps.

- Implementation Challenges: Interpreting strategic intent can be subjective. Requires synthesizing information from diverse sources and anticipating future moves, which involves inherent uncertainty. Often involves qualitative analysis alongside quantitative data.

Product (or Service) Competitive Benchmarking: The Feature-by-Feature Face-Off

- Core Focus: This granular type involves a detailed comparison of the features, functionality, quality, design, usability, performance, pricing, and overall value proposition of specific products or services against direct competitor offerings.

- Key Activities: Creating detailed feature matrices, conducting side-by-side product testing (performance, durability, speed), analyzing user manuals and support documentation, gathering customer reviews and feedback on competing products, reverse engineering (where legal and ethical), comparing pricing tiers and packaging, and assessing ease of use/UX design.

- Sources: Hands-on product testing, competitor websites, product documentation, customer reviews (Amazon, G2, Capterra, Trustpilot), industry publications, technical specifications, mystery shopping (for services), and focus groups.

- Strategic Value: Product benchmarking is crucial for innovation, differentiation, and meeting customer expectations. It identifies gaps in your own offerings, highlights competitor strengths to emulate or surpass, uncovers opportunities for new features or improvements, validates pricing strategies, and informs R&D priorities. It directly answers: “How does our product really stack up?” A software company might benchmark its user interface and core functionality against the market leader to prioritize its development roadmap.

- Implementation Challenges: Can be resource-intensive (acquiring competitor products, conducting thorough testing). Requires technical expertise. Rapidly evolving markets make findings potentially short-lived. Ethical considerations around reverse engineering must be strictly adhered to.

Reputation (Brand) Benchmarking: Measuring Market Perception

- Core Focus: This type assesses the intangible yet critical elements of brand perception, customer sentiment, and overall reputation relative to competitors.

- Key Metrics: Brand awareness (aided and unaided), brand favorability, brand associations, net promoter score (NPS), customer satisfaction scores (CSAT), online review ratings and sentiment (volume and tone), social media sentiment analysis, share of voice (SOV) in relevant online conversations, media coverage tone, and perception of key attributes (e.g., trustworthiness, innovation, customer service).

- Sources: Dedicated brand tracking surveys, social media listening tools (Brandwatch, Sprout Social, Talkwalker), online review platforms, media monitoring services, focus groups, sentiment analysis of news articles and blog posts, and analysis of customer service interactions.

- Strategic Value: Reputation benchmarking reveals how the market perceives your brand versus competitors. It uncovers reputational strengths to leverage and weaknesses to address (e.g., poor customer service perception). It informs marketing and communication strategies, highlights potential PR risks, helps measure the impact of brand campaigns, and identifies opportunities to improve customer loyalty and advocacy. A hotel chain might benchmark its online review scores and sentiment against key rivals to identify specific service areas needing improvement.

- Implementation Challenges: Measuring intangibles like reputation is inherently complex. Data sources (reviews, social media) can be noisy and require sophisticated analysis tools. Attributing changes in perception to specific actions can be difficult. Requires consistent tracking over time.

Performance (Operational) Benchmarking: Optimizing Internal Processes

- Core Focus: This type compares specific operational processes, functional performance, and efficiency metrics across different areas of the business.

- Key Areas & Metrics:

- Sales: Sales cycle length, win/loss rates, average deal size, sales productivity (revenue per rep), lead conversion rates.

- Marketing: Cost per lead (CPL), cost per acquisition (CPA), marketing ROI, website conversion rates, email open/click-through rates, social media engagement.

- Customer Service: First contact resolution rate, average handle time, customer satisfaction (CSAT) for service interactions, service level agreement (SLA) adherence, call abandonment rates.

- Supply Chain/Operations: Order fulfillment time, inventory turnover, manufacturing yield, defect rates, logistics costs per unit, warehouse efficiency.

- HR: Employee turnover rates, time-to-hire, cost-per-hire, employee engagement scores, training effectiveness.

- Sources: Industry associations, specialized benchmarking consortia, consulting firm reports, publicly available case studies (sometimes), direct partnerships with non-competing companies (“functional benchmarking”), and inferred data from customer interactions or market intelligence.

- Strategic Value: Performance benchmarking pinpoints operational inefficiencies and best practices. It answers questions like: “Are our customer service reps resolving issues as quickly as competitors?” or “Is our manufacturing process as efficient as industry leaders?” By identifying performance gaps in specific functions, businesses can target process improvements, reduce costs, enhance productivity, improve quality, and ultimately deliver better customer experiences. An e-commerce company might benchmark its order fulfillment speed and accuracy against Amazon to set internal targets.

- Implementation Challenges: Finding directly comparable competitor data for internal processes is often the hardest aspect. Companies may need to rely on industry averages or benchmark against non-competitors in similar industries. Requires a clear process definition and consistent internal measurement.

These types of benchmarking can be utilized based on the specific needs and goals of a business. Implementing a combination of these types allows organizations to gain comprehensive insights, identify opportunities, and make informed decisions to enhance their competitive advantage.

Best Practices

Engaging in effective competitive benchmarking requires following best practices to ensure accurate and valuable results. Some best practices are:

- Define Clear Objectives: Clearly define your goals and objectives for the benchmarking process. This helps you stay focused and ensures that the benchmarking efforts align with your business strategy.

- Select Relevant Competitors: Identify competitors that are directly relevant to your industry, target market, and competitive landscape. Focus on those that pose a significant threat or have similar offerings to yours.

- Choose Appropriate Metrics: Select metrics that are meaningful and aligned with your objectives. Choose a mix of quantitative and qualitative metrics that provide a comprehensive view of performance.

- Gather Reliable Data: Collect data from credible and reliable sources. Utilize a combination of primary research, such as surveys or interviews, and secondary research, including market reports, industry publications, and public data sources.

- Ensure Data Comparability: When comparing data, ensure that you are using consistent methodologies, time periods, and definitions. Adjust for any significant differences to ensure fair and accurate comparisons.

- Maintain Confidentiality: Respect the confidentiality of competitors’ information and data. Avoid sharing or using proprietary or sensitive information without permission.

- Foster a Continuous Learning Culture: Encourage a culture of learning and improvement within your organization. Regularly communicate and share benchmarking findings with relevant stakeholders to promote knowledge exchange and drive action.

- Embrace Innovation: Look beyond direct competitors and consider benchmarking against companies or industries known for innovation and best practices. Adopting successful strategies from other sectors can give you a competitive edge.

- Monitor Industry Trends: Stay updated on industry trends, technological advancements, and changing customer preferences. This helps you anticipate shifts in the market and adapt your strategies accordingly.

- Iterate and Improve: Treat competitive benchmarking as an ongoing process rather than a one-time exercise. Continuously evaluate and refine your benchmarking approach, incorporating feedback and lessons learned to enhance effectiveness over time.

Xerox’s Case Study

Xerox is a leading copier company that implemented benchmarking initiatives as part of its ‘Leadership through Quality’ program during the early 1980s. The benchmarking concept and its implementation in various processes at Xerox are discussed in detail in this article.

The case examines how Xerox used benchmarking to compare its performance characteristics with those of its key products and services. Furthermore, the article delves into the beneficial effects of implementing benchmarking practices at Xerox.

Conclusion on Competitive Benchmarking

Competitive benchmarking is an invaluable tool for businesses to achieve remarkable success. It involves setting goals, analyzing data, and evaluating performance metrics to gain insights into strengths and weaknesses. This ongoing process allows businesses to optimize strategies, adapt to market changes, and secure a competitive advantage. Adhering to best practices, such as selecting relevant metrics and involving stakeholders, ensures maximum benefits while safeguarding data confidentiality.

Frequently Asked Questions

How to do competitive benchmarking?

- Identify your competitors

- Choose what to measure

- Gather data and analyze it

- Draw conclusions

- Monitor progress

What is an example of it?

An example would be a software company analyzing its user interface (UI) design compared to its competitors. They might compare elements like color schemes, layout, typography, and iconography. By gathering this data through user testing and feedback surveys, they can determine whether their UI design is intuitive, visually appealing, and easy to use compared to competing solutions. If they find areas where their design falls short, they can make improvements to better meet user needs and expectations.