** TL;DR ** In 2025, predicting buying trends means ditching gut instincts and outdated sales reports in favor of real-time insights from inventory intelligence and share of search data. Inventory intelligence tracks competitor stock, distributor data, and supplier lead times to reveal true market demand before it hits your sales, while share of search captures what consumers want, often weeks before they buy, helping identify emerging trends, measure marketing impact, and understand intent. When combined, these tools validate which trends are real, guide hyper-local quick commerce stocking, and optimize pricing and promotions. The winning playbook: invest in integrated analytics platforms, share data across teams, refine forecasts with live signals, test quickly, and use AI to detect patterns, all while keeping data clean, connected, and compliant with privacy rules, ensuring you stock smarter, sell faster, and seize demand before competitors do.

Remember when predicting what customers would buy next felt like reading tea leaves? Those days are over. Predicting buying trends today comes from inventory intelligence and the powerful signal of share of search data. This isn’t just market chatter; it’s actionable ecommerce market intelligence that can transform how you stock, sell, and market. Buckle up – we’re decoding the future of purchase behavior.

Image Source: Column Five

Why Old Trendspotting Tools Are Not Enough to Decode Buying Trends in 2025

You know the drill: last year’s sales reports, gut feelings, maybe a focus group. While historical data has its place, 2025’s landscape moves too quickly for rearview mirror driving.

- The Algorithm Avalanche: Search engine and social media algorithms update constantly. What ranked yesterday might vanish tomorrow, instantly shifting what products consumers discover and desire. Relying solely on past performance misses these seismic shifts.

- The Viral Vortex: A product can go from obscurity to “must-have” status in hours thanks to social media virality. Remember the sudden scramble for that obscure kitchen gadget or quirky accessory? Traditional forecasting cycles are far too slow to catch these social media spikes.

- The Quick Commerce Quake: The intense quick commerce demand requires hyper-localized stocking strategies and an ability to predict micro-trends at lightning speed. (Stat: According to Insider Intelligence, US quick commerce sales are projected to reach $72.16 billion by 2028, highlighting its massive and growing impact.)

Simply put, yesterday’s data won’t cut it for tomorrow’s buying trends. We need live signals.

Inventory Intelligence: Seeing What’s Really Moving (Beyond Your Own Warehouse)

Think of inventory data as the pulse of the market, taken in real-time. But true power comes from looking beyond your own stock levels. This means analyzing competitor inventory, distributor data, and even supplier lead times across the web.

Image Source: 42Signals’ Competitor Analysis Dashboard

- Spotting the Surges (Before They’re Sold Out): A sudden, coordinated drop in competitor stock for a specific product category across multiple retailers is a massive red flag (in a good way!). It signals a surge in demand you might not yet see in your own sales. This allows you to urgently ramp up orders or adjust marketing before the wave hits.

- Identifying the Looming Lulls: Conversely, noticing a gradual but widespread build-up of inventory for a particular item type, despite promotions, is a warning sign. It indicates softening demand, allowing you to slow orders, run targeted clearance campaigns, or pivot resources before getting stuck with dead stock.

- The Dark Store Dynamo: This intelligence is crucial for meeting quick commerce demand. Dark store stocking – those hyper-local fulfillment centers – relies on pinpoint accuracy. Knowing exactly which items are spiking in specific zip codes, based on broader inventory depletion patterns, allows these micro-hubs to stock precisely for immediate, local needs. It’s predictive stocking at the neighborhood level.

This wider lens transforms inventory data from a reactive operational tool into a proactive ecommerce market intelligence powerhouse for spotting emerging buying trends.

Share of Search to Understand Buying Trends: Listening to the Whisper Before the Shout

While inventory tells you what people are buying (or trying to buy), share of search data reveals what they want to buy, often before they make a purchase. It measures the percentage of total search volume within your category that your brand or specific products command.

- The Early Warning System: A rising share of search for a specific product feature, ingredient, or emerging brand is often the very first signal of a budding trend – weeks or even months before it translates into significant sales. Imagine knowing a new wellness ingredient was gaining search traction before every competitor launched a product with it!

- Measuring Marketing Impact (For Real): You poured resources into that big campaign or snagged that influencer deal. But how do you really know it worked beyond getting some buzz? Here’s the litmus test: did your share of search jump up? A real climb in search share means you’re actually shaping what people want to buy next, putting you right in the middle of the buying trends conversation where it counts.

- Understanding the “Why” Behind the Searches: Seeing search volume go up is one thing, but the specific words people type tell the real story. Are they hunting for bargains? Really focused on eco-friendly options? Or maybe they discovered a cool new way to use something they already own? Getting this context – the why behind the surge – is incredibly valuable. It directly feeds into creating products people actually want and crafting marketing messages that truly resonate.

- Catching Social Media Spikes: When a product goes viral, the first place people often go is Google or Amazon. A sudden, explosive jump in search volume for a previously niche item is a direct signal of a social media spike translating into commercial intent. Real-time monitoring here is key to capitalizing on fleeting opportunities.

Share of search is like tuning into the market’s collective subconscious, revealing nascent desires that will soon shape concrete buying trends.

The Magic Happens When They Meet: Synergy in Action

Inventory intelligence and share of search are powerful alone, but together, they create an almost predictive crystal ball for buying trends. Here’s how they work in concert:

- Search Spike Detected: You see a sudden, significant increase in share of search for “retro handheld gaming consoles” across major platforms.

- Inventory Check: You scan competitor inventory and notice rapid depletion of specific popular retro console models, along with rising prices on marketplaces. Distributor data shows low stock levels.

- Conclusion & Action: This isn’t just a blip; it’s a validated trend surge. You can confidently:

- Expedite existing orders of related stock.

- Source additional units aggressively.

- Adjust pricing strategy strategically.

- Brief your sales team on the hot item.

Without inventory data, the search spike might just be curiosity (are people just reading reviews, not buying?). Without search data, the inventory depletion might be due to a competitor’s one-off sale, not a wider trend. Together, they provide validation and context.

Taming the Quick Commerce & Impulse Buying Trends Beast

The 15-minute delivery model thrives on immediacy and often, impulse. This is where these data streams become absolutely critical.

- Predicting Hyper-Local Craves: Quick commerce demand is intensely neighborhood-specific. When you mash up this localized share of search data with real-time dark store stock levels, you unlock something powerful: the ability to shift inventory with pinpoint precision.

- Mastering Impulse Purchase Analytics: What makes someone add that chocolate bar or fancy candle at checkout? Impulse purchase analytics fueled by this combined data can identify:

- High-Impulse Items: Products frequently searched for spontaneously (“best chocolate near me,” “scented candles now”) and showing fast turnover in quick commerce dark stores.

- Optimal Placement: Knowing these items allows for strategic placement on app interfaces and in dark store layouts for maximum visibility at the decision point.

Strategies to Adopt in 2025

Here’s how to leverage inventory and search data to win:

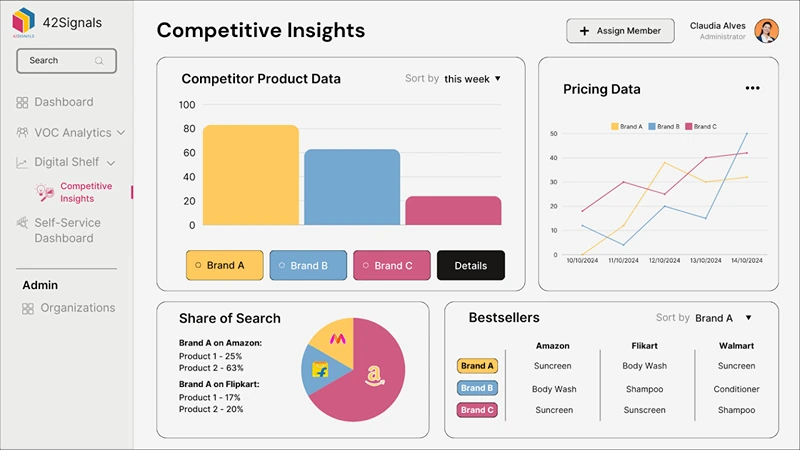

- Invest in the Right Tools: You need robust ecommerce market intelligence platforms. Look for solutions that offer:

- Competitor inventory monitoring across key retailers and marketplaces.

- Comprehensive share of search tracking (brand, product, category, keywords) with geographic granularity.

- Integration capabilities with your existing analytics, inventory management (IMS), and demand planning systems.

- Alerting for significant spikes or drops in either dataset.

Pro Tip: 42Signals offers it all. Check out our digital shelf analytics solutions.

- Build a Cross-Functional Data Hive: Break down silos. Marketing needs search data for campaigns. Sales needs inventory insights for conversations and forecasting.

- Refine Demand Forecasting: Move beyond historical averages. Incorporate real-time search intent signals and broader inventory health metrics into your forecasting models. This makes predictions far more responsive to emerging buying trends.

- Dynamic Pricing & Promotion: Use inventory depletion rates (yours and competitors’) and search volume trends to inform pricing strategies. Low stock + high search = potential for modest price optimization. High stock + low search = signal for targeted promotions.

Future-Proofing: Staying Ahead of the 2025 Buying Trends Curve

The data landscape won’t stand still. Here’s how to stay agile:

- Get Smart Help from AI & Machine Learning: Let’s face it, the sheer amount of data out there is overwhelming. This is where bringing in some AI muscle makes sense. Think of it as having a super-smart assistant that can dig into all that info – spotting connections you might overlook and spotting shifts in what people want to buy before they become obvious.

- Keep Your Data Clean & Connected: Get all your different systems – like your CRM, inventory software, and analytics dashboards – to actually talk to each other smoothly. If they’re working in silos, you’ll never get a clear picture. Having everything connected into one coherent view is absolutely essential for making good decisions.

- Adopt a “Try It and See” Mindset: Look, no data signal is foolproof. The key is to make testing easy and cheap. See a potential new buying trend hinted at in the data? Run a small, focused experiment quickly – maybe a targeted ad campaign or a limited stock run. Don’t be afraid to dip your toe in! And crucially, pay close attention to what happens. What worked? What flopped? Use both to learn what went wrong.

- Don’t forget the Ethics: With great data power comes great responsibility, right? Be upfront with your customers about what information you’re gathering and how you use it, whenever you realistically can. And absolutely, without question, follow the rules – that means regulations like GDPR and CCPA.

Buying trends can be easy to predict when you have the right tools, like 42Signals, to understand them. Here’s what it helps with –

- Anticipate surges (like those driven by social media spikes) before they leave you out of stock.

- Validate genuine trends beyond fleeting hype.

- Optimize for the unique challenges of quick commerce demand and dark store stocking.

If you’re curious, try 42Signals’ ecommerce market intelligence today to see our platform in action.

Frequently Asked Questions

What are the current buying trends?

Current buying trends vary by industry, but some patterns are shaping consumer behavior across markets:

Subscription models – Services offering convenience and regular delivery, like meal kits or curated boxes, are growing in popularity.

Sustainability-focused shopping – Consumers are prioritizing eco-friendly and ethically sourced products.

Mobile-first purchasing – More transactions are happening via smartphones and shopping apps.

Personalized experiences – Buyers expect tailored recommendations and targeted offers.

Social commerce – Platforms like Instagram, TikTok, and Facebook are becoming direct sales channels.

What is a buying trend?

A buying trend is a pattern or shift in consumer purchasing behavior over time. It reflects the types of products people are buying, the platforms they’re using, and the factors influencing their decisions—such as price sensitivity, quality, or sustainability.

These trends can be short-term (seasonal spikes) or long-term (changes in lifestyle or technology adoption)

How to determine buying trends?

You can identify buying trends by:

- Analyzing sales data to see which products or categories are growing.

- Monitoring social media for emerging hashtags, topics, and viral products.

- Using tools like Google Trends to track search interest over time.

- Reviewing competitor activity to see where they’re investing in promotions.

- Conducting customer surveys to understand preferences and priorities.

Combining these sources gives a more accurate picture of market direction.

What are the 4 types of buying?

The four main types of buying behavior are:

Variety-Seeking Buying Behavior – Low-involvement purchases where consumers try new products for a change, even without dissatisfaction with their current choice.

Complex Buying Behavior – High-involvement purchases where the buyer carefully evaluates options, such as buying a car or house.

Dissonance-Reducing Buying Behavior – High-involvement purchases with little difference between brands, where buyers seek reassurance after buying.

Habitual Buying Behavior – Low-involvement, routine purchases like groceries or household items.