Table of Contents

Toggle** TL;DR ** Mastering price intelligence data is fundamental to transforming pricing from a speculative exercise into a data-driven discipline for achieving superior returns. This process involves using retail price intelligence software to systematically gather and analyse market information, converting it into actionable insights for optimising profit margins and overall commercial strategy. By establishing a continuous cycle of monitoring, analysis, and strategic execution, businesses can secure a sustainable competitive advantage and maximise return on investment.

Historically, pricing strategy has often been a speculative exercise, influenced by internal cost structures, anecdotal observations of competitors, and imperfect market assumptions. This approach frequently results in suboptimal outcomes, including eroded profit margins or lost market share. The transition to a digital commerce landscape has rendered such methods obsolete. Today, strategic pricing is a discipline driven by data. Specifically, it is powered by comprehensive price intelligence data, which provides a factual, dynamic, and granular understanding of the market.

Price intelligence data encompasses the systematic collection and analysis of pricing information for products and services across a defined competitive set. It moves beyond static price points to capture the full context of market positioning, including promotional cycles, shipping costs, and inventory availability.

A Strategic Definition of Price Intelligence Data

Image Source: Web Data

A common misconception equates price intelligence with simple competitor price tracking. While monitoring is a foundational activity, true pricing intelligence is a more sophisticated and strategic discipline.

At its core, price intelligence data provides a continuous, contextualised view of the market. It answers not only “what” the price is but “why” it exists within a broader competitive and commercial context. This is typically facilitated by advanced retail price intelligence software, which automates the collection and initial processing of vast datasets from competitor websites, marketplaces, and other digital channels.

The strategic output of this process is threefold:

- It establishes a clear benchmark of competitor pricing for identical and analogous products.

- It quantifies the impact of pricing strategies on key commercial metrics, including sales volume and profit margins.

- It identifies optimal price points that align with business objectives, whether that is margin maximisation, volume growth, or clear inventory.

This intelligence enables a shift from a reactive posture, where businesses respond to market changes, to a proactive one, where they anticipate and shape market dynamics.

The Tangible Value Proposition of Price Intelligence

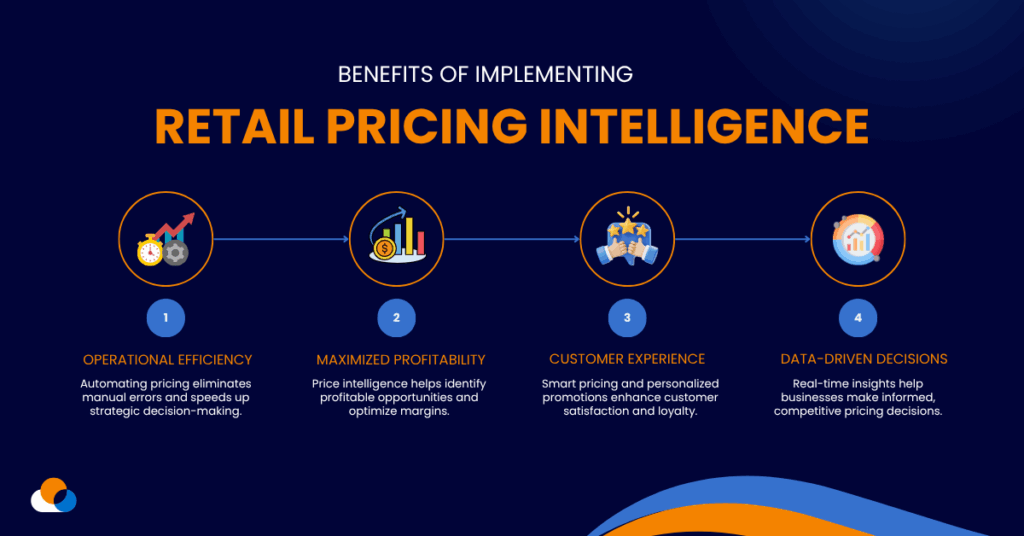

Image Source: 42Signals’ Product data & Prices

Investing in a robust price intelligence system is a strategic decision with direct and measurable impacts on commercial performance. The benefits extend across several critical business functions.

Optimisation of Profit Margins

The most immediate benefit is the ability to systematically improve profit margins. By accurately understanding the price elasticity and competitive thresholds for each product, organisations can identify significant opportunities. For instance, analysis may reveal that premium products are underpriced relative to the competition, allowing for a data-justified price increase that enhances revenue without impacting volume.

Informed Promotional and Commercial Strategy

Price intelligence eliminates the inefficiency of undifferentiated discounting. With a clear view of competitor promotions, businesses can time their campaigns to maximise impact, ensuring their offers are compelling in the current market context. This prevents scenarios where a promotion merely matches a competitor’s everyday price, thereby preserving margin and promotional efficacy.

Enhanced Market Responsiveness and Agility

In dynamic markets, the speed of response is a competitive advantage. Continuous monitoring allows organisations to react to competitor price changes within hours, not weeks. This agility helps protect market share on price-sensitive items and capitalise on competitors’ stock-out situations.

Data-Driven Product and Portfolio Management

Price intelligence data provides valuable insights beyond pricing. Analysis of competitor assortments, stock levels, and new product introductions can inform a company’s own product development, merchandising, and inventory planning strategies.

From Data to Strategy: The Imperative of Advanced Analysis

The collection of raw pricing data is merely the first step. Its true value is unlocked through rigorous data analysis that transforms information into actionable insights.

This analytical process moves beyond basic reporting to address strategic questions:

- What is the underlying pattern or trigger for a competitor’s price change?

- How do total cost structures, including shipping and taxes, compare and influence customer perception?

- What is the correlation between price positioning, sales velocity, and overall profitability for specific product categories?

Modern retail price intelligence software facilitates this deep data analysis by enabling the creation of rule-based pricing strategies.

Organisations can configure rules to, for example, maintain a specific price position relative to a key competitor, automatically flag anomalous price changes, or protect margin floors on strategic products. These actionable insights form the basis of a scalable, consistent, and profitable pricing strategy.

A Methodological Approach to Implementing Price Intelligence

Deploying a price intelligence capability requires a structured methodology to ensure alignment with business objectives and successful integration into commercial operations.

Phase 1: Strategic Goal Definition and Competitive Scoping

The initiative must begin by defining clear commercial objectives. Is the primary goal margin expansion, market share growth, or inventory liquidation? Subsequently, organisations must identify a precise competitive set, focusing on the players that directly influence their customers’ purchasing decisions.

Phase 2: Evaluation and Selection of Technology

Selecting the appropriate retail price intelligence software is critical. Key evaluation criteria should include:

- Data Accuracy and Coverage: The platform’s ability to reliably track the specified competitors and product categories.

- Update Frequency: The cadence of data collection must be sufficient for the volatility of the market.

- Analytical and Reporting Capabilities: The depth of its built-in analytics and the flexibility of its reporting tools.

- System Integration: API connectivity for seamless integration with existing e-commerce platforms, ERP, and pricing management systems.

Phase 3: Systematic Data Collection and Monitoring

With the technology in place, the process of continuous, automated data collection begins. It is essential to configure the system to capture the total price to the customer, including all ancillary fees.

Phase 4: Analysis, Interpretation, and Strategy Formulation

In this phase, commercial teams interpret the actionable insights generated by the platform. This involves analysing trends, testing hypotheses, and developing specific, product-level pricing strategies informed by the data.

Phase 5: Execution and Continuous Optimisation

Pricing strategies are executed in the market. The process does not end here; it enters a cycle of continuous improvement. The impact of price changes is monitored, and strategies are refined based on performance data, creating a feedback loop for perpetual optimisation.

The Strategic Role of Reporting and Governance

For a price intelligence initiative to be fully embraced, its findings must be communicated effectively across the organisation. Advanced data analysis must be complemented by clear, accessible reporting.

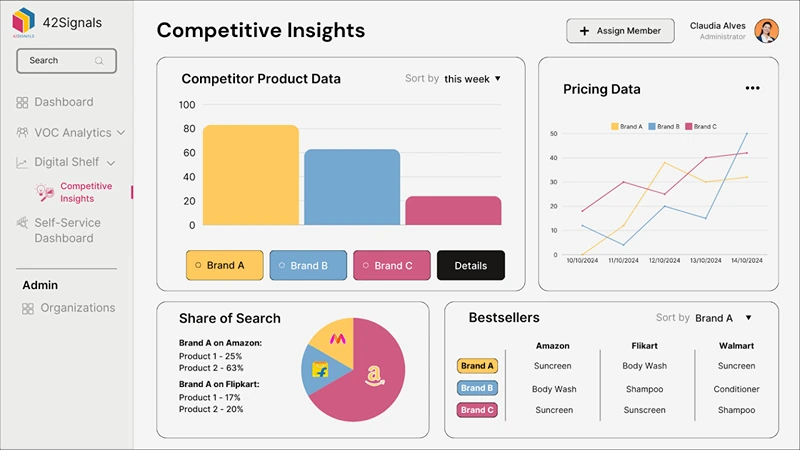

Effective reporting translates complex datasets into intelligible formats for diverse stakeholders, from pricing analysts to senior leadership. Dashboard visualisations and executive summaries replace unwieldy spreadsheets, enabling swift and confident decision-making.

The strategic functions of a robust reporting framework include:

- Enabling Performance Management: Tracking key metrics such as price index, margin, and competitive position against targets.

- Fostering Organisational Alignment: Ensuring commercial, marketing, and finance teams operate from a single, verified source of market truth.

- Quantifying Return on Investment: Clearly demonstrating the financial impact of data-driven pricing decisions on revenue and profitability.

Critical Considerations for Selecting Price Intelligence Software

The choice of technology platform is pivotal to the success of any pricing initiative. When evaluating retail price intelligence software, organisations should prioritise capabilities that align with their strategic goals.

Data Integrity and Comprehensiveness: The utility of the platform is contingent on the quality and scope of its data. It must deliver accurate, comprehensive coverage of the relevant competitive landscape.

Analytical Sophistication: The software should provide advanced analytical tools that move beyond basic monitoring to deliver predictive insights and prescriptive recommendations.

Operational Integration and Automation: To maximise efficiency and impact, the platform must integrate seamlessly with core business systems, enabling a degree of automated, rule-based price execution.

Scalability and Support: The solution must be capable of scaling with the business and should be backed by reliable customer support and strategic guidance.

Key Takeaways

- Shift from Intuition to Data-Driven Strategy: The fundamental goal of leveraging price intelligence data is to replace speculative pricing with an empirical, evidence-based discipline. This transforms pricing from an administrative task into a strategic lever for maximising profitability and market position.

- Embrace a Holistic View of the Market: True pricing intelligence extends beyond monitoring competitor list prices. It involves the comprehensive collection and contextual analysis of the entire market landscape, including promotional cycles, shipping costs, and stock availability, to form a complete competitive picture.

- Focus on Actionable Insights, Not Just Data: The value is not in the volume of data collected, but in the quality of the actionable insights derived from it. Effective data analysis must answer strategic “why” questions to identify precise opportunities for margin improvement and revenue growth.

- Prioritise Clear and Accessible Reporting: The success of the initiative depends on robust reporting. Transforming complex data into clear, visual dashboards and reports is essential for aligning stakeholders, enabling swift decision-making across the organisation, and demonstrating clear ROI to leadership.

- Commit to a Continuous Cycle of Improvement: Price intelligence is not a one-time project but an ongoing process of monitoring, analysis, and optimisation. The market is dynamic, and your pricing strategies must be equally agile to respond to new competitive actions and market conditions.

- Invest in Specialised Technology: Leveraging dedicated retail price intelligence software is critical for scalability, accuracy, and efficiency. The right platform automates data collection, provides advanced analytical capabilities, and enables the implementation of rule-based pricing strategies to protect profit margins.

Securing a Sustainable Competitive Advantage with Price Intelligence Data

In the contemporary commercial environment, where price transparency is the norm and competitive dynamics are in constant flux, an empirical approach to pricing is no longer optional. Relying on intuition or outdated information creates significant strategic vulnerability.

Price intelligence data provides the foundation for a resilient, responsive, and profitable commercial strategy. By implementing a systematic process supported by robust retail price intelligence software, organisations can transform their pricing operations.

This evolution from a speculative exercise to a data-driven discipline empowers businesses to protect and grow profit margins, make informed strategic decisions, and secure a durable competitive advantage.

Try 42Signals to understand price intelligence data for your brand on several marketplaces like Amazon, Flipkart, Blinkit, Zepto and more.

Download The Diwali 2025 Sale: Pricing Strategy Infographic

Frequently Asked Questions

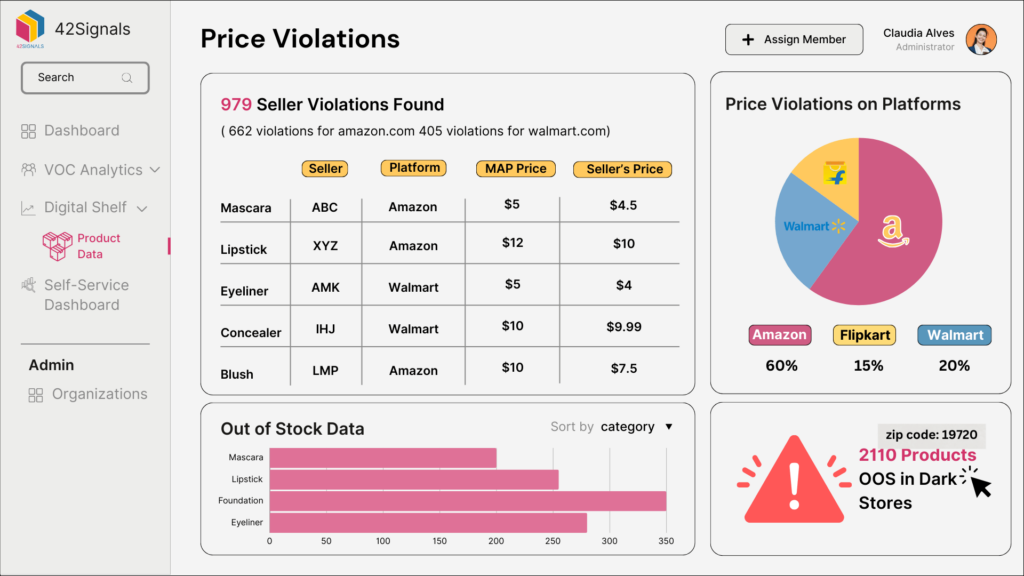

A Price Intelligence tool is software designed to automatically track, analyse, and compare competitor prices across online stores, marketplaces, and retail channels. It helps businesses make smarter pricing decisions by providing real-time insights into how their products are positioned in the market.

For example, 42Signals is a leading price intelligence platform that monitors competitors’ prices, detects MAP (Minimum Advertised Price) violations, and provides dynamic pricing recommendations. It allows brands to respond quickly to market changes, maintain profitability, and stay competitive.

These tools are particularly valuable in fast-moving sectors like eCommerce, consumer goods, and electronics, where pricing decisions directly affect conversion rates and margins.

The four primary pricing strategies that businesses use are:

Cost-Based Pricing: Prices are set by calculating production costs and adding a fixed profit margin.

Example: A manufacturer adds 30% over production costs as profit.

Value-Based Pricing: Pricing depends on how much customers perceive the product to be worth.

Example: Luxury brands like Rolex or Apple use perceived value rather than cost.

Competition-Based Pricing: Businesses adjust prices according to what competitors charge for similar products.

Example: Retailers matching Amazon’s prices to stay competitive.

Dynamic Pricing: Prices fluctuate in real time based on demand, stock levels, and competitor activity.

Example: Airlines or ride-sharing platforms adjusting fares dynamically.

The best software for price comparison depends on your business needs and scale:

For enterprise and brand intelligence, 42Signals stands out. It provides advanced data collection, competitor benchmarking, and automated alerts for price fluctuations or policy violations.

For SMBs, 42Signals continues to offer reliable competitor monitoring and reporting.

For individual shoppers, consumer-friendly apps like Honey, CamelCamelCamel, or Google Shopping help find the lowest prices for everyday products.

For large-scale use, 42Signals is ideal because it offers market-wide visibility, API integrations, and AI-driven insights that go far beyond simple comparisons.

Intelligent pricing is a data-driven strategy that uses AI, predictive analytics, and real-time market data to automatically determine the most profitable and competitive price for a product.

Instead of setting static prices, intelligent pricing systems analyse variables such as:

Competitor pricing

Demand trends

Customer purchase behaviour

Seasonality

Inventory levels

For instance, an online store could use intelligent pricing to automatically lower prices when competitors discount similar products — or increase them when demand surges and stock is limited.

This approach ensures optimised profitability, faster market response, and greater pricing accuracy, giving brands a competitive edge in fast-moving digital markets.