In the ever-evolving e-commerce landscape, staying one step ahead isn’t just about innovation; it’s about keeping pace. Many businesses focus intently on their internal metrics and customer feedback, often overlooking a critical source of strategic insights: their competitors. That’s the need for competitor monitoring.

Harnessing the power of e-commerce insights tools isn’t just about introspection; it’s about understanding the broader market dynamics. From pricing strategies to technological innovations, there’s much to glean from observing those who share the market space with you. In this article, we’ll dive deep into six crucial aspects where turning a blind eye to your competitors could be a missed opportunity for growth.

Understanding Market Movements with Competitor Monitoring

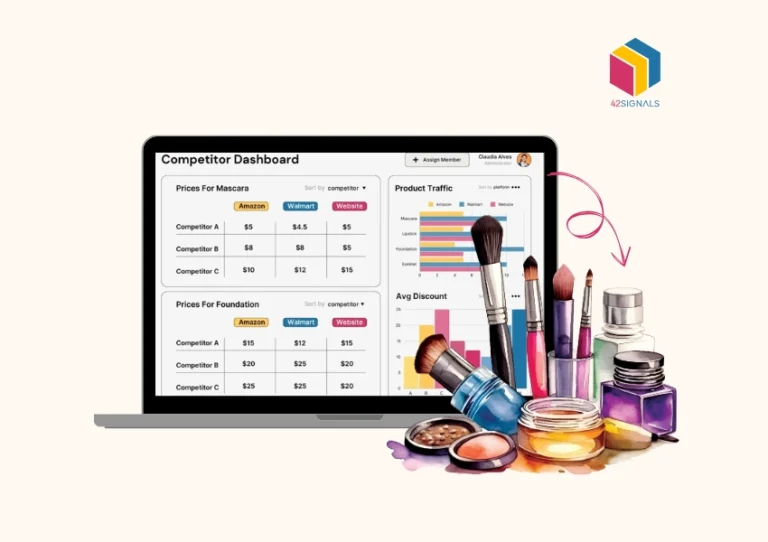

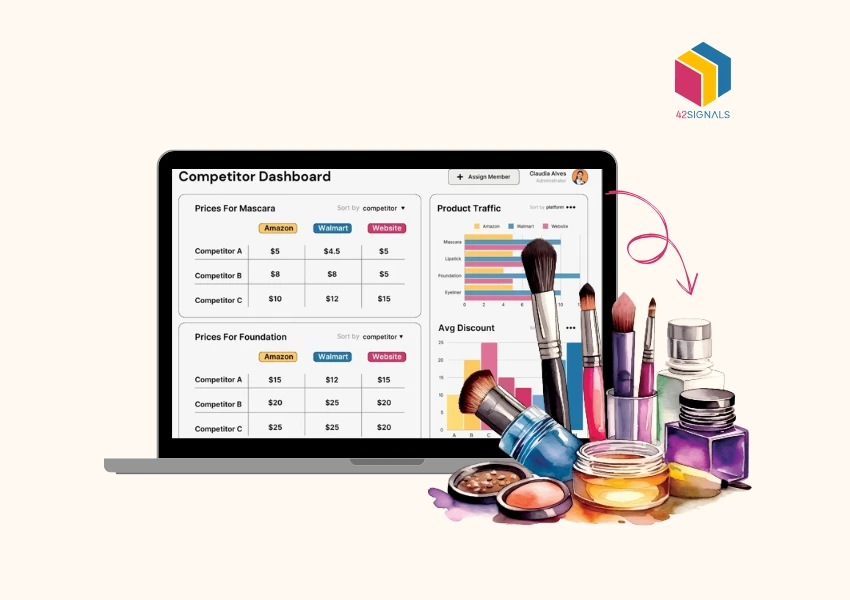

You’re selling a fantastic new product, but for some reason, it’s not flying off the virtual shelves. You dig a little deeper and find out a competitor is selling a similar item just a tad cheaper. This small difference can make a big impact on customer choices. That’s the power of pricing in the e-commerce world.

Prices online change all the time, based on many factors like demand, what competitors are doing, or special sale events. If you’re not watching these price changes, you might either price your items too high or too low and lose out on profits.

Take the Black Friday sale for example. Almost every online store offers discounts. If you knew exactly what your competitors were offering, you could tweak your deals just a bit to stand out and attract more customers.

The takeaway? In online selling, knowing your competitor’s prices can be a game-changer. It helps you set the right price and offer better deals to your customers. And the key to unlocking this competitive edge? Utilizing competitor monitoring tools. These tools provide a clear lens into the pricing strategies of your competitors, ensuring you’re always a step ahead in the pricing game.

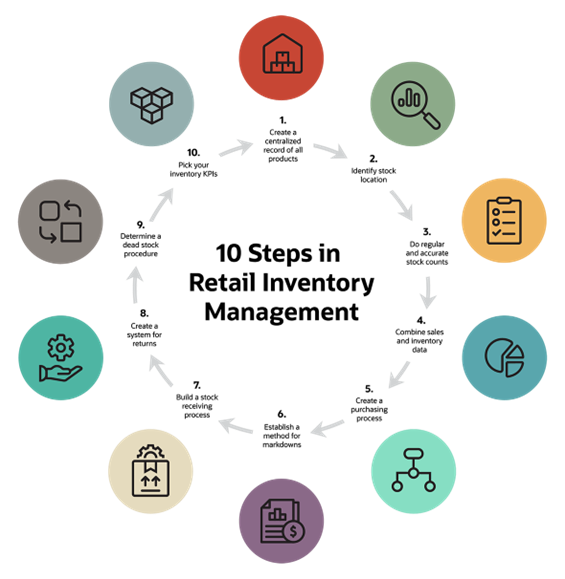

Inventory Intelligence: Decoding Stocking Strategies from Competitors

Ever noticed a competitor frequently running out of stock for a specific product? That’s not just a cue for market demand, but also an opportunity for you. By tapping into e-commerce insights, you can gauge which products are in high demand and ensure your inventory is always ready to meet that demand. Additionally, identifying products that competitors overstock can help you avoid pitfalls and streamline your own inventory.

1. The Psychology of Pricing: Beyond Simple Discounts

- Decoding Tiered Strategies: Top sellers rarely rely on random discounts. Analyze how competitors structure pricing. Do they use anchor pricing (showing a high “MSRP” next to the sale price)? Are they implementing premium pricing for perceived exclusivity or penetration pricing to grab market share? Tools can track price fluctuations over time, revealing patterns tied to seasons, inventory levels, or competitor actions.

- Bundle Brilliance: Examine how competitors bundle products. Are they combining slow-movers with top-sellers? Creating “solution kits” (e.g., camera + case + memory card)? Bundling increases average order value (AOV) and clears inventory. Track the composition and pricing of these bundles – what perceived value are they offering?

- Shipping & Value Perception: Is “Free Shipping” a consistent offer, or is it a threshold-based incentive ($50+)? How do their shipping costs and speeds compare to yours? Free and fast shipping are powerful conversion drivers, but they impact margins. Competitor insights reveal what the market expects and what customers are willing to pay for (or not).

- Psychological Triggers: Look for subtle tactics like charm pricing ($19.99 vs. $20.00), limited-time offers (“Only 3 left!”), or membership-exclusive pricing. These tactics influence purchase decisions at the micro-level.

2. Operational Insights: The Engine Behind the Experience of Competitor Monitoring

- Fulfillment & Logistics as a Competitive Weapon: Speed and reliability are paramount. Monitor competitors’ delivery promises (e.g., “2-Day Guaranteed,” “Same-Day Delivery in Metro Areas”) and track actual customer reviews mentioning shipping times or issues. Are they using regional fulfillment centers? Offering BOPIS (Buy Online, Pickup In-Store)? Their operational choices directly impact customer satisfaction and repeat business.

- Return Policy Transparency & Generosity: A hassle-free return policy reduces purchase friction. Analyze competitors’ return windows, processes (pre-paid labels?), restocking fees, and how prominently they display this information. A superior return policy can be a significant differentiator, especially for apparel, furniture, or electronics.

- Inventory Fluctuations & Stockout Patterns: Tracking when top-selling items go out of stock can reveal supply chain vulnerabilities, demand surges, or even intentional scarcity tactics. Conversely, noticing items perpetually on deep discount might signal overstocking or discontinuation. This helps you manage your own inventory proactively and identify potential sourcing opportunities or risks.

- Customer Service Channels & Responsiveness: How are competitors supporting customers? Live chat 24/7? Extensive self-service FAQs? Active social media support? Monitoring response times on social platforms or review sites provides insight into their customer service investment and effectiveness.

3. Dissecting the Full Customer Journey: Touchpoints Beyond the Transaction

- Content Marketing & Education: Are competitors investing heavily in blogs, buying guides, video tutorials, or webinars related to their products? This builds authority, nurtures leads, and improves SEO. Analyze the topics, depth, and engagement (comments, shares) on their content. What questions are they answering that you aren’t?

- Community Building & User-Generated Content (UGC): Look for signs of fostering community: active social media groups, branded hashtags encouraging customer photos, featuring UGC prominently on product pages or their website. This builds trust and authentic social proof far more potent than traditional advertising.

- Post-Purchase Engagement: The relationship doesn’t end at checkout. Do competitors send engaging order confirmation/shipping emails? Request reviews strategically? Offer loyalty programs? Provide personalized re-order prompts or complementary product suggestions? Effective post-purchase sequences drive repeat purchases and lifetime value (LTV).

- Review Analysis – The Goldmine: Go beyond star ratings. Use text analysis tools on competitor product reviews to uncover:

- Recurring Praises: What specific features or benefits do customers love? (e.g., “battery lasts forever,” “incredibly comfortable”).

- Persistent Complaints: What are the consistent pain points? (e.g., “sizing runs small,” “difficult assembly,” “stopped working after 3 months”). This reveals unmet needs and quality control issues.

- Feature Requests: What are customers explicitly asking for? This is direct R&D input.

- Sentiment Shifts: Track how sentiment changes over time, especially after product updates or marketing campaigns.

4. Future-Proofing: Identifying Strategic Shifts & Long-Term Plays with Competitor Monitoring

Sustainability & Ethical Sourcing: Is there a growing emphasis on eco-friendly packaging, carbon-neutral shipping, transparent supply chains, or charitable initiatives? Consumers increasingly value these factors. Competitor monitoring moves here indicate where market expectations are heading.

New Market Entry & Category Expansion: Are competitors quietly launching products in entirely new categories? Testing new international markets with localized sites or offerings? This signals strategic growth ambitions beyond their core. Early detection allows you to assess the threat or identify partnership opportunities.

Brand Positioning & Messaging Evolution: Track subtle shifts in a competitor’s overall brand voice, imagery, or value proposition. Are they moving from budget-focused to premium? Emphasizing sustainability more heavily? Shifting focus from product features to emotional benefits? This reflects their understanding of evolving market desires.

Partnerships & Acquisitions: Monitor news, press releases, or even subtle website changes indicating new partnerships (e.g., co-branded products, tech integrations) or acquisitions. These moves can rapidly alter the competitive landscape and capabilities.

Turning Insights into Action: A Framework

Simply gathering data isn’t enough. Implement a structured approach:

- Track & Aggregate: Consistently monitor key competitors using chosen tools across product, pricing, marketing, tech, ops, CX, and strategy.

- Analyze & Synthesize: Look for patterns, anomalies, strengths, weaknesses, opportunities, and threats (SWOT). Correlate findings (e.g., did a price drop coincide with a new ad campaign?).

- Benchmark: Compare competitor performance and tactics directly against your own metrics and strategies. Where do you excel? Where are you lagging?

- Hypothesize & Prioritize: Based on insights, formulate hypotheses (e.g., “Offering free shipping over $50 will increase our AOV by 15%”). Prioritize actions based on potential impact and feasibility.

- Test & Iterate: Implement changes as controlled experiments (A/B tests, regional rollouts). Measure results rigorously against your hypotheses.

- Adapt & Evolve: E-commerce is dynamic. Continuously feed new insights back into the cycle. Be prepared to pivot strategies based on competitor monitoring, moves, and market feedback.

In Summary of Competitor Monitoring

By leveraging competitor monitoring tools, brands can decipher competitor strategies, from inventory management to technological innovations, ensuring they’re always a step ahead. Whether it’s capitalizing on trending products, crafting impactful marketing campaigns, or enhancing customer experiences, insights from the competition serve as a lighthouse, guiding businesses towards sustained growth and success. In the digital marketplace, those who observe, adapt, and innovate based on these insights are the ones who truly thrive. Get in touch with us at sales@42signals.com for e-commerce insights.

Frequently Asked Questions

What is competition monitoring?

Competition monitoring refers to the process of keeping track of your business rivals’ activities, strategies, strengths, and weaknesses to gain a competitive advantage. This involves regularly analyzing their marketing campaigns, product offerings, pricing strategies, customer service approaches, and overall performance in the market. By closely watching your competitors, you can identify trends, anticipate changes, and adjust your strategy accordingly.

What are the 4 competitor analyses?

The four components of a thorough competitor analysis typically include:

- Market Position Analysis: Understanding your competitors’ market share, brand recognition, and overall reputation among customers.

- Product and Service Comparison: Evaluating the quality, price point, and differentiation of your competitors’ offerings versus your own.

- SWOT Analysis: Identifying your competitors’ Strengths, Weaknesses, Opportunities, and Threats to your business.

- Strategic Planning: Using the insights gained from the first three components to inform your strategic planning, such as identifying gaps in the market, developing new product ideas, and optimizing your marketing efforts.

What are the three C’s in competitive analysis?

The three C’s in competitive analysis refer to Customers, Competitors, and Company. These factors are critical elements to consider when evaluating the competitive landscape of an industry.

- Customers: Understanding the needs, preferences, and pain points of your target customers is essential to creating a value proposition that resonates with them. By studying your competitors’ customer segments, you can identify areas where there may be overlap or opportunity to differentiate yourself.

- Competitors: Assessing your direct and indirect competitors is crucial to understanding the strengths and weaknesses of their products, services, and marketing strategies. This information can help you determine where you fit within the market and how best to position yourself against other players.

- Company: Evaluating your own internal capabilities, resources, and limitations is necessary to develop a realistic competitive strategy. This includes assessing your financial health, operational efficiency, and organizational culture.