In the world of consumer packaged goods (CPG), the pace never lets up. Shelf space is limited, consumer preferences shift fast, and loyalty can disappear overnight. What gives one brand the edge while others struggle to stay afloat? Increasingly, it comes down to how effectively companies can read and respond to data.

Gone are the days when gut instinct or last quarter’s sales figures were enough to steer decisions. Today, success means knowing what your customer wants before they do. It means predicting demand shifts, reading digital signals, and moving inventory or campaigns in near real time.

Let’s explore how CPG companies are using smarter data insights to rethink how they sell, market, and deliver to consumers—and how even mid-sized players can gain a competitive edge.

Why CPG Data Insights Matter for ECommerce Brands

The New Rules of the Game

Image Source: Zendesk

Consumer behavior has changed. Shoppers no longer browse aisles without preparation. A quick search, a review on a forum, or a TikTok video now holds more sway than traditional advertising. Add that to supply chain instability and growing e-commerce influence, and the game has changed entirely.

Consider this:

- Over 75% of consumers have switched brands at least once due to product unavailability.

- Nearly 70% of buying decisions are influenced by online ratings and reviews.

- Brands that incorporate predictive analytics have seen profit margins rise by 10–15%.

What these stats reveal is a gap—a gap between traditional business cycles and the rapid-fire pace of consumer demand. Brands that close this gap with data-driven decision-making are pulling ahead.

Turning Data Into Strategy with CPG Data Insights: Core Pillars

CPG companies have access to more data than ever. But using it effectively means knowing which signals matter most and how to act on them quickly. Here are four foundational areas where data insights are transforming strategy.

Predictive CPG Data Insights: Seeing Demand Before It Hits

Forecasting used to be a monthly or quarterly affair. Today, it’s a daily task. Predictive analytics, powered by machine learning and historical data, helps brands plan inventory, adjust production, and even tailor marketing based on what’s likely to happen next.

Practical Use Cases:

- A beverage company notices increased searches for “zero sugar energy drinks” and adjusts flavor development priorities.

- A regional bakery chain prepares for a weather-related spike in comfort food demand after analyzing past patterns.

Tools You Can Use:

Platforms like SAP Analytics Cloud or Microsoft Azure Machine Learning help integrate predictive models with existing systems.

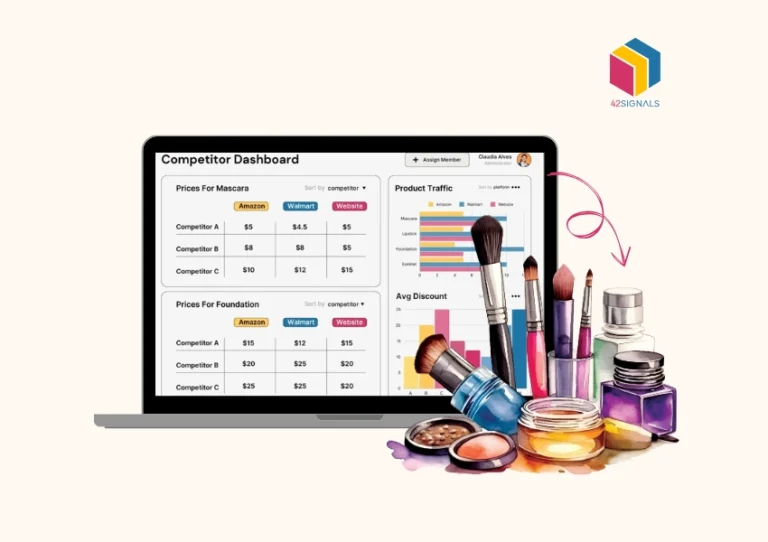

Digital Shelf Analytics: Winning the E-Commerce Race

A product might be top quality, but if it’s buried on page four of Amazon or out of stock on Walmart.com, it won’t sell. Digital shelf analytics lets brands see how their products perform in online retail environments

What to Track:

- Product visibility in search results with share of search (especially for branded vs. generic terms).

- Competitor promotions, pricing, and placements.

- Retailer-specific stock status.

Action Tip:

Use tools like 42Signals that provides CPG data insights to monitor product health across dozens of digital storefronts in real time.

Consumer Sentiment: Listening to the Right Conversations

What your audience says about you matters—and they’re saying a lot. Whether it’s a glowing review, a product complaint, or a trending meme, consumer sentiment can shape your brand image faster than any campaign.

Example:

A home cleaning brand discovered a viral video showing an unexpected use of their product. By quickly jumping on the trend with new packaging and content, they saw a 20% boost in online sales.

Tools to Try:

- Review aggregators like Yotpo and ReviewTrackers.

- Social listening tools such as Sprout Social or Brandwatch.

- Advanced consumer sentiment analysis tools like 42Signals.

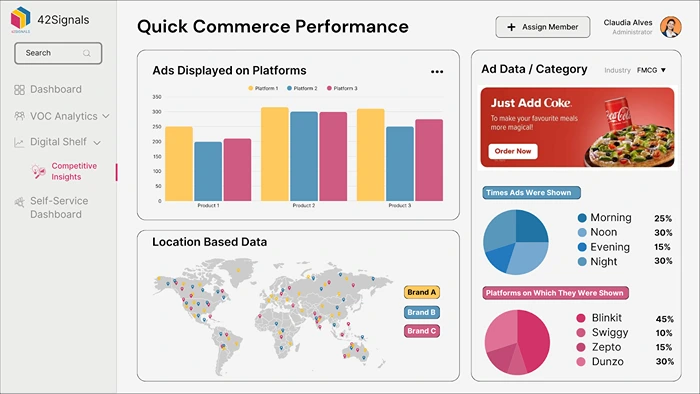

Quick Commerce and Dark Stores: Reaching the Instant Consumer

Delivery expectations are evolving fast. With companies like Gopuff or Getir promising groceries in 15 minutes, CPG brands must adapt to these micro-fulfillment models.

What It Means:

- Smaller pack sizes and optimized packaging for rapid transport.

- Inventory forecasts tuned to fast-moving, hyperlocal trends.

Case in Point:

A popular snack brand introduced single-serving spicy chip packs targeted at quick commerce buyers in major cities. The result? A measurable 18% lift in market share in under 90 days.

Use 42Signals to track product insights on quick commerce platforms and understand performance across various interests.

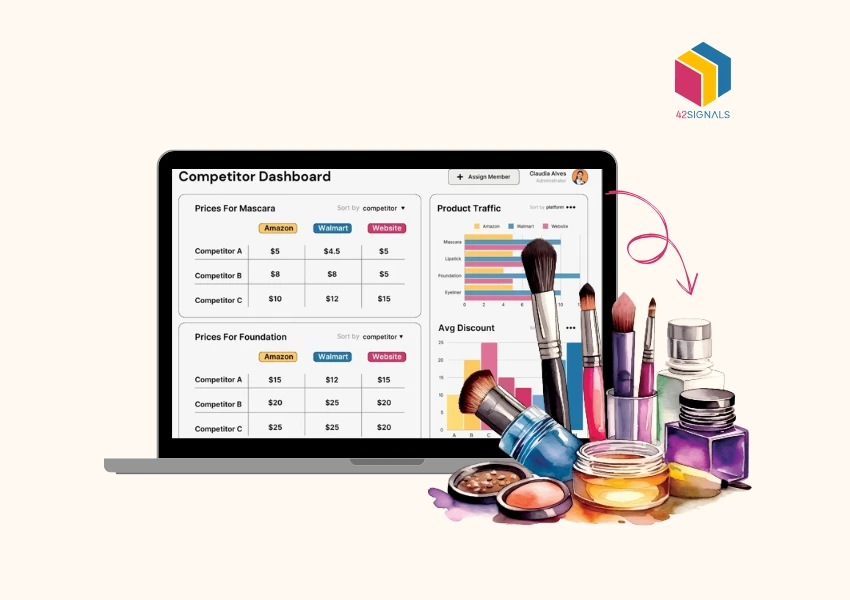

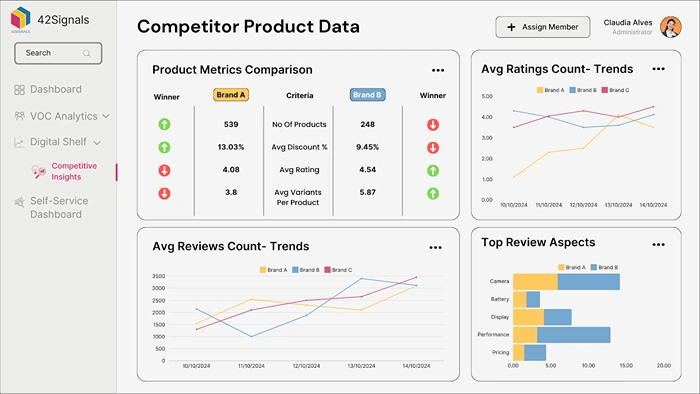

Making Competitor Data Actionable

Keeping tabs on your competitors isn’t new, but doing it in real time is. A well-built competitor analysis dashboard doesn’t just show what others are doing; it gives you the context to make better decisions, fast.

How It Helps:

- You get alerts when a rival launches a big discount.

- You can compare keyword rankings and product placements across retailers.

- You uncover long-term patterns that hint at upcoming shifts.

Smart Example:

Instead of cutting prices to match a competitor, a dog food brand added a free chew toy to its premium line—an emotional hook that preserved margins and boosted loyalty.

Five Steps to Build a Data-Centered CPG Operation

Moving from scattered data to strategic action takes more than tools. It requires a shift in mindset and execution.

1. Conduct a Data Audit

List every source of data across departments—CRM, social, POS, inventory, loyalty programs. Map where it lives, how it’s used, and what’s missing. Look at all the online marketplaces that your products exist as well to get a complete picture of all the data points.

2. Focus on the Few Metrics That Matter

Prioritize KPIs like:

- Shelf availability – to understand how often products are either in or out of stock. This is crucial to get more sales.

- Net sentiment score – to learn what customers truly feel about your products and the areas of improvement.

- Price elasticity – how to price products correctly matching discounts across platforms and staying competitive in the category.

- Repeat purchase rate – great to keep loyal customers happy and understand what’s bringing them back to your brand.

3. Choose Flexible, Future-Ready Tools

Opt for cloud platforms that integrate easily across teams. Think Google BigQuery, Tableau, Snowflake. 42Signals is also a great all-encompassing ecommerce solution helping brands understand the full scope of their online selling presence.

4. Train Teams to Interpret, Not Just Observe

Give frontline sales and marketing staff access to insights dashboards and context on what to do with them. With all teams working together with the right data, it’s easier to have the proper marketing strategies in place based on cross-platform CPG data insights.

5. Pilot, Measure, Improve

Start small. Run A/B tests, track results, and refine. A pricing tweak or a packaging change, backed by data, can yield surprising returns.

Pitfalls to Watch For

1. Data Overload – Not all insights are equally useful. Avoid the trap of tracking everything and acting on nothing.

2. Privacy and Ethics – Always adhere to privacy regulations like GDPR. Consumers are sensitive to how their data is used.

3. Speed vs. Accuracy – Fast decisions are important, but if the data is flawed, so are the outcomes. Clean your inputs before scaling any action.

Case Study: Turning Insight into Revenue

GreenLife Snacks, a mid-size natural foods brand, was flatlining in online sales. Their turning point? An analytics makeover. Here’s what they did:

- Applied predictive analytics to detect rising interest in spicy flavors.

- Used digital shelf tools to improve Amazon rankings.

- Built a competitive intelligence tracker to monitor 10 rival brands.

Six months later, GreenLife had reduced out-of-stocks by 90% and boosted revenue by over 30%.

Looking Ahead: The Next Frontier of CPG Data

AI-Driven Dynamic Pricing

AI tools can now adjust product prices across platforms based on competitor moves, demand, and even weather.

Blockchain and Supply Transparency

More brands are using blockchain to track product origins, reduce fraud, and share sustainability claims with customers.

Voice Shopping Optimization

As Alexa and Google Home change how people shop, product listings need to be voice-friendly, concise, and keyword-optimized.

Data Is the New Shelf Space

If shelf space was once the most valuable real estate in CPG, data has taken its place. Brands that learn to act on insights quickly, personalize offerings, and predict shifts will thrive.

CPG data insights are a valuable source of data in the ecommerce domain and brands that leverage it will stand to see a lot of benefit.

Try 42Signals today to see it in action for your brand.