Table of Contents

Toggle** TL;DR ** For quick-commerce (q-commerce) grocers, uniform pricing across locations destroys profits and frustrates customers (e.g., premium juices selling out downtown but spoiling near campus). The solution is hyperlocal geographical pricing: dynamically adjusting prices based on micro-market demand (often block-by-block), using dark stores as real-time sensors. By analyzing hyperlocal demand mapping (e.g., student budget sensitivity vs. luxury condo convenience premiums), inventory levels, and competitor moves in each zone via tools like 42Signals, q-commerce players can implement targeted strategies, like raising prices 8% during downtown lunch rushes or offering exam-week student discounts, to boost margins in high-demand zones, clear slow stock efficiently, reduce waste by 35%+, and improve availability, turning location-specific data into profit without alienating customers.

Picture this: you run a quick-commerce grocery delivery service. Your dark store in the trendy downtown district can’t keep premium cold-press juices in stock, selling out daily by noon. Meanwhile, the same juices gather dust on the shelves of your dark store just three miles away in the university student district. Charging the same price in both locations? You’re practically throwing profit out the window and frustrating customers who see items constantly out of stock where demand is high. This isn’t just inefficient; it’s a fundamental misunderstanding of how modern quick commerce (q-commerce) operates at the street level. That’s the need for geographical pricing.

In the race for 10-minute deliveries, success hinges on understanding micro-markets – sometimes as small as a few city blocks. It’s about setting prices dynamically based on the specific location of the customer and the dark store fulfilling their order, responding to real-time signals unique to that pocket of the city.

This guide dives deep into how leveraging dark store pricing strategies, powered by hyperlocal demand mapping and tools like 42Signals, unlocks profitability and reduces waste in the hyper-competitive q-commerce landscape.

Image Source: Finshots

Why Your Customer’s Zip Code & Geographical Pricing Matter More Than Ever

The old model of “one price fits all” is dead for q-commerce. It ignores the fundamental engine of speed: inventory proximity. Dark stores – compact, strategically located fulfillment centers packed with essentials – are the backbone.

Demand for sunscreen might consistently spike in neighborhoods near the beach or large parks. Umbrellas and comfort foods could fly off shelves during a sudden downpour in the financial district. A 2023 McKinsey & Company report highlighted a crucial point: while hyper-localized fulfillment models (like dark stores) can slash last-mile delivery costs by 15-30%, realizing these savings depends entirely on optimizing operations – and pricing is a massive, often neglected, part of that equation.

Sticking with standard pricing creates two painful problems:

- You overprice in sensitive areas: In neighborhoods where budgets are tighter (like student zones or certain residential areas), a price that seems reasonable downtown can be a deal-breaker. You lose sales and market share to competitors or local corner shops.

- You underprice in high-demand zones: Where demand is strong and less sensitive (think luxury apartments or busy commercial hubs), you leave significant profit on the table. Customers happily paying a premium for convenience are getting a discount you can’t afford.

Image Source: Hubspot

Geographical pricing directly addresses this imbalance. It’s the practice of adjusting prices based on the specific geographic zone a customer orders from, considering the unique supply, demand, and competitive dynamics of that zone and the dark store serving it. It’s not about gouging; it’s about aligning price with the true, localized value and operational realities.

Dark Stores: Not Just Warehouses, But Hyper-Local Market Intelligence Hubs

Stop thinking of your dark stores merely as storage units. Start seeing them as powerful sensors for hyperlocal demand mapping. Each dark store serves a tightly defined radius – often just 1-3 kilometers. This micro-focus is its superpower for effective dark store pricing:

- Pinpoint Demand Sensing (It’s Not Guesswork): A dark store nestled among office towers experiences predictable lunchtime rushes for sandwiches, salads, and coffee. Another in a dense residential area sees surges in dinner ingredients, snacks, and baby products in the evenings. Hyperlocal demand mapping at this level reveals exactly what items are hot (or not) in that specific zone, and crucially, when that demand hits. This granularity is impossible with a centralized warehouse miles away.

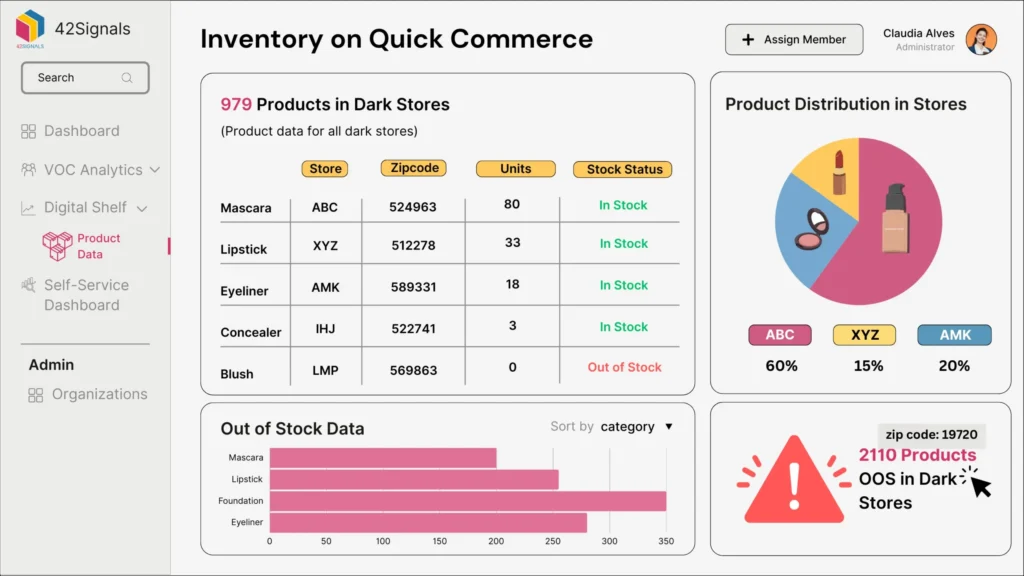

Image Source: Swiggy Instamart Data by 42Signals

- Real Inventory Pressure Drives Smart Decisions: Unlike a distant mega-warehouse, dark stores have severely limited space. If oat milk is flying off the shelves at Store A but barely moving at Store B, geographical pricing empowers you. Store A can implement a modest price increase (say 5-7%) to capitalize on high demand and manage stock, while Store B could run a targeted zone-based promotion (like “Buy 1 Get 1 50% Off”) only within its delivery zone to clear stock efficiently. This responsiveness is rooted in inventory proximity – the physical stock dictates the pricing flexibility locally.

- Competition Gets Crystal Clear: Knowing your exact competitors within a 1-3 km radius is vastly simpler than tracking them city-wide. Is it another q-commerce player? A well-stocked convenience store chain? A local bodega? Dark store pricing allows you to adjust competitively for that specific micro-battleground, reacting to promotions or price changes almost instantly.

Hyperlocal Demand Mapping: Your Secret Weapon for Smarter Geographical Pricing

This is the foundation. Hyperlocal demand maps with geographical pricing to know what customers are looking for and how much they’re willing to pay. It analyzes –

- What Sells Where (and When) – The Nitty-Gritty: Does that expensive artisan sourdough bread disappear in the affluent neighborhood but linger on shelves near the college campus? Do sales of diapers and baby food peak predictably on Friday evenings and weekends in young family-dominated suburbs? This granular quick commerce data is pure gold for inventory planning and pricing. It reveals the unique product preferences and purchasing rhythms of each micro-zone.

- Understanding “Neighborhood Elasticity” – The Price Sensitivity Factor: This is arguably the most critical concept in geographical pricing. How sensitive are customers in this specific area to price changes? A resident in a high-end condo building might barely notice a $1 increase on their daily specialty coffee order. Conversely, students in a nearby zone might abandon their preferred brand entirely for a cheaper alternative if prices rise by $0.50. Accurately gauging neighborhood elasticity prevents costly pricing mistakes – overestimating tolerance kills volume, underestimating it sacrifices margin.

- Spotting Hyper-Local Triggers – The Unexpected Spikes: Is a major new office building opening next month? Is there a local street festival planned? Did a sudden heatwave hit one part of the city harder than another? These hyper-local events create instant, location-specific demand surges that traditional pricing models miss.

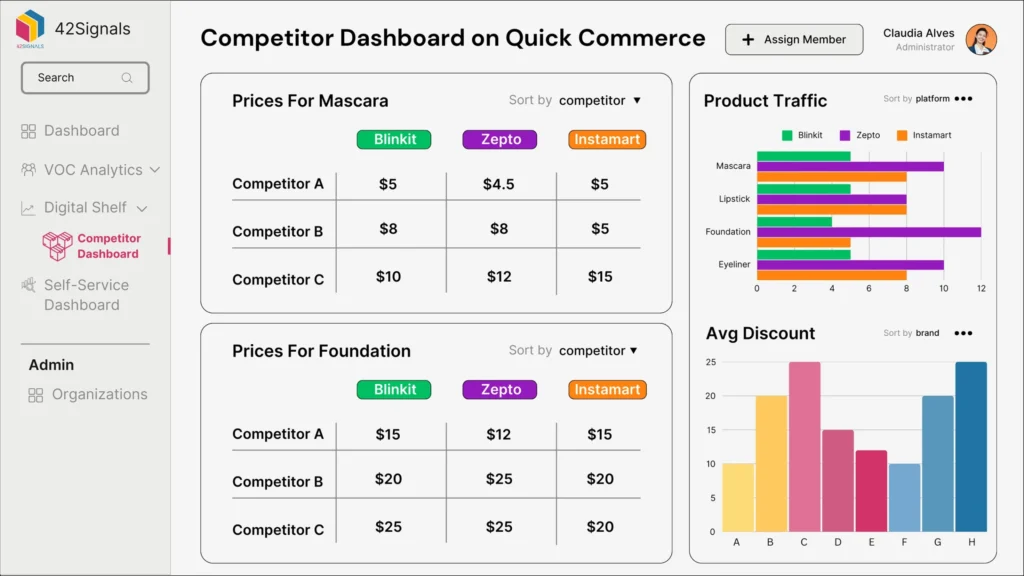

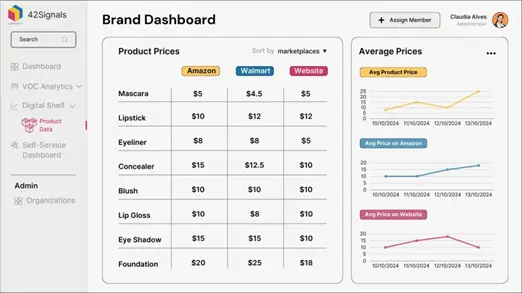

This is where specialized tools like 42Signals become indispensable. They go beyond basic sales tracking. These platforms aggregate and analyze vast amounts of anonymized, real-time quick commerce data at the dark store level:

- Sales velocity for every single SKU per zone.

- Competitor pricing movements within each micro-market.

- Local search trends for products and categories.

- Foot traffic patterns near dark stores and points of interest.

- Potential integration with weather and event data feeds.

This provides the rich, localized intelligence needed to build truly accurate hyperlocal demand maps, replacing guesswork with data-driven confidence.

Your Step-by-Step Blueprint: Implementing Hyper-Local Pricing That Works

Ready to move beyond one-size-fits-none pricing? Here’s a practical, phased approach to implementing winning geographical pricing, grounded in data:

- Define Your Micro-Zones (Draw the Map): Start by logically dividing your delivery area into distinct micro-zones centered around each dark store. Base this on:

- Logistics Feasibility: Can delivery riders realistically cover the zone within your promised time (e.g., 10-15 mins)?

- Observed Demand Patterns: Use your initial hyperlocal demand mapping data (even basic sales per area) to identify natural boundaries. Do sales patterns shift significantly at a major road or park?

- Become a Data Enthusiast: Your pricing decisions are only as good as your data. Rigorously collect and integrate information:

- Core Sales Data: Track real-time sales velocity for every key SKU in every zone. What’s selling fast? What’s slow?

- Competitor Intelligence: Monitor competitor prices (especially other q-commerce players and relevant local convenience stores) within each specific zone. Tools like 42Signals automate this critical, time-consuming task.

- Local Context: Integrate feeds for local events, hyper-local weather forecasts (neighborhood level if possible), and even real-time traffic conditions impacting specific zones. A traffic jam near one dark store might temporarily suppress demand or increase delivery times, influencing pricing levers.

- Historical Patterns: Your historical sales data is a goldmine for understanding the unique heartbeat of each neighborhood. This isn’t about vague seasonal trends; it’s about uncovering the specific rhythms and reactions that define your micro-markets.

- Build Your Pricing Rules Engine (Set the Guardrails): This is where geographical pricing moves from theory to profit. Base your rules on the hard evidence you’ve gathered:

- Rule 1 (High Demand + Low Stock = Premium Value): If Item X sells >25% faster than the zone’s average velocity and stock levels drop below 20%, then increase price by 4-6% in that specific zone. This captures value from high demand and helps manage scarce inventory locally.

- Rule 2 (Slow Mover Clearance): If Item Y sells <40% of the zone’s average velocity for 5 consecutive days and stock is above 75%, then activate a zone-based promotion (e.g., 15% off or “Buy One Get One Half Price”) exclusively within that zone. This targets waste reduction where it’s needed.

- Rule 3 (Competitive Defense/Offense): Imagine you’re running a corner store in Market Square (Zone C). You see the rival shop across the street slashing milk prices to pull in breakfast crowds. Do you drop prices city-wide? Of course not – you match them right there, right now, before regulars defect.

- Rule 4 (Event-Driven Surge): That music festival flooding Riverside (Zone D) with 20,000 thirsty fans? Or is the heatwave making park-goers desperate for cold water? These aren’t disruptions – they’re hyper-local opportunities.

- Master Zone-Based Promotions (Precision Discounting): Ditch the city-wide blanket sales. Use promotions as a surgical tool:

- Target slow-moving items only in zones where they are actually slow-moving.

- Run lunch specials on sandwiches and salads only in business districts between 11:00 AM – 2:00 PM.

- Offer “Weekend Family Bundle” deals only in residential family neighborhoods on Fridays and Saturdays.

This approach clears targeted inventory, attracts specific customer segments, and protects margins in zones where discounts aren’t necessary. It’s hyperlocal demand mapping in action.

- Test, Measure, Learn, Refine (The Continuous Loop): Start conservatively. Don’t roll this out city-wide on day one.

- Pilot: Select 2-3 contrasting zones (e.g., one high-income, one student-heavy) and 15-20 strategically important SKUs (mix of staples, high-margin, and variable-demand items).

- Implement: Apply your initial rule set to these zones/SKUs.

- Monitor Relentlessly: Use your quick commerce data platform (like 42Signals) to track key metrics: sales volume change per SKU per zone, margin impact, stock turnover rate, customer feedback (if possible), and competitor reactions.

- Analyze & Tweak: Did the high-demand price increase in Zone A hold volume? Did the slow-mover promotion in Zone B clear stock without cratering margin? Adjust your rules based on real-world results. Was the neighborhood elasticity estimate accurate? It’s a process of continuous improvement.

Seeing Hyper-Local Pricing in Action: A Detailed Scenario

Let’s bring this to life with “MetroQuick,” a fictional but realistic q-commerce grocer operating multiple dark stores in a large city. Using 42Signals for hyperlocal demand mapping and quick commerce data analysis, they uncovered a telling pattern around their premium “GreenBoost” cold-pressed juices ($4.99 standard price):

- Zone A (Downtown Luxury High-Rises): Analysis indicated low neighborhood elasticity – residents valued convenience and premium products highly; small price increases were unlikely to deter purchases.

- Zone B (University District): Demand for GreenBoost was sporadic and primarily clustered around major exam periods and project deadlines. Students actively sought deals and were highly price-sensitive (high neighborhood elasticity).

MetroQuick’s Data-Driven Actions:

- Zone A (Luxury High-Rises): Implemented a geographical pricing rule: Increase GreenBoost price to $5.39 (an 8% increase) during peak demand hours (7-9 AM, 12-1 PM) on weekdays. Standard price applied outside these hours. Result: Sales volume during peak hours remained stable (a slight dip was offset by the higher margin). Overall margin per unit sold in Zone A increased significantly. Stockouts decreased as the price helped moderate peak demand slightly.

- Zone B (University District): Maintained the standard $4.99 price but implemented a smart zone-based promotion rule using 42Signals’ integration with the university academic calendar: Trigger an “Exam Fuel: GreenBoost $3.99!” promotion only in Zone B for the 3 days leading up to and during major exam blocks. Result: Sales spiked dramatically during exam periods, clearing stock efficiently. Outside exam times, sales remained at baseline, but spoilage plummeted as inventory was optimized for the predictable demand surges. Students felt they got a great deal when they needed it most.

- Overall Outcome: Reduced juice spoilage costs by 35% in Zone B. Increased total profit contribution from the GreenBoost category by 18% across both zones within one quarter. Customer satisfaction in Zone A improved due to better availability during peak times, and Zone B customers appreciated the relevant exam-time deals. This demonstrated the tangible power of combining geographical pricing, dark store pricing intelligence, and precise hyperlocal demand mapping.

The Future of Geographical Pricing: Hyper-Local Gets Smarter and More Granular

Image Source: TGN Data

What we’re seeing now is just the beginning. The evolution of geographical pricing for dark stores points towards:

- AI-Driven Predictive Pricing: Moving beyond reactive rules to predictive AI models. Imagine AI forecasting a local micro-influencer’s post about a specific snack going viral in a particular neighborhood tomorrow, and your system automatically adjusting prices and stock levels in that zone today. Or predicting demand surges for specific items based on hyper-local weather forecasts 12 hours out.

- Shrinking Zones to Streets & Buildings: As logistics technology advances (better routing, micro-fulfillment), zones could become incredibly granular – targeting specific streets, large apartment complexes, or even office buildings. Pricing could adjust based on inventory proximity from a specific micro-hub or even a delivery drone station within that building.

- Personalization Meets Hyper-Location: Combining individual customer purchase history, preferences, and loyalty status with real-time hyperlocal demand mapping. Imagine: “Hi Sarah, since you love Brand X coffee and it’s starting to rain in your neighborhood right now, get it delivered in under 10 minutes for $Y (a slight dynamic pricing premium for instant rainy-day comfort).”

- Deeper Real-Time Data Integration: Pricing engines will ingest even more live external data: real-time traffic congestion impacting specific routes, minute-by-minute weather changes per neighborhood, social media sentiment analysis detecting local trends instantly, and even foot traffic data from nearby venues. This enables near-instantaneous geographical pricing adjustments.

The Bottom Line: Location Isn’t Just About Real Estate Anymore

Mastering geographical pricing for dark stores isn’t about exploiting customers; it’s about sophisticated value capture and operational efficiency. It’s recognizing that the value of immediate convenience, driven by inventory proximity, varies significantly from one neighborhood to the next. It’s about aligning price precisely with the realities of hyperlocal demand mapping and the unique neighborhood elasticity of each micro-market you serve.

By harnessing the power of granular quick commerce data through advanced platforms like 42Signals, q-commerce players can implement intelligent dark store pricing strategies and highly targeted zone-based promotions. Sign up for a free trial today.

The rewards are substantial: unlocked profit potential from high-demand areas, reduced waste through efficient clearance in slow zones, improved customer satisfaction via better availability and relevant deals, and sharper competitive positioning at the hyper-local level.

Frequently Asked Questions

What are the 4 types of pricing?

The four common types of pricing strategies are:

Dynamic Pricing – Continuously changing prices based on demand, market trends, and other real-time factors.

Cost-Plus Pricing – Adding a fixed percentage or amount to the cost of producing a product to determine the selling price.

Value-Based Pricing – Setting the price based on the perceived value to the customer rather than just production costs.

Competition-Based Pricing – Adjusting prices according to what competitors are charging for similar products.

What is the location pricing method?

The location pricing method involves setting different prices for the same product or service depending on the customer’s geographic location. This approach takes into account factors like local demand, purchasing power, transportation costs, and taxes. For example, a ride-hailing app may charge higher rates in a busy city center compared to suburban areas.

What is geocentric pricing?

Geocentric pricing is a global pricing strategy where a company considers both local market conditions and a standardized global approach. Instead of setting the same price worldwide or fully customizing prices for each market, businesses find a balanced pricing model that works internationally while allowing for some local adjustments.

What is the definition of regional pricing?

Regional pricing is the practice of setting different prices for the same product or service across various regions within a country or across multiple countries. It often accounts for differences in costs, competition, demand, and economic conditions. For example, an online retailer might price products higher in metropolitan areas compared to smaller towns due to higher operating expenses.