Table of Contents

Toggle** TL;DR ** Gone are the days when checking competitors’ prices and moves could be done under 10 minutes with your morning coffee. Today’s business needs retail competitor pricing to track hundreds, if not thousands, of products promptly.

This need has changed because shoppers are browsing across multiple marketplaces searching for the best deal on a product, and price agility has become of the utmost importance. Let’s break down why knowing your rivals’ prices in real-time isn’t optional anymore.

Why Retail Competitor Pricing Is Needed

Image Source: SB Shopping Basket

Picture this: You’re a pricing manager for a mid-sized home goods brand. Your top-selling coffee maker is priced at $89.99. At 10 AM, it’s competitive. By 2 PM, a key Amazon rival drops theirs to $79.99 with “FREE 2-Hour Delivery.” By 5 PM, you’ve lost 12 sales you didn’t even see coming.

- The Comparison Obsession: 83% of shoppers now check at least two stores or sites before buying (Statista, 2024). They’ve got apps like Honey, CamelCamelCamel, and even TikTok price-comparison bots doing the legwork for them.

- The Speed of Change: On Amazon alone, popular items see price changes 6-8 times per day (Marketplace Pulse, 2025). Miss one shift, and you’re suddenly the most expensive option.

- The Margin Squeeze: Between supply chain hiccups, inflation sticking around like an unwanted houseguest, and rising ad costs, your wiggle room is razor-thin. Price too high? The cart gets abandoned. Too low? You’re basically working for free.

As Lisa Henderson, VP of Pricing at a major US retailer, bluntly put it: “In 2025, pricing isn’t just strategy—it’s reflexes. If you’re reacting tomorrow to today’s price change, you’ve already lost.”

Setting Pricing Benchmarks That Don’t Sugarcoat Reality

Forget the old “lowest price wins” mantra. In 2025, smart benchmarks are about context. You need a clear, honest picture of where you stand. Here’s how to build that picture without fooling yourself:

1. Know Your Real Rivals (It’s Probably Not Who You Think):

Your true competitors aren’t just the big-name brands you see on TV. Think smaller, faster, sneakier:

- The Amazon Marketplace Ninja: That third-party seller with no overhead, undercutting your price by 15% and stealing your precious Buy Box.

- The Quick-Commerce Wildcard: A local delivery app selling your exact product at 3 AM with a 20% convenience markup you didn’t account for.

- The Stealth Substitute: That cheaper, “good enough” alternative shoppers grab when your price feels just a few bucks too high. (Think generic batteries vs. your branded pack).

2. Track More Than Just the Sticker Price (The Devil’s in the Details):

True retail competitor pricing intelligence digs way deeper than the big number:

- Shipping Costs & Speed: Is “Free Shipping” really free, or is the price inflated? Is “Next Day” $3.99 or $14.99? This is the price for millions of shoppers.

- Bundle Deals & Kits: Are rivals bundling your star product with accessories (e.g., “Blender + Travel Cups for $10 less than buying separately”)?

- Promo Patterns & Psychology: Does Competitor X always run a “Flash Sale” the first Tuesday of the month? Do they use charm pricing ($49.99 vs. $50)?

- Stock Levels & Scarcity: If your main competitor is constantly out of stock, you can hold a firmer price. If they’re flooded, expect a drop.

- Return Policies & Guarantees: A competitor offering “365-Day Returns” or “Price Match Guarantee” is effectively lowering the risk (and perceived cost) for the buyer.

3. Define Your “Win Zone” (The Sweet Spot Between Profit & Competitiveness):

Let’s get practical. Say your costs for that coffee maker demand a minimum price of $50 to make a healthy profit. Your main competitors sell it between $55 and $70.

- Your Absolute Floor: $50 (Never go below this unless it’s a strategic loss leader).

- Your “Win Zone”: $58 – $63. Here’s why:

- At $58, you’re clearly more affordable than premium brands ($70) but not triggering a race-to-the-bottom with the $55 budget seller.

- At $63, you signal slightly higher quality while still undercutting the top tier.

- The Danger Zones:

- $64-$70: You risk losing price-sensitive buyers unless your brand strength or features justify it.

- $55-$57: You’re cutting deep into margin and potentially training customers to wait for discounts.

- Below $55: Profit? What profit?

This Win Zone isn’t static. It shifts with new competitors, seasonality, and quick commerce data showing delivery premiums. You need constant updates.

Turning Raw Data Into Real Dollars: 2025 Retail Competitor Pricing Strategies That Work

Having data is one thing. Turning it into profit is another. Here’s how savvy retailers are using retail competitor pricing intelligence to win:

→ Dynamic Pricing That Doesn’t Mean Panic Discounting:

Gone are the days of wild price swings. Modern tools let you set smart rules for auto-adjustments based on competitor moves:

- Example Rule: *”If Competitor A (our primary Amazon rival) drops their price on SKU-X by more than 5%, decrease our price by 2% (but never below $58). If Competitor B (a budget brand) drops theirs, hold our price.”*

- Why it Works: You stay competitive instantly on key battlegrounds (Amazon data is crucial here) without blindly racing to the bottom. Protects margin while defending share.

→ Margin Murder Prevention (Spotting Fire Sales vs. Strategic Shifts):

Imagine: Brand Z suddenly slashes prices on its premium headphones by 30% across all channels. Panic? Not if your intel shows:

- Their stock levels are critically low (via tracking).

- They haven’t run ads for this product in weeks.

- They have a newer model launching next month.

- Conclusion: It’s a clearance move, not a permanent shift. Smart response? Hold your price. Discounting would have needlessly torched your margin. Competitor analysis dashboards flag these contexts.

→ Promotions That Hit Harder & Cost Less:

Ditch the “20% Off Everything!” blanket approach. Use competitor intel for surgical strikes:

- Target Weaknesses: Launch a promo on items where your main rivals aren’t discounting.

- Beat Them to the Punch: See historical data showing Competitor Y always runs a back-to-school sale on August 1st? Launch yours on July 28th with slightly better deals on key items.

- Bundle Strategically: If rivals sell a stand-alone blender, bundle yours with a $20 accessory for only $10 more. Your intel shows this beats their perceived value.

→ Launching New Products? Price Smarter Out the Gate:

New Product Introduction (NPI) is high-stakes. Product data and prices for similar launches are gold:

- Analyze how price points impacted early sales velocity for comparable products. Did Product Alpha fail at $199 but soar at $149?

- Track competitor reactions to your launch. Did they discount their older model aggressively? Bundle? Your competitor analysis dashboard alerts you instantly, allowing mid-launch tweaks.

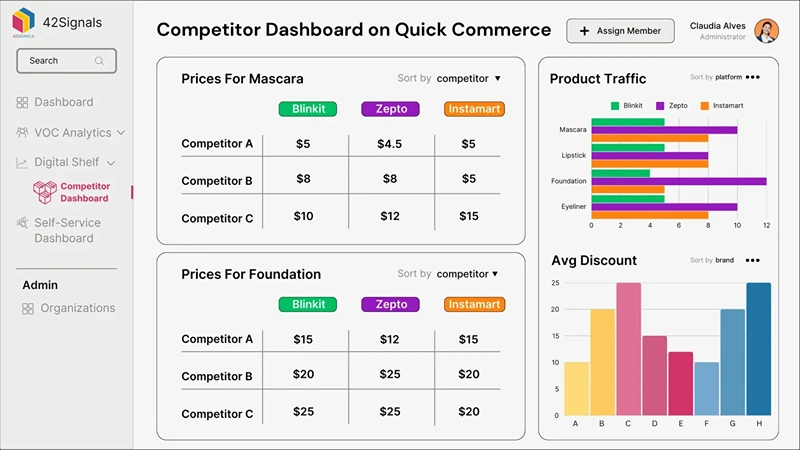

→ Omnichannel Pricing That Makes Sense (Not Headaches):

Should your price be identical on Amazon, your website, and inside Target? Probably not.

- Amazon: Factor in referral fees (often 8-15%) and FBA costs. You might need a slightly higher price than your DTC site. Competitor tracking here (Amazon data) is non-negotiable.

- DTC Site: No marketplace fees? You can price more aggressively or offer exclusive bundles.

- Quick Commerce: Quick commerce data consistently shows that a 12-18% premium is acceptable for under-30-minute delivery (McKinsey, 2024). Price accordingly!

- Brick-and-Mortar: Leverage the immediacy advantage. Maybe match your online price, but highlight “Take it home TODAY!”

The Tech Stack That Does the Heavy Lifting (So You Don’t Have To)

Forget endless spreadsheets and manual checks. 2025 demands tools that work while you sleep:

1. Automated Price Trackers & Scrapers (Your 24/7 Sentries):

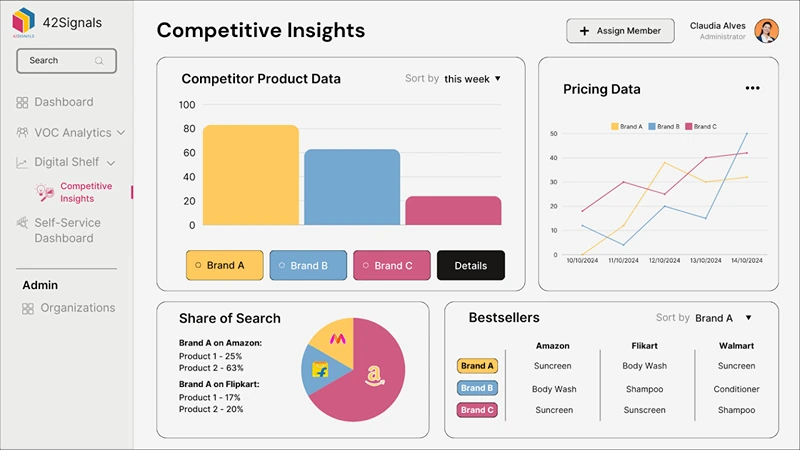

Tools like 42Signals act like tireless digital scouts:

- They scan thousands of product pages across Amazon, Walmart, Target.com, Instacart, eBay, niche marketplaces, and even major retailer websites in real-time.

- They capture:

- Live prices (including dynamic/cart-based pricing)

- Stock availability (Crucial!)

- Active promotions, coupon codes, and bundle offers

- Product images and descriptions (to catch bundle changes or misleading tactics)

- Seller information (Who’s selling it? 1st party or 3rd party?)

They feed this raw product data and prices into your central system.

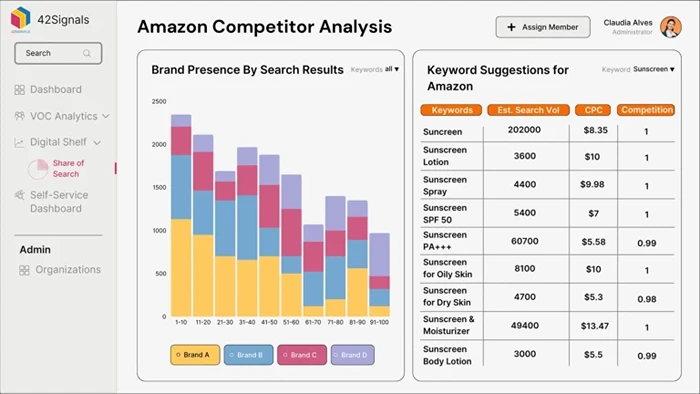

2. Your Mission Control: The Competitor Analysis Dashboard

This is the brain. A modern competitor analysis dashboard, like 42Signals, acts like your command center.

- Live Price Battle Maps: See your price vs. 5 key competitors for your top 20 SKUs—updated minute-by-minute. Color-coded red (you’re high) to green (you’re low).

- Positioning Clarity: Visual charts showing where you sit: Premium, Value, or Stuck-in-the-Middle? See this per category or per channel.

- Smart Alerts: Get pinged only when something critical happens: “Competitor A dropped price on SKU-123 by 10%!”, “SKU-456 now out of stock at Competitor B!”, “New 3rd party seller undercutting on Amazon!”

- Quick Commerce Insights: See the markup premiums happening on Gorillas, Getir, or DoorDash for your category (quick commerce data visualized).

- Digital Shelf Integration: Overlay your pricing with digital shelf analytics – see if your higher price correlates with better search rank, more reviews, or a “Amazon’s Choice” badge, justifying it. Or, if you’re priced low but have poor images, you know where to fix.

- Historical Trends: Spot patterns. Does Competitor X always discount before quarterly earnings reports?

3. AI & Predictive Analytics

Basic dashboards show the past. Modern AI helps predict the future:

- “Competitor A has an 87% likelihood of discounting Product X within 72 hours based on their typical 3-day sales velocity drop pattern.”

- “Market demand for Category Y is predicted to spike 22% next month based on social sentiment and search trends. Competitors are likely to raise prices.”

- “Your current price point on SKU-Z is optimal based on competitor positioning, digital shelf strength, and predicted demand. Recommend holding.”

This moves you from reactive to proactive.

4. Integration is King (Breaking Down Silos):

Your competitor analysis dashboard shouldn’t live in a vacuum. It needs to talk to:

- Your PIM (Product Information Management): Ensuring accurate product data feeds the tracking.

- Your Digital Shelf Analytics Platform: Correlating price changes with changes in visibility, conversion rate, and review sentiment.

- Your Inventory Management System (IMS): Preventing promotions on out-of-stock items or highlighting opportunities where high stock levels might warrant a tactical discount.

- Your ERP/Pricing Software: Feeding competitor data directly into your rules engine for dynamic pricing.

- Your CRM/Marketing Automation: Triggering targeted campaigns when competitor stockouts create an opportunity for you.

This omnichannel data flow is essential for truly intelligent decisions.

Getting This Right: No-Fluff Adoption Tips for 2025

Buying fancy software isn’t enough. Success requires smart execution:

→ Start Laser-Focused, Aim for Quick Wins

Don’t boil the ocean. Pick your 5 most critical products (your cash cows or strategic heroes). Identify your 3 most dangerous competitors. Use a simple competitor analysis dashboard view just for them.

Goal:

Find one actionable insight per week (e.g., “Competitor A always runs out of stock on Tuesdays – raise our price slightly then”). Prove the value fast.

→ Blend Human Smarts with Machine Speed (The Cyborg Approach)

Technology gives you speed and data volume. Humans provide context, brand strategy, and gut checks.

Example:

Your AI tool flags, “Match Competitor B’s new $49.99 price!” But your merchant knows Competitor B is dumping old inventory before a refresh. Override the auto-match. Hold your price.

Example:

Your dashboard shows you can safely raise prices 5% based on competitor moves. But your marketing team knows a major social media push starts next week. Delay the increase to maximize campaign impact.

Regular Practice:

Regularly review the competitor analysis dashboard together (pricing, marketing, sales).

→ Shatter Data Silos Like Your Margins Depend On It (They Do)

Force your systems to talk:

- Integrate Pricing & Inventory:

Never run a promo if stock is low. Highlight items where high stock and competitor weakness suggest a profitable discount opportunity. - Connect Pricing & Reviews:

A price hike combined with sinking star ratings is a recipe for disaster. See it coming. Conversely, a price increase after a surge of 5-star reviews might be perfectly justified.

Feed DSA & Q-Commerce into Pricing:

Make digital shelf analytics and quick commerce data core inputs for your pricing team.

→ Train Your Teams on the “Why,” Not Just the “How”

Don’t just dump a dashboard link on your merchants. Show them:

- “See this alert? It caught Competitor X’s price drop 17 minutes after it happened. We adjusted within the hour and saved 8 sales we would have lost last month.”

- “Look at this chart. Our Win Zone analysis showed we could safely raise this price by $3. That’s an extra $12k profit per month.”

Make the competitor analysis dashboard their tool, not just a report from IT.

→ Prioritize Quality Data Sources (Garbage In, Garbage Out)

Ensure your tracking covers:

- All Relevant Channels:

Amazon (including 3rd party sellers!), Walmart, Target, key specialty marketplaces, your DTC site, and major Q-commerce apps. - Accuracy & Speed:

Can it handle complex pages, logged-in pricing, and dynamic content? Does it update fast enough (sub-hourly is ideal for battleground categories)? - Geographic Granularity:

Are you tracking prices relevant to your customer locations (regional variations matter!)?

→ Build Guardrails for Automation

If using dynamic pricing:

- Set ABSOLUTE minimum margins per product/category.

- Define exactly which competitors trigger actions (only strategic rivals, not every random seller).

- Set maximum downward adjustments per day/week.

- Require human review for large deviations.

- Use the competitor analysis dashboard to monitor automated actions closely, especially at first.

Gut Feelings Lose. Data Wins. Profit Follows.

Let’s be brutally honest: Navigating retail competitor pricing in 2025 on instinct or outdated reports is a recipe for shrinking margins and market share. The volatility is too high, the speed too fast, the competition too fierce.

But here’s the flip side:

Retailers investing in robust pricing intelligence aren’t just surviving; they’re thriving:

- 3–8% Revenue Uplift:

By optimizing prices dynamically and defending share (Gartner, 2024). - 1–4% Margin Improvement:

By avoiding unnecessary discounting and identifying safe price increases (BCG analysis). - 22% Faster Competitive Response Times:

Turning hours of manual checks into instant alerts and actions.

“We cut ‘price panic’ meetings by 50%. Now we meet proactively with insights.”

(Actual quote from Home Goods Category Manager using a competitor analysis dashboard)

The Real Power? It’s Not Just About Reacting Faster. It’s About Anticipating.

- Spotting Amazon data trends showing a category heating up before competitors stock up? You secure inventory early.

- Seeing a quick commerce data spike for your product in urban centers? You adjust local pricing and promotions instantly.

- Noticing a competitor consistently struggling with stockouts via your omnichannel data feed? You position yourself as the reliable alternative and hold price.

If you haven’t tried 42Signals, sign up for a free trial today to see retail competitor pricing in action.

Frequently Asked Questions

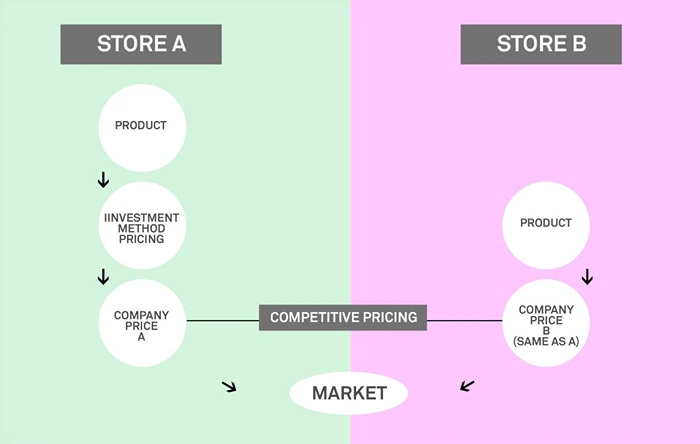

What is competitive pricing in retail?

Competitive pricing in retail refers to setting the price of a product based on what other businesses are charging for similar items. Rather than only considering internal costs or target profit margins, retailers analyze their competitors’ pricing to ensure their own prices are appealing to consumers. This strategy is common in highly competitive markets, such as electronics, apparel, and groceries, where small price differences can influence buying decisions.

What are the 4 types of pricing?

Cost-Plus Pricing – A markup is added to the cost of the product to ensure a profit. For example, if an item costs $50 to produce and the retailer wants a 20% margin, it’s sold at $60.

Competitive (or Market-Based) Pricing – Prices are set in response to what competitors are charging, either to match, undercut, or position the product as a premium alternative.

Value-Based Pricing – Pricing is based on how much customers believe a product is worth. This approach often applies to unique or high-demand items.

Dynamic Pricing – Prices are adjusted frequently based on real-time demand, seasonality, or customer behavior. Airlines and ecommerce platforms commonly use this strategy.

What is an example of competitor pricing?

Here’s an example:

You’re selling running shoes for $80. A competitor offers a similar pair for $75. You might respond by either lowering your price to $74.99, bundling the shoes with a free accessory, or keeping the price but emphasizing superior features.

This kind of adjustment—based directly on what rivals are doing—is competitor pricing in action.

What is competition-based pricing?

Competition-based pricing is a strategy where a business sets its prices primarily based on the prices set by competitors, rather than internal factors like production cost or desired profit margin. It involves constant market monitoring and can take one of three directions:

- Pricing lower than competitors to win price-sensitive customers

- Matching competitor prices to stay in line with the market

- Pricing higher while offering extra value to justify the premium

It’s particularly effective in saturated markets where many products offer similar value, and consumers can easily compare prices.