Table of Contents

ToggleWhat’s the need for retail price intelligence?

Image Source: Flipkart

You’ve spent weeks picking out great products, building a clean, professional-looking store, and maybe even running some ads. But sales? Still slow. It’s frustrating, especially when you’ve done so much right. The problem might not be your products or your site. It could be your prices. In the crowded world of eCommerce, pricing isn’t just about covering your costs.

It’s about staying competitive, understanding how shoppers think, and making fast adjustments when the market shifts. That’s where Retail Price Intelligence (RPI) comes in. Instead of relying on hunches, RPI helps you use real data to make smarter pricing decisions—and grow your margins in the process.

In this guide, we’ll walk through practical ways to price your products more effectively using tools like competitor tracking, discount analysis, and category data. Whether you’re a one-person shop or a growing brand, these strategies can help you stay ahead.

What Retail Price Intelligence Actually Means

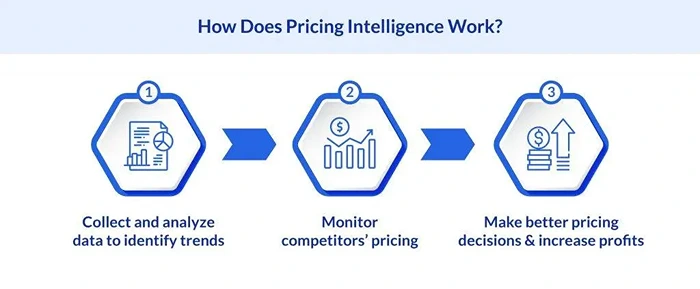

At its most fundamental, Retail Price Intelligence (RPI) is the practice of using data—primarily focused on competitor pricing, internal sales performance, and broader market trends—to inform and automate strategic pricing decisions.

While the core definition is simple, its execution and implications represent a seismic shift from traditional, gut-feel retail pricing into a disciplined, data-driven methodology. It’s the critical difference between being a passive participant in the market and becoming an active, strategic player.

To truly understand RPI, we must first recognize what it is not. It is not merely a fancy term for “checking competitor prices.” That is a single, reactive component. True RPI is a continuous, analytical process that transforms raw price points into a narrative about the market. It answers the “why” behind the “what.”

When a competitor changes a price, that is a data point. Understanding whether that change is a short-term promotion, a permanent strategic shift, an inventory clearance tactic, or a response to your own pricing is the “intelligence” that gives the practice its name.

You’re not guessing, and you’re not just trying to be the cheapest. You’re watching what’s happening around you and adjusting. It’s like watching a few chess moves ahead.

Say you’re selling headphones, and two major competitors suddenly drop their prices.

- Is it a fire sale?

- Are they clearing inventory?

- Are they trying to win more market share before the holidays?

RPI helps you figure that out instead of reacting blindly. And no, you don’t need a huge budget.

There are affordable retail price intelligence tools out there that track pricing and help smaller stores stay sharp—tools like 42Signals’ pricing data feature or even browser extensions that flag changes.

The Core Components of an RPI Strategy

An effective RPI system synthesises three key streams of data:

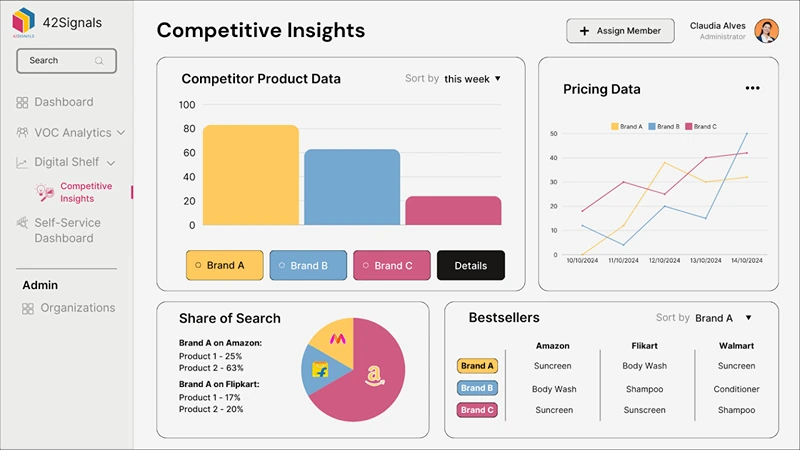

- Competitor Pricing: This is the most visible element. It involves continuously monitoring the prices of your direct and indirect competitors for identical or substitutable products. However, sophistication lies in segmentation. Are you tracking mass-market retailers, premium boutiques, or Amazon? Each competitor has a different pricing strategy, and RPI helps you understand their playbook. For instance, one competitor may always aim to be the lowest, while another competes on value-added services and can sustain a higher price. Tracking them all gives you a complete battlefield map, not just a snapshot of one skirmish.

- Internal Performance Data: Price is meaningless without context. The most powerful pricing decisions are made when external competitor data is fused with your own internal metrics. This includes current stock levels, profit margins, sales velocity, seasonality, and product lifecycle. A competitor might drop the price on a product you are also low on; matching them might not be necessary if you can sell through at your current price. Conversely, if you have a warehouse full of a slow-moving item and a competitor’s price drop creates demand, that’s critical intelligence for your own promotional strategy.

- Market and Channel Trends: This is the macro layer. It involves understanding the broader environment. Are there new tariffs affecting production costs industry-wide? Is there a social media trend causing a surge in demand for a specific product category? What is the average selling price (ASP) for “wireless headphones” trending on Amazon versus on Shopify stores? This data helps you differentiate between a competitor’s isolated action and a market-wide movement, allowing you to set prices that are not just competitive, but also aligned with the current value perception of the market.

The Chess Game Analogy: Thinking Several Moves Ahead

The analogy of watching chess moves ahead is perfectly apt. A novice player reacts to the immediate threat—a piece is under attack, so they move it. This is the equivalent of seeing a competitor’s price drop and immediately undercutting them, triggering a race to the bottom that erodes everyone’s margins.

A grandmaster, however, sees the entire board. They anticipate their opponent’s strategy three to five moves into the future. They might sacrifice a pawn (a low-margin product) to gain positional advantage (market share or customer loyalty) for a more powerful piece (a high-margin bundle). This is what strategic RPI enables.

Let’s expand on the headphone example:

You sell a popular model of headphones for $199. Two major competitors suddenly drop their price to $179.

- The Novice Reaction: “They’re cheaper! We must match them to $179 to stay in the game.” This might win a few sales today but starts a price war.

- The RPI-Informed Strategy: Your intelligence tool shows you that this price drop is isolated to these two competitors and only on this specific model. Further, your data indicates that one of them has recently launched a new, upgraded model. The intelligence you’ve gathered suggests this isn’t a market-wide devaluation, but a clearance strategy.

- Your Strategic Move: Instead of matching the price, you hold at $199. You create a bundle: “Headphones + Carrying Case + 3-Month Music Subscription for $209.” You are no longer competing on the same product; you are competing on value. You protect your margin on the headphones while clearing out accessory inventory. Alternatively, your data might show that your core customer values fast shipping. You could maintain your price but prominently advertise “Free 2-Day Shipping,” effectively making your total offer more attractive without touching the product’s price point. You have assessed their move and countered with a stronger strategic position.

Democratizing Intelligence: No Longer a Luxury for Giants

A common misconception is that this level of strategic pricing is reserved for Fortune 500 companies with multi-million dollar analytics budgets. This is no longer the case. The democratization of technology has made powerful RPI tools accessible to businesses of all sizes.

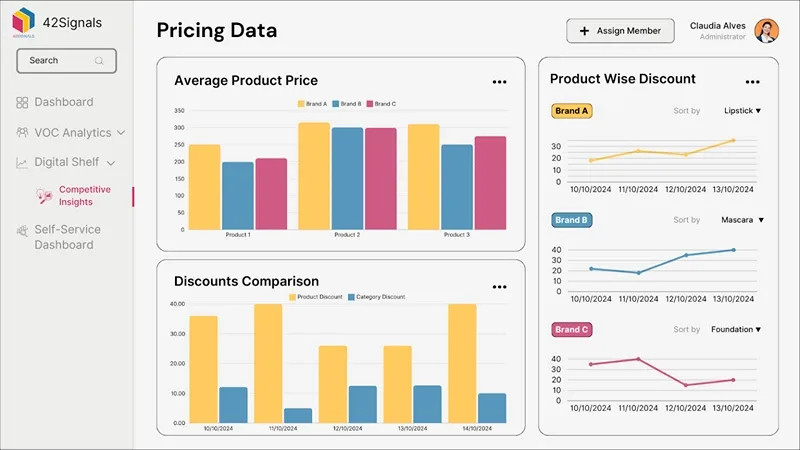

Affordable SaaS (Software-as-a-Service) platforms, like 42Signals, specialize in providing granular pricing data and analytics that were once the domain of large corporations. These tools can automatically track thousands of SKUs across dozens of competitors, alerting you to changes in real-time and even providing dashboards that visualize pricing trends and recommend optimal price points.

For the smallest retailers or those just starting, even browser extensions that monitor price history and flag changes can serve as a foundational RPI tool. The barrier to entry is not cost, but rather the commitment to shift from a reactive to a proactive mindset. By leveraging these accessible technologies, a small boutique can compete on intelligence, not just on price, making calculated decisions that protect their margins and build a sustainable brand. In today’s market, Retail Price Intelligence isn’t a luxury; it’s a fundamental component of retail literacy.

How to Use Competitive Benchmarking Without Just Copying Rivals

There’s a difference between keeping an eye on competitors’ pricing and following them off a cliff.

Let’s say you’re selling yoga mats and a big brand suddenly slashes theirs by 20%. Does that mean you should panic and lower yours? Not necessarily. They might be clearing stock or promoting a new line.

If your mat includes something they don’t like, eco-friendly materials or an extra-thick design, you might actually be undercharging.

So instead of matching their price, maybe you highlight your product’s strengths more clearly.

Maybe you offer a bonus, like a free carrying strap, or lean on better reviews. Some store owners get too caught up in trying to “match the market” without realizing the market isn’t always smarter.

Focus on your top 3–5 direct competitors. Know what they charge, sure—but also know why they charge it.

Real-Time Retail Price Intelligence to Help Your Brand

No one has time to manually check product pages every day. That’s why retail price intelligence software exists—it keeps tabs on competitors so you don’t have to live inside spreadsheets.

Tools like 42Signals let you set price alerts. So if someone drops the price on a product that’s similar to yours, you’ll know.

You don’t have to react every time, but at least you’ll see the wave coming before it hits. And don’t just watch Amazon. Look at niche platforms too—like Etsy if you’re in handmade goods or niche electronics stores if you sell tech accessories. Smaller competitors can be just as important, especially if you’re playing in a specialized market.

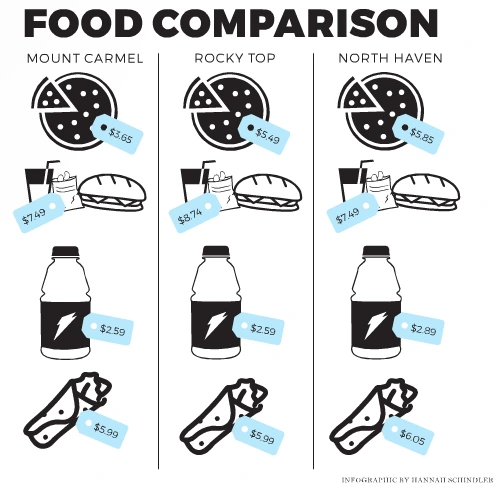

Discounts Are a Trap If You’re Not Careful

Everyone loves a good deal, but discounts can train your customers to wait for them. If your sales always come with 20% off, that starts to feel like the real price.

Over time, you lose the ability to charge full value. That’s why discount tracking matters. If your biggest competitor is running back-to-school deals, maybe don’t jump in at the same time.

Let their sale pass—then launch your own a week later when customers are still looking, but the noise has quieted down. Another trick: Instead of discounting your product, add a little something extra.

A skincare store bundled a free trial-size cleanser with their main product instead of dropping the price. It felt like a better deal—and it kept their margins intact.

Not All Products Should Be Priced the Same Way

You know this intuitively: not everything in your store is created equal.

Some items, like luxury candles or premium headphones, can carry a higher price because customers expect to pay more. Others, like charging cables or t-shirts, are in a price war whether you like it or not.

That’s where category insights come in. Pull up your retail price intelligence analytics and look at categories where traffic is high but conversions are low.

Maybe your price is scaring people off. Or maybe it’s too low, and people assume the quality isn’t there. Test. Adjust. Watch how things change. There’s no single rule—you’ll need to tweak by segment.

Let the Retail Price Intelligence Software Do the Heavy Lifting

You don’t need to guess anymore. Pricing tools like 42Signals allow you to price products correctly by giving you the right insights on discounts, competitors, and the platform’s are having.

Such tools can also help you see what’s starting to sell more (so you can raise the price slightly) or what’s gathering dust (so you can test a drop, or a bundle, or even a new product photo). There’s a learning curve, sure. But once it’s set up, it saves hours and makes you money in the background.

Mistakes You Can Avoid Right Now

A few things trip people up again and again. You don’t have to be one of them. Forgetting shipping: Your price might be lower, but if they offer free shipping and you don’t, your total looks more expensive at checkout.

Either roll the shipping into the price or set a free shipping threshold (like “Spend $50, get free delivery”). Never changing prices: That $12.99 mug you’ve had since last year? It should probably be more during the gift season.

Prices should move with demand. Copying big brands without thinking: Just because Best Buy slashes laptop prices doesn’t mean your tiny store can. You don’t have the same margins. Always check your costs before following a discount trend.

Try This: Run a Mini Retail Price Intelligence Audit

You don’t need a full-blown dashboard to start. Just open up a spreadsheet and do this: Export your product list with current prices and costs. Pick 10–20 top-selling items. Google each one and see what competitors are charging. Mark the ones where you’re significantly higher or lower. Try small adjustments—up or down. Track what happens. If it works, scale it. If it doesn’t, adjust again.

Alternatively, use 42Signals for a free trial to see the same in action and then decide.

Where Pricing Is Going Next

With AI, personalization is getting real. Some stores are already showing different prices to repeat buyers versus first-time visitors. It’s powerful—but it needs to be used carefully. Be transparent. Don’t sneak in hidden fees.

Don’t get cute with manipulative pricing tricks. Customers can smell that stuff, and it breaks trust fast. Pricing should be smart, yes—but also fair.

Final Thoughts: You Don’t Need to Be Amazon

Even small stores can compete on pricing—if they’re smart about it. You don’t have to win every price war. You just have to know your market, watch your margins, and use the tools available.

Start with one product or category. Run a few tests. Watch what happens. Then double down on what works. Small tweaks can lead to big wins.

Retail price intelligence software like 42Signals can help you with all these details by cutting out the manual labor process and leaving out human error.

Sign up for a free trial today.

Frequently Asked Questions on Retail Price Intelligence

1. What is a price intelligence tool?

A price intelligence tool is a software solution that helps businesses track, analyze, and respond to pricing trends in real time. It collects data from competitors, marketplaces, and other sales channels to give brands a clear picture of the market.

Key functions typically include:

- Competitive price monitoring across SKUs, platforms, and geographies.

- MAP (Minimum Advertised Price) compliance tracking.

- Dynamic pricing recommendations based on market fluctuations.

- Promotional and discount tracking to understand competitor tactics.

- Historical pricing insights to guide strategic decisions.

For example, a retailer can use a price intelligence tool to detect when competitors drop their prices on a best-selling item and respond strategically—either by adjusting prices or offering bundled promotions. Tools like 42Signals specialize in this space, offering real-time insights designed for retail and e-commerce teams.

2. What are the 5 C’s of pricing?

The 5 C’s of pricing are key factors companies consider when setting or adjusting prices:

- Cost – The base cost of production, distribution, and overhead that determines minimum viable pricing.

- Customer Value – How much customers are willing to pay based on perceived value and brand strength.

- Competition – What other players in the market are charging for similar products.

- Channel – The platform or distribution method used (e.g., direct-to-consumer, wholesale, marketplace).

- Compliance/Constraints – Legal, regulatory, or contractual pricing boundaries (e.g., MAP policies or tax structures).

Together, these help businesses set prices that balance profitability, competitiveness, and customer expectations.

3. What do you mean by retail price?

Retail price is the final price a customer pays when purchasing a product in a store or online. It includes not only the base cost of production but also markups for overhead, distribution, marketing, and profit margin.

Retail prices can vary by channel or region, but they’re typically the most visible price point to consumers and play a critical role in shaping brand perception.

For example:

- A manufacturer might sell a shirt to a retailer for ₹500.

- The retailer adds a 40% margin and lists it at ₹700.

- ₹700 becomes the retail price.

This price can also be influenced by promotions, discounts, or seasonal sales.

4. What are the 4 pricing methods?

There are several ways to set product prices, but the four most common pricing methods are:

- Cost-Plus Pricing – Adding a fixed percentage markup to the production cost. Simple and predictable.

- Value-Based Pricing – Setting prices based on the perceived value to the customer, not just costs.

- Competitive Pricing – Adjusting prices in line with or against competitor prices to stay market-relevant.

- Dynamic Pricing – Continuously adjusting prices based on demand, competition, seasonality, and other real-time factors.

Each method has its strengths—many modern retailers use a hybrid approach combining cost-based discipline with competitive and dynamic pricing intelligence to maximize revenue.