Table of Contents

ToggleIntroduction to Competitive Intelligence and DIY Research

Navigating the intricacies of establishing a potent competitive presence and concurrently maximizing operational efficiency presents a common quandary for modern enterprises. Balancing external resources, such as Competitive Intelligence software, with internal undertakings like Do-It-Yourself (DIY) research holds the key to success.

Amidst countless options and sparse authoritative recommendations, finding the most suitable approach becomes a formidable task. Dive into our detailed exploration of the respective benefits and challenges inherent in each avenue, culminating in a well-informed decision crafted explicitly for your particular setting, financial capacity, and strategic intentions.

Understanding Competitive Intelligence Software

Competitive Intelligence (CI) software is an instrument created for companies to gain a competitive advantage through the collection, examination, and sharing of data related to market patterns, rival firms, and customers. It enables companies to:

- Quickly aggregate relevant data from various sources such as websites, news articles, and social media

- Utilize advanced analytics to spot market patterns, growth opportunities, and competitive threats

- Engage in proactive strategy formulation based on insights derived from data comparison and trend analysis

- Benefit from real-time monitoring of competitors’ activities, thus allowing for rapid response to market changes

- Leverage intuitive dashboards and reporting tools for easy dissemination and interpretation of intelligence among team members

Such abilities enable companies to maintain their competitiveness by making shrewd, informed choices.

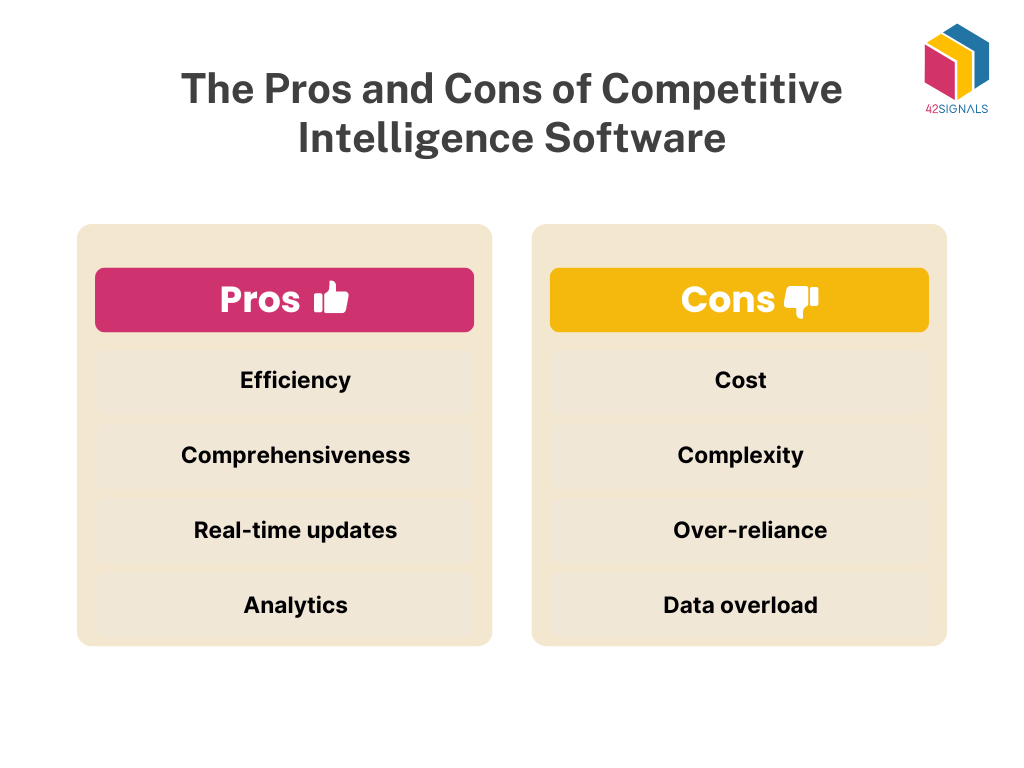

The Pros and Cons of Competitive Intelligence Software

Pros:

- Enhanced Efficiency & Time Savings:

- How: Automates labor-intensive tasks like scraping websites, monitoring social media, tracking news, aggregating financial data, and scanning regulatory filings.

- Benefit: Frees up analysts’ time (often saving 20-50+ hours weekly) from manual collection, allowing them to focus on higher-value analysis, strategy formulation, and actionable insights.

- Unmatched Comprehensiveness & Scope:

- How: Continuously gathers data from a vast array of sources simultaneously, including competitors’ websites, product pages, pricing, marketing campaigns (digital & social), review sites, news outlets, industry reports, patent databases, job boards, and sometimes even dark web or niche forums.

- Benefit: Provides a much broader and deeper view of the competitive landscape than manual efforts, reducing the risk of missing critical information and revealing hidden patterns or emerging threats/opportunities.

- Critical Real-time Updates & Alerts:

- How: Monitors key sources 24/7 and sends instant notifications (email, dashboard alerts, Slack/Teams integrations) for significant events like price changes, new product launches, executive moves, PR crises, funding announcements, or negative reviews.

- Benefit: Enables businesses to react swiftly to competitor moves, market shifts, or emerging threats, turning intelligence into a proactive advantage rather than a post-mortem analysis.

- Powerful Analytics & Actionable Insights:

- How: Goes beyond data aggregation. Utilizes AI, machine learning, and data visualization tools to:

- Identify trends, correlations, and anomalies.

- Perform SWOT analysis (automated or assisted).

- Track competitor market share and sentiment.

- Predict competitor strategies or market shifts.

- Benchmark performance against competitors.

- Visualize complex data through dashboards and reports.

- Benefit: Transforms raw data into clear, strategic insights that directly inform decision-making regarding product development, marketing, sales, pricing, and overall business strategy.

- How: Goes beyond data aggregation. Utilizes AI, machine learning, and data visualization tools to:

Cons:

- Significant Cost & Investment:

- Components: Costs include subscription/license fees (often tiered by features/users/data volume), potential setup/implementation fees, integration costs, and ongoing training/support. Premium features (AI analytics, extensive data sources, dark web monitoring) command higher prices.

- Challenge: It can be prohibitively expensive for startups and small businesses. Requires careful ROI justification, especially beyond basic monitoring. Budgeting must account for the total cost of ownership.

- Inherent Complexity & Learning Curve:

- Why: Powerful tools often have sophisticated interfaces, complex query builders, intricate dashboard customization, and numerous configuration options. Understanding data sources, filters, and analytical tools takes time.

- Challenge: Requires dedicated training for users to become proficient. Without proper onboarding, users may underutilize the software, leading to frustration and poor ROI. May necessitate hiring or training specialized analysts.

- Risk of Over-reliance & Diminished Human Judgment:

- How: The volume and apparent authority of automated data can lead users to accept outputs uncritically. Algorithms might miss nuance, context, sarcasm, or emerging trends that are not in their training data.

- Challenge: Can result in flawed insights if human expertise, intuition, industry knowledge, and critical thinking aren’t actively applied to interpret, validate, and contextualize the software’s findings. CI software is a tool, not a replacement for skilled analysts.

- Potential for Data Overload & Noise:

- Why: Continuous monitoring of vast sources generates enormous data volumes. Not all data is relevant or accurate. Irrelevant alerts (“noise”) can easily flood users.

- Challenge: Can overwhelm users, making it difficult to identify truly critical signals. Requires disciplined setup (precise keywords, filters, alert thresholds) and ongoing management to refine data streams and focus on what matters most. Poor setup leads to “analysis paralysis.”

The Ins and Outs of DIY Research in Business

Image Source: Insight Platforms

Engaging in DIY research vs competitive intelligence software arms a business with a nuanced understanding of its market ecosystem. This typically involves:

- Collecting Data: Businesses must gather information from multiple sources, including market analysis reports, customer feedback, and competitive offerings.

- Analyzing Trends: Identifying patterns within the data helps predict future market movements and consumer behavior.

- Benchmarking Performance: Comparing a company’s metrics against competitors highlights areas for improvement.

- Assessing Risks and Opportunities: Weighing potential threats and opportunities in the market is crucial for strategic planning.

- Implementing Changes: Insights gained from research should propel actionable strategies to enhance the business’s competitive stance.

The practice of conducting independent or DIY research can indeed offer financial benefits; however, it necessitates a considerable investment in terms of both time and specialized skill sets.

Therefore, this approach may be optimally adapted for organizations equipped with sufficient resources to consistently allocate toward rigorous and protracted investigatory pursuits.

Balancing the Advantages and Challenges of DIY Research

Businesses that choose to conduct their own research without using competitive intelligence software have the advantage of having full control and the possibility of reducing costs. Nevertheless, this approach requires them to overcome a challenging learning process and invest significant amounts of time. DIY research allows for highly customizable data generation, ensuring that businesses focus exclusively on what they deem most relevant.

Advantages of DIY Research

- Enhanced Cost-Effectiveness & Budget Control:

- How: Eliminates fees charged by external agencies, consultants, or specialized software subscriptions. You pay primarily for internal staff time and potentially basic tools (e.g., survey platforms, web analytics).

- Benefit: Significant direct cost savings, especially for ongoing or smaller-scale projects. Provides greater budget predictability and allows reallocation of funds to other areas. Avoids markups on third-party services.

- Deep Customization & Specificity:

- How: Research questions, methodologies, target audiences, data collection instruments (surveys, interview guides), and analysis frameworks can be designed exactly to address the unique, often nuanced, needs of your specific project, department, or strategic question.

- Benefit: Generates highly relevant and actionable insights that directly tackle your core business challenges. Avoids the “off-the-shelf” feel of some standardized external reports. Allows exploration of niche areas or specific hypotheses that might not be a priority for an external firm (e.g., testing very specific product features, understanding internal process pain points).

- Direct Control & Process Ownership:

- How: Complete oversight of every stage: defining the scope, designing the methodology, collecting raw data, conducting analysis, and interpreting results. Internal teams have direct access to the raw data and intermediate findings.

- Benefit:

- Transparency & Trust: Full visibility into how data is gathered and processed, fostering greater internal trust in the findings.

- Agility & Iteration: Ability to quickly adapt the research mid-stream if initial findings reveal new avenues to explore or if business needs shift.

- Data Security & Confidentiality: Sensitive information or proprietary questions stay entirely within the organization.

- Knowledge Retention: Builds internal research capabilities and institutional knowledge.

Challenges of DIY Research

- Significant Time Investment & Resource Drain:

- How: Requires substantial internal staff time for learning methodologies, designing research instruments, recruiting participants, collecting data, cleaning/organizing data, conducting analysis, synthesizing findings, and creating reports. This diverts resources from core operational roles.

- Challenge: High opportunity cost. Can lead to project delays, rushed analysis, or research being deprioritized when core business demands peak. Scaling research efforts becomes difficult without dedicated personnel.

- Demand for Specialized Expertise & Skills Gaps:

- How: Effective research requires skills in: research design (quant/qual/mixed), statistical analysis, survey/questionnaire design, interview/facilitation techniques, data visualization, and unbiased interpretation. Many internal teams lack formal training in these areas.

- Challenge: Risk of poor methodology leading to unreliable or invalid data (“garbage in, garbage out”). Flawed analysis can produce misleading conclusions. Difficulty handling complex data sets or advanced techniques (e.g., regression, sentiment analysis, ethnographic studies). It may necessitate expensive training or hiring specialized staff.

- Heightened Risk of Bias & Lack of Objectivity:

- How: Internal researchers often have pre-existing hypotheses, stakes in the outcome, or organizational blind spots. Common biases include:

- Challenge: Undermines the validity and credibility of the research findings. Can lead to costly strategic decisions based on skewed or inaccurate insights. Lack of an external “critical eye” makes it harder to identify and mitigate these biases internally.

Comparing Costs: Software Vs. DIY Approach

Evaluating the expenses of competitive intelligence (CI) software versus a do-it-yourself (DIY) method requires careful consideration of various aspects. CI software usually entails a recurring subscription fee which covers updates, technical assistance, and maintenance. Despite being more pricey initially, this option offers extensive and consistent services.

Alternatively, the do-it-yourself approach might seem cheaper initially; yet, it could eventually end up being pricier due to unforeseen costs like:

- Time spent by employees on research tasks

- Potential missed opportunities due to slower response times

- Resources diverted from core business activities

- The need for training or hiring analysts with specialized skills

These hidden costs suggest that while DIY saves on initial expenses, software could offer a more cost-effective solution over time.

Making the Decision: Factors to Consider Before a Competitive Intelligence Software

Image Source: Paper Flite

When deciding between competitive intelligence software and DIY research for your business, consider the following:

• Budget constraints

Determine how much you can allocate toward these tools or processes.

• In-house expertise

Assess the level of expertise available within your organization to conduct effective research.

• Data needs

Examine the type and volume of data your business requires for informed decision-making.

• Timeframe

Consider how quickly you need insights and whether you can accommodate the time investment required for DIY research.

• Competitive landscape

Evaluate the intensity of competition in your industry and the necessity for real-time competitive intelligence.

• Business goals

Align your choice with the strategic objectives of your business, whether that’s growth, innovation, or market penetration.

• Integration with existing systems

Ensure that the solution can be integrated seamlessly with your existing infrastructure.

• Scalability

Choose an option that can accommodate the growing needs of your business.

Conclusion on Competitive Intelligence Software

Choosing between competitive intelligence software and DIY research hinges on a business’s specific needs, resources, and competencies. Businesses must assess:

- Scalability: Will the solution grow with the business?

- Cost: Is there a clear ROI that justifies the investment?

- Timeliness: How quickly is actionable data required?

- Accuracy: Is the data reliable and error-free?

- Expertise: Does the business have the skill set to interpret the data effectively?

A carefully considered strategic decision demands an optimal balancing of critical factors to guarantee that the adopted approach remains consistent with the organization’s comprehensive aims and resources. This delicate equilibrium ensures that the chosen path not only supports but also enhances the long-term success and sustainability of the enterprise.

For intelligence about the market and your competitors, schedule a free demo with us today.

Frequently Asked Questions

What is a competitive intelligence tool?

A competitive intelligence tool is a software or platform designed to help organizations gather, analyze, and interpret data about their competitors, industry trends, and market environment. These tools facilitate informed decision-making by providing insights into competitors’ strategies, customer preferences, market dynamics, and emerging opportunities or threats.

Examples of competitive intelligence tools include solutions for social media monitoring, website traffic analysis, pricing comparison, and tracking market trends.

What are competitive intelligence programs?

Competitive intelligence programs are structured initiatives within an organization aimed at collecting, analyzing, and leveraging information about competitors and the broader market. These programs often combine human expertise with specialized tools to uncover strategic insights.

What are the 7 P’s of competitive intelligence?

The 7 P’s of competitive intelligence represent key elements or focus areas in developing and executing an effective competitive intelligence strategy. They are:

Planning – Establishing objectives, resources, and timelines for the competitive intelligence effort.

Prioritization – Determining which competitors, markets, or trends warrant the most attention.

People – Building a skilled team to gather, analyze, and interpret intelligence data.

Processes – Defining the methods and workflows for data collection, validation, and reporting.

Platforms – Utilizing the right tools and technologies to streamline data gathering and analysis.

Protection – Safeguarding sensitive information and maintaining ethical standards in intelligence gathering.

Performance – Measuring the effectiveness of the competitive intelligence efforts and refining strategies based on outcomes.