Table of Contents

Toggle** TL;DR ** Moving from manual to automated “Smart Alerts” is crucial for maintaining a competitive edge by enabling near real-time tracking of critical competitor moves. This automation focuses on capturing specific intelligence like price fluctuation data via price alerts, launch detection for new products, and promo tracking for temporary discounts. The key strategy involves creating intelligent alerting logic that filters out irrelevant data, sets critical action thresholds (e.g., a 5% price drop on key products), and instantly routes the information to the correct internal teams (pricing, R&D, marketing). This process effectively transforms passive competitor tracking into a proactive strategic system, allowing for rapid and informed counter-responses.

If you’re not keeping a close eye on your competitors, you’re falling behind. It’s not enough to check their website once a month. You need to know what they’re doing—when they’re doing it—in near real time. This persistent, focused attention is what we call effective competitor monitoring, and it’s the absolute foundation of a winning market strategy. If you don’t have a solid system for competitor tracking, you’re basically guessing your way through a crowded market.

Image Source: Web Data

No matter what your Line of Business (LOB) is, relying on someone to manually check competitor prices and product pages is old-school and just plain slow. Competitors launch new things, change prices, and run promotions faster than any human can track. That’s why automation is essential. We’re going to talk about setting up “Smart Alerts”—automated notifications that jump into action the moment a competitor makes a move that actually matters to your business. This ensures you capture critical price fluctuation data the second it appears.

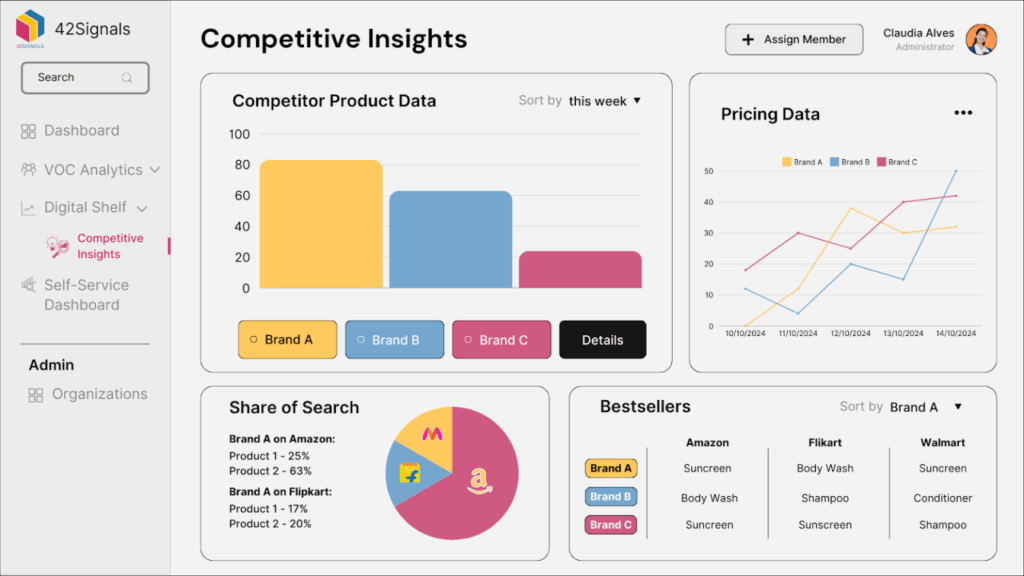

The real goal here isn’t just collecting data; it’s turning that data into fast, powerful actions. Imagine being notified when your main rival drops the price on their top product or rolls out a major new feature. That immediate heads-up lets you fire off a quick response: maybe you launch a targeted counter-promotion, adjust your own pricing defensively, or quickly tell your sales team what’s happening. This is the strategic edge you gain with automated competitor tracking.

The Problem with Manual Competitor Monitoring

Ask yourself: are you still sending an employee to browse competitor sites every Monday? If so, your strategy has a major leak. The time delay, or latency, is a business killer. A crucial price change made on Tuesday could cost you huge sales by the time your analyst finally spots it on Friday.

On top of being slow, manual competitor monitoring is full of potential for human error and generally lacks the detail you need for real competitive advantage. People miss subtle but important changes—like a rival quietly changing their product bundles or slipping in a new, unannounced service tier. To be truly nimble in the market, you need a high-quality, comprehensive, and most importantly, automated competitor monitoring tool system.

The best defense is often a proactive offense, and in this game, that means having better intelligence. By automating your surveillance, you stop being reactive—only responding after your market share has taken a hit—and become proactive, ready to anticipate and neutralize threats instantly.

Keeping Tabs on Launches: The Art of Launch Detection Intelligence

One of the most important aspects of great competitor monitoring is catching a rival’s new product, service, or feature launch the very moment it happens. This early warning, delivered by sharp launch detection intelligence, buys you priceless time for internal strategizing and preparing your market response.

How to Spot a New Product Launch, Even the Subtle Ones

Competitors don’t always announce their launches with big, noisy press conferences. In fact, the most interesting moves are often soft launches or minor feature updates quietly folded into their existing platform. Smart launch detection needs to be able to catch these hidden changes.

- Watching All Their Digital Footprints: Smart alerts don’t just look at the main “Products” page. They track changes across all of a competitor’s digital properties. This means monitoring their sitemap for new URLs that pop up, looking for code changes that hint at features being built behind the scenes, and scanning every update to their press release or blog sections. If a rival is prepping a new product line, the structure of their website will often reveal their intentions long before the official announcement.

- Tracking the Technology Under the Hood: For companies built on software, competitor monitoring should include tracking the technologies they use (their tech stack). A change in technology might signal a major strategic shift—maybe they’re moving into a totally new market or focusing on different system integrations. While this might not be an immediate “launch,” it’s a crucial early signal that allows your research and development (R&D) and strategy teams to prepare.

- Listening to the Outside World: True launch detection looks beyond the competitor’s own properties. It involves tracking industry forums, product review sites, and even official government filings (if applicable) for early signs of a new product. A small discussion thread on a niche forum about a competitor’s beta test can be the earliest and most actionable intelligence, giving you a serious head start.

Setting up automated triggers for these signals ensures that the second a launch is detected—no matter how small or subtle—the right people in your company get notified right away.

Price Alerts in Real Time: The Value of Price Fluctuation Data

In the world of e-commerce and any market with visible pricing, a price change by a competitor can immediately impact your sales and your bottom line. Smart, near real-time price alerts are absolutely necessary for maintaining your competitive position and are the core of effective competitor monitoring.

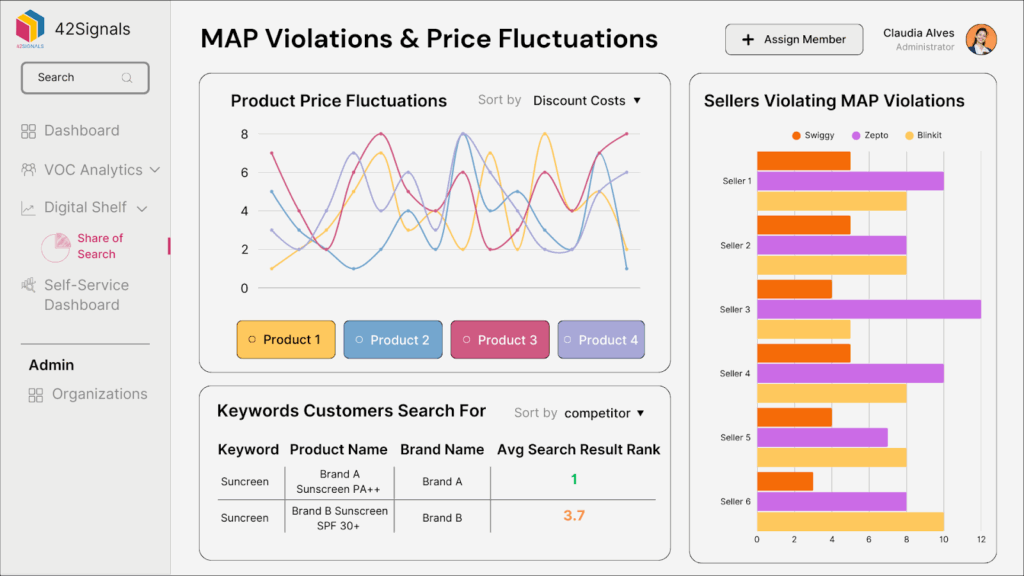

42Signals price alerts feature

Why Price Fluctuation Data Must Be Instant

Pricing changes have an immediate effect. If your main competitor drops the price of a popular product by 10% and you don’t adjust within an hour, you could lose significant sales volume that very day. Getting a summary of pricing at the end of the day is too late. Your price alerts need to operate almost minute by minute.

Checking prices manually is tedious, time-consuming, and full of errors, especially if you have a large product catalog. Automated systems, on the other hand, constantly scan and analyze competitor websites, reliably capturing massive amounts of price fluctuation data without ever getting tired or making a mistake.

Checklist for Monitoring Price Fluctuation Data:

- Track the Difference, Not Just the New Price: Your system should not just report the new price; it must compare it to the original price and highlight the delta (how big the change is). A 1% change might be ignored; a 15% drop is an emergency.

- Give Context with the Alert: Price is rarely the only factor. The system must capture the surrounding pricing context. Did the price drop also come with free shipping, an extended warranty, or some extra included product? This contextual data makes the alert useful for your pricing team.

- Watch Specific Regions and Segments: For global businesses or those serving different customer types, a critical part of competitor monitoring is tracking local and segmented pricing. A competitor might drop their price only in one country, or only for new customers. Smart alerts must be detailed enough to catch and notify you about these specific, targeted price changes.

With immediate access to accurate price fluctuation data, your team can quickly decide whether to match the price, offer a better value proposition, or communicate the unique reasons why your product is worth its current price.

Automated Promo Tracking and Discount Intelligence

A temporary promotional campaign or a product bundle is a different beast than a simple price drop. These are tactical, often aggressive, moves designed to grab market share quickly. Having robust promo tracking is vital for countering these short-term, high-impact threats. This is a core part of smart competitor tracking that focuses on rapid, temporary changes.

The Inner Workings of Discount Intelligence

Discount intelligence looks deeper than just the price tag. It involves analyzing the specific terms and structure of a competitor’s offer. A coupon code for 20% off, a “buy one, get one half off” bundle, or a limited-time extension of a free trial are all promotions that must be tracked accurately.

- Detecting Coupon Codes: Automated systems can spot when a competitor introduces new coupon fields or publicly available codes. The alert needs to deliver the exact details of the coupon (e.g., “20% off for the first 100 customers”) so your marketing team can plan a response, perhaps a special loyalty offer or a matching promotional window.

- Tracking Bundles: Competitors often try to make their offering look more appealing by bundling products or services. For example, offering a software subscription with a free piece of hardware. Your promo tracking system should detect these bundles, analyze what’s included, and estimate the actual value of the discount. This intelligence helps your product team create an equal or better offer.

- Monitoring Limited-Time Offers: Promotions are often short-lived—running only for a weekend or a single week. The near real-time capability of your competitor monitoring is crucial here. An alert triggered on a Friday morning about a weekend sale gives your sales team the time they need to prepare targeted messages or counter-promotions before the critical sales period ends.

Effective promo tracking ensures you are never surprised by a competitor’s flash sale. It guarantees that your response is fast, informed, and targeted, minimizing lost sales and preserving your market momentum.

Building Smart Alerting Logic: Turning Data into Decisions

Collecting huge amounts of price fluctuation data and launch information is only the first step. The true value lies in the alerting logic—the rules that filter out the unnecessary noise and deliver timely, useful intelligence to the right person. This is how the alerts become “Smart.”

Deciding What’s Critical and Setting the Rules

You can’t send an alert for every small change; you’ll overwhelm your team, and they’ll start ignoring everything. The alerting logic must prioritize changes that cross a set threshold of importance, making your competitor monitoring system highly effective.

| Competitor Action | Suggested Criticality Threshold | Who Needs to Know |

| Price Drop | More than 5% change on products that make up 10% or more of the market you share. | Pricing/Revenue Team |

| New Product Launch | Detection of a new major product line or a specific item with a lot of overlap with yours. | Product/R&D Team |

| New Promo/Discount | Any deal that is over 15% off, or a bundle that has never been offered before. | Marketing/Sales Team |

| Feature Update | A feature that directly solves a major, known problem for your shared customers. | Product/UX Team |

These established rules are the backbone of smart competitor monitoring. An alert about a 1% price change is irrelevant noise. An alert about a 15% price cut on a flagship product is a critical signal that requires immediate action.

Making Sure the Right Person Gets the Alert

A Smart Alert must not only identify the change but also ensure it reaches the person who can act on it most effectively. This requires connecting the alerts directly to your existing team workflows.

- Alerts Based on Job Role: Notifications should be sorted. A price alert triggered by price fluctuation data goes directly to the pricing and sales teams, perhaps in a specific Slack channel or email. A launch detection alert about a new competitor product goes straight to the R&D and Strategy departments.

- Alerts with Different Urgency Levels: Not all alerts are equally important. A Tier 1 alert (like a massive price cut on a core product) might trigger an immediate phone notification to a department head, while a Tier 2 alert (a minor feature update) might just appear on a daily competitive intelligence dashboard. This tiered approach prevents alert fatigue.

- Adding Context to the Data: Every alert should be enhanced with important background information. When a price alert is triggered, the system should automatically pull in your own corresponding product’s profit margin, current inventory levels, and past performance. This immediate context turns a simple observation into an action item, speeding up the response time.

This powerful alerting logic is what moves generic competitor tracking into a quick, strategic intelligence function.

The Technology Behind Near Real-Time Competitor Monitoring

To achieve true, fast intelligence, the technology supporting your competitor monitoring must be quick, reliable, and able to grow with your business. This isn’t something you can manage with simple spreadsheets; it requires specialized data infrastructure.

Gathering and Scraping the Data

The process starts with efficient, ethical, and very frequent data scraping. To generate reliable price alerts and strong promo tracking, your system needs to visit competitor websites often—potentially every few minutes for products that change price a lot—while being careful not to overload their servers or get blocked.

The system must handle several complicated issues:

- Modern Dynamic Websites: Many current websites use JavaScript to load content, which often breaks traditional scraping methods. The platform must be able to view and analyze these dynamic pages to capture accurate price fluctuation data.

- Bypassing Blockers: Sophisticated competitors use tools to block automated traffic. Your competitor tracking solution needs to employ smart techniques to reliably get around these defenses, ensuring continuous access to important data.

- Cleaning Up the Data: Competitor data rarely comes in a neat, uniform format. Prices might show up as “$29.99,” “29.99 USD,” or “Save 20% Today.” The raw data must be cleaned, standardized, and mapped to your internal product list for effective comparison and for correctly triggering price alerts.

Using Machine Learning for Launch Detection

For catching subtle moves, especially in launch detection, machine learning (ML) models are incredibly useful. ML can analyze huge amounts of unorganized data—like changes in website text, updates to blog posts, or new patent filings—and flag potential competitive moves that a simple rules-based system would miss.

For example, an ML model trained on past launches can detect that a competitor has added a small, new paragraph to their “About Us” page detailing a new area of focus. This minor text change could be flagged as highly likely to lead to a major product launch, giving you a critical advanced warning. This sophisticated approach elevates competitor monitoring from simple data collection to predictive intelligence.

Making Sure the Data is Fresh and Reliable

The entire point of competitor monitoring is lost if the data is old. Data reliability means more than just collecting it; it means constantly checking the collection process to ensure every data point is accurate. For instance, the system might mistakenly read a “sale price” as the “new permanent price.” Continuous checking and careful validation of the gathered price fluctuation data are essential for creating trustworthy price alerts.

Strategic Integration: Putting Competitor Monitoring to Work

A smart competitor monitoring system is a powerful tool, but its real power emerges when its intelligence is woven into your everyday business decisions. You must view it not as a separate tool, but as a core part of how you operate and strategize.

Pricing Strategy and Price Alerts

The most immediate use for smart alerts is in pricing. When a price alert is triggered by sudden price fluctuation data, your response needs to be quick and organized.

How to Respond to a Critical Price Alert (Tier 1):

- Alert Notification: The near real-time alert is sent to the Pricing Manager and the VP of Sales.

- Automated Analysis: The system instantly creates a report showing the projected impact of matching the competitor’s price versus keeping your current price (based on expected lost sales and profit margin changes).

- Strategic Decision: The pricing team reviews the analysis (which includes the competitor’s shipping terms, warranties, and bundles gathered by competitor monitoring).

- Execution: Within an hour, a final decision is made—to adjust the price, launch a targeted counter-promotion tracked by promo tracking, or start a campaign emphasizing your product’s superior value.

This structured process, fueled by timely data from competitor tracking, makes your pricing less reactive and more agile and data-driven.

Product Development and Launch Detection

Launch detection intelligence must flow directly into your product planning process. If an alert shows a competitor has launched a feature that solves a known market problem, your R&D team needs to immediately assess whether that feature should become a top priority on your own roadmap.

- Gap Analysis: The competitor monitoring alert should kick off a formal meeting to analyze the gap. Is the competitor’s new feature a true game-changer? Can we build something similar, or even better, faster than they can?

- Prioritization: If the competitor launch is deemed critical, the product team can use this intelligence to justify shifting internal development resources toward a direct competitive countermeasure. This can save months of development time that might have been spent on less important features.

Marketing and Promo Tracking

Marketing teams benefit enormously from advanced promo tracking and discount intelligence. Knowing exactly when and how competitors are running deals allows you to launch highly targeted, opportunistic marketing campaigns.

For instance, if a competitor announces a “24-Hour Flash Sale,” your marketing team, armed with robust promo tracking, can immediately launch a highly focused social media campaign highlighting one of your product’s superior features or a better long-term value proposition that the competitor’s short-term discount can’t beat. This rapid, informed counter-marketing is a defining trait of superior competitor monitoring.

Keeping the Edge: Continuously Improving Competitor Monitoring

Setting up a smart alerting system for competitor analysis is an ongoing journey, not a final destination. The market is always changing, and your monitoring rules must change right along with it.

Regularly Reviewing Your Alerting Rules

What was considered a “critical” change six months ago might be common practice today. The rules for price alerts and launch detection need to be checked every quarter.

- Are you getting too many false alarms?

- Are you missing important, subtle changes?

For example, if a competitor starts running a 10% discount every single month, that 10% alert might become useless noise. You may need to increase the critical promo tracking threshold to 15% or adjust the logic to only flag new kinds of promotions or bundles. This continuous refinement keeps your competitor tracking sharp and focused.

Expanding Who You Monitor

As your business grows, your competitors change. Your competitor monitoring system needs to be flexible enough to quickly add new, up-and-coming rivals who could pose a serious threat.

The system should also be able to track different data sources. If a key competitor starts focusing heavily on YouTube videos to announce launches, your launch detection strategy must quickly adapt to monitor their video content and descriptions for new product hints, rather than relying only on website changes.

The Human Touch in Competitor Monitoring

Automation provides speed and scale, but human analysts provide the strategy and depth of understanding. The best competitor monitoring systems include a feedback loop where analysts can refine the alert settings based on their interpretation of actual market events.

If a specific competitor move wasn’t flagged but turned out to be critical, the analyst should be able to instantly adjust the alerting logic to ensure similar moves are caught next time. This partnership between automated price alerts and human strategic judgment is the ultimate competitive advantage, ensuring your competitor tracking system delivers unmatched discount intelligence and lightning-fast response capabilities. By making competitor monitoring a core, evolving part of your business, you ensure you always stay ahead of the game.

Download our full 2026 outlook report to understand the trends of 2025 that have driven ecommerce.

Frequently Asked Questions

What is Competitive Monitoring?

Competitive monitoring is the persistent, systematic process of tracking, gathering, and analyzing information about your market rivals to understand their strategies, movements, and performance. It moves beyond occasional checks, utilizing automated systems (“Smart Alerts”) to capture near real-time intelligence—such as price fluctuation data, new launch detection, and active promo tracking. The goal is to transform passive observation into proactive, strategic action, ensuring you can anticipate market shifts and maintain a competitive advantage.

How Do You Monitor Your Competitors?

Effective competitor monitoring today relies heavily on automation and systematic data collection, shifting away from manual checks. The process involves:

Automated Data Gathering: Utilizing specialized tools and systems to continuously scrape and analyze competitor websites, product pages, sitemaps, and even public code changes. This is essential for capturing real-time data like price alerts and discount intelligence.

Tracking Digital Footprints: Monitoring all digital properties, including social media, blogs, press releases, job postings, and technological stacks (e.g., using BuiltWith or similar tools), for subtle hints of new strategic direction or upcoming launches.

Establishing Alerting Logic: Setting clear, critical thresholds for changes that matter (e.g., a 5% price drop, a major feature release) to filter out noise. This logic directs “Smart Alerts” to the correct internal teams.

Strategic Integration: Ensuring the captured intelligence flows directly into operational workflows. Price alerts inform the pricing team’s adjustments, and launch detection informs the R&D team’s product roadmap.

External Signal Listening: Looking beyond the competitor’s own sites to track industry forums, review sites, and third-party data to gain a comprehensive, objective view of their market presence and customer perception.

What Are the 4 Types of Competitors?

Competitors can be categorized based on the nature of the product, service, or customer need they address:

Direct Competitors (Primary): These are businesses that offer the exact same product or service to the same target market. (Example: Coca-Cola vs. Pepsi).

Indirect Competitors (Secondary): These are businesses that offer different products or services but satisfy the same customer need or job-to-be-done. (Example: A coffee shop vs. a high-end energy drink producer—both satisfy the customer’s need for a morning boost).

Replacement Competitors: These are businesses whose products are viable, though not identical, alternatives that a customer could choose instead. (Example: A train service vs. an airline for long-distance travel).

Potential Competitors (Future): These are companies currently outside your market but that have the capacity, technology, or capital to enter your market and become a direct competitor in the future. (Example: A major tech company developing an internal tool that could be commercialized as a direct competitor to an existing software product).

What Are the 5 Forces of Competitor Analysis?

The Five Forces framework, developed by Michael E. Porter, is a model for analyzing the competitive intensity and overall attractiveness (profit potential) of an industry. The forces are:

Threat of New Entrants (Barriers to Entry): How easily can new competitors enter the market? High entry barriers (like patents, significant capital requirements, or complex regulatory needs) reduce this threat.

Bargaining Power of Suppliers: How much leverage do the providers of raw materials, components, or services have? If there are few suppliers, or if switching suppliers is costly, their power is high, potentially squeezing industry profits.

Bargaining Power of Buyers: How much control do customers have over pricing? Buyers have high power if they are concentrated, if the product is undifferentiated, or if they can easily switch to a competitor.

Threat of Substitute Products or Services: How likely is it that customers will switch to an alternative from a different industry that satisfies the same core need? A high threat of substitution caps the price ceiling for the industry.

Rivalry Among Existing Competitors: How intense is the current competition? High rivalry involves frequent price wars, aggressive promo tracking, and expensive advertising battles, which generally drives down overall profitability.