Table of Contents

ToggleIn today’s highly competitive business landscape, staying informed about your competitors’ pricing strategies is crucial for making informed decisions and maintaining a competitive edge. Implementing an effective competitor price monitoring strategy allows businesses to identify pricing trends, respond quickly to market fluctuations, and optimize their own pricing strategies. In this article, we will explore key steps and strategies to help you successfully implement a competitor price monitoring system that drives your business forward.

How to Get Started with Your Competitor Price Monitoring Strategy

To launch an effective competitor price monitoring strategy, begin by defining 1-2 critical objectives aligned with urgent business needs, such as reclaiming market share on a flagship product or optimizing holiday season margins. Immediately identify your 3-5 most impactful direct competitors and prioritize 10-15 core SKUs where pricing battles directly influence your revenue. Select one reliable data source (e.g., Amazon for e-commerce brands or industry-specific marketplaces for B2B) and implement a lightweight monitoring tool like 42Signals for daily tracking.

Within two weeks, establish baseline competitor pricing patterns and run a pilot price adjustment on one product category—measuring sales impact and competitor reactions for 7 days. Document insights in a shared dashboard (Google Sheets or Power BI), then refine your scope, tools, and response rules in monthly iterations to systematically scale from tactical wins to enterprise-wide price intelligence.

1. Define Your Objectives:

Before collecting a single data point, crystallize why you’re monitoring competitor prices. Ambiguous goals lead to wasted effort. Examples include:

New Product Launch: “Benchmark introductory pricing for Product Y against competitor equivalents.”

Pro Tip: Align objectives with broader business goals (e.g., “Increase market share by 5% in 6 months”). Define KPIs (e.g., price index, win/loss rate) upfront.

Strategic Positioning: “Maintain premium pricing while ensuring we don’t exceed Competitor X by more than 10%.”

Market Share Growth: “Identify 3 key products where competitors are +15% above our price, and capture market share via aggressive pricing.”

Margin Optimization: “Detect competitor discount patterns to avoid unnecessary price wars during non-peak periods.”

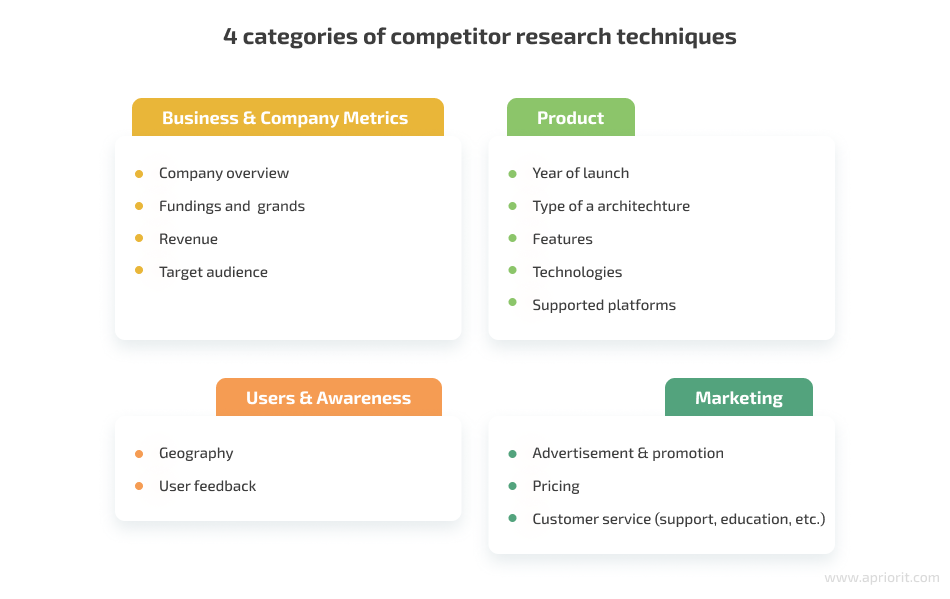

2. Identify Competitors and Products:

Not all competitors deserve equal attention. Segment them:

Monitor substitutes that could sway customer decisions (e.g., a premium brand lowering prices into your mid-tier space).

Direct Competitors: Brands offering identical products/services to your core audience (e.g., Nike vs. Adidas running shoes).

Indirect Competitors: Brands solving the same need differently (e.g., Uber vs. public transit).

Emerging Threats: Fast-growing disruptors (e.g., a DTC brand stealing niche market share).

Action Steps:

Map competitors’ product catalogs to your SKUs. Focus on hero products (your top sellers) and competitive battlegrounds (high-visibility items).

3. Select Data Sources for your Competitor Price Monitoring Strategy

Prioritize sources that reflect real customer experiences:

Social Media & Ads: Track flash sales promoted on Instagram/Facebook.

Key Consideration: Ensure data includes shipping, taxes, and discounts for true price comparison.

Competitor Websites & Apps: Capture live prices, promo codes, and bundle deals.

Marketplaces: Amazon, eBay, Walmart – where 56% of product searches begin.

Aggregators & Review Sites: Google Shopping, PriceGrabber.

Third-Party Data Providers: For inaccessible data (e.g., member-only pricing, B2B portals).

4. Choose the Right Tools and Technologies:

Manual tracking is unsustainable. Deploy purpose-built solutions:

Competitive Intelligence Suites (e.g., SEMrush, Similarweb): Add traffic and SEO context to pricing.

Tool Selection Checklist:

✔️ Real-time monitoring capabilities

✔️ Geographic/location-based tracking

✔️ Customizable alert thresholds (e.g., “Notify if Competitor Z drops prices by >8%”)

✔️ Historical trend analysis

Web Scraping Tools (e.g., Bright Data, Apify): Extract real-time data at scale.

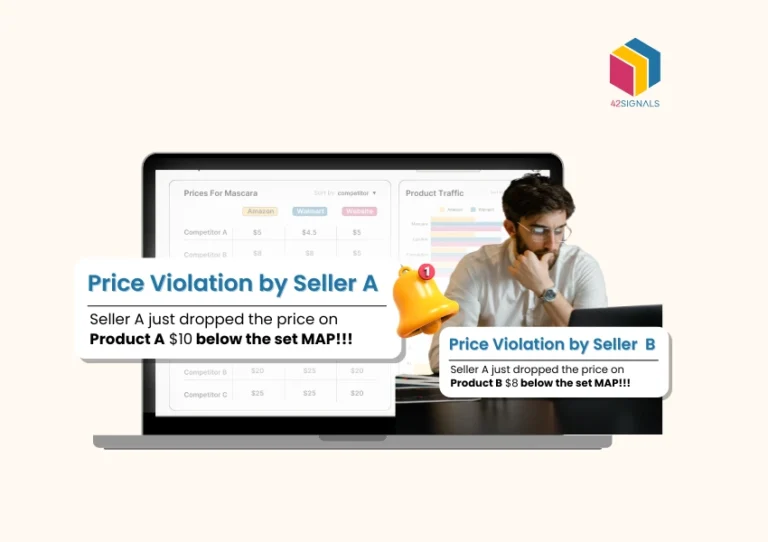

Price Intelligence Platforms (e.g., 42Signals, Competera): Automate tracking, historical analysis, and alerts.

E-commerce APIs: Direct integrations with Shopify, Magento, or Amazon Seller Central.

5. Develop a Monitoring Schedule:

Consistency is key in competitor price monitoring. Establish a monitoring schedule that suits your industry and the frequency of pricing changes. Daily or weekly monitoring is often recommended, depending on the competitiveness of your market.

Frequency depends on market volatility:

- High-Turnover Industries (e.g., electronics, fashion): Monitor daily or hourly.

- Stable Industries (e.g., furniture, B2B supplies): Weekly checks suffice.

Critical Add-ons: - Event-Triggered Tracking: Monitor during Black Friday, product launches, or competitor PR crises.

- Granular Timing: Track time-limited deals (e.g., “2-hour flash sale”).

6. Analyze and Interpret Data:

Gathering data is only the first step. Develop an effective data analysis framework to gain meaningful insights. Identify pricing patterns, seasonal trends, and competitor strategies. Look for opportunities to differentiate your pricing strategy based on the analysis.

Raw data is noise; analysis reveals strategy:

- Pattern Recognition: Identify MAP (Minimum Advertised Price) violations, discount cycles (e.g., “Competitor A discounts every Thursday”), or inventory-driven fire sales.

- Price Elasticity Modeling: Test how demand for your product shifts when competitors adjust prices.

- Basket Analysis: Compare total cart value (product + accessories + shipping) vs. rivals.

- Visualization: Use dashboards to track price position over time (e.g., “Are we the premium, mid-tier, or budget option?”).

7. Implement Adjustments with Competitor Price Monitoring Strategy

Image Source: Hubspot

Based on your analysis, develop a pricing strategy that aligns with your business goals. Adjust your prices strategically to capitalize on market opportunities and respond to competitor moves. However, consider factors beyond price alone, such as product quality, customer service, and value proposition.

Respond with precision, not panic:

- Rules-Based Automation: “If Competitor B’s price falls below $50, match it within 1 hour.”

- Value-Add Differentiation: If you can’t compete on price, emphasize superior service (free returns), bundles (product + tutorial), or loyalty perks.

- A/B Testing: Pilot price changes on select channels (e.g., Amazon only) before full rollout.

Golden Rule: Never race to the bottom. Use pricing as a lever for profit, not just volume.

8. Monitor and Iterate:

Competitor price monitoring is an ongoing process. Continuously monitor competitor prices, market dynamics, and customer feedback. Stay updated on industry trends and adapt your pricing strategy accordingly. Regularly evaluate the effectiveness of your monitoring system and make improvements as needed.

Pricing is a continuous battle:

- Track Impact: Measure how price changes affect sales volume, margin, and market share.

- Monitor Competitor Reactions: Did they counter your adjustment? How quickly?

- Incorporate External Data: Layer in customer reviews (“Too expensive!”), economic shifts, or supply chain costs.

- Audit Quarterly: Is your toolset still effective? Are new competitors emerging?

9. Data Validation & Cleansing: Ensure Accuracy

Why it matters: 30% of scraped pricing data contains errors (MIT Research).

- Tactics:

- Implement anomaly detection algorithms to flag improbable price swings (e.g., $100 → $1).

- Cross-verify data across 3+ sources (website, app, API).

- Track “out-of-stock masking” tactics (competitors showing false high prices when inventory is low).

- Pro Tip: Dedicate 15% of monitoring time to data hygiene.

10. Psychological Pricing & Perception Analysis

Beyond raw numbers: How competitor pricing shapes customer behavior.

- Monitor:

- Charm pricing ($19.99 vs. $20) and prestige pricing (whole numbers for luxury).

- Decoy pricing strategies (e.g., mid-tier product priced to make premium seem reasonable).

- Bundling psychology (e.g., “Complete kit” pricing vs. individual items).

- Tool Integration: Use session replay tools (Hotjar) to see how users react to competitor price displays.

11. Cost Structure Integration with you Competitor Price Monitoring Strategy

Avoid profit-killing reactions:

- Map competitor prices against your COGS (Cost of Goods Sold).

- Calculate breakeven points before matching discounts.

- Track raw material price shifts (e.g., cotton futures) to predict competitor moves.

12. Legal & Ethical Compliance

Landmines to avoid:

- MAP Policy Violations: Document competitor breaches for manufacturer reporting.

- Anti-Trust Risks: Never collude with competitors on pricing (use third-party tools as buffers).

- GDPR/CCPA Compliance: Ensure scraped data doesn’t include PII.

- Checklist:

✓ Consult legal counsel on price-matching public communications.

✓ Avoid automated pricing that triggers “algorithmic collusion” flags.

13. Omnichannel Price Synchronization with Competitor Price Monitoring Strategy

Modern customer journey complexity:

- Track channel-specific disparities:

- Online vs. in-store pricing

- Marketplace (Amazon) vs. DTC website discounts

- Monitor “showrooming” enablers (e.g., Best Buy’s price match guarantee).

- Case Study: Target’s 2023 strategy: Online prices 5% lower than stores to drive app adoption.

14. Competitor Reaction Forecasting

Shift from reactive to predictive:

- Build models using historical data:

- “If we lower Product A by 8%, Competitor X responds within 48 hrs 70% of the time.”

- Identify “triggers” (e.g., stockouts, new product launches).

- Run war games: Simulate price cuts to project competitive responses.

- Tool: Machine learning platforms (DataRobot) for scenario modeling.

15. Organizational Alignment & Workflow Integration

Break departmental silos:

- RACI Framework:

- Pricing Team – Analysis, strategy recommendations

- Marketing – Communicating value over price

- Sales – Real-time competitive intel from field

- IT/Legal – Total compliance and data security

- Tech Stack Integration: Embed pricing alerts into:

- CRM (Salesforce)

- ERP (SAP)

- Chat tools (Slack/MS Teams)

Implementation Roadmap

| Phase | Key Activities | Timeline |

|---|---|---|

| Foundation | Objectives, competitor mapping, tool selection | 1-2 weeks |

| Execution | Data pipeline setup, monitoring schedule | 3-4 weeks |

| Optimization | ML modeling, cross-team workflow design | Ongoing |

Critical Success Factor: Price monitoring isn’t a “set and forget” system. Allocate 10% of monthly revenue operations budget to tooling and talent. Companies that treat pricing as a dedicated competency achieve 2.7x higher YoY profit growth (Gartner).

These additions address hidden risks (data errors, legal issues), strategic depth (psychology, cost integration), and organizational scalability – transforming monitoring from a tactical exercise into a core competitive advantage.

Successfully implementing a competitor price monitoring strategy requires careful planning, accurate data collection, and data-driven decision-making. By defining clear objectives, identifying key competitors, leveraging appropriate tools, and analyzing data effectively, businesses can gain a competitive advantage in pricing. Regular monitoring and iterative improvements will ensure that your pricing strategy remains aligned with market dynamics and customer demands. Embrace the power of competitor price monitoring to enhance your decision-making and drive business growth.

Conclusion on Competitor Price Monitoring Strategy

An ecommerce insights tool is a valuable resource for businesses seeking to implement an effective competitor price monitoring strategy. By leveraging the power of data analytics and market intelligence, these tools provide comprehensive insights into competitor pricing, empowering businesses to make informed decisions and gain a competitive edge.

These tools offer a range of features and functionalities that aid in competitor price monitoring. Firstly, they automate the process of data collection by scraping pricing information from competitor websites, e-commerce platforms, and marketplaces. This eliminates the need for manual data gathering, saving time and effort.

Once the data is collected, ecommerce insights tools employ advanced analytics techniques to analyze and interpret the pricing information. They identify pricing trends, compare prices across multiple competitors and product categories, and highlight changes in pricing strategies over time. This enables businesses to identify market patterns, spot pricing anomalies, and understand how their competitors are positioning themselves.

Additionally, ecommerce insights tools often provide real-time or near-real-time updates on competitor pricing. They send notifications or alerts when significant price changes occur, allowing businesses to respond promptly. This agility in monitoring competitor prices enables businesses to adjust their own pricing strategies quickly, capitalize on market opportunities, and remain competitive.

Furthermore, these tools offer benchmarking capabilities, allowing businesses to compare their own prices against competitors. They provide insights into how a business’s pricing stacks up in the market and whether adjustments need to be made. This information aids in setting competitive yet profitable price points, balancing market positioning, and optimizing revenue.