Table of Contents

Toggle** TL;DR ** Revlon survived bankruptcy and regained relevance by ruthlessly listening to critics and acting on feedback: executives personally responded to online complaints, used affordable monitoring tools to identify packaging flaws (62% of complaints), and implemented rapid fixes (e.g., solving leaky glosses in 72 hours). They avoided destructive price wars through psychological bundling (e.g., mascara + eyeliner “duos” with perceived savings) instead of discounting hero products, and transformed e-commerce with hyper-personalized messaging, live inventory transparency, and stunningly human customer service (like overnighting replacements with handwritten notes). By empowering employees to address pain points publicly, treating complaints as “free R&D,” and embracing vulnerability (even sharing product failures on social media), Revlon doubled positive sentiment, attracted younger shoppers, and increased repeat purchases from 28% to 43% within 6 months—proving that radical customer obsession beats chasing fleeting trends.

When Revlon filed for bankruptcy, the company’s future did not look good. But in a few years, they seemingly made a turn for the better and seemed to be growing. How does a brand that literally painted Marilyn Monroe’s lips survive an era of 10-second GRWM videos and hyper-disposable beauty trends?

We’re breaking down their entire playbook here: how they weaponized brand monitoring to transform online haters into loyal evangelists, why their Revlon ecommerce strategy made improvements and started driving sales once again.

Image Source: Revlon

Revlon’s Near-Death Experience

Picture this scene: It’s late 2021. You walk into your local CVS. Where there used to be 12 gleaming feet of Revlon lipsticks, foundations, and iconic ColorStay displays? Now it’s shrunk to maybe 4 feet. The reclaimed space isn’t going to L’Oréal or Maybelline – it’s plastered with e.l.f., NYX, and 20 other TikTok-hyped brands you’ve never heard of. The visual screamed irrelevance.

What went wrong? The financial autopsy was brutal:

- Mass-market makeup grew just 1.3% in 2021 versus prestige beauty’s 25% surge (NPD Group) – a chasm revealing how mid-tier brands were getting crushed

- Revlon’s debt ballooned to $3.7 billion after its $870 million acquisition of Elizabeth Arden in 2016 – a deal that backfired when indie brands exploded during the pandemic

- Most damning? 78% of Gen Z shoppers called Revlon “their mom’s brand” in a 2022 Piper Sandler survey, with 62% admitting they’d never purchased it

The Listening Bootcamp (How They Learned to Love Their Haters)

After the bankruptcy filing, newly empowered CEO Debra Perelman made a radical decree: Every executive – including herself – would spend 4 hours/week doing digital “grunt work”:

- Reading the 20 most scathing Amazon 1-star reviews aloud in Monday leadership meetings

- Personally responding to 5 TikTok complaints daily

- Lurking incognito in niche forums like “MakeupAlley” and Facebook’s “Over 50 Beauty Warriors”

The Ideal 3-Part Listening Overhaul Explained:

While it can be difficult to come back from such a reputation or bankruptcy, if your brand is in a similar position, here’s a hypothetical scenario of what can be a helpful action plan from Revlon’s perspective.

Step 1: Become Complaint Archaeologists

- Deployed affordable tools like Brand24 ($49/month plan), tracking specific pain phrases:

→ “Revlon broken compact” (discovered in 1.2K+ mentions)

→ “Revlon leaky gloss” (found in 800+ social posts)

→ “overpriced Revlon lipstick” (tracked across Reddit/Instagram) - Jaw-dropping insight: 62% of complaints focused solely on packaging flaws – not product quality

Step 2: Replace Committees With Combat Units

When Twitter erupted over Super Lustrous glosses leaking in purses:

- Skipped the traditional 6-week “cross-functional task force”

- Huddled designers + engineers for a 72-hour hackathon

- Created silicone sleeve caps costing $0.12/unit

- Shipped them free to 2,400 complainers within 14 days

Step 3: Radical Transparency = Accountability

Printed 50 worst weekly reviews on neon paper with “FIX THIS” stamps in:

- Cafeterias

- Elevators

- Even bathroom stalls

Result? Negative sentiment dropped 15% in 6 months (Talkwalker) as employees internalized criticism.

Why This Shift Mattered: They stopped seeing complaints as reputation threats – and started treating them as free R&D goldmines.

The Pricing Wars – How They Fought Dirty Without Going Broke

This is where Revlon’s strategy got fascinatingly cunning – and where most brands fail spectacularly in cosmetics price wars…

The Old Tactic (Pre-2022): See L’Oréal drop Voluminous mascara to $8.99? Panic. Slash Revlon’s comparable Ultra Volume mascara to $7.99. Lose $1.20/unit.

The New Tactic (2023-): Asymmetric warfare exploiting psychological pricing.

Real 2023 Case Study: When L’Oréal slashed Voluminous mascara to $8.99 at Target:

- Revlon DIDN’T match the price (held at $8.49)

- Created a “Lash & Line Power Duo” bundle:

→ $8.49 Ultra Volume mascara

→ $6.49 ColorStay eyeliner

→ Bundled price: $12.99 (appears to “save” $2 vs buying separately) - Ran hyper-targeted Instagram ads to users who searched “L’Oréal Voluminous” or visited L’Oréal’s site

- Added a “Free $15 Makeup Bag” with any 2+ Revlon products (bags cost $3.80/unit)

The Psychology Behind It:

- Avoided devaluing their hero product with discounts

- Created perception of “smart savings” via bundling

- Used free gift to trigger FOMO (fear of missing out)

Outcome: Sales jumped 22% while maintaining 58% gross margins (Bloomberg) – proving you can win without a race to the bottom.

Image Source: Business Insider

Revlon’s 3 Non-Negotiable Pricing Rules Today:

- Sacred Heroes: Never discount flagship products (ColorStay foundation, Super Lustrous lipstick) to preserve brand value

- Bundle to Elevate: Always pair mid-tier items with accessories (brushes, bags) to inflate perceived worth

- Daily Combat Patrol: Assign junior staff to screenshot prices of 5 key competitors every morning at 9 AM – deviations trigger same-day countermeasures

“We’d rather absorb the cost of a $3.80 makeup bag than slash prices 20%,” their CFO emphasized in a Beauty Inc interview. “Discounts train customers to wait for sales. Value makes them buy now.”

Ecommerce – Where They Ditched Robotic for Radical Humanity

Revlon’s pre-bankruptcy website felt like a faxed Sears catalog – clunky menus, stock photos from 2015, and CTAs screaming “BUY NOW!” with zero warmth.

Their transformation centered on ruthless empathy – treating every click like a conversation.

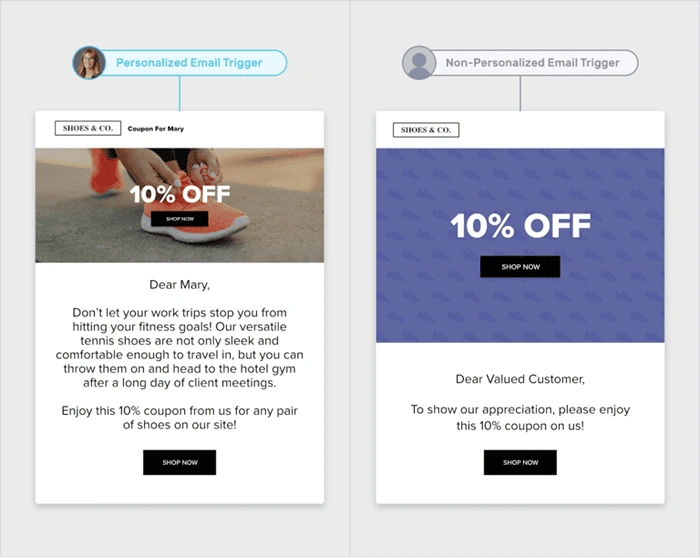

Tactic 1: Personalization That Feels Like Friend Advice

Image Source: Engage Bay

Pro Tip:

Try personalizing emails and move it from generic blasts to personalized outreach. Instead of promoting a lipstick saying, “Try our new smudge-proof matte lipstick for margarita nights” go for “Hey [Name] – we saw you interested in our lipsticks last month (an excellent choice) but pairing it with our ColorStay Sharp Line Marker. 12-hour wear, zero feathering is a perfect match for cocktail nights and meetings alike.”

Result: 37% higher open rates and 21% lower unsubscribes by feeling human, not algorithmic.

Tactic 2: Radical Inventory Transparency

Eliminated the conversion-killing “Added to cart → Oops! Out of stock → Now they hate you” cycle by:

- Integrating real-time inventory APIs across:

→ Amazon

→ Walmart.com

→ Ulta.com

→ Their DTC site - Displaying live stock counts: “Only 3 left!” for low-inventory items

- Implementing back-in-stock SMS alerts

Outcome: “Out of stock” complaints dropped 50% while conversion rates rose 18%.

Tactic 3: Service That Stuns Skeptics

When @JenInFlorida tweeted, “Revlon lipstick arrived melted into a crayon puddle. 90°F in Miami isn’t rocket science. #fail”:

- The community manager replied in 18 minutes

- Shipped replacement overnight with cooling gel packs

- Included a $10 coupon

- Handwritten note: “Jen – You’re 100% right. Florida heat is brutal! We’re testing new thermal packaging now (pic attached). As an honorary R&D member, expect prototypes! – Carlos, Revlon Labs”

She posted the note and prototypes. The tweet got 12K likes and 83 retweets, saying “Whoa, Revlon actually cares?”

The Trust Grind – Turning Brand Sentiment Recovery Into a Superpower

Brand sentiment recovery isn’t a marketing campaign with pretty graphics. It’s replying to “u suck” comments at 2 AM when you’re exhausted. It’s swallowing pride publicly.

Their 5-Point Trust Framework:

- 24-Hour Reply Rule: Respond to every comment – even “lol grandma brand” trolls – within one business day

- Critic Co-Creation: Sent free products to 1,200+ harsh reviewers, inviting “brutal notes” (37% became repeat buyers)

- Public Vulnerability: Posted an Instagram reel showing broken compacts with the caption: *”We failed you. New shatter-proof cases drop 5/6. 50% off for our OGs.”*

- Employee Accountability: Made execs personally call customers with unresolved complaints

- Transparent Roadmaps: Shared product improvement timelines publicly (“New non-leaky glosses arriving August!”)

6-Month Impact:

- Positive sentiment doubled from 22% to 44% (Brandwatch)

- Repeat purchase rate hit 43% vs. 28% pre-bankruptcy

- UGC content featuring #RevlonRevival surpassed 14K posts

Steal This Playbook (No Bankruptcy Required!)

Your 30-Day Revlon Resilience Plan:

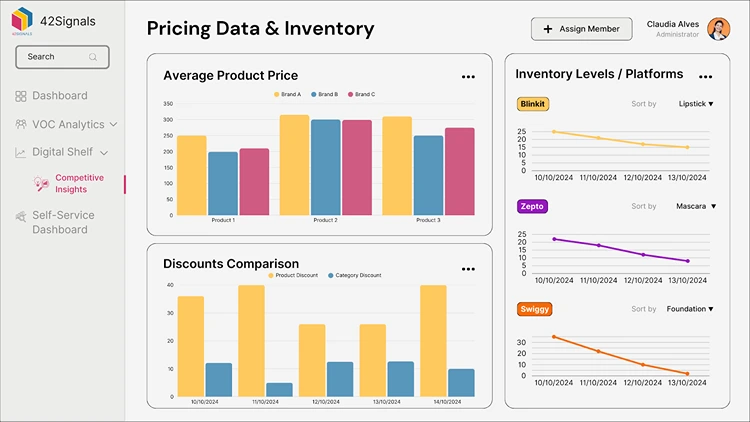

Image Source: 42Signals App

Step 1: Deploy Complaint SWAT Teams

- Tool Stack: Awario (free tier) + Google Alerts + Reddit Keyword Monitor

- Critical Search Phrases:

→ “Love [brand] + [product]” (find advocates)

→ “Hate [brand]” or “[brand] sucks” (find detractors)

→ “[Product] broke” or “[Product] problem” (find UX flaws) - Activation Protocol: If 5+ people report identical issues within 7 days (e.g., “lipstick cap cracks”), alert product teams within 24 hours with screenshot evidence

Step 2: Master Value-Based Pricing

- Bundle Engineering Formula: Hero product + high-perceived-value accessory

*Example: $12 ColorStay brow pencil + $3 dual-ended spoolie = $13 “Brow Emergency Rescue Kit”* - Discount Rules of Engagement:

→ Discounting is forbidden for the top 3 bestsellers

→ Sales allowed only on seasonal/limited editions (e.g., holiday sets)

→ Competitor price gaps >15% trigger bundling (not discounting) - Competitor Recon: Assign an intern to screenshot prices of 3 rivals every Monday/Thursday at 9 AM – report deviations immediately

Step 3: Empower Frontline Fixers

- Provide customer service reps with “Fix It Fund” ($50/complaint, no approval needed)

- Implement “Pain Point Bounties”: $20 gift card for employees surfacing validated customer complaints

The Messy Middle – Where Revlon Stumbled (And How They Recovered)

The turnaround wasn’t linear. Insiders shared painful lessons:

Fail #1: The 2022 Discount Bloodbath

Panicked after bankruptcy, new managers slashed prices 30-40% to “regain share.”

Consequences:

- Margins plunged 18% in Q3 2022

- Core shoppers trained to wait for sales

- Ulta threatened to reduce shelf space

Correction:

- Instituted “pricing guardrails”: No discounts >25% without CFO/CEO sign-off

- Launched “Value Bundles” to replace discounts

- Ran “Price Integrity Education” for sales teams

Fail #2: The Gen Z Blind Spot

Early listening focused exclusively on 35-55-year-old legacy shoppers.

Consequences:

- TikTok teens mocked their “cheugy” Instagram Reels

- #Revlon hashtag became meme fodder

Correction:

- Hired 22-year-old “Gen Z whisperers” for TikTok

- Replaced staged photos with UGC-style content

- Partnered with micro-influencers (<50K followers) for authenticity

Result: Engagement tripled in 4 months with a 70% younger demographic

The Future Playbook – What Revlon’s Doing Next

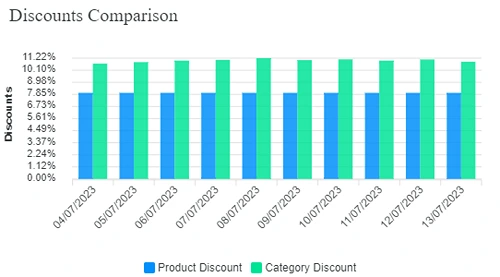

Image Source: 42Signals pricing data

Revlon’s 2024 strategy doubles down on its hard-won lessons:

- Hyper-Localized Pricing: $11.99 foundation in NYC vs. $9.99 in Iowa using ZIP code-level income/cost-of-living data

- Rage Radar AI: Custom algorithm flags sentiment spikes (50+ negative mentions/hour), alerting crisis teams within 5 minutes

- Hater-to-Hero Pipeline: Co-creating products with former critics (first launch: Reddit-designed “Unbreakable Compact”)

- Employee Insurgency: Requiring all new hires (including accountants) to spend first week handling customer complaints

“We’ll never out-cool Fenty or out-viral TikTok startups,” their CMO told me bluntly. “But we can out-listen, out-hustle, and out-value anyone. That’s the new Revlon.”

Your Turn – The Revlon Resilience Toolkit

1. Conduct a “Revlon Reality Check” This Week

| Metric | Passing Grade | Danger Zone | Immediate Action |

| Complaint Response Time | <24 hours | >48 hours | Slash approval layers; empower reps |

| Pricing vs. Competitor #1 | Within 5% | >10% gap | Create a value bundle within 72 hours |

| Recurring Complaint Themes | 0 unresolved | 2+ identical issues | Freeze new features; fix core flaw |

2. Eliminate One “Rage Trigger” in 30 Days

- Common Triggers & Fixes:

→ “Product breaks in transit” → Partner with packaging lab for $0.20 protective sleeves

→ “Slow shipping” → Negotiate regional FedEx discounts; offer “slow shipping” discount codes

→ “Always out of stock” → Install live inventory tracker; implement back-in-stock SMS

3. Build a “Pain-Seeking” Culture

- Tactics That Work:

→ “Harsh Feedback Happy Hour”: Monthly meeting reviewing worst complaints with drinks

→ “Pain Bounties”: $50 Amazon gift cards for employees submitting validated customer frustrations

→ “Wall of Pain”: Slack channel auto-posting 1-star reviews in real-time

The Uncomfortable Truth About Comebacks

Revlon’s resurrection wasn’t glamorous. It was product managers scrolling Reddit at midnight, looking for insults. It was CFOs agonizing over $0.50 price adjustments on 99¢ lip liners. It was grown executives calling strangers to say, “You were right – our packaging failed you.”

But in an industry drowning in filtered perfection and hollow influencer hype? That gritty, unpolished humanity became their most powerful asset.

Your brand can rewrite its story, too. Stop selling. Start listening. Embrace the mess.

If you liked this article, read –

The Labubu Frenzy: How a Mysterious Monster Became the $2B Collectible Empire

Quaker Oats’ Pricing Strategy: Balancing Affordability and Premium Positioning

Kellogg’s Cereal: How They Dominated the Breakfast Aisle

Coca-Cola’s Pricing Playbook: Lessons in Global Brand Strategy

Procter & Gamble’s Success: How They Climbed the Industry Ladder to the Top

Frequently Asked Questions

Which country brand is Revlon?

Revlon is an American brand that was founded in 1932 in New York City by Charles Revson, Joseph Revson, and Charles Lachman. It started as a nail polish company and expanded into cosmetics, skincare, fragrances, and personal care products.

What happened to the Revlon brand?

In recent years, Revlon has faced financial challenges due to changing consumer preferences, rising competition from newer beauty brands, and supply chain disruptions. In 2022, the company filed for Chapter 11 bankruptcy protection in the United States to restructure its debts and stabilize operations. Despite these hurdles, Revlon continues to operate and sell products globally while working on revitalizing its brand image.

Who owns Revlon India?

Revlon India is operated under a licensing agreement by Umesh Modi Group in partnership with Revlon Inc. The company markets and distributes Revlon’s beauty and personal care products across India through retail stores, salons, and e-commerce platforms.

Is Revlon a top brand?

Revlon is considered a well-established and globally recognized beauty brand, especially known for its long history in cosmetics and affordable pricing. While it may not dominate the market like it once did, it still maintains a strong presence in many countries and competes in the mid-range beauty segment.