Table of Contents

ToggleRemember scrolling through grainy product photos back in 2010, crossing your fingers that the shirt wouldn’t fit like a potato sack? Feels like ancient history, doesn’t it? Fast forward to July 2025, and US ecommerce isn’t just part of retail – it is retail for millions of us. It’s wild how natural it feels to order groceries while waiting for your kid’s soccer practice to end, or to spec out industrial valves at 2 AM because that’s when inspiration strikes.

We’re diving into what’s cranking the engine (hint: it’s not just faster delivery) and how staying this way affects how all of us buy and sell stuff.

1. Why Your Phone Becomes Your Wallet: The Unstoppable Surge of US Ecommerce Online Shopping

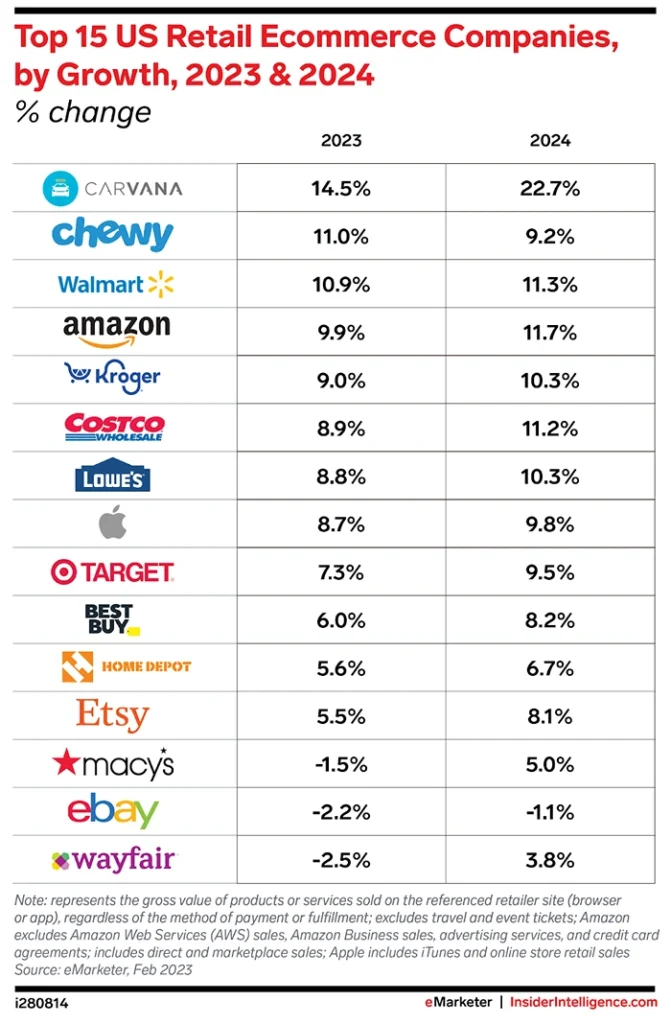

Image Source: EMarketer

Let’s get real: convenience stopped being a “nice perk” around 2023. Today? If you can’t get it now, we swipe left. I mean, McKinsey dropped a stat last year: 73% of shoppers dump their cart if delivery feels slow. That’s not pickiness – that’s our rewired brains screaming, “Why wait?”

But here’s what’s really happening:

- Your Phone Isn’t Just a Screen – It’s the Cash Register. Over 60% of US ecommerce sales happen on these little rectangles in our pockets. Why? Because buying a lawnmower during your commute feels… normal now. Apps don’t just work – they anticipate. Ever notice how your coffee brand “magically” pops up right before you run out? Yeah, that’s not magic. That’s ecommerce data getting creepily useful.

- “Just Looking” Is Dead. Now It’s “Just For You.” Those generic “Customers also bought…” suggestions? They feel as dated as dial-up. Today’s algorithms watch everything. Browsed hiking boots last Tuesday? By Friday, your feed’s showing moisture-wicking socks, trail maps for your zip code, and energy bars with your name on it (almost literally). It’s less “shopping,” more having a pushy-but-helpful personal shopper in your browser.

- Blurrier Lines Than a Wet Watercolor: The Hybrid Hustle. This one’s my favorite shift. “Online OR offline”? Nah. It’s “YES AND.” Think about buying a couch online after seeing it in-store via AR. Or grabbing curbside pickup because parking’s a nightmare. Or joining a live video demo for a $10k CNC machine while eating cereal. These hybrid sales models aren’t trends – they’re survival tactics. Retailers clinging to one channel? They’re the modern-day Blockbuster.

The “Why Now?” Factor:

Honestly, the pandemic didn’t create this – it hit fast-forward. Remember when grandma learned Zoom? Suddenly, she was also buying vitamins online. That behavioral shift stuck. Now, combine that with Gen Z entering peak spending years *never knowing a world without 1-click buying*. They’re not impressed by “online stores” – they expect digital experiences as intuitive as breathing. And businesses? They’ve finally cracked the code on making complex tech feel simple. Payment gateways don’t fail half the time. Sites don’t crash on Black Friday (mostly). That reliability builds trust – and trust builds carts.

2. B2B’s Digital Makeover: Ditching Faxes & Sales Reps for Self-Service Swagger

The $3 Trillion Silent Boom (Yeah, Trillion.)

Okay, lean in. This might surprise you: While we’re all obsessing over TikTok hauls, B2B ecommerce growth is quietly eating the world. Forrester predicts it’ll hit $3 TRILLION stateside by 2026. Why? Because business buyers are tired of playing phone tag. They want the Amazon experience – even when buying pallets of safety goggles.

Here’s the vibe shift:

- “Just Give Me the Login, Brenda.” Modern procurement teams won’t tolerate clunky PDF catalogs or “Call for Pricing” tags. They want 24/7 portals where they can compare specs, see bulk discounts instantly, check live inventory, and click BUY. No small talk. No waiting. Digital Commerce 360 found 68% of B2B buyers prefer clicking over calling.

- Beyond Buying: When Tech Fixes Broken Supply Chains. This isn’t just about easier orders. Real unified commerce adoption means a factory manager can start a purchase on their desktop, check certifications on their tablet at lunch, and approve payment via phone on the warehouse floor – all synced in real-time. Imagine tracking a $50k compressor like your Domino’s pizza.

Image Source: App 0

The Human Angle: Why Sales Reps Are Evolving:

Don’t think this kills the sales role. It changes it. Reps become consultants, not order-takers. When complex deals need negotiation or custom configurations, that human touch is golden. But for reordering standard M12 bolts? The portal wins every time.

Sarah, a procurement manager at a mid-sized manufacturer: “Before their portal launch, ordering from Supplier X meant 3 emails and a call. Now? I log in, see my contract pricing, check stock, and click. Saved me 4 hours last week.” That’s real productivity – the kind that keeps CFOs smiling.

3. Pricing Wars: How Data Keeps You From Going Broke (Mostly)

Slashing Prices ≠ Winning

Raise your hand if inflation’s made your budget spreadsheet look scary. Yeah, thought so. In this climate, US ecommerce pricing feels like high-stakes poker. Drop prices too much? Margins evaporate. Hold firm? Shoppers bounce to the guy down the digital street.

How the winners play it:

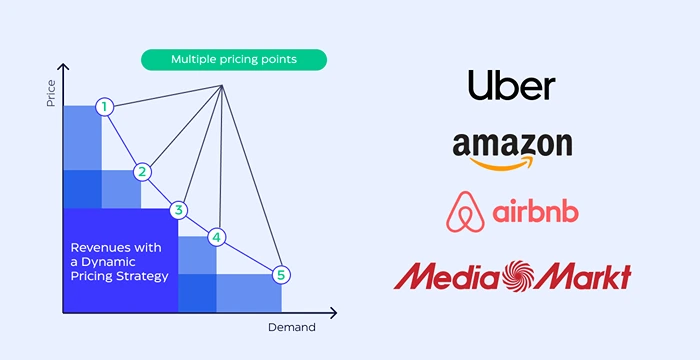

- Your New Secret Weapon: The Pricing Algorithm. Forget guessing. Tools now scan rival prices, your stock levels, demand spikes (like heatwaves boosting AC sales), and global shipping costs – then tweak prices automatically.

Picture this: Competitor drops drill prices by 8% at 10 AM. By 10:03 AM, your AI counters with a 7% discount + free bits. That’s not cheating. That’s ecommerce analytics keeping you alive.

- The Loyalty Tightrope: Discounts That Don’t Destroy Value. Here’s the trap: Deep cuts attract deal-hoppers who’ll leave tomorrow. Smart retailers use ecommerce data surgically. Which promotions build long-term fans? Which just trains customers to wait for sales? Target nailed this – their 2024 earnings call credited smart, data-driven pricing for a 9% profit jump. Proof that brains beat panic.

The Dark Side of Dynamic Pricing:

It’s not all sunshine. Ever feel like the flight price just jumped because you refreshed? Consumers are getting savvy (and suspicious). Over-reliance on algorithms can backfire big time if it feels predatory.

Image Source: Symson

Remember the viral horror story about the $50 bottle of water during a hurricane? Yeah. Don’t be that guy. Transparency matters. The best tools factor in fairness and brand perception, not just pure profit maximization. One outdoor gear brand I follow actually explains small price bumps due to sustainable material costs – and customers respect it.

4. Unified US ECommerce: Why Your Customer Hates Silos

Confession time: How often have you rage-quit a site because your cart vanished between devices? Or did you have to re-enter your card again? That frustration? It’s lethal. Unified commerce adoption fixes this. Simply put: Make every touchpoint feel like one smooth conversation.

Why it’s non-negotiable:

- The Nike & Sephora Playbook: Be Everywhere, Effortlessly. These giants crush it. Start a cart on the app? Finish on your laptop – no restarting. Buy online, return in-store without 20 questions. Loyalty points work identically everywhere. This isn’t just slick tech – it builds trust.

- Hybrid Models LIVE on Unity. True hybrid sales models implode without unified systems. If online stock says “In Stock,” but the store is clueless? Disaster. If curbside pickup takes 45 minutes because systems don’t talk? Reputation wrecked. In 2025, disconnected tech isn’t inefficient – it’s brand suicide.

The Inventory Accuracy Nightmare (and How to Fix It):

This is where rubber meets road. Unified commerce demands real-time, accurate inventory across every channel. That warehouse system from 2018? It won’t cut it. Modern platforms use RFID tags, IoT sensors on shelves, and cloud syncing measured in milliseconds. I saw a demo where a store associate’s handheld device updated online stock levels as she walked an item to the pickup counter. That’s the level of precision needed to prevent “Sorry, it’s actually out of stock” emails that murder customer loyalty.

5. Analytics: Grab the Spreadsheet

Remember when bosses bragged about “decades of instinct”? Today, that’s like navigating I-95 blindfolded. Ecommerce analytics are your headlights, GPS, and roadside assistance rolled into one.

How this changed everything:

- Beyond “What Sold?” to “Why Did Karen Bail?” Modern tools don’t just tally sales. They show why people leave. Heatmaps reveal where shoppers zone out on your product page. Funnel reports scream, “Hey, genius! 40% of 25-34-year-olds ditch checkout at Step 2! Fix that dang address field!” It’s like customer therapy via dashboard.

- Predict or Perish: The New Retail Mantra. Predictive analytics spot patterns humans miss. See that yoga pants surge every January? Stock up mid-December. Supplier delayed? Shift promotions before customers notice. Adobe’s 2025 report found brands leaning hard on analytics grew revenue 2.5x faster than the “winging it” crowd. Data isn’t power – it’s profit.

A Day in the Life of a US Ecommerce Manager (Armed with Data):

Meet Alex (not her real name), who runs online ops for a home goods brand. Her morning doesn’t start with coffee – it starts with her analytics dashboard:

- 8:00 AM: Sees a 15% spike in abandoned carts for ceramic planters. Drill-down shows 90% failed on the shipping calculator. Action: Tests free shipping threshold for planters.

- 10:30 AM: Predictive alert flags potential stockout of best-selling throw blanket in 72 hrs based on sales velocity + weather forecast (cold snap coming). Action: Expedites restock and pushes blanket bundles.

- 2:00 PM: Ecommerce data shows TikTok drove 3x more high-value customers than Instagram last week. Action: Shifts ad spend.

“Five years ago, this was guesswork,” she tells me. “Now? It’s chess, not checkers.”

6. The Grit Under the Gloss: Returns, Scams, & Eco-Anxiety

Growth Isn’t Always Pretty. Let’s not sugarcoat it. This boom has thorns:

Image Source: Statista

- The Returns Nightmare: Online return rates hover around 30% (Narvar, 2024) vs. 9% in-store. Why? Sizing guesswork, “meh” fabric quality in photos, impulse buys. Solutions? Virtual try-ons, user-generated video reviews, AR previews – anything to bridge the “touch gap.” The Cost of Getting It Wrong: For some apparel brands, returns eat 15-20% of revenue. Ouch.

- Fraud’s Tech Arms Race: Sneaker bots snatch limited drops in milliseconds. Phishing scams get slicker. Defense? Biometric logins, AI spotting suspicious clicks (e.g., mouse movements too fast/robotic), and blockchain verification. It’s cyber warfare for your checkout page. The New Frontier: “Friendly fraud” – where legit customers falsely dispute charges – is rising fast. Fighting it needs better documentation and customer service.

- The Green Ultimatum: Gen Z doesn’t just want fast delivery – they want it carbon-neutral. Brands like Patagonia now show emissions saved per product. Fail this? Lose a generation. Beyond Packaging: It’s creeping into sourcing. Apps like Good On You rate brands’ ethical practices. A bad score = viral backlash.

7. Tomorrow’s Cart: Voice Shopping, Mood-Based Ads & Robot Negotiators

Where’s this headed? Buckle up:

- “Alexa, Buy My Life”: Voice shopping evolves past novelty in US ecommerce. Soon: “Reorder dog food, find the cheapest organic brand, use my coupon, deliver Saturday.” The AI handles the legwork. The Catch: Privacy concerns are HUGE. Opt-in transparency will be critical.

- “We Knew You’d Want This…”: Hyper-personalization gets… intense. Sites will curate based on your Spotify playlists (“Hard rock morning? Here’s edgy jackets”), local weather (“Rain predicted? Waterproof boots 30% off”), or even stress levels detected via wearable data (opt-in, hopefully!). The Creep Factor: Brands walking the line between helpful and invasive will need serious finesse.

- B2B’s Blockchain Bonanza: Smart contracts automate procurement. What took days (POs, approvals, invoices) happens in minutes via secure, unchangeable digital ledgers. Real Impact: Imagine automatic payment releases when a shipment’s GPS confirms delivery. Fewer arguments, faster cash flow.

Wrapping Up: It’s Not About Tech – It’s About Trust

US ecommerce in 2025 feels less like shopping and more like a high-speed relationship. Winners get this: It’s not about the fanciest AI or fastest delivery. It’s about using unified commerce adoption to erase friction (“Why is this so hard?”), leveraging ecommerce analytics to make customers feel understood (“They get me!”), and embracing hybrid sales models to be wherever they need you – be it Instagram DMs, a physical kiosk, or a VR showroom.

For B2B? Digital transformation isn’t optional. It’s table stakes. The companies thriving are those giving procurement teams the self-service ease they crave while freeing sales reps to tackle complex, high-value relationships.

The Real Magic Ingredient? Clean, actionable ecommerce data. It’s the fuel for smarter pricing, sharper personalization, efficient fulfillment, and genuine sustainability efforts. Without it, you’re flying blind in a hurricane.

Final Thought on US ECommerce

The most successful brands won’t just use technology. They’ll use it to amplify humanity. They’ll turn data into delight. They’ll remember that behind every click, every cart, every B2B bulk order, is a person wanting something solved, something enjoyed, something easier.

If you liked this article, read –

Why Your Search Rankings Tool Needs to Integrate with Pricing & Inventory Analytics

How to Set Up and Leverage a Competitor Price Engine for Maximum Profit Margins with 42Signals

ECommerce Analytics for Accurate Competitor Price Tracking with a Product Matching Software

How Detailed Makeup Product Insights Helped Capture 20% Market Share in India

Frequently Asked Questions

What is U.S. e-commerce?

U.S. e-commerce refers to the buying and selling of goods or services over the internet within or from the United States. It includes online retail stores, digital marketplaces, direct-to-consumer websites, and business-to-business platforms. E-commerce in the U.S. spans a wide range of industries, from fashion and electronics to groceries and digital services.

The U.S. is one of the most developed and competitive e-commerce markets in the world, driven by advanced logistics, widespread internet access, mobile commerce, and a strong culture of online shopping.

Which e-commerce is best in the USA?

Amazon is widely considered the best and most dominant e-commerce platform in the United States. It offers unmatched product variety, fast shipping through Prime, competitive pricing, and a strong reputation for customer service.

Other top e-commerce platforms in the U.S. include:

Shopify – Powers thousands of independent U.S. online stores and is a go-to for small and mid-sized businesses.

Walmart.com – Strong in both online and in-store integration (omnichannel retail).

eBay – Popular for auctions, second-hand goods, and collectibles.

Target.com – Known for a user-friendly interface and strong product categories like home goods and apparel.

How big is e-commerce in the U.S.?

As of recent estimates, U.S. e-commerce sales exceed $1 trillion annually, accounting for over 15% of total retail sales. The market has grown rapidly over the last decade, especially after the pandemic, which accelerated consumer adoption of online shopping.

This growth is supported by rising smartphone use, improved delivery services, and innovations in digital payments and AI-driven personalization. The U.S. continues to be one of the largest e-commerce markets globally, second only to China.

What is the largest e-commerce company in the U.S.?

The largest e-commerce company in the U.S. is Amazon. It dominates the market with a significant share of online sales—estimated at over 35–40% of total U.S. e-commerce transactions.

Amazon’s success is driven by its vast product selection, Prime membership benefits, fulfillment network, and strong digital infrastructure. It has also expanded into streaming, cloud services (AWS), and smart devices, reinforcing its influence beyond traditional retail.