Table of Contents

ToggleIn the crowded world of skincare, few brands have managed to carve out a loyal following as effectively as CeraVe. What began as a dermatologist-recommended brand in 2005 has since exploded into a household name, dominating Amazon’s skincare charts with staples like its CeraVe face wash, CeraVe moisturizer, and CeraVe cleanser. But how did this once-niche brand rise to such prominence?

Image Source: New Beauty

The answer lies in a mix of science-backed formulations, strategic partnerships, and an uncanny ability to leverage customer feedback analytics to refine its offerings.

Let’s unpack the key factors behind CeraVe’s Amazon success and explore the skincare brand insights that set it apart.

CeraVe Brand Origin and Foundational Philosophy

CeraVe was founded in 2005 by a team of dermatologists who identified a gap in the market for effective, accessible skincare that supports the skin’s natural barrier. The name itself is a portmanteau of “ceramide” and “MVE” (Multivesicular Emulsion), highlighting the core technology of its first product. This delivery system was designed to release key ingredients like ceramides, hyaluronic acid, and niacinamide over time, providing lasting hydration and repair.

The brand is owned by L’Oréal, which acquired it in 2017. This partnership provided CeraVe with the resources for global expansion and increased R&D investment, while L’Oréal has maintained the brand’s dermatologist-driven, no-frills identity. This origin story of scientific collaboration over marketing hype established the trust that remains its cornerstone.

Clinical Credibility and the “Dermatologist-Recommended” Edge

CeraVe’s authority stems from its foundational collaboration with dermatologists, not as mere endorsers but as co-creators. This strategy embedded the brand directly into clinical practice and patient recommendations long before it became a social media staple. Products like the Hydrating Facial Cleanser and Moisturizing Cream are frequently cited by professionals for conditions like eczema, psoriasis, and retinoid-induced irritation due to their non-comedogenic, fragrance-free formulas that restore the skin barrier.

The brand’s commitment to “ecobiology”—supporting the skin’s natural ecosystem—is evidenced by its focus on essential ceramides in a 3:1:1 ratio to mimic the skin’s natural composition. This clinical proof of effectiveness, validated by both professional recommendation and published studies, creates a powerful justification for its price point and defends against the threat of new entrants who lack this scientific pedigree.

The Science-Backed Foundation of CeraVe: Trust in Formulation

CeraVe’s origin story is rooted in collaboration with dermatologists, a detail that became its golden ticket to credibility. Unlike brands that rely on trends or flashy marketing, CeraVe prioritized ingredient transparency and efficacy from the start.

Image Source: Byrdie

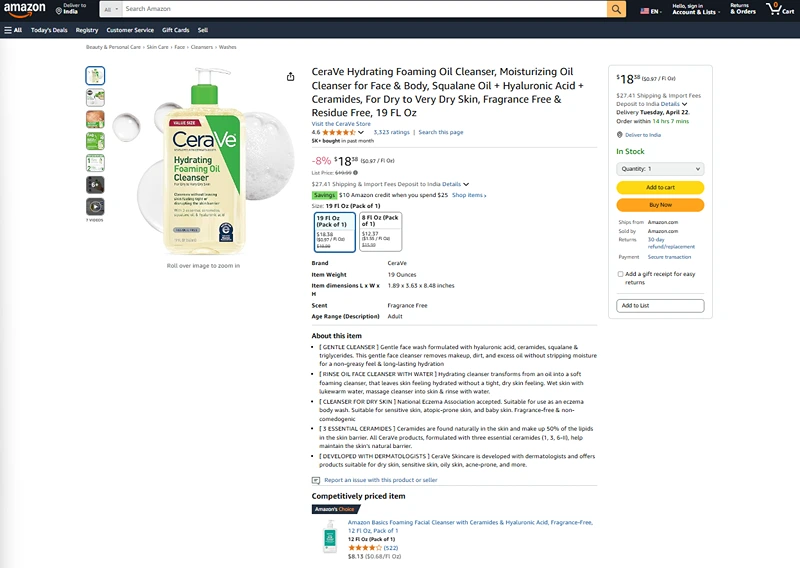

Its signature blends of ceramides, hyaluronic acid, and fatty acids were designed to mimic the skin’s natural barrier, making products like the CeraVe Hydrating Facial Cleanser and CeraVe Daily Moisturizing Lotion instant hits among those with sensitive or dry skin.

The brand’s focus on gentle yet effective formulas resonated with consumers tired of harsh, overpriced alternatives. For example, the CeraVe Foaming Facial Cleanser became a go-to for acne-prone users seeking a non-stripping wash, while the CeraVe Moisturizing Cream (often dubbed the “blue tub”) gained cult status for its ability to soothe eczema and psoriasis.

By addressing universal skincare concerns without compromising on safety, CeraVe positioned itself as a trustworthy authority—a reputation that translated seamlessly to Amazon’s review-driven platform.

Pricing Strategy: Value-Based Positioning in the “Masstige” Market

CeraVe operates in the “masstige” (mass-prestige) segment, positioned above traditional drugstore brands but below luxury dermatological lines. Its pricing strategy directly aligns with its brand image of accessible, professional-grade science.

- Justifying the Premium: The price reflects the cost of patented MVE technology, high concentrations of key actives (like ceramides), clinical testing, and fragrance-free, sensitive-skin-safe formulation. For consumers, the value proposition is clear: pharmacy accessibility with dermatology-grade ingredients.

- Competitive Pricing Analysis: When evaluating “which facial moisturizer brands’ pricing best aligns with their brand image,” CeraVe serves as a benchmark. It is priced higher than basic moisturizers (e.g., Pond’s) due to its advanced formulation, yet significantly lower than clinical luxury brands (e.g., SkinCeuticals). This careful positioning makes it a perceived “smart buy” for efficacy-seeking consumers.

Affordability Meets Accessibility

While clinical efficacy was crucial, CeraVe’s affordability played an equally important role in its ascent. In an industry where luxury brands charge upwards of 50 dollars for a moisturizer, CeraVe’s products rarely exceed 20 dollars.

Image Source: Walgreens

This price point made it accessible to a broad audience, from teenagers managing acne to adults combating aging or dryness.

Amazon’s marketplace amplified this advantage. The platform’s competitive pricing, subscription options, and fast shipping turned CeraVe into a convenient, budget-friendly staple. A quick search for “best drugstore moisturizer” or “gentle face wash” often leads shoppers to CeraVe’s Amazon listings, where thousands of positive reviews reinforce its value proposition.

The Power of Dermatologist Partnerships and Social Proof

CeraVe’s early investment in dermatologist endorsements paid dividends long before social media influencers entered the picture. By partnering with skincare professionals, the brand embedded itself in clinical settings, earning trust before it became a TikTok favorite.

When dermatologists began recommending the CeraVe Renewing SA Cleanser for keratosis pilaris or the CeraVe PM Facial Moisturizing Lotion for nighttime repair, consumers listened.

This groundwork laid the foundation for CeraVe’s viral moments. During the 2020 skincare boom, influencers and Reddit forums like r/SkincareAddiction hailed the brand as a “holy grail,” praising its simplicity.

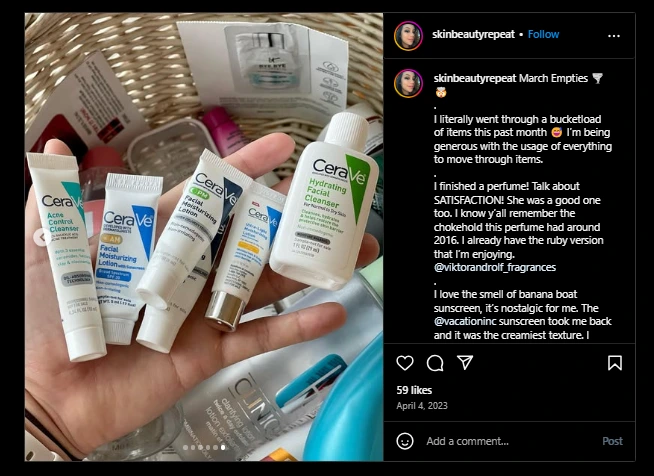

Image Source: Instagram User

User-generated content showcasing empty tubs of moisturizer or shelfies filled with CeraVe products flooded social media, creating organic buzz. Amazon’s algorithm, which prioritizes high-rated, frequently purchased items, quickly pushed CeraVe to the top of search results.

A Customer-Centric Model: Listening and Adapting

CeraVe exemplifies this through a data-driven, iterative approach.

- Feedback Loops: The brand actively monitors customer feedback analytics and review sentiment across Amazon, retailer sites, and social platforms. This isn’t just for reputation management; it directly informs R&D.

- From Feedback to Formulation: For example, recurring requests for a lighter moisturizer for oily skin contributed to the development of the Ultra-Light Moisturizing Lotion. Similarly, consumer desire for more targeted treatments led to lines like CeraVe Acne with benzoyl peroxide and salicylic acid, and the Skin Renewing range with retinol. This consistent adaptation demonstrates a brand that “acts on customer feedback,” building intense loyalty and high retention rates.

Competitive Positioning in the US Market

CeraVe’s success lies in carving a distinct, defensible niche. The table below illustrates how it differentiates itself from key competitors in the US facial moisturizer and cleanser market:

| Brand | Price Segment | Key Brand Image & Positioning | Primary Customer Base |

|---|---|---|---|

| CeraVe | Mass-Prestige ($$) | Dermatologist-developed, science-backed, barrier-restoring. Accessible clinical skincare. | Efficacy-focused, sensitive skin, routine builders, dermatology patients. |

| Cetaphil | Mass-Prestige ($$) | Gentle, classic, no-frills. Trusted basic care for sensitive skin. | Those seeking simple, reliable, and gentle staple products. |

| Neutrogena | Mass ($-$$) | Innovative, fast-acting, solution-oriented. Wide range for various concerns (acne, aging). | Problem-solvers, trend-aware shoppers, younger demographics. |

| La Roche-Posay | Prestige ($$$) | Pharmaceutical elegance, thermal water therapy. Prescriptive skincare for sensitive and intolerant skin. | Consumers seeking European pharmacy luxury and high-tolerance formulations. |

| The Ordinary | Mass ($) | Radical transparency, ingredient-focused, disruptor. “Skincare as chemistry.” | Ingredient-savvy, cost-conscious enthusiasts who enjoy customizing routines. |

Mastering Amazon’s Ecosystem

CeraVe’s success on Amazon wasn’t accidental—it was strategic. The brand optimized its product listings with keywords like “fragrance-free,” “non-comedogenic,” and “dermatologist-developed” to align with common skincare searches. Detailed descriptions highlighting clinical benefits (e.g., “restores the skin barrier”) catered to informed shoppers, while bundled deals (think: cleanser + moisturizer sets) encouraged trial.

But the real game-changer was CeraVe’s use of customer feedback analytics. By closely monitoring reviews and ratings, the brand identified pain points and opportunities. For instance, recurring praise for the CeraVe Hydrating Cleanser’s gentle formula reinforced its positioning, while complaints about packaging led to incremental improvements.

Amazon’s Q&A feature also allowed CeraVe to address concerns in real time, fostering transparency.

Sentiment Score Analysis: Helping CeraVe Decode What Customers Really Want

One of CeraVe’s lesser-known strengths is its reliance on sentiment score analysis to gauge consumer emotions. Tools that parse through reviews, ratings, and social mentions helped the brand quantify satisfaction levels.

For example, sentiment analysis might reveal that users of the CeraVe SA Smoothing Cream love its exfoliating properties but wish it absorbed faster. These insights guide everything from reformulations to marketing messaging.

This data-driven approach also informed product launches. When the CeraVe Acne Foaming Cream Cleanser debuted in 2022, its formulation—featuring 4% benzoyl peroxide—directly responded to demand for an effective yet non-drying acne treatment. By aligning launches with gaps highlighted in customer feedback analytics, CeraVe stayed ahead of competitors.

Adapting to Trends Without Losing Core Identity

While CeraVe thrives on consistency, it hasn’t shied away from evolution. The brand expanded its lineup to include sunscreens, serums, and even a baby line, all while maintaining its core principles. Limited-edition collaborations, like a 2023 tie-in with the National Eczema Association, kept the brand relevant without diluting its medical ethos.

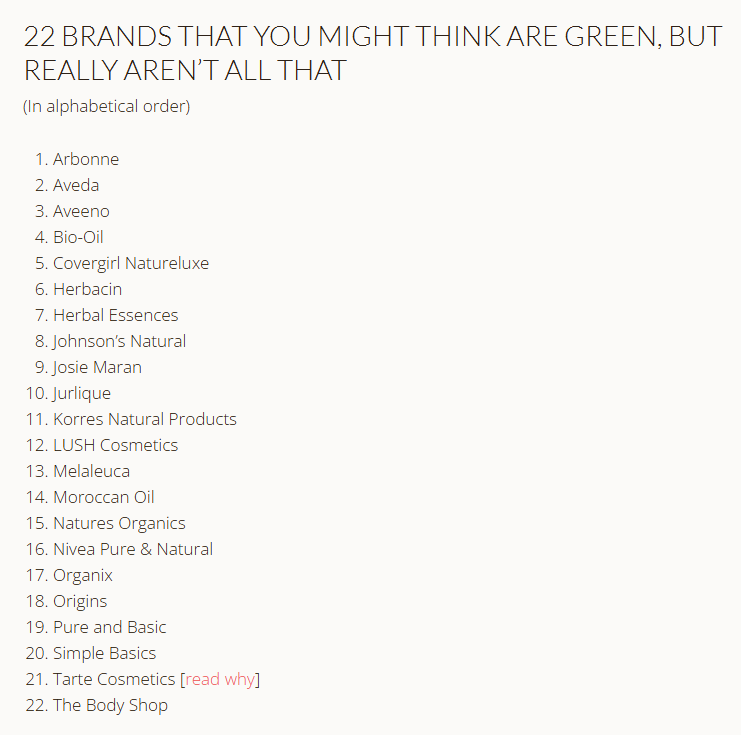

Image Source: Kristenarnett

Crucially, CeraVe avoided the “greenwashing” trap that ensnared many clean beauty brands. Instead of chasing fleeting trends, it doubled down on proven ingredients, emphasizing its commitment to “skin health” over “skin perfection.” This authenticity resonated with Amazon shoppers, who increasingly prioritize substance over hype.

The Future of CeraVe: Staying on Top

CeraVe’s journey from pharmacy shelves to Amazon’s bestseller list offers key insights for aspiring disruptors. Its formula—credibility, affordability, and agility—is deceptively simple but challenging to replicate.

As the brand continues to innovate (think: eco-friendly packaging or personalized skincare tech), its ability to listen to customers through sentiment score analysis and customer feedback analytics will remain vital.

For now, CeraVe’s dominance shows no signs of waning. With millions relying on its face washes, moisturizers, and cleansers daily, the brand has cemented itself as a skincare staple—one Amazon review at a time.

If you liked this article, read –

The Owala Insulated Tumbler Trend: How This Home Goods Star Is Challenging the Stanley Cup’s Reign

Stanley’s E-commerce Takeover: Everything There is to Learn from the Mega Viral Stanley Cup

Tru Fru’s Frozen Fruit Success: How Data Analytics Fueled Their Growth

NotCo’s Vegan Revolution: How Data-Driven Strategies Are Disrupting the Food Industry

Costco’s Success Secrets: What Retailers Can Learn from the Membership Giant

Frequently Asked Questions on CeraVe

When and where was CeraVe founded?

CeraVe was founded in the United States in 2005. It was created by dermatologists to develop effective, accessible skincare centered on ceramide and MVE technology to repair the skin’s barrier.

Who owns CeraVe now?

CeraVe is owned by the global beauty conglomerate L’Oréal, which acquired the brand in 2017. L’Oréal has scaled its international distribution while maintaining its dermatologist-led product development.

Is CeraVe considered expensive?

CeraVe is positioned in the “mass-prestige” segment. It is more expensive than basic drugstore moisturizers due to its patented technology and clinical ingredients, but it is significantly more affordable than luxury dermatologist brands. Most consumers and experts consider its price justified by its proven effectiveness and formulation quality.

What makes CeraVe different from other dermatologist-recommended brands like Cetaphil?

While both are dermatologist-recommended, CeraVe’s key differentiator is its use of essential ceramides and Multivesicular Emulsion (MVE) technology designed to restore the skin barrier. Cetaphil traditionally focuses on gentle, non-irritating cleansing and moisturizing. CeraVe markets itself more actively on specific skin repair and maintaining a healthy skin barrier.

How does CeraVe compare to other dermatologist-recommended brands like Cetaphil or La Roche-Posay?

While all three are trusted by dermatologists, their approaches differ. CeraVe’s hallmark is its MultiVesicular Emulsion (MVE) technology and focus on restoring the skin barrier with three essential ceramides. Cetaphil is known for its ultra-gentle, no-frills formulas, often recommended for the most reactive skin. La Roche-Posay, also owned by L’Oréal, frequently features its soothing thermal spring water and often targets specific, more sensitive conditions. CeraVe strikes a balance as an accessible, science-driven brand focused on barrier health.

Is CeraVe considered a “clean” or “natural” beauty brand?

No, CeraVe does not market itself as a “clean” or “natural” brand. Its philosophy is “skin health science” over ingredient sourcing trends. It prioritizes clinically proven, effective ingredients (like ceramides, hyaluronic acid, niacinamide) and stable formulations over claims of being natural or organic. It avoids fragrance and common irritants, aligning with a “gentle” and “sensitive skin-safe” positioning rather than a “clean beauty” one.