Table of Contents

Toggle** TL;DR ** Manual price checks are a losing game in today’s fast-paced market, where competitors and algorithms change prices thousands of times a day. True competitive price tracking mastery means using a dedicated dashboard to see the whole picture—not just prices, but also inventory levels, promo bundles, shipping speeds, and search rankings—so you can protect your margins, react intelligently to market shifts instead of panicking, and compete on value rather than just engaging in a race to the bottom.

Hey there. Let’s talk about something that keeps most business owners up at night: watching sales suddenly drop and having absolutely no idea why. The answer, almost always, is happening on someone else’s screen. A competitor made a move, and you didn’t see it coming. In essence, that’s the need for competitive price tracking.

I want to tell you about a client we had. We’ll call them “Alpha Electronics.” For years, they had been a respected name in the audio space, and their flagship wireless headphones were a genuine hit. For months, sales were strong and predictable. Then, out of the blue, they fell off a cliff. A fifteen percent drop in one week. Their first thought was that Amazon had broken their listing. Maybe an algorithm change? They checked everything—their backend, their ad spend, their inventory. Nothing was wrong.

Image Source: Priceva

After a seriously stressful week, one of their junior employees stumbled onto the real problem almost by accident. By pure luck, she found a new competitor while doing a casual Google search. This company had launched a nearly identical product—same features, similar design—and had been selling it for twenty percent less. And they’d been doing it for almost two weeks. Alpha Electronics had been bleeding customers and didn’t have a clue. All that revenue, just gone, because they were flying blind.

Not having competitive price tracking is the difference between being proactive and being profoundly reactive. It’s the gap between knowing your market and just hoping you understand it. Learn how to stop guessing and start knowing.

Get your free competitive price tracking report by 42Signals

Your Spreadsheet is Not Accurate like a Competitve Price Tracking Software

I get it. The old way makes sense on paper. It feels responsible. You calculate your costs, add a margin you can live with, and then maybe once a month, you or an intern spends an afternoon clicking through competitor websites, jotting down prices in a Google Sheet. You feel like you’re on top of things. You’ve done your “competitor analysis.”

But here’s the brutal truth: that spreadsheet is a historical document the second you finish it. It’s a snapshot of a single moment in time that is instantly outdated. The digital market moves at a pace humans simply can’t match. Think about your own business. You have dozens, maybe hundreds of products. Each one of those products might have a dozen different competitors selling across Amazon, Walmart, eBay, and their own direct-to-consumer websites.

Your brand is competing with big sellers and savvy brands use automated repricing software that changes prices thousands of times a day based on predefined rules. Your monthly manual check is useless against that kind of firepower. You’re bringing a knife to a gunfight. You might check a price on Monday, but if their algorithm changes it on Tuesday based on a change in their competitor’s price, you’re in the dark for six more days.

We often remind folks of a McKinsey finding that’s too important to ignore: a mere 1% price increase can lift operating profits by almost 9%, assuming sales hold steady. Let that number really sink in. Now flip it around. If you’re accidentally priced too low because you’re unaware of the overall market value, you’re leaving a massive amount of money on the table every single day. Conversely, if you’re priced too high, you’re invisible to cost-conscious shoppers. This isn’t about being the cheapest. It’s about being the smartest. It’s about finding that optimal price point that maximizes both your sales volume and your profit margin. And you can’t find that point without data.

The Bigger Picture of Competitive Price Tracking

If you think competitive price tracking is just about the number after the dollar sign, you’re missing most of the story. That price is just the headline. You need to read the whole article, understand the subtext, and know the biography of the author.

Think of it as digital shelf analytics. The “digital shelf” is everything your customer sees when they land on a product page. Your job is to see not just your own shelf, but every relevant shelf in the digital supermarket.

- That killer price might be because the item is on a “Lightning Deal” that ends in an hour. Matching it would be a mistake.

- That “out of stock” message on your competitor’s page? That’s not a reason to relax; it’s your biggest opportunity to capture their frustrated customers.

- That new five-star review on a rival product? That’s what’s really driving their sales velocity, more than a price drop.

- The fact that they’re featuring “FREE NEXT-DAY DELIVERY” in their title? That’s a huge value proposition in the age of quick commerce that you might be ignoring.

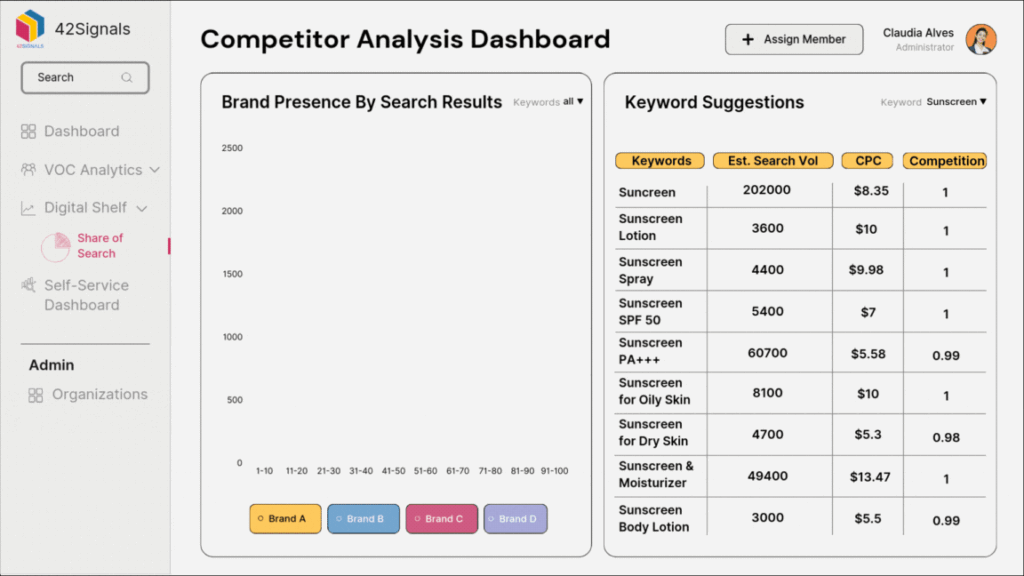

A proper competitor analysis dashboard connects these dots for you automatically. It shows you the history. It’s one thing to see a low price today. It’s another thing to see a graph that shows you this specific competitor always drops their price every Tuesday at 3 PM, like clockwork. That’s pattern recognition. That’s power.

It tells you the critical story behind their inventory levels. This might be the most underrated metric in all of retail pricing analytics. A low price on an item with critically low stock is a clearance sale. You can probably ignore it. Knowing the difference between these two scenarios changes how you respond entirely. It prevents you from starting a price war over a fire sale.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

A Deep Dive: How We Actually Helped Alpha Electronics Stop the Bleeding

Image Source: Price Mole

Back to our client, Alpha Electronics. When they first came to us, they were understandably panicked and hyper-focused on one thing: price. “Just tell us who’s cheaper!” was their primary directive. They were ready to slash their prices across the board.

We convinced them to take a broader view. We set up our system to watch their top five competitors, but we told it to look at everything. Not just price. We configured it to track their daily stock levels, their active promo banners, their placement in search results for key terms (“wireless headphones,” “noise-cancelling earbuds”), their customer rating changes, and even when they used special Amazon badges like “Amazon’s Choice.”

The discovery phase was a real lightbulb moment for their entire team. The initial report revealed a story far more complex than a simple price war.

Yes, one competitor was consistently 5% cheaper. But that was only a small piece of the puzzle. The bigger issues were things they’d never even thought to check:

- The Bundle King: One major competitor wasn’t competing on headphone price alone. They were always running a bundle deal, throwing in a free high-quality carrying case. Their effective value was much higher, and they were winning the “value” argument, not the “cost” argument.

- The Speed Demon: Another competitor had masterfully capitalized on quick commerce. They had “FREE NEXT-DAY DELIVERY” plastered everywhere—in their title, in their bullet points, in a promotional banner. Alpha Electronics offered the same fast shipping through FBA but never talked about it. They were losing on a key purchase driver they didn’t even know was a battleground.

- The New Advertiser: The new, agile competitor wasn’t just cheaper. They were aggressively buying up all the top Sponsored Product ads for their most important keywords. They were winning the share of search war, effectively making themselves the most visible option, regardless of price.

The conclusion was clear: Alpha was losing on value, promotions, visibility, and messaging—not just on price. They were so busy looking at one number on a spreadsheet, they missed the entire battlefield unfolding around them on the digital shelf.

With this full, panoramic picture, they could finally fight back intelligently. They didn’t just mindlessly match the lowest price. Instead, they:

- Fought for Visibility: They adjusted their ad strategy and budget to compete aggressively for the top Sponsored spots, reclaiming their share of search.

- Used Price Strategically: They used daily price monitoring to stay in the game, making small, tactical adjustments on their core product to remain competitive, but they now competed on their terms.

The result? Within a single quarter, they hadn’t just recovered their lost sales. Their overall profit margin on that product line was actually healthier than before because they were selling a higher-value bundle.

Get your free competitive price tracking report by 42Signals

What You Really Need to See: The Guide to Your Dashboard

1. A Story, Not a Number

Price History. Anyone can show you a price. You need a tool that shows you the timeline. A simple graph that visualizes a competitor’s price over the last 30, 60, or 90 days is worth a thousand static numbers. This history reveals patterns. Does a specific competitor always run a sale on holidays? Do they drop prices on weekends? Do they react within minutes of you changing your price? This context is everything. It transforms a data point into a strategy.

2. The Inventory Truth Serum

I can’t stress this enough. This is arguably the most valuable piece of competitor data you can get. Seeing a competitor’s stock level tells you their intentions. Low stock + low price = a clearance event. It’s a temporary play. You can likely ignore it. High stock + low price = a strategic, aggressive move. They’re playing for keeps. This is a red alert. Furthermore, getting an instant alert the moment a key rival goes out of stock is like a starting gun going off for your sales team. It’s the perfect time to ensure your listings are perfect and your ads are running. Their misfortune is your immediate opportunity.

3. Who’s Winning the Search War?

Share of Search & Rank Tracking. You can have the best price on the planet, but it means nothing if shoppers can’t find you. If you’re on page three of Amazon search results, you might as well be on another planet. Your dashboard needs to track search ranking for your most critical keywords.

4. New Kid on the Block Alerts

The competitive landscape isn’t static. New products launch every single day. Your dashboard should automatically send you an alert—an email, a Slack message—the moment a new competing product lands in your category. This gives you a head start to analyze its features, its price point, its imagery, and the initial customer reception. This allows you to assess the threat and formulate a response long before it starts impacting your sales. No more surprises.

5. The Promotion Behind the Price

Price is never just a number. Is the product featured in a “Today’s Deal” box? Is there a clip-out coupon on the page? Is it part of a “Buy One, Get One” offer? Is there a special financing offer? Tracking these promotional elements gives you the full context behind the price tag. It explains the “why” and tells you exactly how to respond. Maybe you need to run your own deal, or perhaps you counter with a different promotion. This completes your understanding of their strategy.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

Getting Started Without Losing Your Mind: A Practical, Step-by-Step Plan

This all might sound overwhelming, but it doesn’t have to be. You don’t need to boil the ocean on day one. Here’s a simple, practical plan to get started without getting paralyzed.

- List Your Real Rivals. Sit down with your team and make a definitive list. Who are your true, direct competitors? Not every single seller on Amazon, but the 10-15 brands and retailers that truly impact your business. Focus on the ones that sell products most similar to yours and target the same customer.

- Pick Your Heroes. You don’t need to track every single SKU from day one. Focus on your hero products—your top 20 best-selling products and your most important new launches. These are your revenue drivers and your market signals. Master tracking on these first. You can expand later.

- Decide What You Need to Know. What is your biggest pain point? Is it being surprised by stockouts? Is it losing the buy box to cheaper sellers? Is it losing visibility in search? Choose a tool that excels at solving that specific problem first. Maybe you start with daily price monitoring and inventory tracking before adding on more advanced digital shelf analytics.

- Have a Game Plan. This is the most overlooked step. Before you even get your first alert, decide on a process. Who on the team receives the alerts? Who has the authority to change a price or launch a promotion? What are the rules of engagement? Without a clear process, the data will just flood your inbox and cause chaos. A simple Slack channel dedicated to competitor alerts can be a great start.

The Bottom Line: It’s Time to Stop Competing in the Dark with Competitive Price Tracking

Look, the modern e-commerce market is simply too fast and too volatile to rely on hunches, manual checks, and quarterly reports. Your pricing strategy is directly tied to your profitability; it’s too important to leave to chance.

Mastering competitive price tracking isn’t about becoming the cheapest. It’s about becoming the most informed. It’s about seeing the whole chessboard, not just one piece. It’s about using a powerful competitor analysis dashboard and the principles of digital shelf analytics to move from a state of reactive panic to one of proactive strategy.

Tools like 42Signals make this job easier and with our free trial, you can see the results for yourself.

Sign up for a free trial today.

Get your free competitive price tracking report by 42Signals

Frequently Asked Questions

Competitor pricing tracking is the ongoing process of monitoring and analyzing how competitors price their products or services. It involves collecting real-time data about rival prices, discounts, bundles, and promotional strategies across different channels like websites, marketplaces, and physical stores. This information helps businesses adjust their own prices strategically to remain competitive while maintaining profitability. Many companies use automated tools or price intelligence platforms to track these changes efficiently rather than relying on manual research.

Price competitiveness can be measured by comparing your product prices with those of competitors offering similar value. Here’s how:

Benchmark Prices: Identify the average market price for your product category.

Compare Value Offered: Consider not just the base price, but also additional factors like product quality, warranty, and delivery speed.

Use Key Metrics: Monitor metrics like price index (your average price ÷ competitor average price) and sales volume changes after price adjustments.

Leverage Analytics Tools: Use pricing analytics or business intelligence platforms that visualize how your prices rank in the market over time.

By consistently evaluating these factors, businesses can ensure they remain attractive to price-sensitive buyers without compromising on margins.

The competitive pricing method is a strategy where businesses set their product prices based primarily on competitors’ pricing rather than internal costs or target profit margins alone. The idea is to position your offering either slightly below, at par with, or above competitors depending on your brand positioning and value proposition. This method is widely used in markets with many similar products, such as electronics or consumer goods, where buyers easily compare prices across sellers.

To implement competitive pricing effectively:

Identify Key Competitors: List out direct competitors and monitor their products regularly.

Gather Market Data: Track prices across all relevant channels and consider factors like promotions, shipping, and return policies.

Segment Your Products: Not all items need the same strategy; some may compete on price while others compete on quality or exclusivity.

Set Pricing Rules: Decide if you want to undercut, match, or slightly exceed competitor prices based on your business model.

Monitor and Adjust Continuously: Markets are dynamic; use automated tools to keep track of competitor moves and adjust accordingly.

A well-executed competitive pricing approach allows you to remain attractive to customers while still protecting profit margins.