Table of Contents

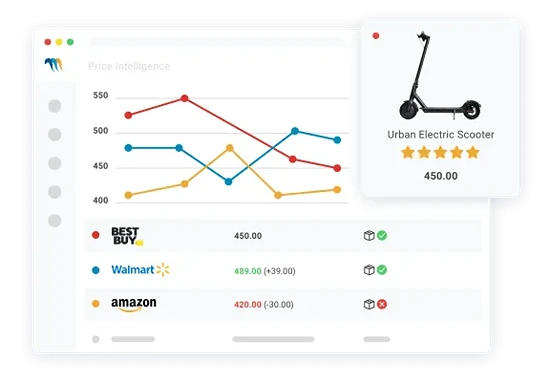

ToggleIf you’re selling online today, you’re constantly checking over your shoulder. What’s that competitor charging for the blender you both sell? Did this marketplace just slash the price on your best-selling headphones? Knowing your competitors’ prices is helpful for survival. But here’s the real problem: without rock-solid product matching software, your competitor price tracking is likely built on shaky ground, riddled with errors and missed opportunities. That’s the need for a product matching software.

You might think you have a handle on it. Maybe you’ve got a scraper pulling prices or even someone manually checking key items. But the ecommerce landscape? It’s a chaotic ocean of product listings. Identical items appear under wildly different titles, descriptions, and images across hundreds of sites.

Trying to manually ensure you’re comparing apples to apples (and not apples to oranges) is nearly impossible. That’s where the real competitive advantage hides: in sophisticated product matching software. This isn’t just data collection; it’s about accurately linking your products to theirs. Let’s unpack why this tech is the secret sauce behind reliable ecommerce analytics.

Image Source: Mayple

Why Manual Price Checks (and Basic Scraping) Just Don’t Cut It and the Need for Product Matching Software

Before we dive into solutions, let’s talk pain points. I’ve watched companies lose money and momentum here:

- Catalog Chaos: Competitors don’t structure their catalogs like yours. Different SKUs, internal codes, titles—you name it. Your “Nike Air Max 90 Men’s Running Shoe White/Black” might be their “Nike AM90 Mens Trainers – Light Bone/Black.” Is it the same shoe? Probably. Will a basic script know that? Doubtful.

- Scale Struggles: Manually tracking even 50 products across 3 competitors eats hours. For businesses with thousands of SKUs? Forget it. Competitor data becomes noise, not insight.

- The High Cost of Mistakes: Mis-pricing hurts. Undercut based on a different product? You leave money on the table. Price too high because of a bad match? A competitor can change a price in seconds. If your “daily” scrape runs overnight, or your manual check happens weekly, you’re seeing yesterday’s (or last week’s) battle. By the time you react, they’ve moved again. McKinsey consistently shows that pricing is a huge profit lever, but bad data makes it risky.

- You’re Always Behind: By the time you manually verify prices, the market’s moved. Competitors react in real-time; your insights can’t crawl. Basic tools fail miserably at reliable Amazon data extraction and matching.

Traditional methods just don’t scale for serious players. You need smart automation and pricing data insights.

Product Matching Software: Your Digital Matchmaker

Think of product matching software as a hyper-observant detective solving product identity crises. Its job? Prove that “Product A” on your site is identical to “Product B” on theirs, no matter how differently they’re described. (This is competitor catalog mapping in action.)

How does it work? It’s a blend of tech and ingenuity:

- Decoding the Data: The software first consumes massive amounts of raw competitor data – product pages, titles, descriptions, bullet points, technical specifications, images, brand mentions, prices, availability, and even customer reviews sometimes. It doesn’t just store this mess; it meticulously dissects it.

- Key Specifications: Size, color, weight, capacity, material, screen size, resolution, processor type, power output – whatever defines the product category.

- Descriptive Elements: Key features, benefits, and included accessories.

- Categorical Data: Product type, category hierarchy.

- Visual Data: Image analysis for object recognition

- Hunting for Clues: It prioritizes unique identifiers:

- GTINs (Barcodes): The gold standard. Same GTIN? Almost certainly a match. But not all products have them, and retailers don’t always share them accurately.

- MPNs (Manufacturer Part Numbers): Super reliable if available and listed right. If the Manufacturer Part Number (MPN) and the verified Brand match exactly, it’s extremely strong evidence (confidence: 85-95%). Requires clean MPN data on both sides.

- Brand + Model Combos: When GTINs/MPNs fail, this combo becomes critical evidence.

- Fuzzy Logic & AI Muscle: When clear IDs are absent, inconsistent, or conflicting, the software employs sophisticated algorithms, often powered by Machine Learning (ML):

- Text Analysis: It understands that “4K Ultra HD” and “3840 x 2160p” mean the same thing. Semantics matter.

- Image Recognition: It spots visual similarities—a coffee maker’s shape, a shoe’s pattern. This confirms or rules out matches visually.

- Weighting What Matters: It learns that screen size matters more for TVs than packaging color. Matches get confidence scores.

- Packaging Recognition: Identifies differences in packaging that might signify region-specific versions or bundles.

- Visual Similarity Scoring: Quantifies how visually alike two product images are. A high score alongside decent textual similarity boosts confidence significantly. This is crucial for fashion, home goods, and items where visual appearance is paramount and textual descriptions are often sparse or generic.

- Attribute Weighting & Learning: The ML engine learns over time which attributes are most critical for matching in specific categories. Screen size is paramount for TVs; thread count and size are key for sheets; flavor and size define soft drinks. It dynamically adjusts the weighting of attribute matches, boosting confidence scores when critical attributes align perfectly.

- Human Oversight (Often): Top tools flag tricky matches for human review. This trains the AI and boosts accuracy for complex items.

The result? A precise map: Your SKU 12345 = Competitor A’s ID XYZ = Amazon ASIN ABCDEFG. This competitor catalog mapping is your foundation.

From Matches to Meaning: Powering Price Intelligence

So you’ve got an accurate map. Now what? Product matching software fuels your pricing engine:

- Sniper Data Collection: Your tracker knows exactly which competitor listings match your products. No wasted effort scraping irrelevant pages.

- Always Watching: It monitors mapped listings 24/7, catching price changes instantly. Crucial in fast markets. The system continuously monitors the mapped competitor listings – often hourly or even more frequently for high-value or volatile items. It detects price changes as they happen.

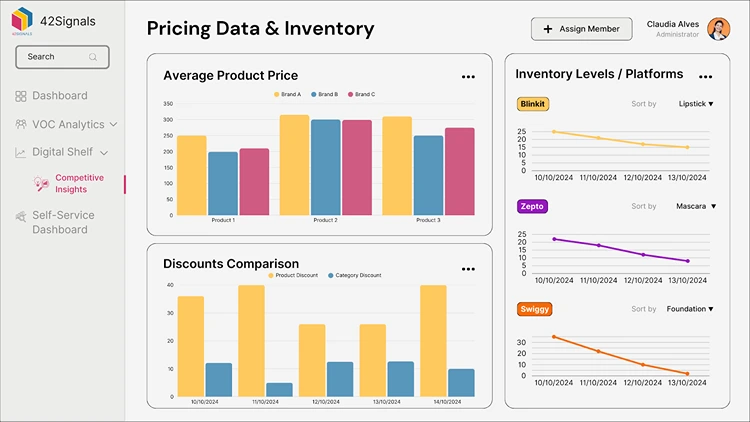

- Structured, Usable Data: The collected data isn’t dumped into a spreadsheet. It’s stored cleanly and structured within a database, intrinsically linked back to your master product record and its mapped competitor listings. This creates a rich historical record: You don’t just see today’s price for Competitor X; you see the price history for that exact product over time. This structured competitor data is the fuel for powerful analytics.

- Enrichment & Context: Leading systems go beyond pure price. They might track competitor stock levels (indicating potential restocks or clearance), seller count and ratings on marketplaces (especially important for Amazon data and Buy Box ownership probability), bundle information, and promotional text. This adds crucial context to the raw price number.

The Real Payoff: Smarter Decisions & Sharper Strategies

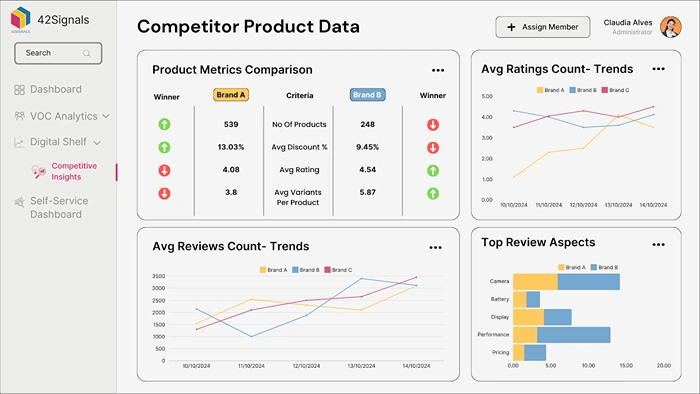

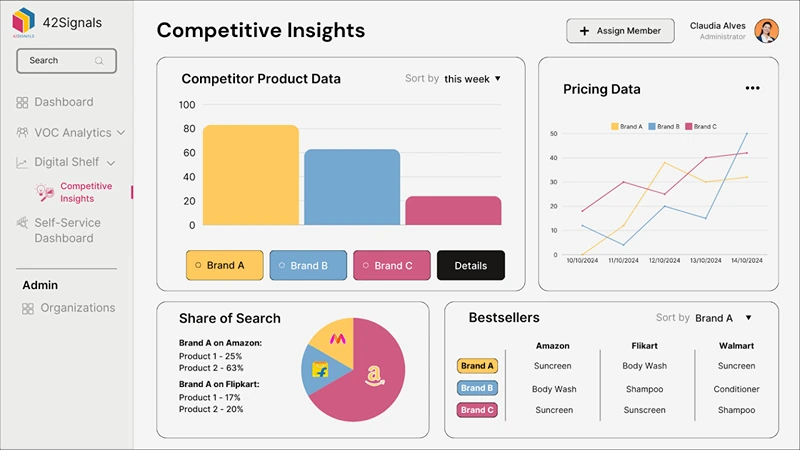

Accurate, mapped data changes everything. Here’s what reliable competitor data unlocks:

Dynamic Pricing You Trust: Ditch the gut feelings. With verified matches, algorithms can adjust prices confidently. BCG found that companies using advanced pricing analytics see 2-7% revenue lifts. Accurate matching makes this possible. Crucially, because the matches are accurate, you know these adjustments are based on true comparisons. Boston Consulting Group (BCG) found that companies leveraging advanced pricing analytics typically achieve a 2-7% increase in revenue and a 5-25% increase in profit contribution. Accurate product matching software is the bedrock enabling this.

See Your True Position: Are you the premium option or the bargain? Know exactly where you stand item-by-item against each rival.

Spot Trends Early: Dashboards reveal patterns. Is a rival undercutting you in key categories? Are prices tanking industry-wide? These product insights drive action. Are certain items seeing frequent, deep discount cycles? This signals buying opportunities, inventory clearance needs, or potential margin pressure.

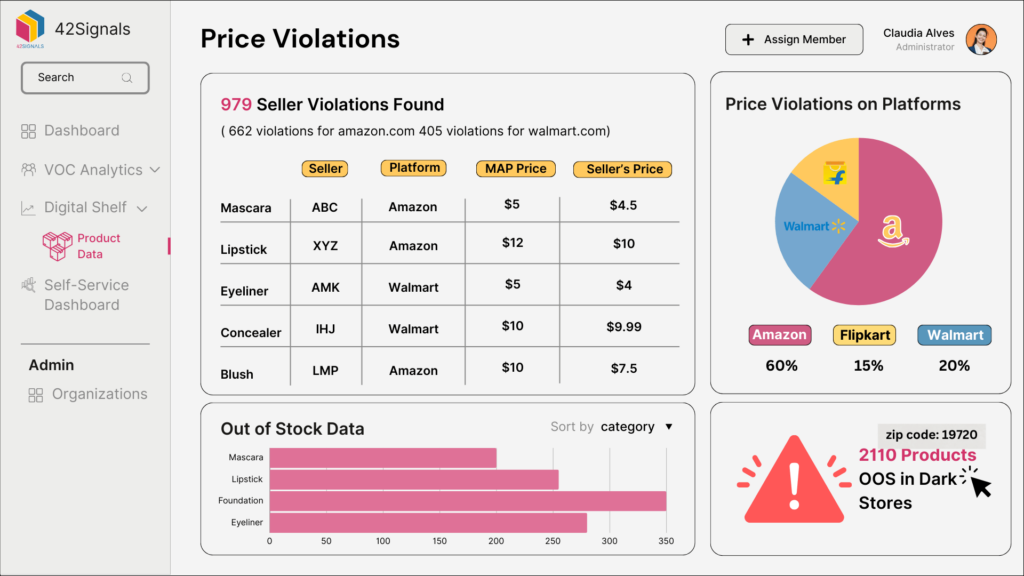

MAP Monitoring That Works: For brands, enforcing Minimum Advertised Price (MAP) policies is easier. Track your exact products across resellers and flag violations instantly.

Promotions That Hit Hard: Did your 20% off sale actually beat the competition? Did rivals counter it? Accurate tracking shows you.

Master the Amazon Game: Tracking Amazon data is non-negotiable. A whopping 85% of shoppers check Amazon prices before buying elsewhere (Statista, 2023). Matching software tracks Buy Box prices and sellers for your products accurately.

- Accurate Buy Box Tracking: Track the Buy Box price for your exact product, understanding who owns it (Amazon, a 3P seller) and at what price. The Buy Box wins ~82% of sales on Amazon.

- Navigating Seller Chaos: Map your product to the correct ASIN and track prices across all sellers offering it, not just the Buy Box winner. Understand the competitive landscape within Amazon itself.

- Identifying Hijacked Listings: Detect if unauthorized sellers are listing your product on someone else’s ASIN (a common problem), allowing you to take action.

- Monitoring Listing Health: Track changes to titles, images, or descriptions on your core ASINs.

Picking Your Product Matching Partner: Key Questions

Not all product matching software is equal. Ask:

- Where Can It Match? Does it handle Amazon, eBay, Walmart, niche sites, and social commerce? Don’t accept vague promises. Ask for documented accuracy rates (e.g., 95%+ on standard consumer goods) and how they measure it. What’s their process for handling low-confidence matches (HITL)? Accuracy is paramount.

- How Smart Is the Tech? Deep attribute analysis? Strong image recognition? Machine learning that improves? Can it handle competitor catalog mapping across this diverse landscape? Does it use robust probabilistic matching with ML? How advanced is its NLP and image recognition? How does it handle variants and bundles?

- Can It Grow With You? How many products/competitors? How fast does data update?

- Does It Play Nice? Does it integrate with your pricing tools, ERP, or dashboards?

- Can You Trust It? Does it show confidence scores and how it matched?

- What About Variants? Can it tell between sizes, colors, or bundles without mixing them up?

- Vendor Expertise & Support –

- Do they deeply understand ecommerce and the specific challenges of competitor catalog mapping?

- What is their onboarding and support process like? Is HITL support included?

- Are they proactive in maintaining match accuracy as competitor sites change?

Ditch the Guesswork, Own Your Pricing

In today’s cutthroat ecommerce world, accurate pricing intel is oxygen. But bad data? It’s toxic.

Product matching software is the unsung hero. It solves the core problem: linking your products to theirs across the messy web. This delivers the clean competitor data, fueling true ecommerce analytics.

Get this right, and you gain:

- Confidence in dynamic pricing

- Stronger MAP enforcement

- Faster trend spotting

- Smarter promotions & inventory moves

- Clear understanding of your Amazon position

Investing in robust product matching software isn’t just buying a tool—it’s building a foundation for winning pricing strategies. Stop comparing apples to oranges. Start knowing exactly where you stand, and compete to win.

See this in action with a free 42Signals app trial.

Frequently Asked Questions

1. What is product matching?

Product matching is the process of identifying and linking identical or equivalent products listed across multiple online sources—such as different e-commerce marketplaces, competitor websites, or data feeds.

This process helps businesses:

- Eliminate duplicate listings,

- Compare pricing and assortment across channels,

- Track market share and availability, and

- Enforce MAP (Minimum Advertised Price) compliance.

For example, a retailer might have the same product listed under slightly different names or SKUs on Amazon, Flipkart, and their own site. Product matching ensures these are recognized as the same item in the database.

2. What is an example of product matching?

Imagine a Samsung Galaxy S23 smartphone is listed on three marketplaces:

- Amazon: “Samsung Galaxy S23 128GB Black”

- Flipkart: “Samsung S23 5G 128 GB – Black”

- Brand site: “Galaxy S23 (Black, 128GB)”

Even though the titles are worded differently, product matching algorithms identify that all three listings refer to the same product by analyzing attributes like brand, model, capacity, and color.

This allows businesses to:

- Compare pricing across platforms,

- Monitor availability, and

- Consolidate sales and performance data for a single SKU.

3. What is matching and types of matching?

Matching is the act of identifying similarities or equivalence between different data points. In product and pricing intelligence, matching is generally used to unify information from multiple sources.

Types of matching include:

- Exact Matching – When two records are identical (e.g., same SKU or GTIN).

- Attribute-Based Matching – When records are matched by product attributes like brand, size, and color.

- Fuzzy Matching – When there are slight variations in names or details, and algorithms use similarity scores to find likely matches.

- Rule-Based Matching – When predefined business rules are used to match products (e.g., “if brand and model number are identical, it’s a match”).

- AI/ML-Based Matching – Using machine learning to detect and match products even when data is messy or incomplete.

4. What is the product market matching process?

Product market matching is a broader strategic process where businesses ensure that their product offering aligns with a specific market segment’s needs and preferences. This typically involves:

- Understanding the Market – Researching customer pain points, buying behavior, and demand patterns.

- Defining Product Attributes – Identifying unique features, pricing, and positioning of the product.

- Matching Products to Demand – Ensuring the product fits the needs of a target audience (e.g., premium vs. budget segment).

- Testing & Validation – Launching pilot campaigns or test listings to measure engagement, sales, and feedback.

- Iterating & Scaling – Refining product-market fit and expanding reach through optimized pricing and positioning.

In pricing intelligence contexts, this also means ensuring the right product is matched to the right competitive set—so that pricing, promotions, and assortment decisions are made on accurate comparisons.