Table of Contents

Toggle** TL;DR ** Effective ecommerce channel management requires a strategic framework to coordinate sales across multiple platforms efficiently. Key best practices include: implementing a centralised inventory system to prevent overselling and stockouts; establishing a unified pricing policy, such as MAP, to minimise channel conflict; and maintaining consistent product listings to protect brand integrity. Strategically selecting channels based on customer data and operational capacity is more effective than pursuing maximum presence. Furthermore, success hinges on building strong partner relationships through structured onboarding and communication (PRM), leveraging unified analytics for data-driven decisions, and integrating operations to create a seamless omnichannel customer experience.

For ecommerce managers, the expansion into multiple sales channels presents a significant operational challenge. The initial promise of expanded reach and diversified revenue streams can quickly give way to complexities involving inventory synchronisation, pricing discrepancies, and strained relationships with partners. Without a definitive strategy, this multichannel environment can become fragmented, inefficient, and costly. This underscores the critical importance of strategic ecommerce channel management.

As consumer purchasing behaviours continue to fragment across direct websites, major online marketplaces, and retail partners, a coordinated approach is no longer optional but fundamental to sustainable growth. This discipline involves the systematic oversight and integration of all touchpoints in the distribution network, transforming potential chaos into a cohesive growth engine.

Download our free channel management guide

Defining Ecommerce Channel Management

Image Source: Virto Commerce

Ecommerce channel management is the strategic process of selling products through various online platforms and meticulously coordinating all associated operations—from inventory and order fulfilment to pricing and marketing. It is the architectural blueprint for a company’s online sales ecosystem. Effective management is less about mere presence and more about the strategic orchestration of each channel’s role and performance.

In practice, this involves managing a portfolio of sales channels, which may include a branded D2C (Direct-to-Consumer) website, third-party platforms like Amazon and eBay, and a network of authorised digital retailers.

The goal is to ensure these channels operate in concert, rather than in competition, to deliver a consistent brand experience and maximise overall market penetration. Failure to coordinate these elements systematically often results in operational inefficiencies, partner dissatisfaction, and a diluted brand identity that confuses consumers and erodes trust.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

The Strategic Imperative of Coherent Channel Management

The rationale for investing in robust channel management is driven by its direct impact on profitability and brand equity. A disjointed approach leads to stockouts, brand dilution, and eroded partner trust, ultimately compromising customer retention and lifetime value. The costs of poor management are both tangible, like lost sales and costly refunds, and intangible, such as damage to brand reputation.

Research by McKinsey & Company substantiates this, revealing that companies with strong omnichannel customer engagement retain an average of 89% of their customers, compared to 33% for companies with weak omnichannel strategies. This data highlights the tangible return on investment in a unified channel strategy. Furthermore, a structured approach to ecommerce channel management allows businesses to gather consolidated market data, providing a holistic view of performance and customer trends that is impossible to achieve with siloed channels.

Systematic ecommerce channel management delivers measurable value by:

- Preventing direct revenue loss due to overselling and inventory inaccuracies.

- Protecting brand integrity and perceived value through consistent messaging and pricing.

- Generating consolidated analytics for informed strategic decision-making and forecasting.

- Establishing a foundation for effective partner relationship management (PRM) and collaborative growth.

Download our free channel management guide

A Framework for Excellence: 10 Best Practices in Channel Management

1. Conduct a Comprehensive Customer Journey Analysis

Data-driven insights into customer behaviour inform an effective channel strategy. The first step involves meticulously mapping the customer path to purchase across all potential touchpoints. Analysis should identify where different customer segments discover products, conduct research, and ultimately complete their purchases.

For instance, a technology brand might find that its B2B clients primarily research on its D2C site but purchase through a specialised IT distributor, while its B2C customers buy directly from Amazon.

Understanding these distinct pathways is critical. This intelligence allows for the strategic allocation of resources, ensuring each channel is optimised for its specific role in the funnel.

The D2C site in this example would be optimised for detailed technical information and lead generation, while the Amazon presence would be streamlined for convenience and competitive pricing. This strategic alignment prevents redundant efforts and ensures marketing spend is effectively deployed.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

2. Implement a Centralised Inventory Management System

Inventory integrity is the cornerstone of operational reliability and customer satisfaction. Disparate stock levels across channels inevitably lead to overselling, cancelled orders, and severe customer dissatisfaction.

A centralised inventory management system that integrates in real-time with all sales channels is a non-negotiable technological investment for any serious multichannel retailer.

Such a system acts as the central nervous system for your operations, automatically synchronising stock quantities and deducting inventory immediately upon a sale, regardless of its origin. This provides a single source of truth for supply levels, which greatly enhances forecasting accuracy and procurement planning. It also safeguards the customer experience by ensuring that what is shown as available is, in fact, available for purchase.

For businesses with brick-and-mortar partners, this may extend to implementing distributed order management (DOM) systems that can source products from store inventory, further optimising stock levels and reducing shipping times.

3. Establish a Unified Pricing Policy with ECommerce Channel Management

Inconsistent pricing is a primary catalyst for channel conflict. When consumers or partners observe significant price variations for the same product across different outlets, it erodes trust in the brand and can destabilise partner relationships.

A customer who purchases a product from your website for $100 may feel cheated upon discovering the same item for $75 on a major retailer’s site, potentially leading to returns and negative reviews.

A formalised Minimum Advertised Price (MAP) policy is the standard solution for maintaining price integrity. This policy, communicated clearly and enforced consistently with all distribution partners, ensures pricing remains stable and fair across the network.

While tactical promotions on a D2C site may be permissible to foster loyalty, a coherent overarching strategy is essential for maintaining brand value and ensuring equitable partner relationship management. The key is transparency and consistency, ensuring all parties in the distribution chain understand and adhere to the rules of engagement.

Download our free channel management guide

4. Maintain Brand Consistency Across All Product Listings

Image Source: Convert Cart

A brand is defined by its consistent presentation. In a multichannel environment, every product listing is a brand ambassador. Therefore, listings must maintain uniformity in imagery, descriptive copy, key features, and specifications across every channel.

A customer transitioning from a brand’s website to a major retailer’s product page should encounter a coherent and recognisable brand identity. Inconsistencies, such as different product imagery or conflicting feature lists, can create doubt about the product’s authenticity or quality.

This requires the development and distribution of a detailed digital asset management (DAM) guide and brand style guide for all internal and external teams. Standardising core assets does not preclude tailoring content to fit platform-specific formats; for example, leveraging A+ Content on Amazon while using a more narrative style on a D2C site.

However, the fundamental brand message, key value propositions, and product specifications must remain consistent to reinforce professionalism and build enduring consumer trust.

5. Cultivate Partnerships through Strategic Communication

Distribution partners are strategic allies, not merely endpoints in a supply chain. Proactive and structured partner relationship management (PRM) is vital for mutual success.

This involves moving beyond transactional interactions to establish collaborative communication and shared goals. A partner who feels supported and valued is more likely to prioritise your products and adhere to your brand guidelines.

Implementing a PRM platform or establishing a structured communication cadence, such as quarterly business reviews (QBRs), ensures partners are equipped with timely information on upcoming marketing campaigns, inventory updates, and product launches.

This collaborative approach transforms the relationship from vendor-client to true partnership. An informed partner is better positioned to represent the brand effectively, provide valuable feedback from the front lines, and manage their operations in alignment with your overall distribution strategy, thereby minimising instances of channel conflict.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

6. Systematise the Partner Onboarding Process

The initial engagement with a new partner sets the tone for the entire relationship. An ad-hoc partner onboarding process introduces significant risk and can lead to early missteps in branding, pricing, or policy compliance.

These early errors are difficult to correct and can poison the relationship from the start. A standardised, efficient onboarding protocol is the solution to scaling your partner network reliably.

A comprehensive partner playbook should serve as the primary resource, detailing brand guidelines, MAP policies, approved marketing assets, technical integration requirements for API feeds, and dedicated support contacts.

A formalised partner onboarding procedure, potentially managed through a PRM portal, accelerates time-to-revenue for new partners, ensures brand and policy compliance from the outset, and scales efficiently as your partner network grows. This demonstrates professionalism and makes it easy for partners to do business with you.

7. Adopt a Strategic Approach to Channel Selection

Expansion should be driven by strategic fit, not merely by opportunity. The temptation to be present on every potential online marketplace can dilute resources, focus, and operational capacity.

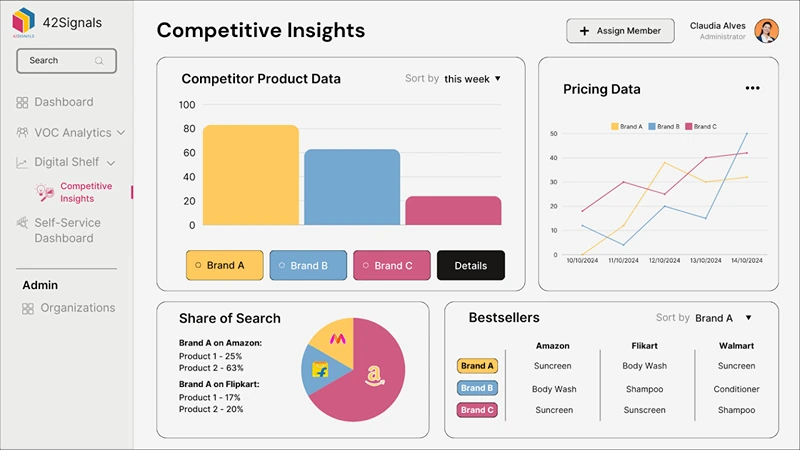

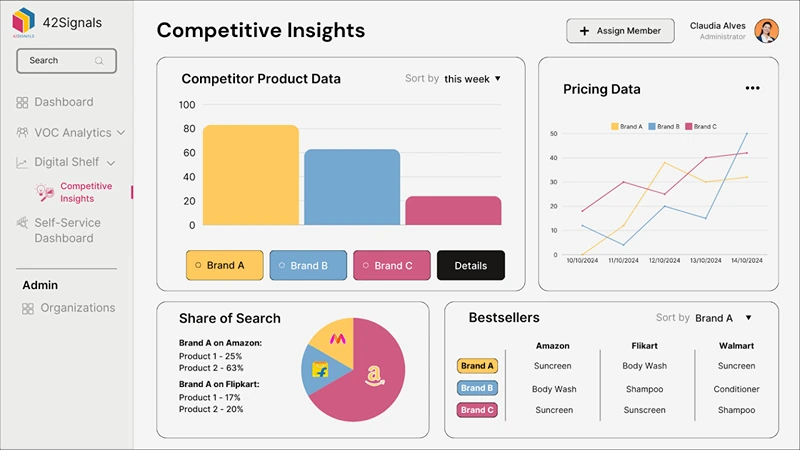

Image Source: 42Signals’ pricing data

A more effective and sustainable approach involves a disciplined evaluation of each channel’s alignment with target customer demographics, brand positioning, and internal operational capabilities. For example, a luxury brand may deliberately avoid certain mass-market platforms to preserve its exclusive positioning.

The objective is to achieve depth and excellence in a curated selection of channels rather than a superficial presence across many. A focused distribution strategy allows for more effective resource allocation, deeper platform expertise, and a stronger, more competitive position within chosen venues.

This involves continuous evaluation; a once profitable channel may no longer be viable due to fee changes or audience shift, and the strategy must be agile enough to accommodate this.

Download our free channel management guide

8. Integrate Operations for an Omnichannel Experience

A critical evolution in retail is the strategic shift from a multichannel presence to a true omnichannel experience. Multichannel involves operating on several independent platforms; omnichannel involves seamlessly integrating those platforms to create a unified, fluid customer journey. The modern consumer does not think in terms of channels; they think in terms of the brand, and they expect a consistent interaction regardless of how they engage.

This means enabling capabilities such as “Buy Online, Return In-Store” (BORIS) even at a partner’s physical location, or providing customer service teams with a unified view of a customer’s order history and interactions across all channels.

Developing an omnichannel strategy acknowledges that the lines between channels are blurred. It requires backend system integration and a cultural shift within the organisation, but the payoff is significantly increased customer loyalty and lifetime value.

A study by the National Retail Federation found that 62% of consumers prefer to buy from brands that offer a seamless omnichannel experience, underscoring its business-critical nature.

9. Leverage a Unified Analytics Dashboard for ECommerce Channel Management

Strategic decision-making must be grounded in consolidated, accurate performance data. Without a holistic view, it is impossible to accurately assess the true profitability, efficiency, and customer acquisition cost (CAC) of each channel.

Siloed data leads to misguided strategies, such as investing in a channel that generates high gross sales but has a prohibitive CAC when accounting for marketplace fees and marketing spend.

A unified analytics dashboard that aggregates data from all sources—web analytics, marketplace reports, and partner data—is indispensable for performance management. Key metrics to monitor include channel-specific net revenue, profit margins, inventory turnover rates, and returns rates.

According to Forrester, insights-driven businesses are growing at an average of more than 30% annually. This analytical approach empowers leadership to identify high-performing channels, reveal hidden inefficiencies, make data-backed decisions about resource allocation, and objectively justify strategic pivots in the distribution strategy.

Ready to Take the Next Step?

See how our solutions can help you achieve your goals and drive measurable results.

10. Commit to Continuous Strategy Evaluation

The digital commerce landscape is inherently dynamic. Consumer preferences shift, new platforms and social commerce trends emerge, competitive pressures evolve, and economic conditions change. Consequently, a static, set-and-forget channel strategy will inevitably become obsolete, causing the business to fall behind more agile competitors.

The final best practice is to institutionalise a process of continuous review and adaptation. This should not be a reactive measure but a proactive, scheduled discipline.

Regularly scheduled strategy sessions, ideally quarterly, should convene key stakeholders to assess channel performance against KPIs, gather qualitative feedback from partners and customers, and evaluate new market opportunities and competitive threats.

This agile, iterative approach to ecommerce channel management allows businesses to pivot quickly, test new channels with controlled risk, and continuously refine their operations for maximum efficiency and market relevance.

Download our free channel management guide

Achieving Cohesive Growth through Strategic ECommerce Channel Management

Mastering ecommerce channel management is a strategic imperative that directly influences revenue stability, brand equity, and long-term customer relationships. It is a complex discipline that requires balancing strategic oversight with tactical execution across a diverse network of owned and partner sales channels.

By implementing this structured framework—from inventory centralisation and unified pricing to advanced partner relationship management and data-driven analytics—organisations can transform their multichannel operations from a source of operational friction into a scalable, resilient, and profitable engine for growth.

The ultimate outcome is a data-driven distribution network where all channels, including the vital D2C component, are synchronised to support a superior, seamless brand experience.

This level of operational excellence not only prevents the pitfalls of channel conflict but also builds a significant competitive moat. It is this strategic mastery of the entire commercial ecosystem that ultimately separates market leaders from the competition in the modern digital marketplace.

Schedule a demo with 42Signals to see how to get quick insights from different platforms to understand competitor performance, inventory intelligence, share of search, and pricing intelligence.

Frequently Asked Questions

The channel management process helps businesses organise how products move from producers to consumers efficiently. The five main steps are:

Channel Design – Identify which distribution channels (online, retail, wholesale, etc.) best fit your product and audience.

Channel Selection – Evaluate potential partners or platforms and choose those that align with your brand goals.

Channel Motivation – Encourage and support partners through incentives, communication, and shared goals.

Channel Coordination – Ensure smooth collaboration between all participants through policies, technology, and data sharing.

Channel Evaluation – Continuously measure performance metrics like sales volume, customer reach, and cost efficiency to improve outcomes.

This process helps companies maintain strong relationships and deliver products to customers seamlessly.

An eCommerce channel is any online platform or medium used to market, sell, or distribute products. It represents the digital pathway through which customers discover and purchase goods.

Examples include:

Online marketplaces like Amazon, eBay, or Flipkart.

Brand websites or direct-to-consumer (D2C) stores.

Social commerce platforms like Instagram Shops or Facebook Marketplace.

Third-party distributors or affiliate websites.

In short, an eCommerce channel is how a product reaches customers in the digital ecosystem.

The four main channels of distribution describe the paths that goods take from the producer to the consumer:

Direct Channel – Manufacturer → Consumer (e.g., a brand’s website).

Retailer Channel – Manufacturer → Retailer → Consumer (e.g., selling via Amazon).

Wholesaler Channel – Manufacturer → Wholesaler → Retailer → Consumer.

Agent/Broker Channel – Manufacturer → Agent → Wholesaler/Retailer → Consumer.

Each channel offers different levels of control, profit margins, and customer engagement depending on the business model.

The four main types of eCommerce categorise transactions based on who’s buying and selling:

B2C (Business-to-Consumer): Businesses sell directly to end customers. Example – Amazon or Nike.com.

B2B (Business-to-Business): Companies sell products or services to other businesses. Example – Alibaba or HubSpot.

C2C (Consumer-to-Consumer): Individuals sell products to each other through online platforms. Example – eBay or OLX.

C2B (Consumer-to-Business): Individuals offer goods or services to businesses. Example – freelance platforms like Upwork.

Each model serves a unique market segment and often overlaps in modern multi-channel strategies.