Table of Contents

ToggleLet’s talk about what it meant if you ran out of toilet paper at 10 PM. Five years ago, this meant an awkward dash to the 24-hour convenience store. Today? You grab your phone, tap an app, and get it delivered within 15 minutes. That’s how much the quick commerce market has evolved in recent years.

Customer behavior has changed so drastically over the recent years that consumers are comfortable ordering everything online. Here are a few reasons why –

- Traditional e-commerce? Too slow (2 days? Unthinkable!)

- Running to the store can be too much effort, and sometimes unnecessary

- Quick commerce hits all the spots, especially when it comes with free delivery

Let’s find out more.

What is Quick Commerce? Definition and Key Concepts

Quick Commerce (Q-commerce) refers to business models that deliver products to consumers within 30 minutes, typically using a network of micro-warehouses (dark stores) located in urban centres.

Key Characteristics:

- Speed: Delivery in 15-30 minutes

- Hyperlocal Operations: Dark stores within 1-2 miles of customers

- Curated Inventory: ~2,000 high-demand SKUs

- App-Based Ordering: Mobile-first shopping experience

- Urban Focus: Services concentrated in dense metropolitan areas

Global Quick Commerce Market Overview 2025

Market Size & Projections:

- Global Market: Projected to reach $12.7 billion by 2030

- US Market: Valued at $7.5 billion in 2023 with 8% CAGR

- Indian Market: $5 billion+ with Blinkit and Zepto leading

- European Market: $3.2 billion led by Getir and Gorillas

Regional Performance Metrics:

- India: Average delivery time 12-15 minutes, order volume growing 25% quarterly

- Middle East: GCC market expanding rapidly with 18-minute average delivery

- Europe: Mixed performance with some markets seeing consolidation

- United States: Selective urban penetration with longer average delivery times

What Makes the Quick Commerce Market Different?

Image Source: Profitero

Q-commerce isn’t just “faster Amazon.” Traditional e-commerce prioritizes selection and cost, often sacrificing speed for bulk deliveries. Quick commerce flips this script. It targets small, urgent purchases—think snacks, toiletries, or emergency groceries—and delivers them faster than a pizza. To pull this off, companies like Getir and Gorillas rely on three pillars:

- Ultra-Localized Inventory: Instead of massive warehouses, q-commerce uses dark stores—small, tech-driven fulfillment hubs hidden in city centers. These spaces stock roughly 2,000 high-demand items tailored to local tastes.

- Hyper-Focused Logistics: Delivery riders operate within a 1–2 mile radius, enabling rapid turnaround.

- Data-Driven Precision: Real-time q-commerce data helps predict demand spikes, like ice cream during a heatwave or umbrellas before a storm.

The result? A service that feels less like shopping and more like a “magic trick” for time-strapped urbanites.

Why Quick Commerce Succeeded in India But Struggled in the US

India’s Success Factors:

- Dense Urban Populations: High population density in cities like Mumbai and Delhi

- Mobile-First Consumers: 700+ million smartphone users comfortable with app-based services

- Lower Labor Costs: Affordable delivery infrastructure

- Cultural Factors: Preference for daily shopping vs bulk purchasing

- Competitive Landscape: Blinkit, Zepto, and Swiggy Instamart driving innovation

US Market Challenges:

- High Operational Costs: Real estate and labor expenses in urban centers

- Suburban Sprawl: Lower population density outside core urban areas

- Established Competition: Amazon Prime, Instacart, and DoorDash already serving similar needs

- Consumer Habits: Preference for weekly grocery shopping vs immediate needs

- Profitability Pressure: Low average order values struggling to cover delivery costs

Leading Quick Commerce Companies and Their Strategies

Global Players:

- Getir (Turkey): Pioneer expanding globally with focus on urban centers

- Gorillas (Germany): Known for rapid delivery but facing restructuring

- Gopuff (USA): US market leader with 15-minute delivery promise

- Blinkit (India): Acquired by Zomato, dominating Indian market

- Zepto (India): Fast-growing competitor focusing on 10-minute delivery

Traditional Retailers Adapting:

- Walmart: Express delivery through Spark Driver network

- Target: Same-day delivery via Shipt acquisition

- Tesco: “Whoosh” service delivering in 30 minutes

- Carrefour: Partnership with Cajoo for quick commerce in France

The Technology Stack Powering Quick Commerce

Micro-Warehouse Management:

- AI-Powered Inventory: Predictive algorithms stock products based on neighborhood demand

- Automated Picking: Robotics and optimized layout for faster order fulfillment

- Real-Time Tracking: Live inventory management across dark store networks

Delivery Logistics Software:

- Route Optimization: Algorithms calculating fastest delivery paths

- Dynamic Dispatch: Automatic rider assignment based on proximity

- Performance Analytics: Monitoring delivery times and operational efficiency

Data Intelligence Platforms:

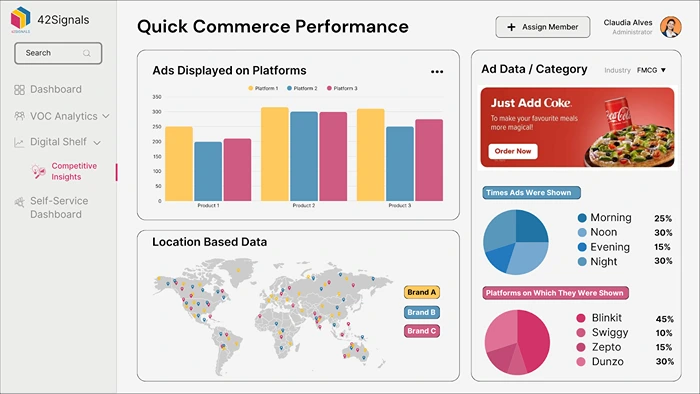

- Demand Forecasting: Tools like 42Signals providing real-time market insights

- Price Monitoring: Tracking competitor pricing and promotions

- Digital Shelf Analytics: Optimizing product visibility across quick commerce apps

The Hidden Engine: Dark Stores and Hyperlocal Networks

Image Source: CNN

Walk past a nondescript building in Manhattan or Berlin, and you might be standing next to a dark store. These unmarked facilities are the backbone of q-commerce. Unlike traditional stores, they’re designed for efficiency, not foot traffic.

Shelves are organized algorithmically to speed up order-picking, and AI guides workers through the fastest routes.

But dark stores alone aren’t enough. Enter hyperlocal fulfillment—a strategy that embeds micro-warehouses directly into neighborhoods. Startups like Jokr and Zapp partner with local businesses to convert unused storage space into mini-hubs.

This not only cuts delivery times but also reduces traffic congestion and carbon emissions. For instance, Jokr’s Madrid hubs use electric bikes to fulfill orders in under 10 minutes.

Profitability Challenges and Solutions

Major Cost Centers:

- Real Estate: Premium rents for urban dark store locations

- Labor: Delivery rider costs and dark store staff

- Customer Acquisition: High marketing spend to attract users

- Last-Mile Delivery: The most expensive part of the supply chain

Profitability Strategies:

- Dynamic Pricing: Higher fees during peak demand periods

- Subscription Models: Monthly fees for unlimited free delivery

- Expanded Product Categories: Higher-margin electronics and beauty products

- Dark Store Automation: Reducing labor costs through technology

- Delivery Fees: Implementing minimum order values and service fees

Tech Tools Driving the Q-Commerce Surge

Digital Shelf Analytics: Winning the Visibility Game

In a world where apps compete for top search results, digital shelf analytics are critical. These tools track how products appear on q-commerce platforms, monitoring everything from pricing to stock levels. If a competitor slashes the price of laundry detergent, analytics platforms alert businesses instantly.

Companies like Reposit use this data to adjust promotions or highlight exclusive deals, ensuring their app stays at the top of consumers’ screens.

Price Alerts and Tracking: The Battle for Loyalty

Price sensitivity is rampant in Q-commerce. Apps like Blinkit and Zepto use price alerts to notify users when items on their wishlists drop in cost. Meanwhile, price tracking tools scan rivals’ platforms 24/7, allowing companies to stay competitive without sacrificing margins.

For example, when Gorillas noticed a competitor discounting bottled water in London, they countered with a “buy one, get one” deal—a move that boosted sales by 20% in a single day.

The Challenges: Why Quick Commerce Isn’t Easy

1. The Profitability Puzzle

Speed is expensive. Maintaining dark stores, paying couriers, and managing perishable inventory squeezes margins. Many startups rely on investor funding to offset losses, a risky strategy as interest rates rise.

2. Labor and Ethical Concerns

Critics argue that q-commerce exploits gig workers. In 2022, Deliveroo riders in Paris staged protests over pay and safety, forcing companies to rethink labor models. Some, like Germany’s Flink, now offer benefits like health insurance and fixed salaries.

3. Sustainability Trade-Offs

Frequent deliveries mean more vehicles on the roads. While startups tout eco-friendly bikes, the sheer volume of orders raises questions about long-term environmental impact.

Quick Commerce Market Trends 2025

1. Beyond Groceries: The “Instant Everything” Expansion

- Electronics: Phones, accessories, and gadgets

- Beauty & Skincare: Emergency makeup and skincare products

- Pharmaceuticals: Prescription and OTC medication delivery

- Office Supplies: Last-minute business needs

2. Sustainability Initiatives

- Electric Vehicles: E-bikes and EVs for urban delivery

- Packaging Reduction: Minimal, recyclable packaging

- Route Optimization: Reducing carbon emissions through efficient routing

3. Traditional Retail Partnerships

- White-Label Solutions: Q-commerce platforms powering retail delivery

- Store-as-a-Warehouse: Using existing retail locations for fulfillment

- Hybrid Models: Combining quick commerce with scheduled delivery

4. AI and Automation Advancements

- Predictive Analytics: Anticipating demand spikes by location

- Automated Dark Stores: Reduced human intervention in fulfillment

- Dynamic Pricing: Real-time price adjustments based on demand

Quick Commerce Data Intelligence: The Competitive Edge

Why Data Matters in Quick Commerce:

- Demand Prediction: Understanding what products will be needed where

- Competitor Monitoring: Tracking rival pricing and delivery times

- Inventory Optimization: Right-sizing stock across dark stores

- Customer Insights: Understanding purchasing patterns and preferences

Platforms like 42Signals Provide:

- Real-time market share data by region and category

- Competitive pricing intelligence across multiple platforms

- Product performance tracking and trend identification

- Delivery time monitoring and service level comparisons

The Future: Where the Quick Commerce Market is Headed

1. Beyond Groceries: The Rise of “Instant Everything”

Q-commerce is expanding into electronics, beauty, and even furniture. In Dubai, Careem lets users order iPhones for delivery in 20 minutes. Meanwhile, startups like Mednow deliver prescriptions in under 15 minutes.

2. Smarter Tech: AI and Automation

Dark stores are testing robotic pickers to cut labor costs. In Tokyo, Rakuten’s automated warehouses use AI to sort orders 50% faster than humans. Drones, like those tested by Amazon Prime Air, could soon handle suburban deliveries.

3. Blurring Lines: Traditional Retailers Fight Back

Supermarkets aren’t sitting idle. Tesco’s “Whoosh” service delivers groceries in 30 minutes, while Walmart partners with q-commerce apps to reach urban customers. Even restaurants are joining in—Domino’s now promises pizza in 10 minutes.

The Future of the Quick Commerce Market

Short-Term (2025-2026):

- Market consolidation with weaker players exiting or merging

- Expansion into suburban areas with slightly longer delivery promises

- Increased focus on profitability over growth at all costs

Medium-Term (2027-2028):

- Drone and autonomous vehicle delivery testing in select markets

- AI-powered hyper-personalisation of product offerings

- Integration with smart home devices for automatic replenishment

Long-Term (2029+):

- Mainstream adoption of 10-minute delivery in urban centres

- Traditional retailers fully integrating quick commerce capabilities

- New business models are emerging around instant gratification

Love it or hate it, quick commerce has already changed the game. With all the ways the quick commerce market has evolved over the past few years, companies now have to adapt to reach a larger target demographic.

This means quicker data expectations for businesses operating on quick commerce platforms like Blinkit, Zepto, and a reliable analytics platform helping brands with the right insights.

If you’re curious to try us out, sign up for a free trial today.

Frequently Asked Questions about the Quick Commerce Market

What is an example of quick commerce?

A great example of quick commerce, or q-commerce, is Gopuff — a U.S.-based delivery service that promises to bring snacks, drinks, essentials, and household items to your door in 15–30 minutes. Other popular examples include Getir, Flink, and Zapp in Europe. These companies focus on hyper-local delivery from small fulfillment centers or “dark stores,” often operating around the clock in urban areas. Unlike traditional e-commerce, q-commerce is all about speed — think of it as the convenience store brought to your doorstep, instantly.

Why did quick commerce fail in the US?

While q-commerce showed a lot of promise, it faced some serious hurdles in the U.S. that slowed its momentum, if not outright caused some ventures to shut down or scale back.

Key challenges included:

- High operational costs: Maintaining micro-fulfillment centers and fleets of drivers is expensive, especially in cities with high labor and real estate costs.

- Low order value: Many customers only ordered a few items at a time, making it tough to turn a profit after delivery and labor costs.

- Customer retention: Some users were excited about free trials or discounts, but didn’t stick around once the promos ended.

- Tough competition: Q-commerce players also had to compete with giants like Amazon, DoorDash, and Instacart, who already had large user bases and delivery networks.

How big is the US quick commerce market?

The US Quick Commerce (Q-Commerce) market is projected to reach $12.7 billion by 2030, growing at a CAGR of 8% from a value of $7.5 billion in 2023.

Is quick commerce available in the USA?

Yes, quick commerce is available in the U.S., but it’s currently limited to select urban areas where delivery logistics are more viable. Companies like Gopuff, DoorDash, Instacart, and even Uber Eats have launched quick delivery options in cities where high population density and strong demand make the economics work.

Some large retailers like Walmart and Target have also rolled out express delivery services (sometimes under 60 minutes), which function similarly to q-commerce in terms of speed, even if they don’t use the exact same business model.

So, while it’s not yet a nationwide standard, quick commerce is definitely alive in the U.S. — just not as widespread or consistent as in some other global markets.

How do quick commerce companies make money?

Through product markups, delivery fees, surge pricing during peak times, subscription programs, and in some cases, advertising and data services. However, many are still operating at a loss while building market share.

What are the biggest challenges facing quick commerce?

Profitability remains the primary challenge, along with high customer acquisition costs, labor management, real estate expenses, and competition from both traditional retailers and other quick commerce platforms.