Table of Contents

Toggle** TL;DR ** Price benchmarking analytics is the systematic process of continuously tracking and analyzing competitor pricing data to inform strategic decisions. Moving beyond guesswork to this data-driven approach is essential for optimizing profitability, strengthening market positioning, and avoiding reactive price wars. By implementing a structured framework for competitive benchmarking, organizations can transform pricing from an administrative function into a core strategic competency that directly enhances financial performance and competitive advantage.

For today’s commerce, pricing decisions can no longer be predicated on intuition or periodic market glances. The digital marketplace is dynamic, with competitor strategies and consumer expectations evolving in real-time. Organisations that rely on static pricing models risk significant revenue leakage and eroded market share. That’s why price benchmarking analytics is so important.

Let’s understand how.

What is Price Benchmarking Analytics?

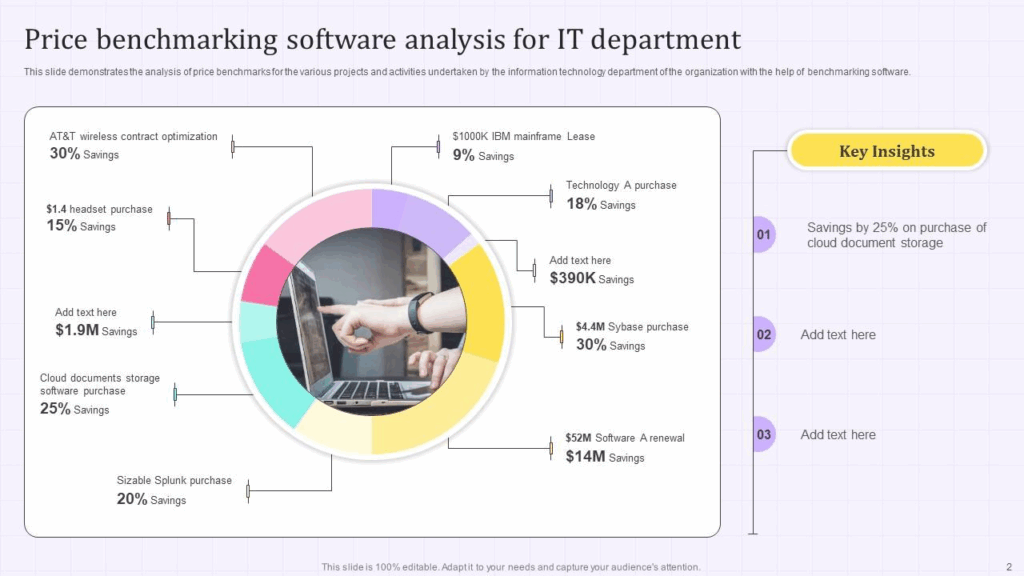

Image Source: Slide Team

Price benchmarking analytics represents the systematic process of collecting, comparing, and contextualising an organisation’s pricing data against that of its competitors. It is a continuous intelligence-gathering function that moves beyond simple price tracking to deliver actionable insights.

This discipline encompasses a multifaceted pricing analysis, evaluating several key dimensions:

- Product Equivalency: Ensuring accurate comparisons between directly competing products and accounting for feature-based differentiators.

- Promotional Context: Distinguishing between permanent price positions and temporary promotional campaigns.

- Strategic Positioning: Interpreting price points as indicators of a competitor’s overarching strategy, whether it is value-based, premium, or penetration-focused.

Effective competitive benchmarking thus provides a multidimensional view of the market, enabling strategic decision-making grounded in empirical evidence rather than conjecture.

The Strategic Value of Pricing Intelligence

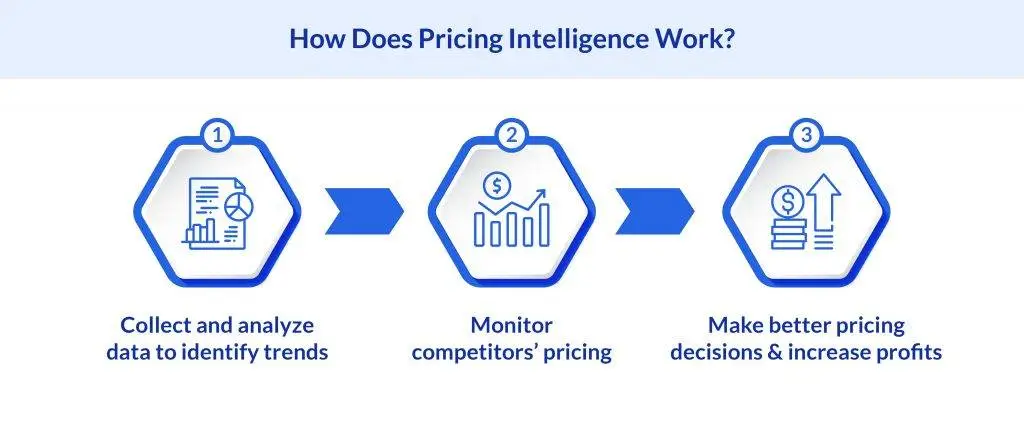

Image Source: Flipkart Commerce Cloud

Operating without a formalised pricing intelligence system exposes an organisation to considerable financial and strategic risk. The consequences of inadequate pricing oversight are quantifiable and severe.

Foremost is the direct impact on profitability. Research by McKinsey & Company underscores that a 1% improvement in price, assuming no loss of volume, can increase operating profits by 8.7% on average. This leverage demonstrates that even marginal pricing optimisations, informed by data, can yield substantial returns.

Furthermore, inconsistent or non-competitive pricing intelligence jeopardises brand perception and customer loyalty. Consumers who perceive a price as unjustified relative to market alternatives are unlikely to become repeat purchasers. A disciplined approach to price benchmarking analytics ensures that pricing strategies reinforce brand value and value proposition.

Ultimately, a lack of pricing intelligence results in a passive market positioning. Organisations cede control of their narrative, allowing competitors to define the market’s price expectations. Proactive price management is, therefore, fundamental to asserting strategic influence.

What is a Competitor Analysis Framework?

A competitor analysis framework is a structured model used to systematically identify, evaluate, and understand your current and potential competitors. It moves beyond sporadic checking to a continuous, holistic process of gathering competitor insights.

Think of it as a strategic blueprint that answers critical questions:

- Who are we really competing against? (Direct, Indirect, and Substitute competitors)

- What are their objectives, strategies, and capabilities?

- What are their strengths and weaknesses?

- How are they positioned in the market, and how might they react to our moves?

This structured approach transforms random data points into actionable intelligence, forming the bedrock of a resilient business strategy. Price benchmarking is a powerful, data-rich component of this larger framework.

A Framework for Implementing Competitive Benchmarking

Implementing a successful price benchmarking initiative requires a structured and methodical approach. The following blueprint outlines the critical phases of deployment.

Phase 1: Competitor Identification and Prioritisation

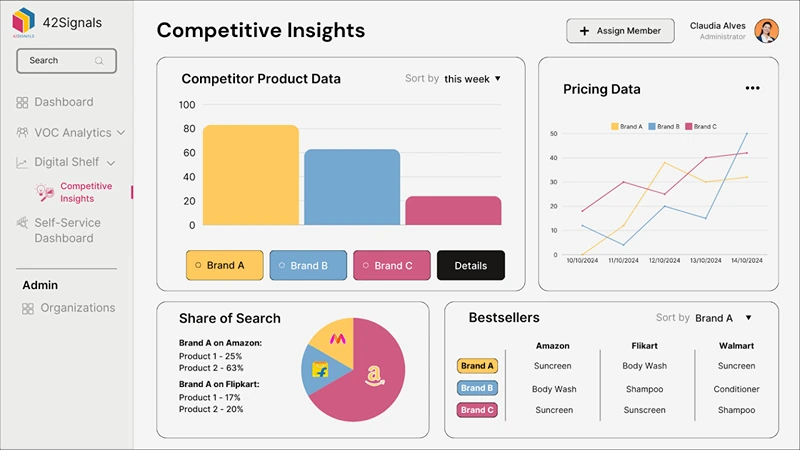

42Signals’ competitor analysis

The foundation of any benchmarking program is a clearly defined competitor set. This should extend beyond direct rivals to include indirect competitors and substitute products that fulfil the same consumer need. A focused cohort of 5-10 key players typically provides the most actionable insights.

Phase 2: Strategic Product Selection

Resource constraints necessitate a focused approach. Initial efforts should concentrate on core products, high-volume SKUs, and price-sensitive items that significantly influence revenue and margin. These products serve as the primary levers for strategic pricing adjustments.

Phase 3: Systematic Data Collection for Price Benchmarking Analytics

Manual data gathering is inefficient and non-scalable. Automated retail analytics platforms are essential for consistent and accurate competitor price tracking. These tools provide continuous monitoring across digital channels, capturing real-time price changes, promotions, and stock availability.

Phase 4: Contextual Data Analysis and Interpretation

Data alone is insufficient; insight is derived from context. This phase involves a deep pricing analysis to identify patterns, correlations, and causal relationships. Key activities include analysing price elasticity, monitoring competitive reactions to promotions, and understanding seasonal pricing trends.

Phase 5: Strategy Formulation and Rule Development for Price Benchmarking Analytics

Analytical insights must be translated into an executable pricing strategy. This involves establishing clear pricing rules and guardrails. For example, an organisation may decide to maintain price parity on benchmark commodities while leveraging a premium position on differentiated products, all within defined margin thresholds.

Phase 6: Continuous Monitoring and Optimisation

Price benchmarking analytics is an iterative process, not a one-time project. The market landscape is fluid, requiring ongoing monitoring of strategy efficacy. Key performance indicators, such as sales volume, margin, and competitive rank, must be tracked to facilitate continuous refinement of the pricing approach.

Key Components of a Comprehensive Competitor Analysis

An effective framework examines multiple dimensions of your competition. The core components include:

- Competitor Identification & Profiling: Who are they? Create detailed dossiers on their size, market share, history, and target audience.

- Product & Service Analysis: What do they offer? Map their product portfolio, features, quality, unique selling propositions (USPs), and pricing tiers.

- Marketing & Sales Strategy: How do they reach customers? Analyze their messaging, branding, channels (digital and traditional), content strategy, and sales process.

- Pricing & Value Proposition: This is where price benchmarking analytics shines. How do they price their offerings, and what value do they claim to deliver for that price?

- Strengths, Weaknesses, Opportunities, and Threats (SWOT): A classic but powerful model to synthesize findings into a clear, strategic summary for each competitor.

- Operational Capabilities: How do they deliver? Assess their supply chain, distribution, customer service, and technology stack.

Popular Competitor Analysis Models and Frameworks

Several established models can structure your analysis. Often, they are used in combination.

1. SWOT Analysis

Perhaps the most well-known framework, SWOT categorizes your findings into four quadrants: Strengths, Weaknesses, Opportunities, and Threats. It’s excellent for a high-level, synthesized view of a competitor’s position.

2. Porter’s Five Forces

This model, developed by Michael Porter, analyzes the industry attractiveness and level of competition. It looks at five forces: Competitive Rivalry, Threat of New Entrants, Threat of Substitutes, Bargaining Power of Suppliers, and Bargaining Power of Buyers. It helps you understand the structural drivers of competition beyond your immediate rivals.

3. Strategic Group Mapping

This visual framework plots competitors on a graph based on two key strategic dimensions (e.g., Price vs. Quality, or Product Variety vs. Geographic Reach). It helps identify which competitors are most similar and reveals potential market gaps.

4. The Competitive Profile Matrix (CPM)

A more quantitative model that allows you to score and weight key success factors for your industry (e.g., market share, pricing, financial strength, product quality) and rate each competitor against them. This provides a clear, comparative snapshot of competitive strength.

Leveraging Technology for Advanced Retail Analytics

The execution of a sophisticated competitive benchmarking program is enabled by modern technology. Specialised retail analytics platforms automate the most labour-intensive components of data management and provide advanced analytical capabilities.

When evaluating a pricing intelligence software, organisations should prioritise platforms that offer:

- Precise Product Matching: Advanced algorithms capable of accurately matching product variants across retailers, accounting for differences in model numbers, sizes, and specifications.

- Real-Time Alerting: Automated notifications for significant price changes or stock-out situations among key competitors, enabling prompt strategic responses.

- Promotional and Assortment Tracking: The ability to monitor and report on promotional campaigns, bundle deals, and changes to competitor product assortments.

- Historical Trend Analysis: Access to historical pricing data to model trends, forecast future pricing movements, and measure the long-term impact of pricing strategies.

Investment in a robust tool elevates the pricing function from administrative data collection to strategic analysis and decision support.

A Step-by-Step Guide to Conducting a Competitor Analysis

Turning theory into action requires a disciplined process. Here is a step-by-step guide:

Step 1: Define Your Objectives and Scope

What key business question are you trying to answer? (e.g., “Should we enter a new market?” “Why are we losing market share?”). This determines the focus of your analysis.

Step 2: Identify Your Competitors before Price Benchmarking Analytics

Categorize them into:

- Direct Competitors: Offer similar products/services to the same target market.

- Indirect Competitors: Offer different products that solve the same customer problem.

- Future Competitors: Potential new entrants or companies pivoting into your space.

Step 3: Choose Your Framework and Gather Data

Select the models (e.g., SWOT, Porter’s) that best suit your objectives. Use a mix of data sources: their websites, financial reports, customer reviews, social media, and—critically—competitive intelligence platforms for data on pricing, assortment, and promotions.

Step 4: Analyze and Synthesize Findings

Don’t just list facts. Look for patterns, gaps, and insights. Why is a competitor successful? Where are they vulnerable? How does their pricing strategy reflect their overall positioning?

Step 5: Develop Strategic Actions

This is the most important step. Translate insights into action. Based on your analysis, what should you start, stop, or change? This could be a new pricing strategy, a marketing campaign targeting a competitor’s weakness, or a product feature improvement.

Step 6: Monitor Continuously

The market is not static. Establish a regular cadence (quarterly, bi-annually) to update your analysis.

The Cross-Functional Impact of Pricing Analysis

The insights generated through price benchmarking analytics possess significant cross-functional value, influencing decisions beyond the finance and pricing departments.

Marketing and Commercial Strategy: Data on competitor promotional timing and depth can inform the planning and execution of more effective marketing campaigns. Understanding competitive reactions allows for the development of pre-emptive or counter-strategies.

Product Management and Development: Consistent data showing a price premium for products with specific features provides validated market intelligence for the product roadmap. It offers empirical evidence of features that customers value and are willing to pay for, directly guiding development priorities.

Supply Chain and Procurement: Insights into competitor pricing can strengthen negotiation positions with suppliers. Demonstrating market price pressures provides a factual basis for seeking cost improvements, thereby protecting margin structures.

Image Source: 42Signals’ Competitor Analysis Dashboard

Mitigating Common Implementation Risks with Price Benchmarking Analytics

Despite its clear benefits, organisations can encounter pitfalls in their benchmarking initiatives. Awareness of these risks is the first step toward mitigation.

Avoiding Destructive Price Wars: The objective of price benchmarking analytics is strategic optimisation, not necessarily achieving the lowest price. Organisations must resist the temptation to engage in reflexive price matching, which can trigger a race to the bottom that erodes industry-wide profitability. The focus should remain on pricing to value, supported by a clear brand proposition.

Preventing Analysis Paralysis: The volume of available data can be overwhelming. To avoid inefficiency, each analysis should be driven by a specific business question or hypothesis. Establishing clear key performance indicators and reporting frameworks ensures that analysis remains focused and actionable.

Accounting for Brand Equity: Quantitative data must be balanced with qualitative factors. A brand’s established reputation for quality, service, or reliability justifies a price premium. The final pricing strategy should be a synthesis of competitive data and the intrinsic value of the brand itself.

From Insights to Action: Integrating Analysis into Your Strategy

A competitor analysis framework is useless if it sits in a report. The value is in its application across the organization.

- For Product Management: Use insights on competitor features and gaps to inform your product roadmap. This is a key part of sophisticated competitor analysis for product managers.

- For Marketing & Sales: Arm your teams with talking points that highlight your strengths against competitor weaknesses. Tailor messaging to counter competitor claims.

- For Pricing Strategy: This is where your price benchmarking analytics directly inform tactical and strategic decisions. Use the data to defend a premium position, win on price in key segments, or identify opportunities for value-based pricing.

- For Executive Leadership: Provide a clear, evidence-based view of the competitive landscape to support strategic planning, M&A decisions, and resource allocation.

Key Takeaways on Price Benchmarking Analytics

- Price intelligence benchmarking analytics elevates pricing from intuition to a data-driven strategy, enabling informed decisions that protect margins and market share. It is a continuous process of tracking, comparing, and contextualising your prices against competitors.

- The financial impact is significant; a 1% price improvement can increase operating profits by 8.7%, making strategic pricing a major lever for profitability. Conversely, uninformed pricing leads to revenue leakage and eroded brand value.

- Successful implementation requires a structured framework, beginning with identifying key competitors and products, then leveraging automated tools for data collection, and culminating in the development of a clear, rule-based pricing strategy.

- Technology is essential for scalability and accuracy, with advanced retail analytics platforms providing real-time data, precise product matching, and historical trend analysis that manual processes cannot match.

- The insights gained have cross-functional value, informing marketing promotions, guiding product development, and strengthening supplier negotiations, thereby embedding pricing intelligence across the organisation.

- The ultimate goal is strategic market positioning, not just matching prices. Effective benchmarking allows a company to confidently command a premium based on value or compete on price selectively, avoiding destructive price wars while asserting control over its competitive narrative.

Establishing Pricing as a Core Competency

In an increasingly competitive and transparent global market, strategic pricing is a definitive component of commercial excellence. Price benchmarking analytics provides the empirical foundation required to navigate this complexity with confidence. It empowers organisations to transition from a reactive posture to a proactive, data-driven strategy.

By mastering this discipline, businesses can optimise profitability, reinforce their value proposition, and secure a commanding market positioning. The integration of continuous pricing analysis into core business operations is no longer an optional enhancement but a fundamental requirement for market leadership and long-term financial health.

Try 42Signals today to get quick price benchmarking analytics data from multiple marketplaces for insights into your products and your competitors’ products.

Download The Diwali 2025 Sale: Pricing Strategy Infographic

Frequently Asked Questions about Price Benchmarking Analytics

1. What is price benchmarking?

Price benchmarking is the process of comparing your product’s prices against competitors’ or industry standards to understand where you stand in the market. It helps businesses identify whether they are overpriced, underpriced, or aligned with market expectations.

Brands use price benchmarking to:

Spot gaps in their pricing strategy

Stay competitive during promotions or seasonal sales

Ensure they aren’t losing customers due to poor price positioning

It’s widely used in e-commerce, retail, CPG, and travel markets where prices change quickly and competition is intense.

2. What are the 5 C’s of pricing?

The 5 C’s of pricing are the core principles that guide smart and profitable pricing decisions:

Company Objectives What the business aims to achieve — profit, market share, customer growth, or premium positioning.

Customers How much value customers see in your product and what they’re willing to pay.

Costs Understanding all expenses (production, marketing, distribution) to ensure the price remains profitable.

Competition What competitors charge and how your product compares in value or features.

Channel Partners Distributors, retailers, and marketplaces that influence final pricing, margins, or placement.

These five forces help create a balanced pricing strategy aligned with both business goals and market realities.

3. What are the 4 pricing methods?

The four common pricing methods used across industries are:

Cost-Based Pricing The price is set by adding a markup on top of production and operating costs.

Value-Based Pricing Prices are determined by how much value customers believe the product delivers.

Competition-Based Pricing Pricing is aligned with or adjusted against competing products in the market.

Dynamic Pricing Prices change in real time based on demand, competitor movement, seasonality, or inventory levels.

Each method fits different business models — for example, value-based pricing suits premium brands, while dynamic pricing is key for e-commerce and travel.

4. What is benchmarking in analytics?

Benchmarking in analytics refers to comparing your business performance metrics against competitors, industry averages, or internal historical data. It helps companies understand whether their results fall below, meet, or exceed expected standards.

Examples include benchmarking:

Conversion rates against industry norms

Your average basket value against competitors

Market share or search share over time

Customer acquisition costs across channels

Benchmarking gives context to numbers — helping you understand not just what your performance is, but how it stacks up against the market.

5. What is competitive price positioning?

Competitive price positioning refers to how a brand’s prices compare to others in the same category. It helps businesses understand whether they’re positioned as a budget, mid-range, or premium option.

6. How often should companies adjust their prices?

The ideal frequency varies by industry, but e-commerce and retail typically adjust prices weekly or even daily, depending on demand, stock levels, and competitor behaviour.

7. What is a price gap analysis?

A price gap analysis measures the difference between your product’s price and a competitor’s price to identify whether you’re overpriced or underpriced.

8. What is the meaning of price elasticity?

Price elasticity shows how much customer demand changes when prices rise or fall. Highly elastic products lose sales with small price increases.

9. Why is real-time pricing important?

Real-time pricing helps businesses respond instantly to market changes, protecting both competitiveness and profitability in fast-moving categories.