Table of Contents

ToggleLook, you’re used to moving pallets, not single units. Your world runs on purchase orders and distributor handshakes. But lately? That direct-to-consumer (DTC) buzz won’t quit. The ground’s shifting under your wholesale fortress, and it may be time to shift your B2B ecommerce business to DTC.

Jumping into D2C selling isn’t just “adding a Shopify store.” It’s rewiring your company’s DNA. Identifying if it’s a profitable solution, what the margins are like, and how your business can capitalize on the new DTC boom.

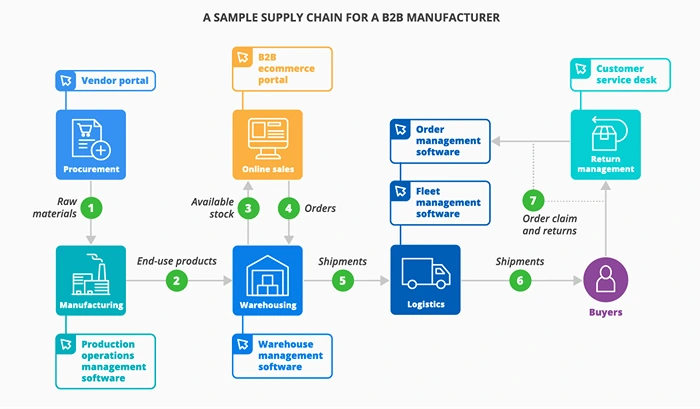

Image Source: SCNSoft

Why DTC Now? The Move From B2B Ecommerce

Sure, fatter margins rock. McKinsey’s number-crunchers found DTC brands often score 15-20% higher gross margins than wholesale-dependent players. But if you think this is just a cash grab, you’ll flame out fast. Here’s why B2B veterans are sweating this shift:

- You Finally Meet Your Real Boss (The Customer)

No more guessing what the end-user hates about your packaging. No more relying on a retailer’s biased sales data. That mom is struggling to open your “industrial-strength” jar? The contractor who needs your adhesive to dry faster? You’ll hear them raw and unfiltered. That’s pure gold for R&D. - Your Brand, Your Rules (No More Shelf-Politics)

Remember when that big-box store buried your premium product next to the bathroom cleaner? Or slapped a “clearance” sticker on it because their buyer screwed up? Gone. You control the narrative now—the photos, the copy, the unboxing experience. - Speed Wins. Period.

Found a typo on your wholesale packaging? Good luck fixing it in 6 months. With DTC, you tweak product descriptions at 2 AM. Test a new price point during lunch. Swap hero images based on real-time clicks. B2B ecommerce moves like molasses. DTC is a fighter jet. - Your Data, Your Secret Weapon

Those clicks, cart-abandons, and 3 AM review rants? That’s your competitive advantage. Wholesale gives you quarterly sales reports—DTC hands you a live brain scan of your customer.

The Ugly Truths Everyone Ignores

It may seem easy to make the move, but there is a new set of problems when moving from B2B ecommerce to DTC.

- “Why’s Karen Furious About ONE Damaged Box?!” Syndrome

Your warehouse crew moves forklifts, not bubble mailers. Suddenly, they’re handling individual orders where a scratched box = a 1-star review. Returns? They used to be quarterly pallets. Now it’s daily emotional therapy sessions with customers demanding refunds before returning the product. The change can be brutal. - Tech Stack Nightmares (RIP Your Sanity)

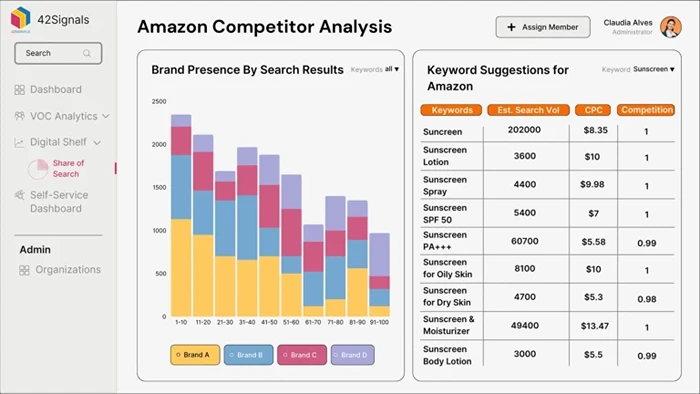

Your old B2B ERP system crumbles under DTC complexity. Now you’re juggling:- A competitor analysis dashboard scraping live product data and pricing from Amazon/Walmart

- Shopify’s checkout quirks

- A CRM tracking individual customer tantrums

- Email/SMS tools demanding constant content

- Returns software that never integrates right

- “Who The Hell Are You?” (Building Trust From Zero)

Your wholesalers leveraged their foot traffic and brand trust. Now? You’re a nobody. Google ignores you. Customers compare you to established players. Prepare to burn cash on ads, influencers, and content just to get noticed.

Your DTC Game Plan: Tactics That Don’t Sugarcoat

Phase 1: Research Like a CIA Operative

- Stalk Your Real Customer (Not the Retailer)

Ditch the firmographics. Dig into:- Where do they actually hang out? (Reddit? TikTok? Trade forums?)

- What pain makes them swear at 2 AM?

- What’s their “holy crap, yes!” moment with products like yours?

Pro Move: Run Facebook ads to a fake landing page for your product. See who clicks. Survey them. Offer $10 Amazon cards for brutal honesty.

- Live Inside Your Competitors’ Pockets

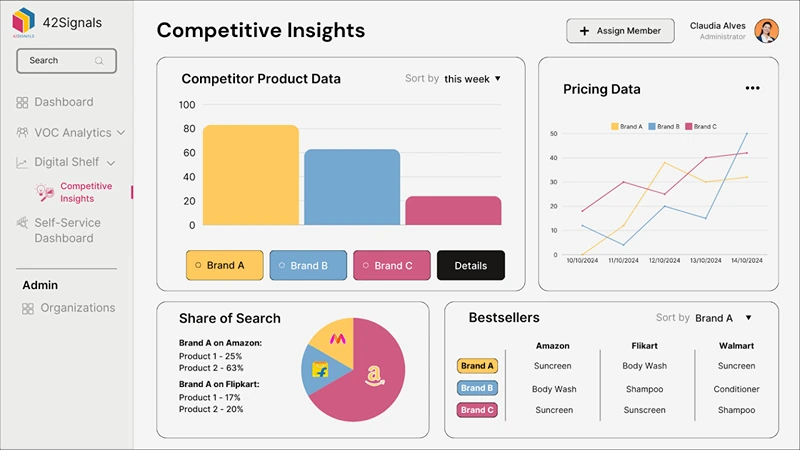

Tools like 42Signals’ competitor analysis dashboards are non-negotiable. Track daily:

- Their pricing swings (product data and pricing alerts are gold)

- New product launches (and flops)

- Promo tactics (BOGO? Flash sales?)

- Customer review disasters (“leaks after 3 uses?!”)

- Shipping costs/return policies

War Story: A kitchenware brand spotted a rival’s “free shipping over $50” offer via their dashboard. They launched “free shipping over $45” the next day. Sales spiked 22%. - Validate Demand Before You Burn Cash

- Run pre-orders for your DTC-exclusive product variant.

- Test pricing tiers: $49 vs $59 vs $69. See where conversions drop.

- Use Google Trends to see if searches for “direct [your product type]” are rising.

Cold Hard Truth: If your email waitlist gets 10 signups, kill the idea.

Phase 2: Pick Your DTC Poison (And Own It)

- What’s Your Fighting Identity as a B2B Ecommerce Business?

- The Premium Guru: Charge 30% more for insane quality/content (e.g., detailed manufacturing videos)

- The Convenience King: “Subscribe & save 15%” + auto-replenish

- The Community Rebel: Limited drops, insider access, user-generated content

Don’t waffle. Craft beer brands crush DTC by being that local weirdo brew—not trying to out-Budweiser Budweiser.

- Your “Why Buy YOU Direct?” Pitch Better Cut Deep

- “Get colors Target doesn’t carry”

- “Members-only restocks of sold-out items”

- “Free 1-on-1 setup consultation”

- “Returns for ANY reason within 365 days”

Slap this everywhere: product pages, ads, packaging.

- Diffuse the Distributor Bomb (3 Options)

- Launch DTC-Only SKUs: Unique colors/bundles not sold wholesale.

- Give Wholesalers First Dibs: Let them sell new lines for 6 months before DTC.

- The Band-Aid Rip: Compensate them for lost volume during transition.

Phase 3: Tech – Spend Smart, Not Pretty

Your Store’s Engine must be thought out very carefully before you begin your venture.

| Platform | Best For | Landmine |

| Shopify Plus | Scaling fast, apps galore | Transaction fees hurt at scale |

| BigCommerce | Built-in B2B + DTC hybrids | Steeper learning curve |

| WooCommerce | Total control (if you have devs) | Hosting/security = your mess |

- PIM Systems: Your Product Data Liferaft

Juggling product data and pricing across Amazon, Walmart, DTC, and wholesalers? A Product Information Management (PIM) tool like Akeneo or Salsify stops the chaos. Sync descriptions, specs, and prices instantly. Update once, blast everywhere. - Data or Die: Track These or Stress

- CAC (Customer Acquisition Cost):

Formula: Ad Spend + Team Salaries / New Customers

If selling a $100 product costs you $120 in ads, you’re bankrupt. - LTV (Lifetime Value):

Formula: Avg Order Value x Repeat Purchase Rate

Healthy DTC: LTV should be 3x CAC. - Cart Abandonment Rate:

Formula: Abandoned Carts / Initiated Checkouts

Over 70%? Your checkout’s broken.

- CAC (Customer Acquisition Cost):

Phase 4: Logistics – Where Heroes Are Crushed

DIY Fulfillment: Control vs. Chaos

The Good:

- Total Brand Control: Every package feels like yours – custom tape, handwritten notes, free samples.

- No Third-Party Screwups: No blaming a 3PL for shipping the wrong item to Nebraska.

The Ugly Reality:

- Staffing Hell: Hiring/training pickers/packers. Weekend shifts. Turnover. OSHA compliance. Health insurance headaches.

- Real Estate Trap: Leasing warehouse space ($$$), buying racks/forklifts, and HVAC costs.

- Scaling Nightmares: That “100 orders/day” sweet spot? Hit 150, and you’ll need double the staff/weekend overtime.

- Hidden Costs:

- Packaging supplies (bubble mailers aren’t free)

- Shipping software subscriptions

- Carrier negotiation time (FedEx doesn’t care about your startup)

3PL Partners: Scaling vs. Surrender

The Good:

- Scale Overnight: Hit 500 orders/day? They handle it.

- Geographic Reach: Store inventory in multiple regions → cheaper/faster shipping.

- Carrier Discounts: Their volume gets 30-50% off UPS/FedEx rates you can’t touch.

The Cons:

- Less Control: Your “premium unboxing” becomes a poly mailer tossed in a bin.

- Fee Landmines:

- Receiving fees ($25/pallet)

- Storage fees ($15/pallet/week)

- Pick/Pack fees ($2.50/order)

- Returns processing ($5+/item)

Your Checklist to Vet:

- Tour Their Facility:

- Is it cleaner than a hospital or dustier than your attic?

- Ask: “Show me your returns processing area.” (Chaos = red flag)

- Quick Commerce Test:

“If I need 50 units delivered to a dark store in 2 hours, can you do it? What’s the fee?” - Returns Torture Test:

- Mail back a damaged item. How fast is the refund?

- Do they inspect returns or just shred them?

Phase 5: Marketing – Stop Selling, Start Solving

- Content Is Your Bouncer (Qualify Leads Early)

- Problem-First Blog Posts: “How to fix wobbly cabinet hinges” → then pitch your premium hinges.

- Raw Demo Videos: Show your product surviving stupid abuse (hammers, freezers, mud).

- UGC (User-Generated Content): Repost customer photos/videos. Offer $20 store credit.

- Ads: Sniper Shots, Not Spray & Pray

- Facebook/Instagram: Ideal for impulse/lifestyle products ($10-$150). Use carousels showing use cases.

- Google Search: Capture high-intent buyers (“heavy-duty drill bits for steel”).

- LinkedIn: For niche B2B-DTC hybrids (e.g., $5k industrial tools).

- Email/SMS: Your Profit Engines

- Abandoned Cart Emails: Recover 10-15% of lost sales (SaleCycle, 2023). Send within 1 hour.

- Post-Purchase Email Series: Teach usage, request reviews, and cross-sell.

- SMS for Nuclear Offers: “FLASH SALE: 30% off ends midnight.” Open rates hit 98%.

Quick Commerce & Dark Stores: The 800-Pound Gorilla

Quick commerce (15-minute delivery apps like Gorillas, Getir, Blinkit, Swiggy Instamart) isn’t a fad—it’s rewiring urban brains. Those ghost warehouses (dark stores) in abandoned strip malls? They’ve made “slow” shipping feel prehistoric.

Your Survival Playbook:

- Speed Is Now Oxygen

If you sell convenience items (snacks, phone chargers, baby gear):- Place inventory in urban fulfillment hubs.

- Offer “same-day delivery” if possible.

- Reality Check: 2-day shipping is now table stakes.

- Partner or Perish? (The Margin Squeeze)

- Pros: Massive volume, instant urban reach.

- Cons: Razor-thin margins, packaging rules, and delivery SLA penalties.

- Tactic: Negotiate exclusive SKUs for Q-commerce to avoid price wars.

- Watch Them Like a Hawk

Integrate quick commerce players into your competitor analysis dashboard. Track:- Their pricing on YOUR products

- Stock-out frequency

- Promo tactics (e.g., “20% off first app order”)

If they discount your flagship item? You’ll know by lunch.

Don’t Toss Your B2B Superpowers!

Your old life gives you unfair advantages. Leverage them:

- Product Knowledge = Content Goldmine

- Create “insider” guides: “Why our glue beats epoxy (chemistry deep-dive).”

- Film factory tours showing your QC process.

- Customer Trust Hack: Expertise = authority = less price sensitivity.

- Supply Chain Muscle = Margin Magic

Got that 10-year factory relationship? Negotiate:- Smaller DTC-exclusive batches.

- Priority during material shortages.

- Lower defect allowances (1% vs industry 3%).

- Quality Obsession = DTC Marketing

B2B taught you brutal QA standards. Consumers love “overbuilt” products. Flaunt:- MIL-SPEC testing certifications.

- Side-by-side stress tests vs competitors.

- Warranties that make jaws drop (“5 years? Seriously?!”).

Metrics That Separate Winners From Losers

| Metric | Why It Matters | How to Track | Healthy Target |

| CAC Payback Period | How fast you recoup ad spend per customer | (CAC / Avg. Gross Margin per Order) | < 90 days |

| Repeat Purchase Rate | % of customers buying again (predicts LTV) | (Repeat Customers / Total Customers) | > 30% |

| Net Revenue Retention | Growth from existing customers (upsells, repeats minus churn) | (Starting Revenue + Upgrades – Downgrades – Churn) / Starting Revenue | > 110% |

| Return Rate | Exposes product/description failures | (Units Returned / Units Sold) | Industry-specific |

Conclusion: Grit > Genius. Every. Damn. Time.

Switching from B2B ecommerce to DTC selling isn’t about viral TikToks or fancy branding. It’s a grind:

- Calming furious distributors

- Teaching warehouse teams to love bubble wrap

- Fixing checkout bugs at midnight

- Stalking your competitor analysis dashboard daily

Start with one DTC-exclusive product. Test it like your life depends on it.

Get started with tools like 42Signals to get the data you need from marketplaces like Amazon, Walmart, and competitor platforms.

Frequently Asked Questions

What is B2C with an example?

B2C stands for Business-to-Consumer. It refers to the model where businesses sell products or services directly to individual customers for personal use. This is the most common form of commerce we encounter in daily life.

Example:

Buying shoes from Nike’s official website is a B2C transaction. Nike, the business, sells directly to consumers through its online platform.

Is Netflix B2C or B2B?

Netflix is primarily a B2C company. It delivers streaming content—like movies, series, and documentaries—directly to individual subscribers who pay a monthly fee. The service is designed for personal use, making it a clear example of a B2C digital business.

However, Netflix does occasionally partner with other businesses (like telecom companies), but its core model remains business-to-consumer.

Is Amazon a B2C or B2B?

Amazon operates as both B2C and B2B:

- As a B2C platform, it sells goods directly to consumers through its online marketplace. Shoppers can purchase everything from books and electronics to groceries.

- As a B2B platform, Amazon also runs Amazon Business, which caters to organizations and bulk buyers, offering business-only pricing, multi-user accounts, and purchase order support.

So, Amazon is a hybrid model, serving both individual consumers and businesses.

What are the 4 types of e-commerce?

There are four main types of e-commerce based on the nature of transactions:

C2B (Consumer-to-Business) – Individuals offer products or services to companies.

Example: A photographer licensing a photo to a marketing agency.

B2C (Business-to-Consumer) – Businesses sell directly to end-users.

Example: Zara sells clothing through its website.

B2B (Business-to-Business) – Transactions occur between two businesses.

Example: A wholesaler selling bulk office supplies to a corporate client.

C2C (Consumer-to-Consumer) – Individuals sell to other individuals, often through third-party platforms.

Example: Someone selling a used laptop on eBay.