Table of Contents

ToggleThe art of pricing a product isn’t a mere arithmetic exercise; it resembles a complicated puzzle that requires immense thought, data, and analysis, all in the right combination before settling on the price. Retail pricing strategies are an intricate subject that requires a nuanced understanding of multiple factors that influence the final purchase decision. It’s more than basing prices on gut feeling or competition shadowing but needs in-depth analysis and a proper grasp of the market.

Image Source: Brandly360

Let’s look at a few factors that constitute a successful pricing strategy.

Factors Influencing Retail Pricing Strategies

Costs and Profit Margins – Cost-plus Pricing

Building an effective pricing strategy begins with looking at the costs. Costs are the bedrock upon which other decisions are made. Looking at direct costs (raw materials, production, labor) and indirect costs (overhead, marketing, distribution) is essential in –

- Understanding how much money is spent in creating the product.

- Establishing the base price of the item so that manufacturing and distribution expenses are covered.

- Setting profit margins so the company can be profitable.

Cost-plus pricing, a common approach, involves adding a predetermined percentage to costs to determine the selling price. For F&B this value can be 200-300% of the product value, while for electronics such as a smartphone, it can be around 50-60%.

Value-based Retail Pricing Strategies

A value-based pricing strategy rests upon the perceived value of a product in the eyes of the consumers. It mainly conveys a status, luxury, or eliteness that customers will pay a large price to attain. For example, let’s consider the high-end designer brand Birkins. The cheapest bags in this category can start from $10,000 reaching anywhere north of $250,000. Now, does it actually cost so much to make a bag no matter how luxurious it is? Of course not. Even the sum of all the most expensive materials and labor costs will not come close to a fraction of the final product price.

But customers are not paying for the bag per se; they are spending money for a status symbol – to own a Birkin bag which incidentally has an incredibly long waiting list lasting years – yet another status symbol – for people to purchase the item.

Supply & Demand

This is Economics 101. When demand is high, pricing is high. When demand is low, pricing follows suit and has to be amended to boost sales. Here, pricing elasticity comes into the picture where prices are adjusted with respect to consumer demand – by measuring their responsiveness to changes in price.

Image Source: Economics Help

Products that have an inelastic demand – items that are necessities where demand is constant – allow for higher pricing while elastic products – non-necessities and wants require strategic pricing to avoid demand erosion.

Competitor Shadowing & Consumer Behavior

A company’s pricing decisions can’t exist in isolation; they must be in harmony with the market’s pricing landscape. For products in the same domain, pricing must stay competitive with similar items. Pricing too high may alienate price-sensitive customers, while pricing too low could undervalue a product.

Consumer behavior also plays a role in this decision-making process. Price perception, sensitivity, and psychology influence buying decisions. For instance, setting a price just below a round number (e.g., $9.99 instead of $10) taps into the psychological tendency to perceive it as significantly lower. Businesses can leverage such psychological cues to drive purchasing decisions.

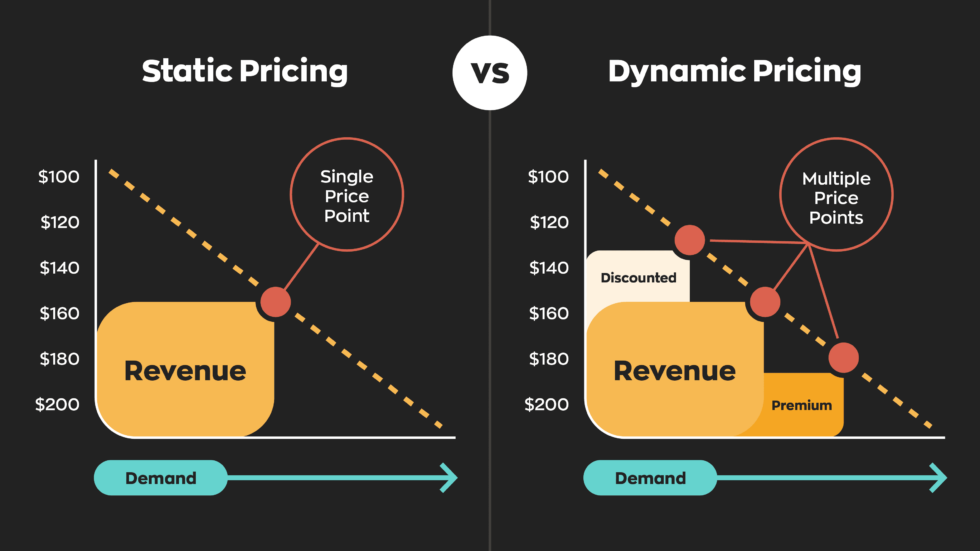

Dynamic Retail Pricing Strategies

Promotions and discounts are potent tools in a pricing arsenal. Businesses can strategically deploy dynamic pricing strategies through temporary price reductions, bundle deals, or limited-time offers to spur sales. However, this must be exercised with caution and proper research as excessive reliance on promotions can erode brand equity and condition consumers to wait for discounts.

Image Source: WallStreet Mojo

Maintaining Economic Resilience

External economic factors, such as inflation rates, currency fluctuations, and overall economic conditions, can exert considerable influence on pricing strategies. Businesses must consider the purchasing power of consumers and adapt pricing to maintain affordability during economic shifts.

A brand that can and does adopt this strategy will gain the trust of consumers and can build lasting relationships. Consumers today are not interested in funding soul-sucking corporations that only look at making more money. They have become more conscious of their spending habits and prefer working with businesses that are honest and showcase transparency. In times of economic despair, adjusting prices for the time being can pay dividends in the future.

Long-Term Sustainable Growth

Any pricing strategy/strategies adopted must be sustainable for the business – bringing in enough revenue at a base requirement for operations to continue smoothly. This may mean opting for penetration pricing to gain market share initially and gradually increase prices as brand recognition grows. Conversely, a skimming strategy may involve launching a product at a high price and gradually reducing it to target price-sensitive segments.

A Tactical Toolkit: Retail Pricing Methods & Approaches

Beyond the influencing factors, retailers must select a tactical pricing method. Discussing the various pricing approaches available to a retailer reveals a spectrum from cost-oriented to market-oriented models.

- Cost-Plus Pricing: A fundamental retail pricing approach. Calculates total cost and adds a fixed markup percentage. Simple but often ignores market demand.

- Competitive Pricing: Sets merchandise pricing based directly on competitor prices. Essential for commodity goods but can lead to margin wars.

- Value-Based Pricing: Sets prices according to the perceived value to the customer. Common for luxury goods or products with strong unique selling propositions (USPs).

- Psychological Pricing: Uses tactics like charm pricing ($9.99 instead of $10) to influence perception. This is a pricing technique in retail that directly affects consumer decision-making.

- Penetration Pricing: Introducing a product at a low price to gain market share quickly, then raising it later.

- Price Skimming: Launching at a high price and gradually lowering it to “skim” revenue from different customer segments over time.

- Dynamic/Promotional Pricing: Temporarily adjusting prices based on algorithms, demand, inventory, or promotional campaigns. A key tool in price optimization for retail.

To explain various methods for setting retail prices with suitable examples:

- Example of Keystone Pricing (a cost-plus method): A boutique buys a dress for $50 and applies a 100% markup, selling it for $100. This simple merch pricing strategy ensures coverage of costs and a healthy margin.

- Example of Competitive Pricing: A new smartphone brand sets its flagship model’s price at $799 after analyzing that its main competitors (Apple, Samsung) price similar models between $799 and $999.

- Example of Bundle Pricing: A software company offers its writing, design, and SEO tools separately but promotes a “Pro Bundle” at a price 20% lower than buying all three individually, making the bundle seem like the better value.

The Pricing Psychology & Presentation Playbook

Retail pricing strategies affect consumer behavior and decision-making profoundly. The presentation of price is as crucial as the number itself.

- Charm Pricing: Ending prices with .99 or .97 creates a left-digit effect, making $19.99 feel significantly cheaper than $20.00. This pricing presentation makes a product appear more appealing by suggesting a deal.

- Anchor Pricing: Showing a “Manufacturer’s Suggested Retail Price” (MSRP) slashed next to the current selling price establishes a value anchor. The discounted price suggests a better value, driving purchase urgency and increasing the consumer’s willingness to purchase.

- Tiered Pricing: Offering “Good,” “Better,” and “Best” options (e.g., Basic, Premium, Enterprise plans) guides customers to the middle, often most profitable, option. It simplifies choice and can trade customers up.

Precautions consumers should take: Be aware of these tactics. Calculate the unit price for bulk items, research historical prices to identify true discounts, and assess personal need versus the allure of a “good deal” presented by strategic price points in retail.

Implementing Strategy: A Step-by-Step Pricing Decision Framework

Let’s apply these retail pricing strategies to a practical scenario, addressing the prompt: “Given that you can optimize pricing in the future, what factors most influenced your initial retail price selection for the backpack? How did the competitive analysis document and Carla’s recommended markup range guide your decision, and what do you anticipate will be the immediate impact of this price on your sales?”

This query outlines a perfect retail pricing decisions framework:

- Ground in Costs & Margin Goals (“Carla’s recommended markup range”): The first influence is internal. Carla’s markup range, based on brand profit margin targets and cost structure, sets the viable financial guardrails for the retail price.

- Analyze the Market (“The competitive analysis document”): This is the critical external check. The document reveals the competitive landscape, identifying the price points of direct competitors. It answers: are we positioning as a premium, value, or mid-market option?

- Synthesize & Set the Initial Price: The decision is a synthesis. If Carla’s markup suggests $59.99, but competitors are at $49.99, you might need to accept a lower margin to enter the market (penetration pricing). If competitors are at $79.99, you could price at $74.99 as a value-based premium alternative.

- Anticipate Impact & Plan to Optimize: The immediate impact of a price set slightly below competitors might be strong initial sales velocity and market share capture. The understanding that you can optimize pricing in the future allows for data-driven adjustments—raising the price if value perception is high, or running promotions if uptake is slow. This is the essence of price optimization in retail.

Conclusion on Retail Pricing Strategies

Pricing strategy is a symphony of interconnected elements that businesses must conduct to create harmonious and profitable outcomes. Each factor influences the final result, blending economics, consumer behavior, market dynamics, and competitive forces.

Successful pricing strategies are not static; they require continuous monitoring, analysis, and adjustments to maintain resonance with evolving market conditions and consumer preferences.

To stay on top of this, businesses must leverage an e-commerce analytics platform such as 42Signals that provides granular insights on the e-commerce landscape to channel the right business decisions

Frequently Asked Questions

What is a retail pricing strategy?

A retail pricing strategy is a method used by retailers to set product prices to maximize sales, profitability, and market competitiveness. It considers production costs, competitor pricing, perceived value, and customer demand to determine the best price point for a product.

What are the 5 most common pricing strategies?

The five most common retail pricing strategies include:

- Cost-Plus Pricing – Adding a fixed percentage markup to the cost of the product.

- Competitive Pricing – Setting prices based on competitor prices.

- Value-Based Pricing – Pricing based on the perceived value to the customer.

- Penetration Pricing – Setting a lower price initially to attract customers and gain market share.

- Price Skimming – Setting a high initial price and lowering it over time as competition increases.

What are the four pricing strategies?

The four main pricing strategies, also known as the Four Ps of Pricing, are:

- Premium Pricing – Setting high prices to create a perception of exclusivity and quality.

- Example: Luxury brands like Rolex and Apple use premium pricing.

- Penetration Pricing – Setting a low price to attract customers and gain market share quickly.

- Example: New subscription services like Disney+ initially offered low-cost memberships to compete with Netflix.

- Economy Pricing – Keeping prices low by minimizing marketing and production costs.

- Example: Walmart’s everyday low-price strategy.

- Price Skimming – Charging a high initial price for a new product and gradually lowering it.

- Example: New smartphones or gaming consoles launching at a high price before dropping over time.

How do I price my products for retail?

Follow these steps to set the right price for your retail products:

- Calculate Costs – Include production, labor, shipping, and overhead costs.

- Set a Profit Margin – Decide on your desired profit percentage.

- Analyze Competitor Pricing – Research similar products in the market.

- Determine Customer Demand – Consider willingness to pay and perceived value.

- Test and Adjust – Use A/B testing or discounts to find the optimal price.

What factors should I consider when setting a retail price?

- Production and operational costs

- Market demand and customer perception

- Competitor pricing

- Economic conditions (inflation, supply chain costs)

- Retailer markups and profit margins

What is the difference between a pricing strategy and a pricing method?

A pricing strategy (e.g., value-based pricing, competitive pricing) is a high-level approach that guides the pricing method used to achieve business goals. A pricing method (e.g., cost-plus, keystone markup) is the tactical formula or process used to calculate the actual price number. The strategy informs the choice of method.

What does ‘price optimization in retail’ mean?

Price optimization is the use of data analytics, often via software, to dynamically adjust prices. It considers the factors influencing pricing decisions—like demand forecasts, competitor price changes, inventory levels, and promotional lift—to recommend or automate the most profitable price point at any given moment, moving beyond static retail price management to a responsive, intelligent system.