Table of Contents

Toggle** TL;DR ** DoorDash is strategically expanding beyond its core, low-margin food delivery business to build a sustainable, profitable company. Its approach rests on four key pillars: 1) DashPass subscriptions to create a loyal customer base and predictable recurring revenue; 2) DoorDash Drive, a white-label logistics service that powers delivery for other businesses like grocery stores and chains; 3) DashMart, its own virtual convenience stores that allow it to control inventory and capture higher margins; and 4) DoorDash for Work, which targets the high-value corporate catering and employee benefits market. By diversifying its revenue streams and increasing customer loyalty, DoorDash is systematically improving its unit economics and moving toward consistent profitability.

We’ve all experienced it. It’s the end of a long day, and the idea of cooking feels like a monumental task. A few quick taps on your phone, and a hot meal is on its way. This modern convenience, powered by companies like DoorDash, has become a staple of daily life. But behind this simple transaction lies a complex question: if the service is so popular, why is making a profit so difficult?

The truth is, the core business of delivering restaurant meals operates on some of the thinnest margins in tech. The costs of paying the driver, partnering with restaurants, and running the platform leave very little left over.

So, how is DoorDash, the leader in the U.S. food delivery market, tackling this challenge? The answer isn’t just about delivering more meals. It’s about a strategic shift to become something much broader. Let’s unpack DoorDash’s multi-layered quest for sustainability.

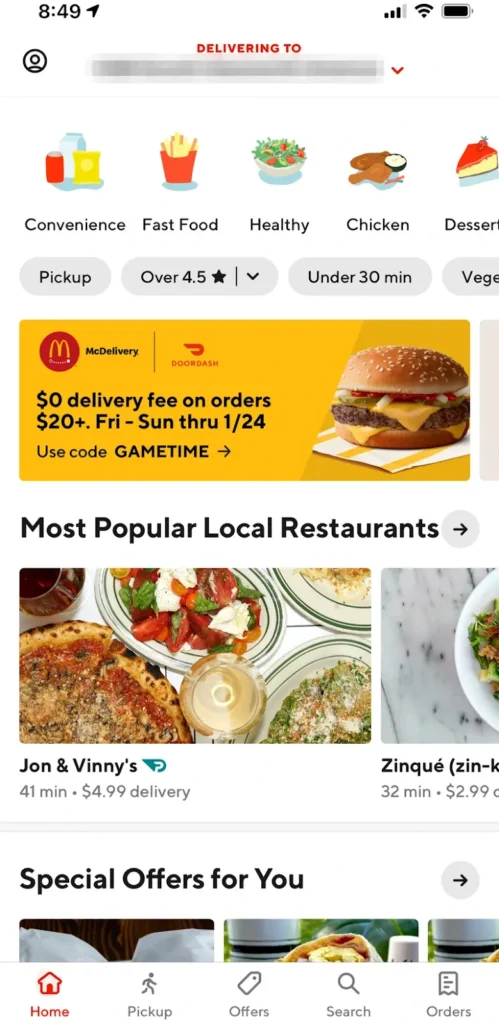

DoorDash’s Success – Making Food Convenient

Image Source: Knowledge

The Delivery Dilemma: Why Your Dinner is a Low-Margin Affair

To truly appreciate where DoorDash is headed, we first need to understand why its original business is such a tough nut to crack. The basic economics of moving a single meal from a restaurant to your door are deceptively complicated and stacked with costs.

Let’s break down a typical $35 order. A significant portion of that sale, often around 70-80%, goes back to the restaurant to cover their costs for food, labor, and overhead. Another substantial share, which can be 15-20% or more, goes to the Dasher to compensate for their time, vehicle use, and fuel. DoorDash then has to cover its own substantial operational expenses from what remains.

This includes developing and maintaining the complex technology that powers the app, extensive marketing campaigns to attract new users and retain existing ones, and providing 24/7 customer support for all parties involved. The revenue that DoorDash collects for itself, primarily through its various platform fees, is the slim slice left after everyone else is paid. This fundamental cost structure makes achieving profitability on a per-order basis incredibly difficult.

This challenging situation brings two crucial concepts in the gig economy into sharp focus: Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV). CAC is the total cost of winning a new customer. In a hyper-competitive market where companies battle for users with deep discounts, promotional offers, and expensive advertising, this cost can be alarmingly high. LTV, on the other hand, is the total projected revenue a company can expect from a single customer throughout their entire relationship with the service.

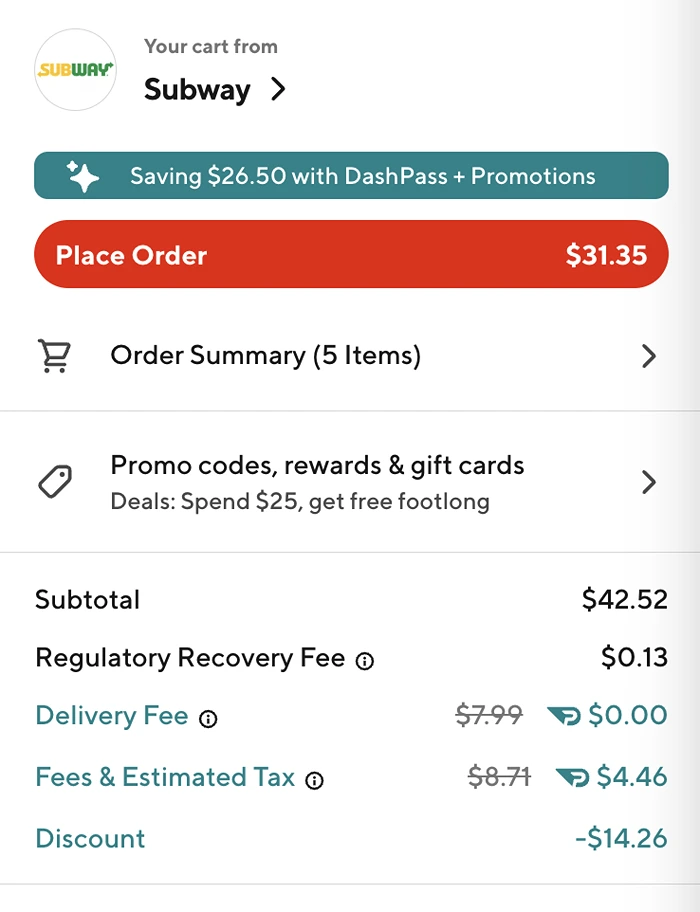

Image Source: Business Insider

For any business to be sustainable, the LTV must be significantly higher than the CAC. For years, the math in the food delivery sector didn’t quite work. Customers exhibited low loyalty, often jumping between apps to chase the best deal, which resulted in a high CAC and a disappointingly low LTV. Solving this fundamental equation is the core challenge driving DoorDash’s entire corporate strategy.

Creating Loyalty: The Smart Logic of the DashPass Subscription

One of the most effective and proven ways to build a more predictable and stable business is through a subscription model. For DoorDash, this is the engine of its customer loyalty program: the DashPass subscription. This isn’t just a perk; it’s a strategic masterstroke.

For a fixed monthly or annual fee, subscribers receive free delivery on orders that meet a minimum value threshold from a vast network of participating merchants. While simple on the surface, this model is transformative for the company’s financial health. Instead of constantly spending to acquire one-time, transactional users, DoorDash secures a steady and predictable stream of recurring revenue.

This financial predictability is invaluable for planning and investment. More importantly, a DashPass subscriber is no longer just a transaction; they are a committed member with a built-in psychological and financial incentive to return to the platform repeatedly.

This membership dramatically improves their Lifetime Value (LTV). Think of it in terms of a gym membership. The gym gains a reliable monthly income regardless of how often any single member visits, and you, as a member, are incentivised to go frequently to get your money’s worth.

Similarly, a DashPass member is far more likely to choose DoorDash for all their delivery needs, consciously or subconsciously, to maximise the value of their subscription. This behaviour reduces their effective Customer Acquisition Cost over time, as DoorDash no longer needs to spend heavily to win each individual order from them. It’s a strategic move that builds a stable foundation of dedicated customers, creating a powerful economic moat around the business.

Powering the Backend: The B2B Play of DoorDash Drive

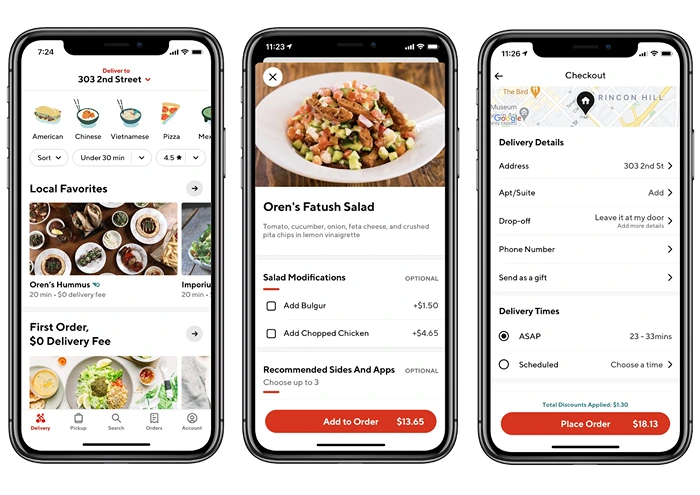

Image Source: Software Advice

What if the consumer-facing DoorDash app was just one facet of a much larger, more powerful logistics machine? This is the sophisticated idea behind DoorDash Drive, the company’s white-label delivery solution. This initiative marks a pivotal shift from being solely a business-to-consumer (B2C) application to also becoming a comprehensive business-to-business (B2B) logistics provider.

In practical terms, DoorDash Drive provides the entire delivery infrastructure for other businesses. When you place an order directly through the website or app of a merchant like Walmart, Wendy’s, or a local grocery store, and the delivery is fulfilled by a DoorDash driver, you are experiencing DoorDash Drive in action.

In this model, the merchant owns the customer relationship, handles the payment transaction, and controls their own branding. DoorDash operates purely as the embedded, behind-the-scenes delivery network, powering the “last mile” that is so critical to modern commerce.

This expansion is strategically brilliant. It allows DoorDash to monetise its most valuable assets, its sophisticated logistics platform, extensive driver network, and intelligent routing algorithms for a whole new set of enterprise clients. The company is no longer just a consumer app; it’s also an essential logistics partner for a wide range of businesses.

This successfully diversifies its revenue streams, creating a B2B income source that is distinct from and complementary to the sometimes volatile B2C food delivery market. It insulates the company from competitive pressures within the consumer app space and establishes DoorDash as a flexible, white-label solution for the growing need for instant delivery across multiple industries.

Stocking the Virtual Shelves: The Direct Retail Approach of DashMart

But what about delivering items that don’t come from a restaurant at all? This is where DashMart enters the strategy. DashMart is DoorDash’s ambitious and owned network of virtual convenience stores and micro-fulfilment centres, stocking a curated selection of thousands of items, from snacks and ice cream to essential groceries, household supplies, and over-the-counter medications.

This move is significant because it represents a bold step beyond being a mere intermediary or marketplace. With DashMart, DoorDash vertically integrates, directly controlling the inventory, pricing, and profit margins on these goods. This allows the company to capture a much greater share of the value chain compared to simply taking a commission from a third-party restaurant.

Furthermore, it elegantly solves a key operational challenge: demand for restaurant delivery is inherently “peaky,” with heavy concentration around lunch and dinner rushes. DashMart creates consistent delivery demand throughout the entire day and evening, filling the valleys between meal peaks. This keeps the driver network active and earning during slower periods, which is crucial for driver retention and satisfaction. The increased order density and improved driver utilisation rates boost the platform’s overall efficiency and directly enhance the Lifetime Value of the entire ecosystem by increasing order frequency from both consumers and Dashers.

Tapping into Business Spending: The Corporate Strategy of DoorDash for Work

While individual consumers are the most visible users, the corporate world represents a massive, reliable, and high-value market. DoorDash for Work is the dedicated division aimed squarely at capturing this lucrative segment, moving the company even further up the value chain.

This service is designed to seamlessly integrate DoorDash into corporate expense management and employee benefits programs. It facilitates solutions for a wide range of business needs, from corporate catering for team meetings and client entertainment to structured employee perk programs where companies provide a designated monthly credit for food delivery. This segment is particularly valuable due to its distinct economic characteristics.

Corporate clients are typically far less price-sensitive than individual consumers. The decision to use the service is often based on convenience, reliability, and integration with expense systems rather than hunting for the lowest delivery fee. Consequently, the average order value for business catering or recurring employee credits is often substantially higher than a typical consumer order. This directly and positively impacts the food delivery margins on these specific, high-value transactions.

By securing enterprise contracts, DoorDash adds a stable, high-margin revenue stream that is largely insulated from the aggressive discounting and coupon-driven behavior prevalent in the consumer market. It’s another powerful layer of diversification that strengthens the overall business model, reduces volatility, and enhances the quality of the company’s revenue mix.

The Financial Picture: Connecting the Dots on the Profitability Timeline

With all these strategic pillars actively being built and scaled, the financial narrative for DoorDash is evolving from a story of pure growth-at-all-costs to one of deliberate diversification and a path to profitability. The company must continuously perform a complex balancing act, carefully managing its platform fees to remain competitive with rivals while ensuring its vast network of driver partners is compensated fairly to maintain a reliable and motivated fleet.

This multi-faceted approach is now showing tangible, positive results in the company’s financial statements. In early 2024, DoorDash reported its first profitable quarter under standard GAAP accounting rules. As noted by Bloomberg, this milestone was driven not just by strong order growth in its core business, but significantly by the successful scaling of its non-restaurant ventures. This achievement marks a critical inflexion point in the company’s long-discussed profitability timeline, signalling to the market that the strategic investments beyond restaurant food are creating a viable and coherent path toward consistent financial sustainability.

The recurring revenue from the growing DashPass subscriber base, the stable B2B logistics fees from DoorDash Drive, the higher-margin direct sales from DashMart, and the premium corporate contracts from DoorDash for Work are collectively constructing a financial foundation that is far more resilient and defensible than one reliant solely on the thin margins of third-party restaurant delivery.

These initiatives work in concert to increase customer order frequency, elevate average transaction values, build deeper loyalty, and improve operational efficiency. They are systematically improving the key financial metrics of LTV and CAC across the entire platform, proving that the strategy is more than just theory. and CAC.

Future Frontiers and Lingering Challenges

While the strategic direction is clear, DoorDash’s path is not without its obstacles and potential for further expansion. The company continues to face regulatory scrutiny and legal challenges related to the classification of its drivers within the gig economy.

The outcome of these debates could significantly impact its operational costs and business model. Furthermore, driver retention remains a persistent challenge, requiring ongoing investment in incentives and features to ensure a robust and reliable courier network.

Looking ahead, DoorDash has other levers it can pull. Its advertising platform, where restaurants can pay to promote their listings within the app, is a growing and high-margin revenue stream. International expansion, though costly and complex, represents a long-term growth vector beyond the North American market.

The company is also continuously exploring new verticals, such as alcohol delivery and retail partnerships, further solidifying its position as a comprehensive platform for local commerce. The key will be to integrate these elements without losing strategic focus or overextending its operational capabilities.

Redefining the Delivery Giant

The narrative around DoorDash is evolving. It’s no longer just a story about food delivery; it’s about a company strategically using its logistics prowess to build an entire ecosystem of convenience. The quest for profitability is driving an evolution from a single-service app to a multifaceted platform.

By intelligently layering subscriptions, white-label services, its own retail operations, and corporate solutions, DoorDash is constructing a business that is far more durable than its original model.

While challenges in the gig economy and competitive pressures remain, the company’s path forward is clear. DoorDash is becoming an integral part of how both consumers and businesses handle local commerce and logistics. And in that expanded role, it’s finding its way to a sustainable future.

If you liked this article, read –

Best Buy’s High-Touch Strategy in a Low-Touch World

The Ingenious Business Model of Etsy: How Sellers Reach Vast Audiences

Britannia Industries’ Digital Leap: From Biscuit Giant to Leading Innovator

The Caudalie Strategy: How a French Skincare Brand Blends Natural Ingredients with Digital Mastery

The Bloom Nutrition Success Story: From Zero to $170M with Influencers and Omnichannel Sales

Frequently Asked Questions

1. What does DoorDash do?

DoorDash is an on-demand food delivery and logistics platform that connects customers with local restaurants, grocery stores, and convenience shops. Through its website or mobile app, users can browse menus, place orders, and have meals delivered to their doorstep.

In addition to food delivery, DoorDash offers:

DashMart – delivery of groceries and household items.

DoorDash Drive – a white-label delivery service for businesses.

DoorDash for Work – meal benefits for employees.

The platform relies on a network of independent delivery drivers known as Dashers, who pick up and deliver orders using their own vehicles.

2. What countries is DoorDash in?

As of now, DoorDash operates primarily in the United States, but it has expanded to several international markets, including:

Canada

Australia

New Zealand

Japan

Germany (recent pilot markets)

The company continues to test new regions while focusing on strengthening its North American footprint, where it holds a leading market share among food delivery platforms.

3. Why is DoorDash so popular?

DoorDash’s popularity stems from its convenience, speed, and variety. Several key factors contribute to its success:

Extensive Restaurant Network: It partners with a wide range of local eateries and major chains.

User-Friendly App: Simple ordering, real-time tracking, and flexible payment options make it easy to use.

DashPass Subscription: Offers free delivery and discounts for frequent users.

Local Focus: DoorDash started by targeting suburban areas before expanding into cities, tapping into a broader customer base.

Strong Logistics Model: Efficient driver routing and smart algorithms reduce delivery times.

Its adaptability and focus on customer experience have made it one of the most trusted and widely used delivery platforms in the U.S. and beyond.